The product life cycle is an indispensable tool for product planners and marketers in general. The product life cycle is based on the life process of all living things, beginning with birth and ending with death.

Like human beings, products also have a limited life-cycle and they pass through several stages in their life-cycle.

The product during its life cycle goes through many phases, involves many professional disciplines, and requires many skills, tools and processes.

The stages involved in the product life cycle are:- 1. Introduction Stage 2. Growth Stage 3. Maturity Stage 4. Decline Stage 5. Abandonment Stage.

Product Life Cycle Stages: 5 Stages (With Diagram)

Product Life Cycle Stages – Introduction Stage, Growth Stage, Maturity Stage, Decline Stage, Abandonment (With Marketing Strategies)

Like human beings, products also have a limited life-cycle and they pass through several stages in their life-cycle. A typical product moves through five stages, namely, introduction, growth, maturity saturation and decline. These stages in the life of a product are collectively known as product life-cycle.

ADVERTISEMENTS:

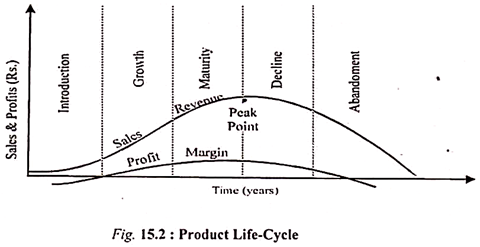

The length of the cycle and the duration of each stage may vary from product to product, depending on the rate of market acceptance, rate of technical change, nature of the product and ease of entry. But sales volume and profit level change from stage to stage as shown in Fig. 15.2. Every stage creates unique problems and opportunities and, therefore, requires a special marketing strategy.

A brief description of each stage and the marketing strategy required for it is given below:

1. Introduction Stage:

ADVERTISEMENTS:

In the first stage, the product is introduced in the market and its acceptance is obtained. As the product is not known to all consumers and they take time to shift from the existing products, sales volume and profit margins are low. Competition is very low, distribution is limited and price is relatively high.

Heavy expenditure is incurred on advertising and sales promotion to gain quick acceptance and create primary demand. Growth rate of sales is very slow and costs are high due to limited production and technological problems. Often a product incurs loss during this stage due to high startup costs and low sales turnover.

The following strategies may be adopted to introduce a product successfully:

(i) ‘Money back’ guarantee may be offered to encourage the people to try the product.

ADVERTISEMENTS:

(ii) Attractive gift as an ‘introductory offer’ may be offered to customers.

(iii) Attractive discount to dealers.

(iv) Some unique features built into the product.

2. Growth Stage:

As the product gains acceptance, demand and sales grow rapidly. Competition increases and prices fall. Economies of scale occur as production and distribution are widened. Attempt is made to improve the market share by deeper penetration into the existing market or entry into new markets. The promotional expenditure remains high because of increasing competition and due to the need for effective distribution. Profits are high on account of large scale production and rapid sales turnover.

During the growth stage, following strategies may be adopted:

(i) New versions of the product may be introduced to satisfy the requirements of different types of customers.

(ii) Brand image of the product is created through advertising and publicity.

(iii) The price of the product is made competitive.

(iv) Customer service is enhanced.

ADVERTISEMENTS:

(v) Distribution channels are strengthened to make the product easily available wherever required.

3. Maturity Stage:

During this stage prices and profits fall due to high competitive pressures. Growth rate becomes stable and weak firms are forced to leave the industry. Heavy expenditure is incurred on promotion to create brand loyalty. Firms try to modify and improve the product, to develop new uses of the product and to attract new customers in order to increase sales.

In order to prolong the maturity stage, a firm may adopt the following strategies:

(i) The product is differentiated from the rival products.

ADVERTISEMENTS:

(ii) Brand image of the product may be emphasised.

(iii) Lifetime or longer period warranty is offered.

(iv) New markets may be developed.

(v) New uses of the product are developed.

ADVERTISEMENTS:

(vi) Reusable packaging is introduced.

4. Decline Stage:

Market peaks and levels off during saturation. Few new customers buy the product and repeat orders disappear. Prices decline further due to stiff competition and firms fight for retaining market share or replacement sales. Sales and profits inevitably fall unless substantial improvements in the product or reduction in costs are made.

The product is gradually displaced by some new products due to changes in buying behaviour of customers. Promotion expenditure is drastically reduced. The decline may be rapid and the product may soon disappear from the market. However, decline may be slow when new uses of the product are created.

In order to avoid sharp decline in sales, a firm may adopt the following strategies:

(i) New features may be added in the product and the product is repositioned.

(ii) The packaging may be made more attractive.

ADVERTISEMENTS:

(iii) Economy packs or models may be introduced to revive demand.

(iv) Selective distribution may be adopted to reduce costs.

5. Abandonment Stage:

Ultimately, the firm abandons the product in order to make better use of its resources. As preferences of customers change, new and more innovative products replace the abandoned product. When the decline is rapid, the product is abandoned. New products with unique features may be introduced. Some firms cannot bear the loss and sell out.

The concept of product life cycle has several implications.

By forecasting the life cycle of a product a firm can obtain following advantages:

Firstly, the concept indicates that products have a limited life and management must develop new products or improve existing ones to replace them to maintain sales and profits.

