Let us make in-depth study of the money market equilibrium in an economy.

Introduction:

Money market is in equilibrium when at a rate of interest demand for and supply of money are equal.

It is worth noting that in the money market people increase or decrease the money they hold by selling short-term bonds that carry a fixed rate of interest. These bonds may be of corporate companies, generally called corporate bonds or debentures or may be securities of government, which are called treasury bills.

Money as a Financial Asset:

The wealth of a household and a business firm consists of tangible assets such as a house, commercial property and the value of financial assets.

ADVERTISEMENTS:

Financial assets include:

(1) Stocks, that is, equity shares of corporate firms (i.e. public limited companies),

(2) Bonds which carry a fixed rate of interest and

(3) Money.

ADVERTISEMENTS:

Money is a financial asset.

It is important to note that money is different from income or wealth. In macroeconomics demand for money has a narrower meaning. Demand for money is a part of wealth of the people which they want to hold in the form of money rather than other assets. What part of their wealth people want to hold in the form of money determines the demand for money to hold.

Transactions and Speculative Demand for Money:

Broadly speaking, people demand money for two purposes:

(1) Transactions demand for money and

ADVERTISEMENTS:

(2) Speculative demand for money.

When the number of transactions in the economy increases, demand for money increases. The most important factor determining the volume of transactions is the level of national income or aggregate output. In a modern economy most goods are produced in the various stages of production. Money is required to buy raw materials for production, to make payment of wages to labour and so forth. A larger stock of money is therefore required to undertake more transactions.

A society keeps a certain proportion of national income in the form of money to carry out various transactions. The greater the level of national income, the higher the demand for money, given the proportion of income which a society keeps in the form of money. Thus

MTd = kY …(i)

where MTd stands for transaction demand for money, Y is the level of national income and k is the proportion of national income which is kept in the form of money. The constant proportion k does not have to be unity because one unit of money is used more than once for exchanging goods and services produced. The number of times a unit of money is used for buying goods and services is called income velocity of money. Thus, V= Y/M where V stands for income velocity of money.

It is worth noting that low income velocity of money implies that demand for money is a higher fraction of income. This indicates that individuals and business organisations keep their money stock for a longer period of time with themselves or in demand deposits with the banks and do not quickly use their money holdings for transaction purposes.

On the other hand, a high income velocity of money implies that demand for money is a smaller fraction of income. This means that individuals and firms quickly use their money stock for purposes of buying goods and services and do not keep it for a longer period with them or in their banks.

Speculative Demand for Money:

Keynes in his book ‘The General Theory’ emphasized that individuals demand money to hold for speculative purpose. Money demand for speculative purpose means that individuals want to hold money to take advantages of the ‘changes in future rate of interest, that is, changes in bond prices’.

ADVERTISEMENTS:

At any given time households or individuals want to keep a certain portfolio of assets consisting of both real and financial assets. When people decide how much money to hold with them for speculative purposes, they make a portfolio choice. At a time some people would like to hold more money and therefore will sell bonds or other assets. Some people may like to hold more bonds or other assets in their portfolio and to achieve this they would withdraw money from demand deposits to buy the bonds and other assets.

Cost of Holding Money and Portfolio Choice:

The money held by the people in their wallets or in demand deposits with the banks do not earn any interest. Instead of holding money in their wallets or demand deposits, they can buy government bonds or corporate bonds and earn higher nominal rate of interest.

The cost of holding money as an asset arises from the fact that money earns no interest or very low interest. Thus, interest rate on government or corporate bonds is the opportunity cost of holding money. The assets other than money such as government bonds or corporate bonds earn higher rate of return. But keeping money and other assets in investment portfolio have advantages and disadvantages.

The advantage of holding money as an asset is that it can be easily and quickly used to purchase goods and services. Its disadvantage is that it earns no interest or very low interest. On the other hand, other assets such as bonds cannot be directly or quickly used for transaction purposes and when they are sold to convert them into money for being used for these purposes, they involve costs such as brokerage fees apart from time and efforts involved in their sale.

ADVERTISEMENTS:

Deciding about how much money to hold as an asset is deciding about a portfolio choice. This portfolio choice depends on individuals’ assessment of advantages and disadvantages of holding money as an asset as compared to other financial assets.

At a given interest rate on bonds, an individual or household decides about an investment portfolio after weighing their advantages and costs. If rate of interest on bonds rises, bonds would become more attractive than money. In this case, the holding of money will decline and that of bonds will increase in the portfolio.

