This article will guide you about how commercial banks create credit (money).

The money supply of a country consists of notes and coins in circulation and bank deposits. The government itself can create money by issuing more notes and coins through its central bank. However, (commercial) banks can also create money by creating bank deposits. Let us examine how this happens.

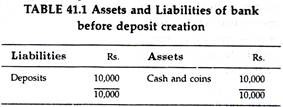

The business of banking may be illustrated by assuming a very simple economy having only one bank. Table 41.1 gives the balance sheet of such a bank which has just received a deposit of Rs. 10,000 from a merchant. The two sides of the account show its assets of Rs. 10,000 of cash and coins in the vaults, and liabilities of Rs. 10,000 to the merchant who may, in principle, come at any time to take his money back again.

Issue of Bank Notes:

ADVERTISEMENTS:

In this case the bank would probably give the merchant a receipt for his Rs. 10,000. Such a receipt, if signed by a reputable banker of good standing, constitutes a claim, or financial asset, which can be negotiable, that is, exchangeable in settlement of debt. It is; in fact, a kind of bank note.

‘Creation’ of Bank Deposits:

There is second way in which banks are responsible for the supply of money. Cheques drawn on bank accounts are acceptable for the payment of most of our debt. Since cheques are acceptable in most transactions, banks deposited are, by definition, money.

ADVERTISEMENTS:

Bank deposits originate in two ways. Firstly, customers may deposits cash in banks and receive in exchange a bank deposit. Secondly, banks may actually create bank deposits in the name of their customers

Let us look again at the balance sheet of Table 41.1. We see that the bank has Rs. 10,000 in its vaults which appears also as a debit on the liabilities side of the account, representing the debt to a customer. To make the example more realistic, let us suppose that Rs. 10,000 was not deposited by one person but by 100 people depositing Rs. 100 each.

The bank realised, by examining its past records, that when it receives a deposit, not all its depositors will require their money back at one. So the bank can just keep a portion of the deposits in reserve to meet the demand for withdrawal.

Let us suppose that the bank finds that, on average, it is safe to keep enough money to meet 10% of total liabilities to meet the demands of depositors. Therefore, it would lend Rs. 9,000 to people who want to borrow for various purposes. By doing so it can make a profit by charging interest on loans.

ADVERTISEMENTS:

What the bank does is indeed to make loans. But it does not need to lend out (currency) notes and coins. The existence of the cheque system, through which people can make payments to each other simply by writing cheques, means that it is sufficient for the bank to lend money merely by opening accounts in the name of borrowers.

Thus, loans can be made, in effect, by creating deposits in favour of persons and institutions to which the bank lends money. Thus, every loan creates a deposit. This means that when a bank makes loans to customers it does this by creating extra deposits. The bank credits the account of the borrower with the amount of the loan.

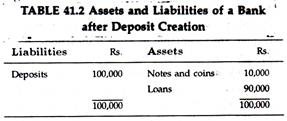

If a bank considers it safe to keep only 10% reserve and has Rs. 10,000 worth of notes and coins in the vaults, it will be able to make loan to the value of Rs. 90,000. The situation, after the loans have been made, is shown in table 41.2.

The bank’s total assets and liabilities are now Rs. 100,000. It has liabilities to all depositors who have the right to withdraw money of Rs. 100,000 and it has the same amount of assets—Rs. 10,000 of notes and coins, and Rs. 90,000 of credits representing loans made.

This simple example makes it clear that the bank has actually created money, as a result of carrying on its commercial operations of borrowing and lending. However, the power of banks to create money is limited by the size of the safety rule to which they adhere.

In our example, the safety rule takes the form of a ratio of coin (or cash) to deposits of 10%. This allows the bank to create deposits equal to 10 times the cash base it holds. This credit-creating power also goes by the name ‘the bank credit multiplier’, or deposit multiplier. It is the reciprocal of the cash (liquidity) ratio (1/0.1= 10).

Thus in our example: total bank deposit

= 1/cash ratio × initial deposit

ADVERTISEMENTS:

= 1/0.1× Rs. 10,000 = Rs, 100,000

It may be noted that the bank in question would not be able to create credit and support deposit liabilities of Rs. 100,000 on its own. Any attempt to do this would result in cash drain from this bank to other banks after the clearing of cheques had taken effect.

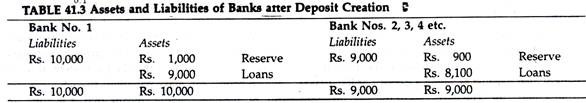

But if other banks are expanding their lending, the first bank would lend 90% of Rs. 10,000, i.e., only nine-tenths of Rs. 10,000 would be loaned so that when other banks acquired deposits from the public, their cash balances would finally increase, thereby enabling a multibank expansion of credit (i.e., deposit liabilities) to take place to total of Rs. 100,000.

ADVERTISEMENTS:

All the banks could claim that they had not created credit, but in fact the banking system as a whole had certainly been responsible for the creation of an extra Rs. 90,000 worth of money in the form of bank deposits. The balance sheets of the first bank and others collectively would appear as in Table 41.3.

Limits to the Process:

Banks do create, as we have noted above, but not indefinitely. The process of deposit creation comes to a halt when the last increase in cash deposit (or deposit liability) is not sufficient to generate a fresh loan. Moreover, banks cannot create credit to the maximum extent possible.

The restrictions on the ability of banks to create credit are the following:

ADVERTISEMENTS:

1. The Reserve Ratio:

The reserve ratio is only a minimum ratio and banks often hold excess reserves taking this ratio to perhaps 15 or 20%. Their decision to hold excess reserve will reduce their credit- creating capacity.

2. Business Outlook:

There is demand for bank loans only when there are sound investment opportunities. If there is economic depression marginal efficiency of capital will be very low. So there will be little demand for bank loans. In such a situation it is not possible to increase the demand for loans by reducing the rate of interest.

3. Lack of Securities:

Banks cannot create deposits unless they have proper securities. Since banks convert various forms of wealth into money the total volume of income-yielding securities available in the country also sets a limit to the process of deposit creation.

ADVERTISEMENTS:

4. Demand for Money:

As money supply increases and with it peoples’ income, people may demand more cash from the banking system in order to buy goods and services.

This leakage of cash from the banks will reduce the bank multiplier so that a small withdrawal will lead to a multiple fall in deposits. In fact, the art of banking lies in maintaining a nice balance between profitability and liquidity— ensuring that there is enough cash to meet normal demands.

5. Monetary Policy:

Finally, the power of the banking system to create bank deposits is often restricted by the policy of the Central bank, which acts as the agent of the Government. The Reserve Bank of India often uses various instruments of credit control to vary the reserve ratio of the commercial banks and thus affects their credit-creating capacity.