ADVERTISEMENTS:

Secondly, the product life-cycle concept shows the expected sales volume and profit margins for a new product at various stages in its life. It can, therefore, be used as a tool of business forecasting.

Thirdly, the concept serves as a framework for taking sound marketing decisions at each stage of the product life-cycle.

Fourthly, the product life-cycle points out the need for significant and periodic adjustments in the marketing strategy or marketing mix of the firm.

Emphasis on different elements of the marketing mix varies from one stage to another. In initial stages, product design and promotion are important considerations. During the middle phase, skilled distribution and effective dealer control become significant.

In the final stage, operating cost control becomes vital. Timely recognition of the need to change marketing strategy is essential to maintain growth. In the introductory stage, informative advertising is used to build up initial demand for the product while during maturity, persuasive advertising is required to improve the competitive status of the product.

Product life-cycle analysis is a disciplined and periodic review that provides a profile of a product’s position. Product life-cycle concept does not perfectly explain the behaviour of all products and it may be difficult to predict the timings of various stages. For instance, salt and sugar have never been in the decline stage. However, by providing a life-history of a product, life-cycle concept is helpful in designing appropriate marketing strategies.

ADVERTISEMENTS:

The life of a product can be prolonged or changed by developing new uses, reducing prices, using aggressive promotion, changing package, brand or label and by improving the product.

For instance, Dupont, a company of U.S.A. has sustained the sale of nylon by:

(1) Promoting more frequent use among current users, i.e., necessity of wearing nylon stockings;

(2) Developing more varied use of the product, i.e., fashion value of tinted hose;

(3) Creating new users, i.e., early teenagers; and

(4) Finding new uses for the basic material, e.g., nylon tyres.

Product Life Cycle Stages – 9 Important Scenarios

By anticipating competitor actions — and sometimes their timing — the firm can develop preemptive strategies. A preemptive strategy means acting before competitors, perhaps targeting an emerging market segment/introducing a new product. Acting preemptively often involves risks; failure may be visible/ costly.

ADVERTISEMENTS:

But the costs of not acting may be significant, particularly for established players. These opportunity costs are the market-share gains, increased profits the firm did not earn. Opportunity costs are insidious; they do not appear on the firm’s income statement, but they may be more serious than costs that do.

Example- Apple and the iPod- Many observers counseled caution- “You are a computer company; you have no experience in digital music. Napster has closed; downloading music via the Internet faces immense uncertainty. Sony owns portable music players — Walkman — this is their turf; they will fight fiercely.”

Many executives would have heeded these arguments, but not Steve Jobs. The iPod launch was an enormous success, even helping Apple sell more Macintosh computers. Think of the opportunity costs Apple would have incurred by not launching the iPod, iPhone, iPad — what did Apple know about recorded music/mobile communications?

By not acting, the firm opens up potential entry windows for competitors. Said former Microsoft CEO Steve Ballmer, “I regret that there was a period in the early 2000s when we were so focused on what we had to do around Windows that we weren’t able to redeploy talent to the new device called the phone.”

Market-leading firms should view preemption as an insurance policy — when change is swift, the costs of inaction escalate rapidly. Firms that will not pay insurance premiums should prepare to lose market position.

The life-cycle framework offers a good way to design insurance policies. Understanding how life cycles, market strategies evolve is valuable for forecasting, anticipating likely scenarios. With these scenarios, the firm is better equipped to generate good competitive strategic options.

Generating Competitive Strategic Options:

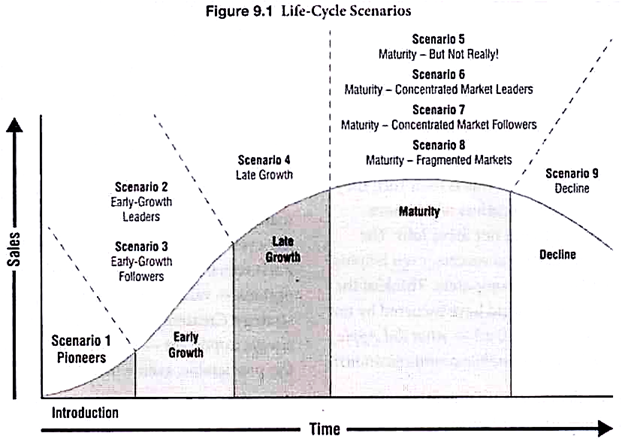

The firm generates strategic options by developing scenarios; hence, anticipating future competitor actions. The main building block- The classic life cycle — introduction, early growth, late growth, maturity, decline — typically at the product-form level. The life-cycle approach is very powerful because market conditions tend to be similar at the same life-cycle stage, across many products/technologies.

Each scenario generates a limited number of strategic options — valuable input into formulating firm strategy. Creativity in generating strategic options is always important — the firm should avoid becoming too predictable, even when it is market leader.

Although the scenarios — Figure 9.1 — and strategic options are valid for many product life cycles, generally life cycles are shortening.

