Monopolistic Competition: Meaning and Characteristics!

Meaning Monopolistic Competition:

The two important subdivisions of imperfect competition are monopolistic competition and oligopoly. Most of the economic situations “are composites of both perfect competition and monopoly”. Chamberlin’s monopolistic competition is an amalgam or an admixture of perfect competition and monopoly.

Thus, monopolistic competition has elements of both perfect competition and monopoly. That is why it is said that this market form, in some sense, is akin to perfect competition and, in some other sense, is akin to monopoly. Since monopolists compete among themselves we call such market monopolistic competition.

Characteristics Monopolistic Competition:

Chamberlin’s theory of monopolistic competition has the following characteristics:

i. Large Number of Sellers:

ADVERTISEMENTS:

Like perfect competition, there are a large number of sellers and buyers. But the ‘number’ is not too large like perfect competition. As a result, each firm has an insignificant share in the market so that action of one seller does not affect rival sellers to any great extent. Every seller in this market form believes that his actions will go unnoticed by his rivals in the market. Thus, each seller behaves independently in the market.

ii. Differentiated Products:

Sellers sell differentiated products, but they are close— but not perfect—substitutes. Buyers may not mind if they do not get Lux soap rather than Rexona. Different varieties of soap that are available in the Indian market are slightly differentiated products and, hence, close substitutes. It is the degree of differentiation that creates both monopoly and competitive elements.

Every product is unique to the buyers. So every seller enjoys some degree of monopoly of his own product over other sellers. But since these goods are close substitutes, sellers face competition. Because of brand loyalty of buyers, sellers exercise some monopoly power.

And sales of closely related goods create a competitive environment. Thus monopolists compete among themselves. It is product differentiation that enables monopolistically competitive firms to possess market power with competition amongst the firms. In this market, monopoly power is, therefore, small.

iii. Elastic Demand Curve:

ADVERTISEMENTS:

Since product of each seller is slightly different from his rivals he enjoys some degree of monopoly power and, hence, can raise the price of his product without losing most customers. But as other rival firms produce closely related goods, every firm faces competition and its influence over the price of the product is rather limited.

Thus, each firm has a downward sloping demand curve implying that it behaves as a price-maker. Since a seller faces a large number of competitors to whom buyers may turn, the demand curve is more elastic.

iv. Non-Price Competition:

Besides price competition, Chamberlin suggested cases of non-price competition that arise due to product variation and selling activities. Seller always tries to establish the fact that his product is superior to others by improving the quality of his product.

And in doing so, he incurs selling costs or makes advertisement to attract more customers in his fold. It is the product differentiation that causes selling costs to emerge, in addition to production costs.

ADVERTISEMENTS:

In Chamberlin’s model, demand for any commodity is not only affected by the price of a commodity but also by non-price competition (i.e., product variation and selling activities). Selling costs or advertising outlays are peculiar to this market.

v. Free Entry and Exit:

Like perfect competition, there is complete freedom of entry and exit.

vi. Product Group:

Chamberlin used the term ‘group’ rather than industry. An industry is a set of firms that produces homogeneous goods. But under monopolistic competition, goods are heterogeneous or slightly differentiated. Thus, the term ‘industry’ cannot be applied here. That is why Chamberlin used ‘product group’ which is defined as a collection of firms producing almost similar goods, but not identical goods.

Concepts of Proportional and Perceived Demand Curve:

We have said that monopolistic competition is an amalgam of perfect competition and monopoly. A monopolistically competitive firm does not face a horizontal demand curve. On the other hand, a competitive firm experiences horizontal demand curve since products by all firms are homogeneous. Product differentiation, however, is one of the chief assumptions of monopolistic competition.

In this market, there are no perfect substitutes like perfect competition. Products by large number of monopolistic competitors are closely related to each other.

Each product is a very close substitute of the product of others. It is due to this product differentiation that every firm enjoys some sort of monopoly power since each product is unique. Then the demand curve faced by a monopolistically competitive firm is negative sloping.

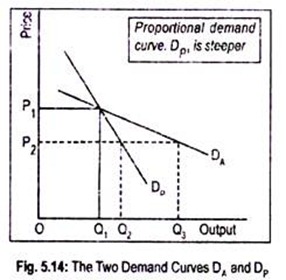

For building up his model of monopolistic competition, Chamberlin considers two demand curves—proportional demand curve, or actual sales curve, and perceived demand curve or anticipated demand curve. The former is drawn by assuming that all the monopolistically competitive firms charge the same price.

On the other hand, a perceived demand curve is drawn on the assumption that the competitor sellers will not change the original price. The curve DP of Fig. 5.14 is the proportional demand curve. This is the demand curve faced by a particular firm when all the sellers charge the same price. DA is the anticipated or perceived demand curve faced the firm if all sellers maintain the original price.

Let us start with a price of OP1 and output sold OQ1. Now if a typical firm wishes a cut in price from OP1 he will expect his sales to go up. This is because Chamberlin assumes that all other firms will keep their prices at OP1.

ADVERTISEMENTS:

Similarly, if the particular seller plans to raise the price of the product, he can expect a drastic drop in sales since all other sellers will keep their price at OP1. Thus, the individual firm perceives a demand curve DA at price OP1 since every seller ‘expects his action to go unnoticed by his rivals’.

DA curve is more elastic than DP because each firm in this model believes that no other firm will react to changes in its price.

Anticipating elastic demand, each firm has an incentive to lower the price of its product in order to capture a larger share of the market. In other words, if a particular firm reduces price of its product from OP1 to OP2, it can expect its sales to increase to OQ3.

ADVERTISEMENTS:

Since every firm hopes that no other firm will cut price, the gain in the ultimate analysis will be smaller. If all firms reduce price to OP2, the actual sales will be QQ2 instead of OQ3. In view of this, DP curve is more steep or less elastic than the DA curve.

DP curve shows the actual sales since it takes into account the effects of the actions of competitive sellers to the price changes. On the other hand, DA curve shows anticipated changes in quantity sold when it contemplates a price change.

Under this market form, every seller believes that his actions will go unnoticed. Thus, every firm ignores the reaction of rival sellers and, hence, behaves independently. All firms acting independently actually sell less than what they anticipate.

However, to make it simple, we have not used anticipated or perceived demand curve to describe equilibrium situation of a firm under monopolistic competition—both in the short run and in the long run.