Let us make an in-depth study of the merits and demerits of indirect taxes.

(A) Merits:

1. Wide Coverage:

The main merit of an indirect tax is that it touches all income groups. Direct tax, like income tax, is imposed on persons having a certain minimum level of income.

People having income below that level are exempted from the payment of tax. But indirect taxes, such as sales tax or excise duty, are equally imposed on all consumers or purchasers irrespective of their incomes.

2. Consumption Control:

By imposing an indirect tax, the consumption of an undesirable thing can be discouraged. For example, by imposing excise duties on wine and opium, the government discourages the consumption of such harmful products.

3. Popularity:

ADVERTISEMENTS:

People are not always conscious of indirect taxes because, in most cases, it is combined with the price. When people purchase cinema tickets they may well remain un-ware of the fact that the price of a ticket also includes the amusement tax. Again, the price of a match-box includes the excise duty imposed on it.

But the consumer does not at all bother to know how much he is paying as price and how much he is paying as an indirect levy. He thinks that he is paying the price, although he pays the indirect tax, too. He is not, therefore, consciously affected by the indirect tax and so he does not resent it much.

4. Productivity:

Like a direct tax, an indirect tax also enlarges the revenue receipts of the government. Indirect taxes in India today provide the bulk of government revenue. Such taxes have been imposed on sugar, cooking gas, textiles, shoes, petrol, cigarettes, and many other essential articles of consumption. By the levy of indirect taxes, the tax net is cast wider and all people are made to contribute to the national fund.

(B) Demerits:

But indirect taxes have certain demerits also.

ADVERTISEMENTS:

These are the following:

1. Regressive Character:

The main drawback of an indirect tax is that it is now an equitable tax. It is regressive in nature. It affects the poorer section more than the rich. A commodity tax imposed on foodstuff will affect a poorer family in a much greater degree than a rich family. A poor man feels the burden of a sales tax much more than a rich man. A rich man does not at all mind paying a few rupees as sales tax, but a poor man is greatly burdened by it.

2. Administrative Difficulties:

Indirect taxes create various administrative problems. The collection of an indirect tax like customs duty often involves large expenses. There is also the possibility of evasion. In India, it is well known that dealers evade the payment of sales tax to the government, although they realise it from their customers.

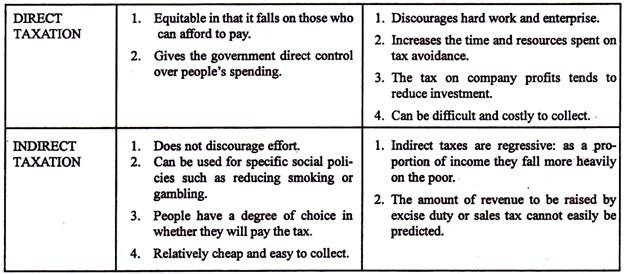

Table 22.1 summarises the merits and demerits of both types of taxes.

ADVERTISEMENTS:

Table 22.1: Direct vs. Indirect Taxation