Implications:

i. When life cycles were longer, firms could enter a market, fail, redevelop products, then reenter with a reasonable chance of success. Today, reentry windows are closing.

ii. Shortening product life cycles reduce the time — in early growth — to earn highest unit profit margins.

iii. Good strategic thinking early in the life cycle is more important than ever.

iv. Faster cycles require proactive management of strategy over the life cycle; evolutionary approaches may be too slow.

Building Product Life-Cycle Scenarios:

Figure 9.1 identifies nine scenarios. Each scenario description in this article begins with a brief introduction; then we focus on creating/analyzing alternative objectives, strategies. We cannot tell you what strategy to follow for a given scenario — your best strategy depends in part on competitor actions. Rather, we provide several options for you to build into your decision process.

Scenario 1- Introduction Stage – Pioneers:

Most products do not generate profits in introduction. Pioneering firms typically incur significant R&D, market-launch expenses; they must also invest in plant, equipment, systems/processes, before launch. Marketing expenses are high; revenues may not cover operating costs, much less fixed costs.

Early on, cash flows are often negative. Example- Karsan- bhai Patel worked for the Gujarat state government. He started a part-time business of making and selling packets of handmade, low-price, good-quality Nirma detergent powder, door-to-door on a bicycle. Today, Nirma revenues exceed Rs7,000 crore. Pioneers generally make many mistakes; productive failure is key to continually moving forward.

Some firms better sustain new-product losses/ negative cash flows than others. Large firms typically cross-subsidize new-product launches — use cash earned from more established products at later life- cycle stages, as part of a long-term product strategy. Example- Tide laundry detergent funds many new P&G ventures; Google AdWords funds Alphabet/Google initiatives.

Small firms typically have fewer resources; they often require outside financing. In the very early stages, wealthy individuals — angel investors — often provide startup funding. Later, when the opportunity shows promise, venture capitalists may provide financial backing. If the value proposition is sufficiently compelling, the firm may raise funds from an initial public offering (IPO) — MakeMyTrip, Lenskart, Flipkart.

The introduction stage has few pioneers, often only one. The pioneer should lay the foundation for achieving market leadership/profitability, at least in the short/medium run. The pioneer must develop an appropriate strategy as the life cycle moves toward early growth — demonstrate value to target customers, reduce market uncertainty.

A particularly effective way of slowing/forestalling competitive entry is to create/exploit entry barriers — government-imposed, product-specific, firm-driven.

I. Government-Imposed Barriers:

Patents are the most common government-imposed barrier. Patents provide owners with legal monopolies for several years. Firms can petition the courts to enforce these patent monopolies via patent infringement lawsuits — Apple successfully slowed Samsung in smartphones. Other government impediments include trade barriers, preferential tax treatment, and outright subsidies. Bankers like ICICI, Axis Bank, Yes Bank, SBI benefit from Indian government regulations that require difficult-to-secure licenses from new entrants.

II. Product-Specific Barriers:

These barriers relate directly to the product — access to capital, raw materials, human resources, minimum scale of operations. Product/process innovations cause product-specific barriers to diminish over time.

The firm can build low-cost barriers via penetration pricing; alternatively, it develops/exploits first-mover advantages:

i. Low-Cost Barriers, Penetration Pricing (PP):

The firm plans on low profit margins for a substantial time period. PP is risky; it takes significant resolve in the face of large prelaunch/post-launch expenditures/ market uncertainty. PP requires substantial resources as the firm continually reduces costs/prices, builds capacity, and grows quickly.

Advantageous conditions for PP- Price-sensitive markets with few government-imposed/product- specific entry barriers. PP is particularly attractive if customer switching costs are high; also if the market for complementary products/services is significant — printers/toners.

ii. First-Mover Advantage:

The pioneer may earn advantages because it was first. The pioneer may sustain technological advantage by improving products/ developing new applications. Examples- Big Bazaars chain of high-quality, low-price retail stores; Duracell with alkaline batteries.

Successful penetration strategy implies continual price reductions, but first-mover advantages may allow high prices — price skimming (PS). Generally, new entrants erode first-mover advantages- As product life cycles shorten, advantages erode more quickly. Firms executing PS strategies must be able to shift direction when advantages disappear.

Scenario 2- Early-Growth Leaders:

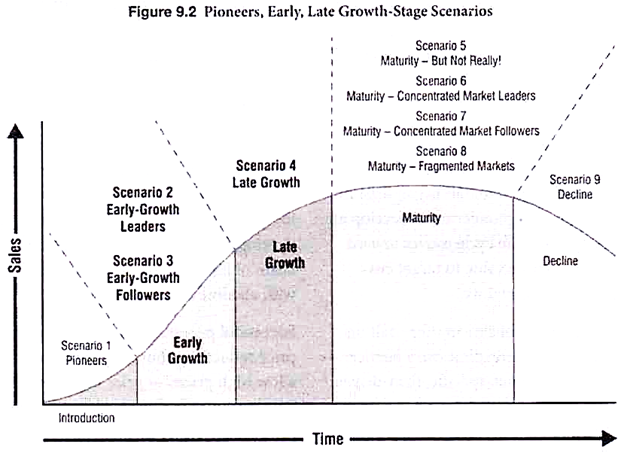

By the early-growth stage — Figure 9.2 — customers have accepted the product form; market demand is growing rapidly.

