In this article we will discuss about the measures of national income.

In short, national income is a measure of the money value of the goods and services becoming available to the nation from economic activity. There are three approaches to measuring this: first, as a sum of the incomes derived from economic activity these broadly divide into incomes from profits and incomes from employment; second, as the sum of expenditures with the main distinction being between expenditure on consumption and expenditures which add to the capital stock (investment); finally, as the sum of the products of the various industries of the nation.

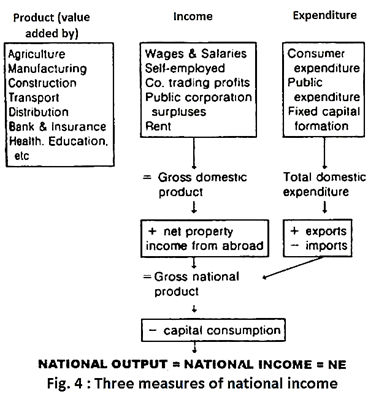

These three measures, the income, expenditure and output (product) approaches, give rise to several different ways of describing the various aggregates employed in compiling the national accounts and these are described and illustrated in Fig.4.

Firstly, the output approach aggregates the sum of the values added at each stage of production by the industries and productive enterprises in the country. The sum of these values added gives gross domestic product at factor cost which; after a similar adjustment to include net property income from abroad, gives gross national product.

ADVERTISEMENTS:

The income approach to measuring national income does not simply aggregate all incomes. It aggregates only those of residents of the nation, corporate and individual, which derive directly from the current production of goods and services. It aggregates the incomes of factors of production, factor incomes and excludes all incomes which cannot be regarded as payment for current services to production (transfer incomes).

The sum of all factor incomes gives total domestic income which, once adjusted for stock appreciation, gives gross domestic product at factor cost. If we then add on net property income from abroad we have obtained one measure of gross national income, or, as it is more commonly known, gross national product.

Finally, expenditure approach aggregates consumption and investment expenditures to obtain total domestic expenditures at market prices. It aggregates only the value of final purchases and excludes all expenditures on intermediate goods.

ADVERTISEMENTS:

However, since final expenditures at market price include both the effects of taxes and subsidies and our expenditure on imports while excluding the value of our exports, all these have to be taken into account before we obtain gross national product by this method.

It is to be noted that, in all national accounting systems, the basic overall aggregate being measured is the total value of output at factor cost (either in constant or in current market prices). This can be directly viewed from three angles — in terms of output itself, O, or in terms of income it generates, Y, or in terms of the expenditure needed to be made to purchase it, E. The details of each calculation give us separate (and independent) information. But, the three totals are the same.

In fact, the three are so defined as to give identical results:

Y ≡ O ≡ E

ADVERTISEMENTS:

Thus, the three are equal by definition. This is why the three-bar identity is called definitional identity. First, Y and O are identical not because Y measures incomes actually paid out in an accounting year, but because it measures the income claims generated by factors of production contributing to society’s output O.

Thereafter, standard accounting practice enables us to establish that all output must be matched by claims on that output. What is left with business firms in particular or producing units in general after fulfilling all contractual obligations (i.e., paying wages, rent and interest) is profit which is a residue — a surplus income).

All factors owners account for all output since someone must own the value that has been created. Differently put, “goods produced and not sold are valued at market prices and the differences between their value and their cost of production is counted as part of profits”.

The identity between O and E can be established by pointing out E does not represent actual expenditure, but what would have to be spent to buy the output, O. Thus, E and O are the same.

However, it is to be noted that each total has separate components. In case of national product, the components are outputs of individual industries. In case of national income, they are factor incomes, such as rent and wages. In case of national expenditure, they are types of expenditures, such as consumption, investment, government expenditure and net export (the difference between total export and total import).