A sales forecast is an estimation of sales volume that a company can expect to attain within the plan period.

A sales forecast is not just a sales predicting. It is the act of matching opportunities with the marketing efforts.

Sales forecasting is the determination of a firm’s share in the market under a specified future. Thus sales forecasting shows the probable volume of sales.

The methods of sales forecasting can be studied under the following heads:-

ADVERTISEMENTS:

1. Qualitative Methods of Forecasting 2. Quantitative Methods of Forecasting.

Some of the qualitative methods of forecasting are:-

1. Expert’s Opinion Method 2. The Delphi Method 3. Sales Force Composite Method 4. Survey of Buyer’s Expectations 5. Historical Analogy Method 6. Jury of Executive Opinions 7. Leading Indicators Method.

Some of the quantitative methods of forecasting are:-

ADVERTISEMENTS:

1. Test Marketing 2. Time Series Analysis 3. Moving Average Method 4. Exponential Smoothing Method 5. Regression Analysis 6. Econometric Models.

Some of the other methods of sales forecasting are:-

1. Users Expectation Method 2. Gross-Root Approach 3. Economic Indicator’s Analysis Method 4. Past Sales Projection Method 5. Statistical Analysis 6. Market Test Method.

Sales Forecasting Methods: Qualitative and Quantitative Methods

Sales Forecasting Methods – Qualitative Methods and Quantitative Methods

Forecasting is based on a common premise of data requirement and application of this data as input for projecting sales in the future. A forecast cannot be better than the data on which it is based. Specialists use two types of forecasting techniques for sales forecasting. They are classified on the basis of the type of input data used by the sales managers in forecasting the demand. They are termed as qualitative and quantitative methods of forecasting.

ADVERTISEMENTS:

The qualitative methods are known as intuitive, subjective, and judgmental methods of forecasting. These methods are used when there is little or no historic data on the demand for the product or service is available and the horizon for the forecasting is long and may be above three years. In such cases the observed trends may not continue as before.

Also, there may be changes in government policies, new innovations, changes in consumption pattern, etc. When relevant sales data as well as factor information are available, the sales managers use mathematical or quantitative methods of forecasting.

I. Qualitative Methods of Forecasting:

Qualitative methods of forecasting are purely based on judgments either of experts or a collective judgment of knowledgeable people in the industry or of potential customers. The five qualitative methods of forecasting include expert’s opinion method, Delphi method, sales force composite method, survey of buyers’ expectation method, and historical analogy method.

Following is a summarized description of the above-mentioned methods:

The expert’s opinion method is the simplest to use. This is usually used by commercial organizations for forecasting the future demand of their products. In this method, the services of experts in that area such as marketing professionals, important members of the distribution channel such as distributors/dealers, and professional bodies such as industry associations and marketing consultants may be asked for.

The estimate may not always show a group opinion. It may favour the more vocal members. The statistical validity of this method is also questionable.

Forecasting on the basis of expert’s opinion is done in two ways- (i) by one seasoned individual (usually in a small company) or (ii) by a group of individuals, sometimes called a ‘jury of executive opinion’.

The group approach, in turn, uses two methods- (i) key executives submit the independent estimates without discussion, and these are averaged into one forecast by the chief executive, and (ii) the group meets, each person presents separate estimates, differences are resolved, and a consensus is reached.

ADVERTISEMENTS:

This is an improvement over the executive opinion method. This method tries to determine the forecasts on the likely time period of occurrence of certain future events and the probability of their occurrence. In this method, a group of experts and a Delphi coordinator will be selected.

The experts give their written opinions/forecasts individually to the coordinator. The coordinator processes, compiles, and refers them back to the panel members for revision, if any. This to-and-fro process continues for several rounds (usually three).

Generally, this process will stop when a consensus has been obtained or when explanations for deviant opinions have been given. Now, the coordinator will carry out statistical analysis of the responses deriving average answers, variability, prediction intervals, etc. Only the coordinator will know all the members of the team and only he/she will have access to all the responses.