Generally, the market leader has a strong position; has worked out market-entry problems; has unit costs under control — should reduce as sales build. The firm should be profitable, but cash flows may be negative- Growth requires investment for increased capacity.

The leader has five strategic options — three based on continuing and two based on surrendering leadership:

i. Continue to Be Leader – Enhance Position:

The firm leverages success to seek market dominance; grows/broadens the market by continually investing — R&D for new products, extensive advertising, personal selling. The firm increases production capacity ahead of market demand, aggressively reduces costs. Leaders may also block competitors by entering emerging market segments, new distribution channels, and new geographies.

ii. Continue to Be Leader — Maintain Position:

The firm may prefer a more conservative approach — merely try to maintain market position. The firm may enjoy monopoly-like status, but may be concerned about potential political, legal, regulatory difficulties — Microsoft, Google. Alternatively, customers may demand additional sources of supply; strong competitors may enter, making clear they intend to stay.

Sometimes technological standards drive this option. Multiple standards cause uncertainty; prospective customers postpone purchases; the market develops more slowly than expected. The firm may elect to work with competitors on a single standard, rather than go it alone. Examples- Early consumer video (Betamax versus VHS), HDTV, wireless technology.

Maintaining a leading market position may be more difficult than striving for market dominance. The firm requires good up-to-date competitive intelligence; must carefully select customer targets; frame competitor targets. The firm must have a clear strategy; sufficient resolve to stick to the strategy despite temporary hiccups; thoughtful contingency/ scenario planning.

iii. Continue to Be Leader – Conclusion:

Whether the firm undertakes to enhance or maintain market position, the broad thrust is the same- Ride the leadership position through the life cycle to maturity. Along the way, the firm shifts focus- From selling to first-time users, to selling to repeat users/ acquiring competitor customers. To be successful the firm must broaden/refresh the product line; add services; build the brand by enhancing communications.

Surrender Leadership:

i. Retreat to a Market Segment(s):

Unlike market-share loss from competitive pressure, the firm makes a deliberate choice to surrender leadership. It may lack resources to fully develop the market/fund an ongoing stream of new products. Or a financially stronger competitor sets a market- leadership goal/aggressive pricing; the firm knows it cannot win a head-to-head battle — decides to target one or more market segments as a specialized competitor. Discretion is the better part of valor.

Leaving a market after being the pioneering leader may seem defeatist, but can be prudent. Throughout the life cycle, as customer need profiles/markets evolve, the firm should continually assess the value of its market position, based on the projected stream of discounted profits. If this projected value is less than the current selling price of the business, the firm should consider exiting, especially if the product is not central to its mission.

Firm products may be strategically significant for a potential acquirer/fit well with its current products; hence, the business may be of immense value. Successful innovators are often better off selling to firms with strong marketing expertise.

Scenario 3- Early-Growth Followers:

Some firms prefer to follow the leader; they enter markets in the early-growth stage. By pursuing a wait-and-see strategy, they can better assess market potential. Followers leverage past successes, learn from the leaders mistakes. But early on, followers often trail market leaders.

Followers in early growth have similar strategic options to the leader. But they start from inferior positions; hence, choosing among them has a different cadence.

Options:

The follower can pursue leadership by imitating or leapfrogging the market leader.

In each case, the follower requires good competitive insight; should enter as soon as possible:

i. Imitation — copy the leader, execute more effectively. Successful imitators spend heavily to play catch-up on product development; they outspend the leader in promotion. If possible, the follower leverages an existing marketing/distribution infrastructure; it clearly highlights differentiated value. The follower should not confuse imitation with price cutting.

ii. Leapfrog — improve on the leader. The follower offers enhanced value by developing innovative/superior products. Alternatively, the follower enters an emerging market segment before the leader. Generally, the leapfrogger avoids head-to-head price competition; it may spend more heavily on R&D than the leader; marketing spending is also high.

Effective leapfroggers often do an excellent job of anticipating emerging customer needs. They spot segment opportunities before leaders, quickly offering new values, securing differential advantage. The most successful followers change the rules.

Former GE CEO Jack Welch famously mandated GE be number one or two in each market it addressed. A follower requires substantial resources to become market leader, so settling for second place may be a reasonable/profitable option. Several situations argue for this alternative.

Perhaps the leader is content with current market share and does not seek increases; customers may demand a second supplier; multiple competitors may help simplify product standards; the political/legal/regulatory environment may be favorable.

c. Focus on Market Segment(s):

This option may be attractive if the follower has fewer resources than the leader/other followers, and if the segment(s) is attractive. Example- When drugs go off patent, pharmaceutical firms often withdraw marketing support, but add services for a narrow physician segment.

If the business sale value is greater than the projected discounted profit stream, the firm should consider exiting. Early-growth products may have high value for a potential acquirer, eager to enter the market.

Scenario 4- Late Growth:

By late growth — Scenario 4, Figure 9.2 — the firm receives minimal value from early market leader- ship/followership. The customer benefits/values that drove purchases in introduction/early growth are still important, but they may not enter customer choice decisions.

The firm must focus on identifying/ offering customers determining versus qualifying benefits/values. Example- In choosing among major airlines, safety is rarely a determining attribute!