Demand for Money and Interest Rate:

It is evident from above analysis that demand for money as an asset, that is, for speculative purposes depends on rate of interest on bonds, which is the opportunity cost of holding money. If rate of interest is higher, the people would demand less money to hold for speculative purposes. This is because at a higher rate of interest they would go in for holding more bonds or other financial assets in their investment portfolio. On the other bond, at a lower rate of interest on bonds, they would demand more money to hold.

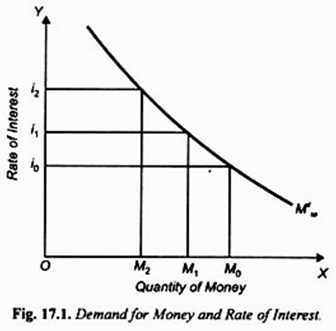

Thus, demand for money to hold for speculative purposes, that is, as an asset is negatively related to rate of interest. Therefore, demand curve for money for speculative purposes slopes downward. This indicates that at a higher rate of interest, less money is held as an asset and at a lower interest rate, more money is held as an asset. Demand for money to hold for speculative purposes is drawn as Mdsp in Figure 17.1.

ADVERTISEMENTS:

Mathematically, we can express the demand for money to hold for speculative purposes as follows:

Mdsp = f(i) = hi …(ii)

where h is the sensitivity of money demand to hold as an asset to changes in rate of interest (i).

Total Demand for Money:

Demand for money to hold comes from transactions and speculative purposes. Therefore, total demand for money to hold depends on level of income and rate of interest. Thus, by adding demand for money equations. (i) and (ii) we have

ADVERTISEMENTS:

Md = MTd + Mdsp

Md = kY – hi

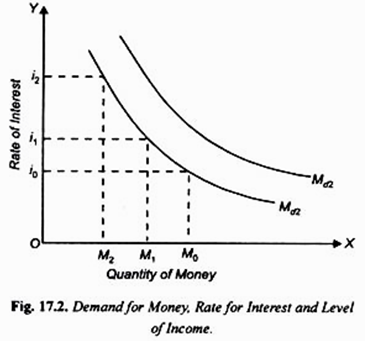

Two things are worth noting in the money demand equation (iii). First, demand for money to hold depends on level of income and rate of interest. The higher the income (Y), the greater will be demand for money. Secondly, demand for money is negatively related to rate of interest (i). At a given level of income, the higher the rate of interest, the lower will be demand for money. In Figure 17.2 total demand for money curve Md1 has been drawn at the given level of income Y1.

As with the increase in income, demand for money for transaction purposes increases at all rates of interest, the rise in level of national income will cause a shift of Md curve to the right. At the given level of income Y1, if rate of interest rises we move up the money demand curve Md1 indicating that quantity of money demanded will decrease, and if rate of interest falls, the quantity of money demanded will increase.

The Demand for Money in a Two-Asset Economy: Portfolio Choice:

In order to explain the demand for money and interest rate determination, Keynes assumed a simplified economy where there are two assets which people can keep in their portfolio balance.

ADVERTISEMENTS:

These two assets are:

(1) Money in the form of currency and demand deposits in the banks which earn no interest and

(2) Long term bonds.

It is important to note that rate of interest and bond prices are inversely related. When bond prices go up, rate of interest rises and vice versa. The demand for money by the people depends upon how they decide to balance their portfolio between money and bonds. This decision about the portfolio balance can be influenced by two factors.

First, the higher the level of nominal income in a two asset-economy, people would want to hold more money in their portfolio balance. This is because of transactions motive according to which at the higher level of nominal income, purchases by the people of goods and services in their daily life will be relatively larger which require more money to be kept for transaction purposes.

Second, the higher the nominal rate of interest, the lower the demand for money for speculative motive. This, is firstly, because a higher nominal rate of interest implies a higher opportunity cost for holding money. At a higher rate of interest holders of money can earn more incomes by holding bonds instead of money.

ADVERTISEMENTS:

Secondly, if the current rate of interest is higher than what is expected in the future, the people would like to hold more bonds and less money in their portfolio. On the other hand, if the current rate of interest is low (in other words, if the bond prices are currently high), the people will be reluctant to hold larger quantity of bonds and instead they could hold more money in their portfolio for the fear that bond prices would fall in the future causing capital losses to them.