ADVERTISEMENTS:

The process aims at gradual reduction of the variability in forecasts. The Delphi forecasts will be primarily median forecasts. This is the original sales forecasting method and is still the most widely used, regardless of company size. More sophisticated methods, such as the time series projections and regression analysis gain new converts every day as forecasters learn how to use them, aided by data processing facilities.

3. Sales Force Composite Method:

In this method, the organization asks its sales personnel to come up with their forecasts. It is assumed that such persons who are in direct contact with the customers and other members of the distribution channel will be better informed about the trends in demand for the product. The individual forecasts are then combined to get an overall demand forecast for the organization.

But the results can be affected by the staff s biases, lack of interest in the process, and ignorance about the wider economic changes and trends. This method is often used to generate forecasts in the industrial equipment industry.

ADVERTISEMENTS:

For example, a company selling forklifts priced at Rs.10,00,000 cannot afford to carry a large inventory and requires that its salespeople contact all potential customers. The territory managers formulate a forecast that is passed on to the senior managers at corporate office.

Corporate management thus uses the sales force composite forecast to determine how many forklifts should be produced for the next year. Many companies use the accuracy of the field sales manager’s forecasts as a major part of their performance evaluation. The more accurate the manager’s forecast is, the higher will be the compensation received by the manager.

4. Survey of Buyer’s Expectations:

The procedures that fall within this method are survey of buying intentions and market tests. The survey of buying intentions involves the selection of a sample of potential buyers and then getting information from them on their likely purchase of the product in future. This information is then extrapolated to get the total demand forecast.

But there may be variations between the stated intentions and the actual purchases. And there may also be biases in the result because of non-responses from many in the target market.

Many companies often poll their actual or potential customers, ranging from individual households to intermediaries, to forecast market demand. Some companies employ consumer panels that are given products and asked to supply information on the product’s quality, features, price, and whether they would buy it. In many instances, consumers have difficulty in predicting their future buying habits.

ADVERTISEMENTS:

Often a positive response in survey may not translate into the real buying of the product. Forecasts based solely on this method tend to be overly optimistic. This method is often effective if the product has relatively few buyers; if buyers make a strong commitment, such as signing a contract or making a partial advance payment; or if specific customers have, said yes and later bought.

Original equipment manufacturers (OEMs) often survey the end consumers to know the level of end consumer demand, which helps them predict the sales and forecast based on the survey of buyer’s intention. This method is also called the build to order method, in which the original equipment manufacturers build their forecasts depending on the demand patterns of their business-to-business (B2B) buyers.

This is used for forecasting the demand for a product or service for which there is no past demand data. Sometimes, the product may be new, but the organization might have marketed other products earlier with features similar to those of the new product. So, the marketing personnel may use the historical analogy between the two products and derive the demand for the new product using the historical data for the earlier product.

The Delphi technique is an iterative technique that can be used to enhance the value of expert’s opinion. The survey of buyer’s expectations requires careful attention to wording, sampling, and methods of selection. These methods are conducted in situations where there is no quantitative data available to the sales manager to forecast the sales for the future.

II. Quantitative Methods of Forecasting:

The major quantitative methods of forecasting are discussed below:

ADVERTISEMENTS:

1. Test Marketing:

Test marketing is one of the popular methods for measuring consumer acceptance of new products. The results from a test market are extrapolated to make predictions about future sales. Companies select a limited number of cities with populations which are representative of the target customers in terms of demographic factors that include age, income, lifestyle and shopping behaviour.

A product is made available at the retail outlets and the features are highlighted either through in-store promotion or through a small advertising campaign. Then the performance of the product is tracked through consumer research and modifications if any are made before taking it for a national launch.

This is a method of simulating future sales in a limited market to test the level of acceptance of the product in the representative market and then execute a national campaign. In another approach companies select two markets. One market is called a ‘test market’ where the product is marketed without any promotional campaign.

A similar market is selected and is termed as ‘control market’ where the product is sold with a promotional campaign. The difference in sales between both the markets is a measure of the effectiveness of the sales promotion campaign. Any inconsistency with the sales variation in both the markets is an indicator of the gap between the customer’s perception and the performance of the product features.