The firm requires considerable marketing research skills to conduct market-segmentation studies; determine which segment(s) to target; decide how to satisfy customer needs in target segment(s); monitor evolving segments for new opportunities. Successful firms address target segments with focused rifle-shot marketing, then build defensible positions against competitors.

Even small segments may offer good profit potential. Example- Many small businesses — Thaggu ke Laddu (Kanpur, Lucknow), Wenger’s Bakery & Confectionery (Delhi) are doing well by targeting a narrow market segment prepared to pay for high-quality products.

Scenario 5- Maturity – But Not Really:

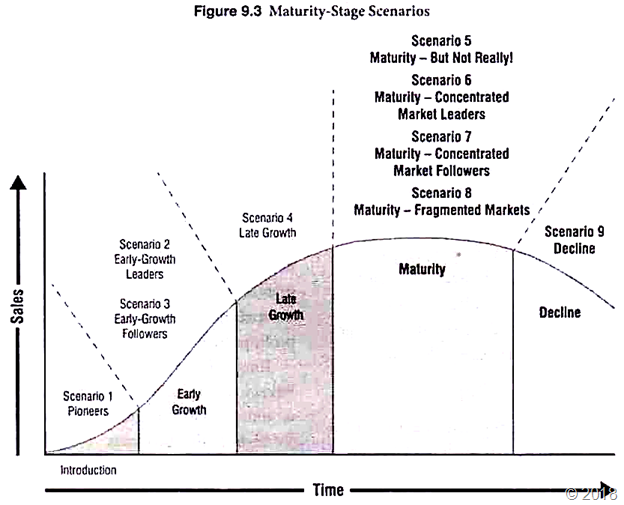

Before the firm examines strategic options in maturity — Figure 9.3 — it must affirm the life cycle really is in maturity.

Perhaps there are possibilities for market growth. To make the point succinctly, many authors assert, “There is no such thing as a mature business, there are only mature managers.”

When assessing if the life cycle is in maturity, the firm should analyze barriers to growth:

i. Behavioral Barriers:

This requires significant change by customers. Techies were early users of PCs — difficult-to-use operating systems — CP/M, MS-DOS. The mass market developed when Apple/ others offered easy-to-use systems.

ii. Economic Barriers:

These are often linked to technology. Example- When Roundup herbicide lost patent protection in the Philippines, Monsanto cut prices to compete with cheaper generics. Monsanto discovered it had vastly underestimated price elasticity; sales grew dramatically as many farmers could now afford Roundup.

iii. Government-Imposed Barriers:

This inhibit competition/ innovation. When governments remove regulations, competitors often enter, growth explodes.

iv. Technological Barriers:

These may be obliterated by innovation. Examples- Inline skates revived the almost-dead roller-skate industry. Bookmyshow, Ola, Spotify have each transformed industries by breaking technological barriers.

Generally, if any of these barriers are in place, the market is not really mature; the key strategic objective should be growth. The most serious barrier may be lack of creativity. Creatively generating/analyzing opportunities and approaching seemingly mature markets can spur growth in several ways.

The firm has many options — reminder/reinforcement communications; promoting different use applications/occasions/locations; providing incentives/bundling opportunities; reducing undesirable consequences of frequency.

Specific Techniques:

i. Change the model — annual automobile models, frequent style changes by fashion houses.

ii. Design the product to expire — incorporate devices to indicate product expiration dates — many FMCG products.

iii. Develop new product uses — Pidilite realized Fevicols potential for consumers in general, having originally developed the product for carpenters.

iv. Improve packaging for better ease of use — single- serve cereals, easy-to-pour condiments.

v. Increase quantity per use occasion — increase package size/design packaging for dispensing ease.

vi. Make product easier to use — disposable contact lenses do not have to be cleaned/disinfected.

Firms should expect sales to slow if products/services do not satisfy customer needs. The remedy- Improve the offer! Sometimes even apparently minor changes can increase sales significantly. Example- Apple launched G# PowerBooks and iMac, are returned to growth, profitability. Securing product-based advantage is difficult in many industries; hence, adding services may be an attractive option.

Improve Physical Distribution:

Sophisticated package delivery/tracking systems helped grow electronic commerce. Example- Kerela fishermen use mobile phones to track and respond to market demand quickly, even while at sea.

Example- IndiGo transformed the seemingly mature Indian airline market into growth with a low-price strategy. Virgin America, JetBlue, Southwest Airlines had similar success in the U.S.

The firm offers the same product but with new benefits/values, for new customers. Example- Hype surrounding Tata Nano’s low price gave it a cheap-car positioning before launch. Tata repositioned the Nano as a smart city car, supported by features like better fuel efficiency, power steering, and improved interiors.

Many firms define new markets by geography — especially emerging markets like BRICI countries (Brazil, Russia, India, China, Indonesia), comprising millions of low-income customers.

Scenario 6- Maturity – Concentrated Market Leaders:

Generally, concentrated markets support a few substantial competitors; aggregate market share often exceeds 60 percent. Several small players may target market niches. Profit margins should be high for low-cost leaders; investment should be relatively low (because growth is low); cash flow should be strongly positive.

