The following points highlight the three methods for measuring national income. The methods are: 1. The Product (Output) Method 2. The Income Method 3. The Expenditure Method.

1. The Product (Output) Method:

The most direct method of arriving at an estimate of a country’s national output or income is to add the output figures of all firms in the economy to get the total value of the nation’s output. The outputs can be grouped into certain product categories corresponding to industries or to sectors (such as the primary sector, secondary sector and the tertiary sector).

Problems:

ADVERTISEMENTS:

When we use the output approach, one major problem arises. This is known as the problem of double counting. It arises due to the fact that the industry’s output is often the input of another industry. This is why when we add up the values of all sales, the same output is counted again and again as it is sold by one firm to another. This problem is avoided by using the concept of ‘value added’, which is the difference between output value and input at each stage of production.

In other words, each firm’s value added is the value of its output minus the value of the inputs that it purchases from other firms. Thus, an automobile manufacturing company’s value added is the value of its output (i.e., the market value of cars) minus the value of tyres and tubes, glass, steel batteries it buys from other firms as also the values of any other inputs, such as electricity and fuel oil that it purchases from other firms.

As Lipsey has put it, “A firm’s output is defined as its value added; the sum of all values added must be the value, at factor cost, of all goods and services produced by the economy”.

ADVERTISEMENTS:

While referring to the concept of value added economists draw a distinction between intermediate goods (like tyres and types which are used as inputs into a further stage of production) and final goods that are the outputs of the economy after eliminating all double (multiple) counting and are used for consumption and not for further production.

In our example, tyres and tubes, glass, steel, electricity were all intermediate goods used at various stages in the production process while cars were final goods. In fact, all investment products used at various stages in the process lead to the final produce, car.

In short, the output approach measures national output called gross domestic products (GDP) in terms of the values added by each of the sectors of the economy. To avoid the problem of double or multiple counting we must either use the value added method or count the total value of all final products.

Exports:

ADVERTISEMENTS:

If we use the value added method of estimating national output, we have to include exports but exclude imported materials and services. Imports are automatically excluded since we only record the values added in this country. This will give us the GDP. In general, the GDP is measured at market prices, giving the market value of all output. To this, we must add (or from this we must subtract) the net factor property.

Income from Abroad:

What is the gross national product? GNP is the name we give to the total rupee value of the final goods and services produced within a nation during a given year. It is the figure one arrives at when one applies the measuring rod of money to the diverse goods and services—from computer games to machine tools—that a country produces with its land, labour, and capital resources and it equals the sum of the money values of all consumption and investment goods, government purchases, and net exports to other countries.

GNP is used for various purposes, but the most important one is to measure the overall performance of an economy.

The gross domestic product (or GDP) is the most comprehensive measure of a nation’s total output of goods and services. It is the sum of the dollar values of consumption, gross investment, government purchases of goods and services, and net exports produced within a nation during a given year.

2. The Income Method:

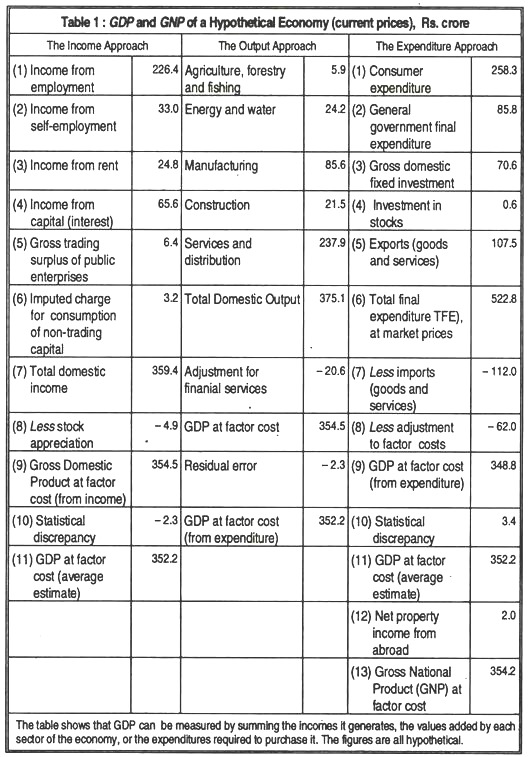

The second approach is to measure incomes generated by production. The main items of income are shown in Table 1.