By a complex test marketing procedure, one can measure the effectiveness of the core product in inviting trial, making people loyal, effectiveness of the promotional campaign, and in-store promotions. Proper experimental design and mathematical analyses are important to correctly evaluate test market data.

ADVERTISEMENTS:

One example of test marketing occurred in testing the Ganga soap in India. Two markets were selected for test marketing. The north Indian market was taken as a test market, whereas the southern market down the Godavari River was used as the control market. The product was promoted in this market, whereas the product was only displayed in the test market.

The sales responses were used to extrapolate the data to find out the national level of sales, and forecasting was done for three years to augment the national launch. Companies often change product features and promotional themes as a result of the data obtained in a test-market situation. This is because the test marketing statistics many a time are found to be discouraging.

In time series analysis, it is important to collect relevant past data for future projects. Time series analysis is a series of techniques that make forecasts based on past patterns of data. These data are collected, observed, and recorded at regular intervals of time. These methods are useful when the market forces are somehow stable and the market shows least erratic behaviour. Actions taken by the firm and the competitor’s move are not taken into account.

Time series methods use chronologically ordered raw data. Historical data are used to project future events. For example, past sales are used to project future sales. However, future events are often different from past events, which make the accuracy of such methods far less than 100 per cent.

Although this method has certain limitations, past sales are useful information inputs in the forecasting procedure. By studying the historical correlation of sales levels over time, a sales manager can identify a trend and find a general indication of the possible continuation of the time series.

ADVERTISEMENTS:

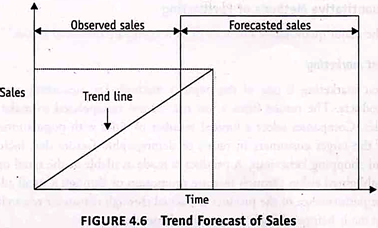

Figure 4.6 illustrates a trend forecast of sales method-

The major advantage of time series analysis is its objectivity as it is based on the established record of historical data. In a time series, time is the most important factor because the variable is related to time. The sales managers can undertake time series analysis in four ways. The changes that have occurred as a result of the general tendency of the data to increase or decrease are known as secular movements.

Changes that have taken place during a period of 12 months as a result of change in climate, weather conditions, and festivals are termed as seasonal variations. Changes that have taken place as a result of booms and depressions are called cyclical variations. Changes that have taken place as a result of such unpredictable forces as floods, earthquakes, famines, etc. are classified as irregular or erratic variations.

If there is a change in the company’s effort in the form of wearing out of advertising, excess of sales promotion, alteration in the prices, opening of new distribution outlets, or discovery of new usage for the product, any such change may affect the time series and the trend may shift dramatically, thereby reducing the accuracy level of the method used for forecasting.

All-time series models look for patterns in the past data. The four components of the past data relevant to time series analysis are trend, seasonality, cyclicality, and irregularity.

A trend is the underlying movement in the time series. For example, if there is a growth of 1 per cent in population, there will be a likely trend of increase in demand for basic commodities such as rice, wheat, and sugar.

A trend can move up or down depending on the product development efforts, consumer tastes, changes in technology, broad economic trends, and other fundamental issues in the market for the product. Seasonality is the extent to which the time series varies consistency within a period of one year. For example, sales of fans and refrigerators in India are very seasonal with a sales peak happening in summer and a slump in winter.

Cyclicality is change that occurs over a period exceeding one year. Certain changes in the economy, such as change in the bank interest rates, tend to occur over a period stretching more than one year. Housing, automobiles, and travel industries are examples of cyclical industries. Customers are likely to purchase these items depending on the fluctuations in the bank interest rates.

Irregularity is changes in sales patterns that occur randomly. Floods, earthquakes, and droughts occur randomly and affect the demand patterns. Random influences can have a major effect on the sales pattern. The more popular time series methods of forecasting include trend projections, free hand or graphic method, moving averages method, exponential smoothing method, and regression method.