The market leader has two key strategic options:

1. Maintain Leadership over the Long Run:

The core decision for maintaining market leadership is choosing the right investment level. With the right investment, in the right areas, the firm may reap profits for many years. Overinvestment to gain market share from entrenched competitors often wastes resources.

Pressures:

i. Few alternative opportunities.

ii. Internally focused funding criteria.

iii. Political power of mature-product champions.

Increasing short-run profits is not difficult; the trick is finding the right investment level to sustain profits in the medium/long run.

Causes of Underinvestment:

i. Fear of cannibalization.

ii. Inertia.

iii. Limited view of competition.

iv. Misunderstanding challenger strategies.

Of course, complacency/arrogance can accentuate these errors; past success can blind the firm to evolving market realities. Generally, the firm can maintain leadership via incremental product improvements. It should also invest in marketing activities that build/sustain brand equity, demonstrate competitive superiority.

The firm should speed up product development, invest in process technology for more efficient lower-cost operations. The firm should also consider variating fixed costs — reducing fixed costs/increasing variable costs. Then, if sales slip, costs also reduce.

New-product innovation should concern market leaders. Products based on new technology can destroy leadership positions. Example- Kodak could not make the transition from chemical film to digital imaging successfully; it filed for bankruptcy. An external orientation is the best protection against this sort of market erosion.

The firm is market leader, but a harvest strategy may be more important than maintaining sales/market share.

Reasons:

i. Change in corporate strategy.

ii. Desire to avoid specific competitors.

iii. Government regulations impose restrictions.

iv. Investment requirements become too high.

v. New technology makes firm products obsolete.

Once the firm decides to harvest, the critical question- Fast or slow? Fast harvesting — divest the product, gain immediate cash.

For slow harvesting, the firm should focus on three issues:

i. Cut costs — simplifying product line, reduce support.

ii. Minimize further investment.

iii. Raise prices.

Scenario 7- Maturity – Concentrated Market Followers:

Followers have smaller market shares than leaders; may also have higher costs, lower profits; are probably weaker financially. But leaders can lose position by poor decisions; followers may attain leadership by inspired management.

The follower has three basic strategic options/several sub-options:

The firm has three primary alternatives to grow/ perhaps ultimately dethrone the market leader:

i. Market Segmentation:

Options for segmentation typically appear in early growth, then become numerous in late growth/maturity. Creative segmentation is the dominant option for countering market- leader advantages. Another segment option- Offering only essential benefits/values — getting back to basics — at low prices. Examples- Tata Safari (automobiles), GoAir (airlines).

ii. Kenneling:

This metaphor implies bringing several dog (seemingly worthless) products together. A follower acquires several unprofitable/marginally profitable low-market-share products, then executes a roll-up into a single offer. By rationalizing operations, distribution, marketing, the follower may become a strong competitor.

iii. Direct Attack:

If the leader has been lazy, under- invested, set prices too high, served customers poorly, then direct attack may be the follower s best option. Good market insight helps identify leader weak spots; the follower can invest to exploit them.

In industries as diverse as credit cards and pharmaceuticals, market leaders have lost market share to new entrants offering better products/lower prices.

This adage describes maintaining/rationalizing the firm’s current position:

i. Maintain Position:

Holding market share roughly constant over the long run can be viable. The firm requires a profitable position/strengths in one or more segments.

ii. Rationalize Position:

If profits are marginal/negative, rationalizing operations may be the way to go. The firm should examine all aspects of operations, distribution, sales with a fine-tooth comb, then make tough cost-cutting decisions.

Followers should choose exit if profitability is unlikely/the products future is doubtful. Perhaps brand image is negative/market demand is slowing.

Two choices:

i. Divest:

Find a buyer for which the product is a good fit; the firm secures cash quickly.

ii. Liquidate:

If no buyers appear, close down, sell assets.

Scenario 8- Maturity – Fragmented Markets:

Fragmented markets have many players, but no firm is dominant. Hence, leader/follower distinctions have little relevance. An important objective is increasing market share.

The firm has two strategic options:

Acquisition is similar to kenneling — can be very successful when geography drives fragmentation.

ii. Standardization, Branding:

Many players typically offer a wide range of products/ services. Standardization is a way to reduce variation/improve consistency across suppliers; branding assures customers that each provider supplies the same value. Franchising a brand is a related option.

Scenario 9- Decline:

Pioneers face little competition; as the market grows, competitors typically enter. In the decline stage, the last life-cycle stage, the reverse occurs- New entry is unlikely; rather, competitors exit. Examples- Carbon paper, many canned foods, full-service travel agents.

Two dimensions are important for analyzing declining markets:

I. Market Hospitality:

Inhospitable characteristics:

i. Decline is rapid/uncertain.

ii. Commodity-based market — no price-insensitive segments.

iii. Competitor characteristics — viable/credible; evenly balanced; view the market strategically; have high fixed costs; sensitive to unit sales decline; have high exit barriers; are emotionally committed to products.

iv. Customer switching costs are low.

v. Bankruptcy laws allow failing competitors to return with lower costs — U.S. airlines.

vi. Product is part of a vertically integrated supply system.

vii. Government/community pressures/subsidizes some firms to remain.