Income from employment (item no. 1 in the Table) is wages and salaries. Income of self-employed persons (item number 2) includes both wages and return on capital owned by self-employed persons (who are treated as firms in microeconomics). Item number 3 is to be interpreted in a broad sense. It includes not only the rent of land but also the rent of buildings, plus royalties earned from patents and copyrights. Thus, it is a partly of return to land and partly a return to capital. Item number 4 is the major part of return on capital to the private sector.

Likewise, item number 5 is the major part of the return to capital for the public sector. Item number 6 is depreciation which is the reduction in the value of capital goods due to their contribution to the production process. Depreciation or capital consumption allowance represents that part of the value of output which is not earned by any factor but is the value of capital used up in the process of production. This depreciation is to be treated as part of the gross return on capital.

Stock appreciation:

ADVERTISEMENTS:

Item number 8 involves stocks and its appreciation. The first one is concerned with the valuation of stock of goods produced but not sold in the same year. These are valued at market prices. This creates a problem in the sense that there is need to record as part of current output (and income) the profits that will be received by the firm only when, and if at all, the goods are sold. Thus, if aggregate inventories of Indian companies go down, national income will raise.

In a year of inflation, it is necessary to make an adjustment for the purely monetary changes in the value of stocks. It is so because a rise in prices increases the value of existing stocks even when there is no change in their volume. As G.F. Stanlake has put it, “In order to obtain an estimate of the real changes in stocks it is necessary to make a deduction equal to the ‘inflationary’ increase in value.”

This deduction is treated as stock appreciation in the national income tables (see Table 1). Thus, in order to avoid distortions caused by stock appreciation in an inflationary period, a correction has to be made to eliminate changes in the value of stocks due to price changes alone.

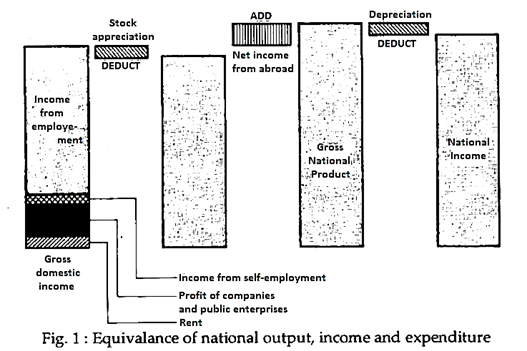

As Lipsey has put it, changes in stocks only contribute to changes in GDP when their physical quantities change. The correction for the change in the value of existing stocks yields GDP, valued at factor cost and calculated from the income side of the economy. See Fig.1.

ADVERTISEMENTS:

In short, the income approach measures GDP “in terms of the factor-in- come claims generated in the course of producing the total output.”

Transfer Income:

When we use the income method we have to exclude all transfer incomes such as unemployment benefit, widow pension, child benefits or even interest on government bonds. These are transfer incomes since they are not payments for services rendered — there is no contribution to current real output by the recipients.

ADVERTISEMENTS:

Thus, while using the income method we must only take into account those which have been earned for services rendered and in respect of which there is some corresponding value of output. Interest paid on government bonds is to be excluded for a simple reason.

The government imposes taxes on some people to pay interest to others. But, the total output (or income) of society does not increase in the process. We may also refer to private transfer in this context. If you receive a gift from your father who is also a resident of India, India’s national income will remain unchanged.

Disposable Income:

Factor incomes are normally recorded gross (i.e., before taxes are paid), because this is the measure of the factors’ contribution to output. If we subtract all direct taxes as also provident funds contributions and interest paid by individuals on loans (say to HDFC or to Citi Bank credit cards) from national income we arrive at disposable income. It is so called because people can dispose it off as they wish.

Personal Incomes:

National income is not the sum of all personal incomes. The reason is simple. All the income generated in production does not find its way into personal incomes. A certain portion of company profit is added to reserves (and not distributed as dividends among shareholders). Likewise, the profits of public sector (state) enterprises are appropriated by the government and not by persons. But, these undistributed surpluses must be added on to the total of factor incomes received by persons to arrive at national income.

ADVERTISEMENTS:

Net Factor (Property) Income from Abroad:

It is also to be noted that some of the income derived from economic activity within the country will be paid to foreign owners of assets located in India, while income from Indian-owned assets abroad will be moving in the opposite direction. The income account, therefore, must be adjusted by including the item ‘net income from abroad’. Thus, if you receive a dividend income $ 1,000 from an U.S. multinational it will be a part of India’s national income.