Sales Forecasting Methods (With Examples)

1. Survey Methods (Also Called Qualitative Methods):

(i) Survey of Buyers Intentions; also called Opinion Surveys – Customers are asked their requirements or what they are planning to buy in coming years. Mainly useful in case of industrial products e.g., Machinery, etc.

(ii) Sales force Polling Method – Also called Collective Method. Here, salesmen are asked to estimate expected sales on their territory. A simple method. Gives first-hand information through Salesmen’s knowledge.

(iii) Executive Polling – The firm can poll its top management from its sales, price, firm & personnel depts., on their views on the sales outlooks of the firm. While these personal insights are to a large extent subjective, by averaging their opinions the firm hopes, to arrive at a better forecast.

(iv) Expert Opinion Method – Experts are asked to give their estimates about likely sales and average is taken. A variant is Delphi method, arriving at consensus amongst experts (instead of calculating average).

(v) Market Test Method also called Controlled Experiments method – Here product is sold in a sample market & on that basis estimate is prepared for entire market.

2. Statistical Methods (Also Called Quantitative Methods):

Various statistical techniques are used to estimate sales.

Examples are:

i. Moving Average Method.

ii. Time Series Analysis Method.

iii. Economic Indicators Method also called Barometric Forecasting. Regression method is used here.

Sales Forecasting Methods – 9 Important Methods Suggested by Different Authors

Different authors have suggested different methods of sales forecasting. Among these authors, names of Spencer, Clark and Houghten, Stanton and Philip Kotler are well known.

The techniques or methods of sales forecasting suggested by them include the following:

1. Survey of Customers Buying Plans (or Users Expectation Method):

In this method of sales forecasting, customers are asked about their future buying plans- quantity and quality of the goods to be purchased, time of buying, place, etc. by contacting them directly. Industrial marketers use this approach more than consumer goods marketers, because it is easier to use where the potential market consists of small numbers of customers and prospects.

Where the numbers of customers are larger, this method of sales forecasting involves much time, labour and money. Even though the survey of customer’s buying plan is generally an unsophisticated forecasting method, it can be rather sophisticated if it is a true survey in the marketing research sense.

2. Polling of Sales Force-Opinion Method (or Gross-Root Approach):

In this method of sales forecasting, the opinion of sales men, sales managers, ad other employees dealing with sales are obtained, and forecasting is made on the basis of their opinion. The customers are not contacted personally, only the sales personnel are asked to give the estimates of the sales of a particular product in a specified territory, during a specified time period. The information so received from the salesmen is more accurate as they are very much aware about the territory and customers.

But the main drawback of this method is that, sometimes, personal bias of the salespersons may get into the forecasting figures and there may be possibility of using defective method of estimating the future sales. Sales persons are, often unaware about using the economic and statistical indicators correctly.

However, this weakness can be overcome to some extent through training the sales force in forecasting techniques. The poll of sales force opinion serves best as a method of getting an alternative estimate for use as a check on a sales forecast obtained though some other approach.

3. Jury of Executive Opinion:

This is the oldest and simplest method of sales forecasting. This method of sales forecasting is made on the basis of opinions ad views of top executives. Top executives are asked to give their opinion about the future sales and then their views are averaged to arrive at a representative forecast.

These executives are experienced persons belonging to the production, finance, engineering, marketing and research departments. Their collective opinions are more accurate as they are facts and figures based on the previous year’s sales, as well as based on their vast experience.

Advantages:

(i) Executive opinion method helps to make the sales forecasting more quickly and cheaply.

(ii) This is the only feasible approach if the company is so young that it has no experience to use other forecasting method.

(iii) It brings a variety of specialized views together by pooling of experience and judgment.

(iv) In the absence of adequate sales and market statistics this method is the only feasible means of forecasting.

Disadvantages:

(i) This method is inferior to a more factual basis of forecasting as its findings are based primarily on opinions.

(ii) It wastes costly executive time; that would otherwise devote to their areas of main responsibility.

(iii) This method is not necessarily being more accurate as the opinions are averaged.

(iv) It is difficult to break down into estimates of probable sales by products by item intervals, by markets, by customers and so on.