Characteristics of hospitable markets tend to be the opposite of these conditions.

II. Business Strengths:

Firms with good business strengths — low costs, good raw material contracts — can keep productive assets running without major investment.

If the market is hospitable and the firm has good strengths, then pursuing leadership may be viable.

The firm should:

i. Publicly recognize the decline — but also demonstrate its commitment.

ii. Market aggressively – add new products, increase advertising/promotion; cut prices.

iii. Consider reducing production capacity — several U.S. domestic airlines.

iv. Encourage competitors to exit by offering them long-term contracts to supply their customers.

Generally, when the firm has poor business strengths, it should harvest/divest; it should also exit inhospitable markets, unless it can dominate one or more price-insensitive segments.

Notwithstanding market decline/poor business strengths, the firm may leverage a strong brand in other markets. By diversifying away from its original business, the firm may yet survive, grow.

Example- Faced with a decline in cigarette smoking, Zippo, makers of the iconic lighter, introduced lifestyle products — camping supplies, casual clothing, fragrances, watches — then tape measures, key holders, belt buckles. Some were successful, some were not.

Product Life Cycle Stages – 4 Important Stages (With Marketing Mix Decisions for each Stage)

In order to be successful, corporations started to produce products that are customer focused and have low costs and high quality. In this sense composing systems that consider four main characteristics which are quality, functionality, cost and time are needed. So products have to include all these four characteristics at the same time.

Developing such systems can be possible if corporations take into consideration all the phases of the product’s life cycle. In order to provide competitive pricing, cost estimations have to be performed repeatedly throughout the products’ life cycles.

All products go through five stages of the product life cycle- Development, introduction, growth, maturity and decline. The consumer is only aware of four of these stages, because the product has not been introduced during the development stage. Some Product Lifecycles even include a sixth stage called the withdrawal stage, when the product is removed from the market. However, price strategies only affect four stages of the product life cycle.

Therefore pricing changes are depending on the stage of the product life cycle.

I. Introduction Stage:

When the product is introduced, sales will be low until customers become aware of the product and its benefits. Advertising costs typically are high during this stage in order to rapidly increase customer awareness of the product and to target the early adopters. These higher costs coupled with a low sales volume usually make the introduction stage a period of negative profits.

During the introduction stage, the primary goal is to establish a market and build primary demand for the product class.

The following are some of the marketing mix implications of the introduction stage:

1. Product – one or few products, relatively undifferentiated

2. Pricing – Generally high, assuming a skim pricing strategy for a high profit margin as the early adopters buy the product and the firm seeks to recoup development costs quickly. In some cases a penetration pricing strategy is used and introductory prices are set low to gain market share rapidly.

3. Distribution – Distribution is selective and scattered as the firm commences implementation of the distribution plan.

4. Promotion – Promotion is aimed at building brand awareness. Samples or trial incentives may be directed toward early adopters. The introductory promotion also is intended to convince potential resellers to carry the product.

II. Growth Stage:

The growth stage is a period of rapid revenue growth. Sales increase as more customers become aware of the product and its benefits and additional market segments are targeted. Once the product has been proven a success and customers begin asking for it, sales will increase further as more retailers become interested in carrying it.

The marketing team may expand the distribution at this point. When competitors enter the market, often during the later part of the growth stage, there may be price competition and/or increased promotional costs in order to convince consumers that the firm’s product is better than that of the competition.

During the growth stage, the goal is to gain consumer preference and increase sales.

The marketing mix may be modified as follows:

1. Product – New product features and packaging options; improvement of product quality.

2. Pricing – Maintained at a high level if demand is high, or reduced to capture additional customers.

3. Distribution – Distribution becomes more intensive. Trade discounts are minimal if resellers show a strong interest in the product.

4. Promotion – Increased advertising to build brand preference.

III. Maturity Stage:

The maturity stage is the most profitable. While sales continue to increase into this stage, they do so at a slower pace. Competition may result in decreased market share and/or prices. The firm places effort into encouraging competitors’ customers to switch, increasing usage per customer, and converting non-users into customers.

During the maturity stage, the primary goal is to maintain market share and extend the product life cycle.

Marketing mix decisions may include:

1. Product – Modifications are made and features are added in order to differentiate the product from competing products that may have been introduced.

2. Price – Possible price reductions in response to competition while avoiding a price war.

3. Distribution – New distribution channels and incentives to resellers in order to avoid losing shelf space.

4. Promotion – Emphasis on differentiation and building of brand loyalty. Incentives to get competitors’ customers to switch.

IV. Decline Stage:

Eventually sales begin to decline as the market becomes saturated, the product becomes technologically obsolete, or customer tastes change.

During the decline phase, the firm generally has three options:

1. Maintain the product in hopes that competitors will exit. Reduce costs and find new uses for the product.

2. Harvest it, reducing marketing support and coasting along until no more profit can be made.

3. Discontinue the product when no more profit can be made or there is a successor product.

The marketing mix may be modified as follows:

1. Product – The number of products in the product line may be reduced. Rejuvenate surviving products to make them look new again.