Stock Adjustment and Capital Gains and Losses:

Finally, stock appreciation adjustment has to be made in order to eliminate the element of windfall gain in the profits received. Similarly, capital gains and losses are to be excluded from national income to avoid double counting. Thus, if you sell shores in the stock exchange and make a gain of Rs. 100,000 it will not be a part of India’s national income. However, if a certain portion of it includes factor payment such as broker’s commission it will be a part of national income.

3. The Expenditure Method:

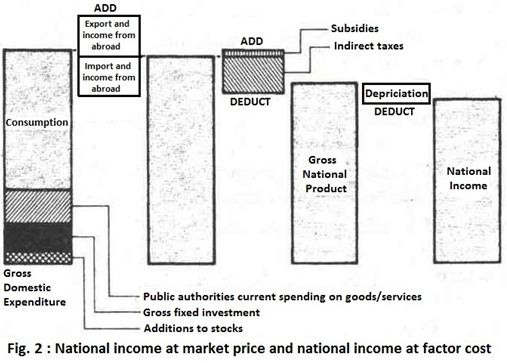

From the expenditure side national income is calculated by adding up the flows of expenditure needed to purchase the nation’s output. However, while estimating the value of national product by the expenditure method we must only record final expenditures.

We have to exclude all the expenditure on intermediate goods and services. While measuring national income total final expenditure (TFE) is divided into four broad categories: consumption, investment, government expenditure (spending), exports and imports. These four components may now be further developed.

ADVERTISEMENTS:

Consumption:

Consumption expenditure refers to all purchases by households of currently produced goods and services, except new houses which are counted as investment. Secondly, consumption of second hand goods like used cars is to be excluded to avoid double counting. Thirdly, we have to measure purchases of goods and services made in a year. We need not measure their actual consumption that occurs during the year (or any other period under consideration).

Investment:

Investment is expenditure on currently produced capital goods like plant and equipment and housing. Stocks are also included. Investment may be gross or net. Gross investment less depreciation is net investment, or net addition to (purchase of) society’s stock of capital.

Government Expenditure:

Money that government spends falls into two categories, one is called transfer payments. These are money paid out for which nothing is given back to the government. One good example is pension paid to retired people. There is a sort of transfer of money from tax-payers to the people receiving pensions.

ADVERTISEMENTS:

These transfer payments are not part of the GNP, since they do not arise from production. It is government spending for goods and of services that enters the GNP. Thus, the purchase of a wagon for the Railway Board and the wages of postal workers are put of the GNP.

Only government expenditure on currently produced goods and services is to be included. This is known as exhaustive expenditure. All transfer expenditure is to be excluded to avoid double counting. As Lipsey has put it, “All government payments to factors of production in return for factor services rendered or payments for goods and services are counted as part of the GDP.”

Examples are wages and salaries of government employees, government expenditure on goods purchased from farmers for distribution through the public distribution system (ration shops) and on medicines purchased from the private sector for distribution through government hospitals.

Exports and Imports:

Since exports represent foreigners’ expenditure on domestic output these are included in GDP. Likewise imports are domestic consumers’ expenditure on foreign goods. Hence, they are not a part of GDP. In the language of Lipsey, “expenditure approach measures the GDP in terms of the categories of expenditure required to purchase the total output of society”.

Market Price Measure Vs. Factor Cost Measure:

ADVERTISEMENTS:

National expenditure is measured at market prices. These prices differ from the factor cost values by the amount of taxes and subsidies they contain. Thus, national income at market price-indirect taxes + subsidies = national income at factor cost. See Fig. 2.

Residual Error:

All these measures of national income are supposed to give the same final figure. Any discrepancy among the three measures is due to statistical error. This is known as rounding-up error or residual error, i.e., the error of calculation (not due to any conceptual or methodological problem).

Problems:

However, various measurement problems crop up in practice.

These are the following:

1. Price Level Changes:

Firstly, price level changes create complications. Such changes make it difficult to compare the value of output in one year with that of another year. Do we express statistics in terms of market prices or constant prices?

If in terms of market prices, then figures will be distorted by inflation even though national output may have remained the same. To overcome this, statistics are often expressed in terms of constant prices. This means that a particular year’s prices are chosen to calculate the value of output. In India, for example, 1980-81 is taken as the base year.

2. Public Goods:

Secondly, difficulties arise in case of public goods like road, hospitals, defence, schools, etc., which do have market prices. They are parts of GDP because they satisfy human wants and make use of scarce resources. So, the solution lies in measuring their values ‘at cost’. The salaries of government school teachers and policemen are taken as a measure of the values of their outputs.