4. Expert Opinion Method:

In this method of sales forecasting, well informed persons, other than buyers and a salesmen, viz. Directors of industrial establishments, financial managers, technical consultants, distributors, etc. are requested to give their expert opinion about the future sales prospects of certain products.

They provide best information based on future demands and sales. They usually charge nominal fees for this job. In India, the National Council of Applied Research and various other similar institutions are engaged in providing such expert opinions.

The automobile companies solicit estimates of sales directly from their dealers. According to Philip Kotler, this method of sales forecasting has the following advantages and disadvantages.

Advantages:

(i) Forecasts can be made relatively quickly and cheaply.

(ii) Different points of view are brought out and balanced in the process of effective forecasting.

(iii) This is the only basis more suitable where the basic data is lacking, for a forecast.

Disadvantages:

(i) Opinions are generally less satisfactory than hard facts.

(iii) Responsibility is dispersed, and good and bad estimates are given equal weights.

5. Economic Indicator’s Analysis Method:

This method of sales forecasting is based on certain indicators affecting conditions in the market. After a thorough study of the economic indicators, the forecasting is made.

For example, (i) On the basis of registration of two-wheelers and four-wheelers, the future demands for petrol and diesel can be forecasted; (ii) The quantum of loans to farmers may decide the approximate number of Tractors to be demanded; and (iii) The trends in construction work will decide the future demands for cements, and so on.

6. Past Sales Projection Method:

Sales forecasting, in this method, takes a variety of forms.

Various forms of this method are in use:

(i) Sets the sales forecast for the coming year as figure as the current year’s actual sales.

(ii) The forecast may be made by adding a set percentage to last year’s sales.

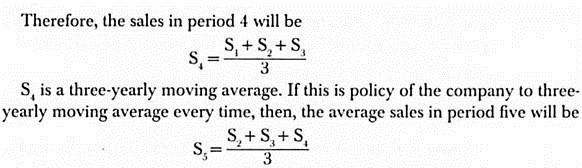

(iii) To a moving average of sales figures for several past years. For example, next year’s sales – This year

7. Statistical Analysis:

In sales forecasting by statistical analysis method, various techniques are employed, such as:

(i) Time Series Analysis:

In this method, past historical data is analyzed and arranged in systematic time series.

The following four types of sales variations are separately analyzed:

(a) Long-term trends

(b) Business cyclical movements

(c) Seasonal variations

(d) Irregular and casual fluctuation

After the analysis, different time series mathematical models are formed; assumed values are applied with each of the models, to arrive at sales forecasts.

Advantages:

(a) This method compels the forecaster to consider the underlying trends, cycles, and seasonal variations in the sales.

(b) It takes into account the particular repetitive or continuing patterns exhibited by the sales in the past.

(c) It provides a systematic means of making quantitative projections.

Disadvantages:

(a) Assuring the regularity or continuation of historical pattern of change in future sales, without considering the outside environment influences, may affect the forecasting period.

(b) This method is not suitable for short-term forecasting as pinpointing a cyclical change cannot be possible in it.

(c) This method is difficult to use in cases where irrelevant forces disrupt the regularity of sales.

(d) It requires the availability of persons with technical skill, experienced and having judgement capacity.

(ii) Regression Analysis:

Regression analysis is a statistical process. It is used in sales forecasting; determines and measures the association between company sales and other variables. It involves fitting an equation to explain sales fluctuations in terms of related and presumably casual variables.

There are three major steps in forecasting sales through regression analysis:

(a) Identify variables casually related to company sales.

(b) Determine or estimate the values of these variables related sales.

(c) Derive the sales forecast from these units.

Computers make it easier to use regression analysis for sales forecasting.

Limitations:

The standard deviation of error made in actual forecasting, is likely to be larger than the computed error of estimates, due to a set of causes persisting in future years, such as –

(a) Consumer buying is affected by changes in physical environment, advertising appeal, availability of new products, etc.

(b) Changes in the method of production.

(c) Changes in business combination, legislation, etc.

8. Econometric Model Building Method:

This method of sales forecasting is used by companies of durable products like refrigerators, T.V.s, washing machines, fans, etc.

