In this article we will discuss the merits and demerits of direct and indirect taxes on an economy.

Taxes may be classified as direct and indirect. Direct taxes are levied on a person’s or a firm’s income or wealth and indirect taxes on spending on goods and services. Thus, direct taxes are paid directly by the person or firm on whom the assessment is made, while indirect taxes are paid indirectly by consumers in the form of higher prices. Direct taxes cannot be legally evaded but in direct taxes can be avoided because people can reduce their purchases of the taxed goods and services.

Direct Taxes:

Examples of direct taxation include income tax, corporation tax (on companies’ profits), capital gains tax (a tax on the profits of sales of certain assets), wealth tax (which is a tax on ownership of property or wealth) and a capital transfer tax (a tax on gifts to replace death duties). Direct taxes are mainly collected by the central government.

Advantages:

(i) It is easy to determine the incidence of the tax – a person or institution who actually pays and suffers the burden of tax.

ADVERTISEMENTS:

(ii) Direct taxes tend to be progressive – people in the higher income group pay a greater percentage than poorer people, e.g., income tax is graduated so that high income earners pay a larger percentage; also a selective wealth tax would only apply to those owning more than a certain level of wealth.

(iii) Direct taxes are easy to collect. Consider, for example, the PAYE system which is used to collect income tax from most wage and salary earners.

(iv) Direct taxes are important to the government’s economic policy. If the government is fighting inflation it can impose, for example, high levels of income tax to restrict consumer demand. If the government is concerned about unemployment it can reduce the levels of income tax to increase consumer demand and increase production.

Disadvantages:

(i) Direct taxation may be a disincentive to hard work. High rates of income tax, for example, may discourage people from working overtime or trying to gain promotion at work. Some economists blame the ‘brain drain’ (i.e., the emigration of highly qualified persons, such as scientists and doctors) on India’s high levels of taxation.

ADVERTISEMENTS:

(ii) Direct taxation discourage savings because, after paying tax, individuals and companies have less income available to save. This means that investment, which relies on the level of savings, is low and this could cause less production and employment.

(iii) This type of taxation encourages tax evasion – to avoid paying so much tax.

(iv) There is no element of choice about paying the tax – it is unavoidable.

Indirect taxes:

Examples of indirect taxation include customs duties, motor vehicles tax, excise duty, octroi and sales tax. Indirect taxes are collected both by the central and state governments but mainly by the central government.

Advantages:

ADVERTISEMENTS:

(i) Indirect tax is fairly easy to collect.

(ii) It is easy to determine the incidence of an indirect tax.

(iii) The government can use it to discourage certain types of consumption. A high rate of tax on tobacco can, for example, affect smoking habits.

(iv) Indirect taxation is a good way of raising revenue when levied on goods with an inelastic demand, such as necessities.

(v) Tourists do not pay income tax. But they spend money on goods and services. This adds to the tax revenue of the government.

(vi) Consumers have a choice as to whether they pay the tax. They can avoid paying the tax by not consuming the goods which are being taxed.

(vii) Indirect taxes do not have a discentive effect on work.

Disadvantages:

(i) Indirect taxes are regressive. A regressive tax is one which causes a poor person to pay a higher percentage of his or her income as tax than a rich person. For instance, the tax ingredient of the price of a new television set would be the same for the poor and the rich person, but as a percentage of the poor person’s income, it is far greater.

(ii) These taxes are not impartial. In recent years, certain groups of consumers have complained that they are being heavily penalised by taxation, e.g., drinkers, smokers and drivers.

ADVERTISEMENTS:

(iii) Indirect taxes may contribute to inflation. The imposition of an indirect tax on an item like petrol will increase its price. Since petrol is an essential input in a large number of industries, this may set off an inflationary spiral. Moreover, trade unions demand higher wages to maintain the real incomes of workers.

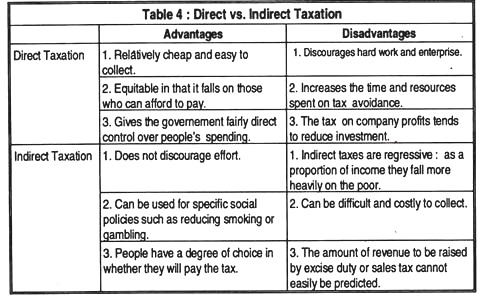

The advantages and disadvantages of two types are listed in Table 4.

Conclusion:

ADVERTISEMENTS:

So, the conclusion is that, in a good tax system there should be a proper balance between direct and indirect taxes. The revenue will be optimum and loss of incentives minimum.