The education and health expenditures are included at their cost since they are obviously no different from similar services for which people pay. All government services are therefore included at cost in national output despite the argument that in some instances this could amount to double counting because these services are financed out of people’s taxation.

3. Self-Supplied Goods and Services:

Thirdly, people produce same goods and services for themselves. For example, many teachers teach their own children, farmers produce food for themselves and many people drive their own cars, and many people even make their own clothes. In such cases, it is not possible to arrive at a market measurement of the value of the output.

If identical goods and services are sold in the market place it is possible to give self-provided goods and services an imputed valuation — an estimate of their values can be included in the national income figures. This method is usually used in case of owner-occupied houses (i.e., income from house property).

The market rents of similar properties are used as measuring rod for the imputed rents of premises occupied by their owners. If there is no reliable market indicator, the assumed (imputed) value must be an arbitrary estimate or the national income accountant may decide to omit the commodity (service) from the calculations of the national output. This latter solution is adopted in case of free services rendered by housewives like coaching their own children, or cooking food or drawing water from the roadside tube-well or even washing clothes.

In short, certain goods and services may be provided by a person for himself or herself and it is very difficult to include these in calculations altogether. Many of these self-supplied goods and services will be omitted from national income. However, an imputed value is given to owner occupied houses and an estimate is made of the value of food consumed by farmers themselves.

Similarly, some goods and services, e.g., services given by housewives, cannot be valued at all and are omitted. However, this creates a difficulty because a housekeeper’s services are calculated in national income.

4. Underground Economy:

Moreover, work done in the ‘Black or Underground Economy’, for which there is no official record, is not included in calculations. This is a serious problem in all market-based economies.

5. Double Counting:

This problem arises because the outputs of some firms are the inputs of other firms. There are two possible ways of tackling this problem. Prima facie, national income can be measured by adding the values of the final products’.

A preferable alternative is to total the values added at each stage of production. Double counting is a common problem faced by all countries. Transfer payments should not be included in the calculations of GNP. In addition, from the value of the products of industries must be deducted the cost of raw materials and products and services provided by other industries. Only the value added is included. Stock appreciation must also be deducted. This occurs when the value of stocks increases because of inflation. But, it represents no increase in real output.

6. Factor Cost:

The value of the national output is measured at factor cost, that is, in terms of the payments made to the factors of production for services rendered in producing that output. As Stanlake has put it, “Using market prices as measures of the value of output can be misleading when market prices do not accurately reflect the costs of production (including profits)”.

In fact, the market prices of most of the commodities that we buy include indirect taxes and some of them include an element of subsidy. Therefore, if we are to arrive at the factor cost value, we have to deduct taxes on expenditure and add subsidies to the market price valuations. It would be misleading to the figures for national income at market prices since it would mean that the value of national output could be increased by raising the rates of indirect taxes such as sales tax or excise duty.

So, in spite of the supreme importance of the national income estimates, a lot of difficulties arise in calculating national income properly.

The following are some major difficulties:

(a) Inadequacy, non-availability and unreliability of accurate data relating to the various sectors of the economy;

(b) Difficulties of reducing the various, diverse economic activities of the people to a common measurable denominator;

(c) Difficulties in excluding raw materials and semi-finished goods from the estimates of national income, in order to avoid the errors of double counting;

(d) Difficulties in discovering true transfer payments (e.g., unemployment allowances or interest on public debts, relief payments or old-age pensions) for their exclusion from the national income estimates;

(e) Difficulties in making proper adjustment of the changes in the price-level in the national income estimates;

(f) Difficulties in treating some major items like government taxes and expenditure, the earnings from abroad, etc., in calculating the national income;

(g) Difficulties in expressing the national product in terms of money owing to the fluctuations in the value of money, existence of non-mentioned transactions, unpaid services and non-monetary economic activities, voluntary work, illegal transactions, etc.; and

(h) Conceptual difficulties in defining national income properly for calculating it with accuracy. These difficulties are also to be faced in estimating India’s national income.

Summary and Conclusion:

Despite these difficulties involved in the satisfactory calculation of the national income, the latter serves as a broad indicator of a country’s material welfare and a summary measure of aggregate economic performances of a country. But, some American writers like William Nordhaus, James Tobin and Paul Samuelson suggest some readjustments in the traditional GNP to compute Net Economic Welfare (NEW) “to gauge quality of economic life” and to get a more meaningful measure of growth in a country.