It presents a real world situation and solves the problems with a formula –

S = R + N

S = Total Sales; R = Replacement Demand and

N = New Owner Demand

There are two components of the total sales of the firm; such as:

(i) Replacement or scrapped demand – It refers to the demand that was created for another product due to replacement of one item by the customer from a product line. This demand can be ascertained by counting the number of scrapped units of a product.

(ii) New owner demand – It is the demand for goods that may be added with the existing stock of the customer.

For the purpose of forecasting, a relationship between independent variables (market variables) and dependent variables (sales and demand variables) are determined. This relationship is built up in the form of a model, and with the help of assumed values forecasting is made.

9. Market Test Method:

Under this technique a goods are introduced for testing in a segment of the market and then studies its demand. On the basis of conclusions arrived from the test market segment, product may be introduced in the total market for a specific period of time. This method of sales forecasting is generally used when the other methods of forecasts are failed and there exists uncertainty about the future volume of sales.

Converting Industry Forecast into Company Sales Forecast:

Converting an industry sales forecast into company sales forecast requires assessment of company strengths and weakness vis-a-vis those of competitors and quantitative estimates of market shares. Many companies forecast both their own sales and sales of the industry. The general practice is to forecast industry sales early in the procedure and from it derive a company sales forecast for use as a check against forecasts arrived at through other methods.

Forecasting a company’s market share in the industry varies in complexity from one industry to another. In the industry where the number of competitors is small (like the steel industry) and market share is stable, so determining a given company’s market share is a simple task, a matter of projecting past trends and adjusting for anticipated changes in the company’s relative strengths and weakness.

On the other hand, for example, in the case of cosmetic and women’s clothing industries, the number of competitors is large and market share fluctuate widely, so determination of market share is difficult.

Most companies operate in industries that lie somewhere between these two extremes, with market share neither as stable as in steel industry or as in women’s apparel. Forecast in most companies need information on competitor’s plans to launch new and improved products, advertising and selling plans, pricing strategies, and so on.

When forecasts evaluate this information in relation to their own company’s proposed marketing and selling plans, they are in a position to exercise informed judgment in predicting the company’s probable market share. Forecasting a company’s market share in a matter both of examining past trends and of appearing impeding changes in competitive relationships.

Sales Forecasting Methods

Forecasting methods can be qualitative and quantitative. Qualitative methods are subjective in nature where the opinion of the experts is given importance while estimating the future sales. Quantitative methods imply objective or mathematical analysis of factors predicting sales. Quantitative methods provide more accurate forecasts than qualitative ones.

1. Qualitative Methods:

Following are the quantitative methods of sales forecasting:

i. Jury of Executive Opinions:

The jury of executive opinions is based upon the collective judgments of a jury of executive panel. Top-level executives in an organization are consulted while estimating the possible future sales of a product or a group of similar products after which an average of all these estimates is calculated. This is in fact a pooled judgment of sales for a definite time period in future. Opinions are pooled and averaged out and finally reconciled in a group meeting.

This is a quick method of sales forecasting because data is easily available within the organization. Only those in the organization are approached who are well-informed about the industry and factors, internal and external to the organization, influencing sales. The closer the opinions of the executives are the more reliable is the estimate. In contrast, when opinions vary significantly, the estimate cannot be depended upon. Executives should be serious enough in having their opinions and should apply their minds in the prediction.

But the method is not scientific and the executives opine on guesswork. Often executives have their own personal workloads and may not find it interesting. Also, the estimates of sales, product- or territory-wise are difficult to get by this method.

ii. Delphi Method:

A group of experts is chosen who are requested to give their views on the projection of sales in the future time period. Experts are selected from various fields such as – industries, government agencies, research institutions, trade associations, distribution houses, etc. They are requested to review competition, customer tastes and preferences, general business conditions, etc., and report how these will influence the results.