It follows from above that quantity of money demanded increases with the fall in the rate of interest or with the increase in level of nominal income. At a given level of nominal income, we can draw a money demand curve showing the quantity of money demanded at various rates of interest.

As demand for money is inversely related to the rate of interest, the money demand curve at a given level of income, say Y1, will be downward-sloping as is shown by the curve Md1 in Figure 17.2. When the level of money income increases, suppose from Y1 to Y2, the curve of demand for money shifts upward to the new position Md2.

The Supply of Money:

Money is an important factor which is used as a medium of exchange for undertaking transactions and for holding as an asset. Money can perform these functions if it is kept scarce, that is, supply of money at a given point of time is fixed and over time it is increased at a limited rate.

Therefore, the Central Bank of a country (in case of India, Reserve Bank of India) is given the right to control the supply of money in the economy. The money supply is fixed by the policy actions of the Central Bank of the country. Through open market operations changes in cost reserve ratio (CRR) of banks Central Bank of a country can influence the creation of bank credit which constitutes an important part of the money supply of the country.

Besides, the extent to which the Central Bank of the country absorbs foreign exchange reserves, also affects the supply of money in the economy. When the Reserve Bank of India buys more foreign exchange from the market, it issues new money to make payments for purchase of foreign exchange from the market.

ADVERTISEMENTS:

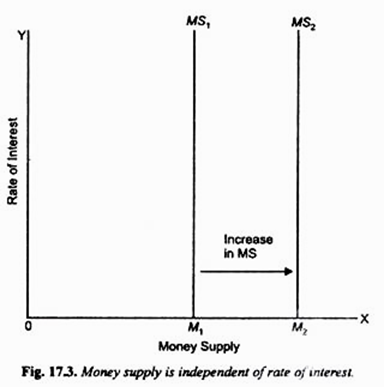

However, it is assumed that money supply does not vary with either level of income or rate of interest unless Reserve Bank decides to change it. In Fig. 17.3 we have therefore drawn a vertical supply curve of money with measuring interest rate on the Y-axis.

If the Central Bank of the country decides to increase money supply and fixes it at M2, money supply curve shifts to the right as shown in Figure 17.3. On the other hand, if the Central Bank decides to reduce the money supply in the economy, money supply curve will shift to the left.

Money Market Equilibrium: Determination of Rate of Interest:

Once the Central Bank of a country fixes the money supply in the economy, households and business firms can make individual decisions regarding how much money to hold. But the total money supply will be unaffected by their decisions to hold more or less money to fulfill transaction and speculative purposes. Money market is in equilibrium at a rate of interest when demand for money is equal to the fixed money supply. Thus money market is in equilibrium when

MS = MD

Money demand (MD) is determined by the level of income and rate of interest. Assuming that money demand is a linear function, we can write it as

MD = kY — hi

Thus, money market is in equilibrium when

MS = kY- hi

or i = 1/h (kY-MS) …(iv)

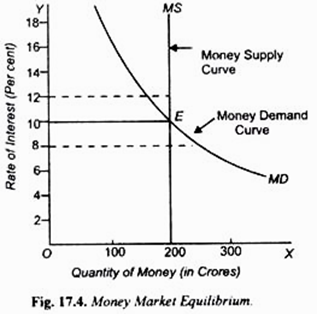

Thus equation (iv) describes the money market equilibrium. Given the level of income (Y), we can determine rate of interest (i). The rate of interest, according to J.M. Keynes, is determined by demand for money (liquidity preference) and supply of money. The supply of money, at a given time, is fixed by the monetary authority of the country. In Figure 17.4 MD is the demand curve for money at a given level of nominal income.

MS is the money supply curve which is a vertical straight line showing that 200 crores of rupees is the money supply fixed by the monetary authority. It will be seen that quantity demanded of money equals the given money supply at 10 per cent rate of interest. So the money market is in equilibrium at 10 per cent rate of interest. There will be disequilibrium if rate of interest is either higher or lower than 10 per cent.

Suppose the rate of interest is 12 per cent. It will be seen from Figure 17.4 that at 12 per cent rate of interest, the given supply of money exceeds the demand for money. The excess supply of money reflects the fact that people do not want to hold as much money in their portfolio as the monetary authority has made it available to them.

The people holding assets in the present two-asset economy would react to this excess money supply with them by buying bonds and thus replace some of money in their portfolios with bonds. Since the total money supply at a given moment remains fixed, it cannot be reduced by buying bonds by individuals. But the bond-buying spree would lead to the rise in prices of bonds. The rise in bond prices means the fall in the rate of interest.