These reports are then processed, analysed, and sent back to the experts for revision. After getting feedbacks from them, the final report is compiled. This technique is helpful for long-term forecasting. The opinions from the experts are taken separately on the basis of which results are reconciled. In fact, the idea for sending the initial reports to the experts is to get second opinions from them. The process is repeated till deviations of opinions are sorted out and a consensual opinion is developed. Through this method, bias can also be minimized to a great extent. The entire process is managed by a coordinator.

iii. Sales Force Composite Method:

Salespeople are asked to prepare a report on the sales estimates of their own territories. These estimates are later aggregated to project sales for the entire geography. After receiving the reports, these are checked and verified for final projections. For a limited number of customers in a territory and industrial products, this method is very practical.

The estimate calculated from this method is expected to be very close to the actual figures because salespeople hardly overstate the estimates to avoid huge sales quota which would adversely affect their performance. Salespeople, here, get a chance to interact with the prospective buyers before they start sales operations. So, the initial recognition to buyers is a bonus to the salespeople.

The company entrusts senior salespeople, particularly those who are engaged in field selling, to find sales potentials. But they may devote less attention to the forecasting jobs, if they are busy with the pressure-selling situations. In such cases, they either might not do it or do it casually, in which case, the results will be wrong. Sometimes salespeople intentionally report some figures that best suit them to accept as sales quota, as a result of which, organizations lose a part of their revenues in those territories.

Some salespeople overstate the sales estimates from share over ambition and in this case, the company’s selling expenses mount up with less productive results. So, an initial training of salespeople regarding methods of sales forecasting is important before, they do it in fields.

iv. Survey of Buyers’ Intentions:

The method suggests selecting a sample of buyers and questioning them about their intentions to purchase a particular product.

This information is then extrapolated to the total population of buyers to estimate probable future sales. The validity of this method depends on –

a. How accurately the sample is chosen;

b. How accurately the questionnaire is constructed to get information from the samples; and

c. How accurately the sales are estimated from the sample results.

Many companies select a panel of consumers and interact with them at regular intervals about buying intentions. They are also asked on various other issues such as – product quality, their satisfaction with price level, after-sales service, etc. Even suitable suggestions can be obtained on how to improve features or cause changes in the deficient areas to improve sales. The method is suitable for buyers and industrial products because the procedure is manageable unlike the situations where the number of buyers is very high.

v. Leading Indicators Method:

The method suggests identification of key factors that are called indicators that influence sales. The trends or time series of the leading indicators are studied to see their impacts on sales. In fact, these series are combined to see their joint impacts on sales. For example, GDP, industrial production, whole sales price index, quality of life, etc., can be leading indicators to influence sale of a product or product line.

A leading indicator may contain some underlying indicators to influence it. Study of an economic indicator involves examining the statistics or trends of it. These leading indicators change to cause change in the business environment. Similarly, leading indicators (say, demand, personal disposable income, etc.,) are responsible for the change in sales. Forecasting study, therefore, implies estimation of combined impacts of leading indicators on sales of a product under study.

2. Quantitative Methods:

Following are the quantitative methods of sales forecasting:

i. Moving Average Method:

The method suggests drawing an average of the sales of a number of years to predict the sales of a coming period. The objective is to smooth out the fluctuations and provide a close estimate of the forecasted sales.

This method can be better understood from the following:

So, the sales of the preceding three years are considered to forecast the sales of the year of interest. This is a very simple method and the calculation for this is easy too. When the market is stable for a considerable period of time, it gives an accurate estimate of sales. Alternatively, this can be construed that when factors influencing sales are common for previous three years (for calculating three-year moving average), this method gives accurate projection of sales.

ii. Exponential Smoothing Method:

It is similar to the moving average method. In moving average, the sales of previous years are given equal importance but in exponential smoothing, the recent past sales are given more weight than the earlier pasts. The objective is to smooth out fluctuations in the time series for accurate estimation of sales forecast.

The general equation of exponential smoothing is as follows:

Next year’s sales = a (this year’s sales) + (1-a) (this year’s forecasts)

Where,

a is a constant, and is called the smoothing constant or weight

where a = weight for the current year’s sales

(1 -a) = Weight for the immediate preceding year.

If a =1, then, the forecasted sales is equal to sales of the current year. If a = 0, then current year’s forecast is equal to next year’s forecast. No adjustment is needed.

The range of the value of ‘a’ is from 0 to 1. For practical reasons, the value of a is chosen between 0.1 to 0.4. Similarly, the observations for the preceding second year, third year, etc. may be considered.

A practical illustration is discussed as follows to understand the concept better:

iii. Time Series Analysis:

A time series is a sequence of values, a variable assumes corresponding to different time periods. Data on sales, industrial production, revenues or profits are arranged in a sequence with respect to time period produces a time series. Say, ten years annual sales, when arranged chronologically against years give us a time series. A time series of sales represents four basic elements of variations in sales.

These are:

a. Trends,

b. Cyclical variations,

c. Seasonal variations, and

d. Irregular factors.

a. Trend (T):

Trend (T) represents long-term increment or decline in the sales. It is the long- term movement in time series.

b. Cyclical Variations (C):

Cyclical variations (C) represent the ups and downs in the business and are better understood by studying the nature of the business cycle. Ups in business cycle mean prosperity and downs mean recession. Twists and turns in the cycle take place in a regular sequence. Time series over an extended period of time indicate cycles. Exponential smoothing can detect cyclical variations satisfactorily.

c. Seasonal Variations (S):

Seasonal variations (S) represent periodic movements over a time period, usually one year. For example, climatic changes, festival periods, Christmas occasions, etc., take place every year at a particular time period and these influence sales for some products. The sales of garments, consumer durables pick up during festival times.

Seasonal variations can be understood when data in the time series are presented monthly or quarterly. Seasonal variations take place in a definite time of a year and when the sales data are assumed to pick up for some products during that period and therefore, percentages of the total sales are high. If past data are indicative of it, then percentages of sales during previous years can be used to predict future sales.

d. Irregular Factors (I):

Irregular factors (I) are unexpected events such as wars, natural calamities, strikes in the organization, etc., that cannot be predicted in advance.

These four factors are combined to calculate the estimate.

Thus, Sales = T x C x S x I

Projection of sales is made by extrapolating the trends with adjustments of cyclical and seasonal variations. The irregular factors cannot be anticipated in advance and therefore certain allowances are given in the future sales trend by provisioning contingency plans.

iv. Regression Analysis:

Regression analysis is a statistical method that is used for representing the linear relationship between two or more variables. If a relationship between two variables exists, then the value of one variable can be predicted given the information on the value of the other variable. This method can be used in sales forecasting to measure the relationship between a firm’s sales and other economic or demographic indicators.

Dillon et.al (1987) defined regression analysis as the procedure that determines how much of the variation in the dependent variable can be explained by the independent variables.

Four questions are pertinent in this regard as follows:

a. Is the relationship linear?

b. How strong is the relationship, i.e., how well can we predict the dependent variable from the value of independent variables?

c. Whether the relationship is statistically significant?

d. Which independent variable contributes more in explaining the variation of the dependent variable?

Suppose, the personal income and education are indicators for the sale of personal computers to households, it can be assumed that sales go up with increase in personal income and education. But what is important is whether the regression model with sales as dependent variable and personal income and education as independent variables are linear.

This can be understood when the change in the independent variables causes a constant absolute change in the dependent variable. Second, what is the degree of relationship? For example, if the income rises by 20 per cent and the average education rises by 10 per cent, what will be the per cent increase of sales? Third the researcher should test the statistical significance of the model. Otherwise, the certainty of relationship will be in question. Fourthly, which variable, personal income or education contributes significantly to sales than the other?

Econometric models are mathematical models describing the economic relationship between variables; say the relationship between demand and the disposable income. Studies of these relationships help managers to take economic decisions. Econometrics determines how different economic variables interact and affect one another.

So far as application of econometrics in sales forecasting is concerned, forecasters study the past relationships between sales and the sales determining variables such as household incomes, spending patterns, consumption behaviour, etc. After this they predict how changes in these variables would affect sales in future by statistical analysis.

However, these relationships are assumed to be based on theoretical rationales rather than full empirical understandings. Green and Tull (1986) viewed that econometric models are less empirical than correlative models.