As will be seen from Figure 17.4, with the fall in the interest rate from 12 per cent to 10 per cent, quantity demand of money has increased to be once again equal to the given supply of money and the excess supply of money is entirely eliminated and money market equilibrium is restored.

On the other hand, if the rate of interest is lower than the equilibrium rate of 10 per cent, say it is 8 per cent, then as will be seen from Figure 17.4 there will emerge excess demand for money. As a reaction to this excess demand for money, people would like to sell bonds in order to obtain a greater quantity of money for holding at the lower rate of interest.

The stock of money remaining fixed, the attempt by the people to hold more money balances at a rate of interest lower than the equilibrium level through sale of bonds will only cause the bond prices to fall. The fall in bond prices implies the rise in the rate of interest.

Thus, the process started as a reaction to the excess demand for money at an interest rate below the equilibrium level will end up with the rise in the interest rate to the equilibrium level.

Effect of an Increase in the Money Supply:

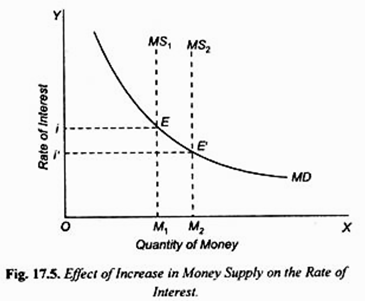

Let us now examine the effect of increase in money supply on the rate of interest. In Fig. 17.5, MD is the demand for money for satisfying various motives. To begin with, OM1 is the quantity of money available. Rate of interest will be determined where the demand for money is in balance or equal to the fixed supply of money OM1. It is clear from Fig. 17.5 that demand for money is equal to OM1 quantity of money at i rate of interest.

Hence i is the equilibrium rate of interest. Assuming no change in expectations and nominal income, an increase in the quantity of money (through buying securities by the Central Bank of the country from the open market) will lower the rate of interest.

In Fig. 17.5, when the quantity of money increases from OM1 to OM2 the rate of interest falls from i to i’ because the new quantity of money OM2 is in balance with the demand for money at i’ rate of interest. In this case we move down on the curve. Thus, given the money demand curve or curve of liquidity preference, an increase in the supply of money brings down the rate of interest.

Let us see how increase in money supply leads to the fall in the rate of interest. With initial equilibrium at i, when the money supply is expanded from M1 to M2, there emerges excess supply of money at the initial i rate of interest. The people would react to this excess quantity of money supplied by buying bonds.

As a result, the bond prices will go up which implies that the rate of interest will decline. This is how the increase in money supply leads to the fall in rate of interest.

Effect of Increase in Money Demand:

The position of money demand curve depends upon two factors:

(1) The level of nominal income, and

(2) The expectations about the changes in bond prices in the future which implies changes in rate of interest in future.

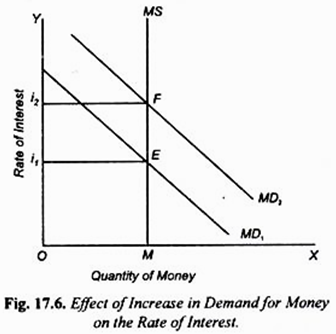

A money demand curve is drawn by assuming a certain level of nominal income. With the increase in nominal income, money demand for transactions motive increases causing an upward shift in the money demand curve. Shift in money demand curve (or what Keynes called liquidity preference curve) can also be caused by changes in the expectations of the people regarding changes in bond prices or movements in the rate of interest in the future.

If some changes in events lead the people on balance to expect a higher rate of interest in the future than they had previously supposed, the money demand or liquidity preference for speculative motive will increase which will bring about an upward shift in the money demand curve or liquidity preference curve and this will raise the rate of interest.

In Fig 17.6 assuming that the quantity of money remains unchanged at M, the shift in the money demand curve from MD1 to MD2, the rate of interest rises from i1 to i2 because at i2, the new demand for money is in equilibrium with the supply of money OM.

It is worth noting that when the money demand curve shifts from MD1 to MD2, the amount of money held does not increase; it remains OM as before. Only the rate of interest rises from i1 to i2to equilibrate the new liquidity preference or money demand with the available quantity of money OM.

Critical Appraisal:

Thus we see that Keynes explained interest in terms of purely monetary forces and not in terms of real forces like productivity of capital and thrift which formed the foundation stones of both classical and loanable fund theories. According to him, demand for money for speculative motive together with the supply of money determines the rate of interest.

He agreed that the marginal revenue product of capital tends to become equal to the rate of interest but the rate of interest is not determined by marginal revenue product of capital.

Moreover, according to him, interest is not a reward for saving or thriftiness or waiting but for parting with liquidity. Keynes asserted that it is not the rate of interest which equalises saving with investment. But this equality is brought about through changes in the level of income.

According to Keynes, rate of interest is determined by liquidity preference (i.e. demand for money) and supply of money. However, as we have seen, liquidity preference, especially demand for money for transactions motive, depends on level of income. Now, when income increases, liquidity preference curve (that is, money demand curve) will shift to the right and, given the supply of money, new equilibrium rate of interest will be obtained.

Thus, at different levels of income there will be different money demand curves. As a result, at different levels of income, there will be different equilibrium rates of interest. Thus, we cannot know the rate of interest unless we know the liquidity preference curve, and also we cannot know the liquidity preference curve unless we know the level of income.

According to different levels of income, there will be different demand curves for money and therefore different rates of interest, given the supply of money. In this way we can derive LM curve which indicates various combinations of interest rate and income at which money market is in equilibrium.

Thus, Keynes’ analysis at the most helps us to obtain LM curve which shows what will be the rate of interest at different levels of income and not any unique or particular rate of interest. Thus, the Keynesian theory, like the classical theory, is indeterminate. “In the Keynesian case the supply and demand for money curves cannot give the rate of interest unless we already know the income level, in the classical case the demand and supply schedules for saving offer no solution until the income is known. Precisely the same is true of loanable funds theory. Keynes’ criticism of the classical and loanable funds theories applies equally to his new theory”.

Problem:

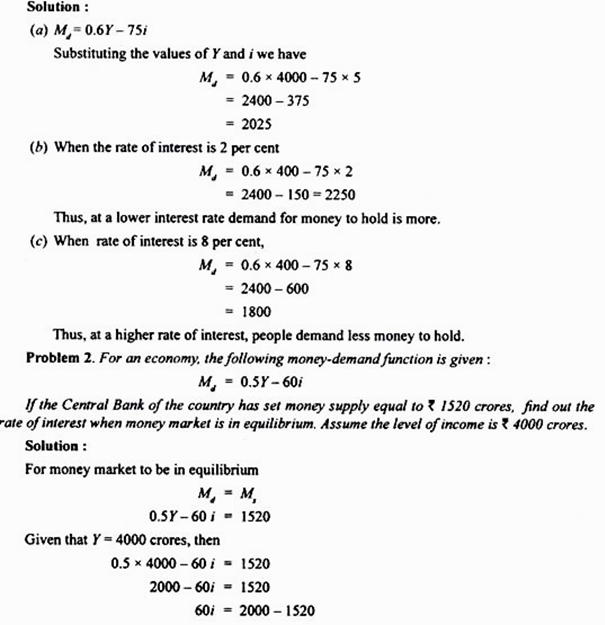

The following demand for money function is given:

Md = 0.6Y – 75i

where income Y is in crores of rupees, and interest rate i is in percentage.

(a) Calculate the demand for money when income is 4000 crores and the interest is 5 per cent.

(b) Given that level of income remains equal to Rs. 4000 crores, (i) if rate of interest falls to 2 per cent, how will it affect demand for money? (ii) if rate of interest rises to 8 per cent, what will be demand for money ?

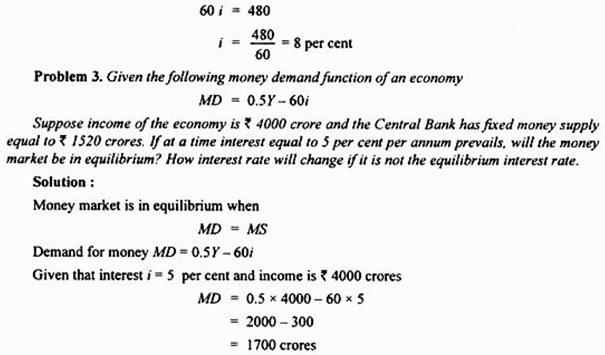

1700 > 1520. Thus, given money supply of Rs. 1520 crores. at 5 per cent rate of interest, demand for money exceeds supply of money. This excess demand for money will lead to rise in interest to the level where money demand equals the given money supply.