2. Pricing – Prices may be lowered to liquidate inventory of discontinued products.

3. Distribution – Distribution becomes more selective. Channels that no longer are profitable are phased out.

4. Promotion – Expenditures are lower and aimed at reinforcing the brand image for continued products.

Product Life Cycle Stages

The product during its life cycle goes through many phases, involves many professional disciplines, and requires many skills, tools and processes.

Product life cycle (PLC) has to do with the life of a product in the market with respect to business/commercial costs and sales measures; whereas product lifecycle management (PLM) has more to do with managing descriptions and properties of a product through its development and useful life, mainly from a business/engineering point of view.

To say that a product has a life cycle is to assert four things:

(1) That products have a limited life.

(2) Product sales pass through distinct stages, each posing different challenges, opportunities, and problems to the seller.

(3) Profits rise and fall at different stages of product life cycle.

(4) Products require different marketing, financial, manufacturing, purchasing, and human resource strategies in each life cycle stage.

The different stages in a product life cycle are:

1. Market Introduction Stage:

i. Cost is high

ii. Sales volume low

iii. No/little competition – competitive manufacturers watch for acceptance/segment growth losses

iv. Demand has to be created

v. Customers have to be prompted to try the product.

2. Growth Stage:

i. Costs reduced due to economies of scale

ii. Sales volume increases significantly

iii. Profitability

iv. Public awareness

v. Competition begins to increase with a few new players in establishing market

vi. Prices to maximize market share.

3. Mature Stage:

i. Costs are very low as product is well established in market & no need for publicity.

ii. Sales volume peaks

iii. Increase in competitive offerings

iv. Prices tend to drop due to the proliferation of competing products

v. Brand differentiation, feature diversification, as each player seeks to differentiate from competition with “how much benefit” is offered

vi. Industrial profits go down.

4. Decline or Stability Stage:

i. Costs become counter-optimal

ii. Sales volume decline or stabilize

iii. Prices, profitability diminish

iv. Profit becomes more a challenge of production/distribution efficiency than increased sales.

Product Life Cycle Stages – With Pricing Strategies at each Stage of Product Life Cycle

The pricing strategies followed by a firm would vary from stage to stage over the life cycle of a product, depending upon the market conditions.

(1) Pricing at the Introduction Stage (Pricing of New Products):

The introduction of a new product will pose a challenging problem for any firm. In the case of new products there is no past information for ascertaining trends and consumer reaction.

In pricing a new product, generally two types of strategies are suggested:

(i) Skimming price policy, and

(ii) Penetration price policy.

(i) Skim the Cream Pricing or Skimming Pricing:

It involves setting a very high price so that in the initial stages the cream of demand may be skimmed, and enormous profits made for an indefinite period, or the price may be lowered later in order to tap other segments of the market.

By this method the investment made in the product may be quickly realised. Cream skimming is probably most effective with a highly distinctive or differentiated product which is aggressively promoted in the early stages of its life cycle.

There are four main reasons for the use of skimming price policy for new and distinctive product:

(a) The quality of the product that can be sold is likely to be less affected by price in the early stages than it will be when the product is full grown and limitation has had time to take effect. This is the period when promotion can have the greatest effect on sales.

(b) Skimming price policy takes the cream of the market at a high price before attempting to penetrate the more price-sensitive segments of the market. This means that more money can be got from those who don’t care how much they pay, while building up experience to hit the big mass market with tempting prices.

(c) This policy can be used to manage the demand of the product in the initial stages. It is easier to start with a higher price and reduce it later, depending upon market conditions.

(d) Higher initial prices will help in recouping the costs of product development early.

(ii) Penetrating Pricing (Low Pricing) Strategy:

It involves setting a low price for the product as an entering wedge to get into mass markets easily.

This approach is likely to be desirable under the following conditions:

(a) When the quantity of product sold is highly sensitive to price, even in the early stages of introduction.

(b) When substantial economies can be achieved in unit cost and effectiveness of manufacturing and distributing the product by operating at large volumes.

(c) When the product is faced by threats of strong potential competition soon after its introduction.

(d) When there is no “elite” market, i.e., a body of buyers who are willing to pay a much higher price in order to obtain the latest and best.

(e) Where there is a possibility that public will accept the new product.

(2) Pricing at the Growth Stage:

Sales rise rapidly during the growth stage. Production also increases due to increased demand. Price, generally, remains constant or a small reduction takes place due to increase in demand. If the firm has used high price in the introduction stage (price skimming), it may switch to low penetration price when a large number of competitors appear or reduce the price step by step as more and more competitors enter the market.

During the growth stage, the marketer should have always an eye on competitor’s pricing strategies. During this period, non-price competition again increases. Different competitors try to gain advantages over each other through increased promotional efforts and product differentiation and once they succeed in doing so, they become the market leaders. Then they will price their products somewhat over and above the existing market price which is called premium pricing strategies.

(3) Pricing at the Maturity Period:

During this stage growth rate of sales declines. In other words, the sales will increase only at a diminishing rate. It is during this stage, the marketer faces tough challenges to retain the existing market share. During this stage new products enter the market. Customer start moving towards other product and substitutes.

Pricing in this stage depends upon whether oligopolistic conditions or monopolistic conditions exist. Oligopolistic pricing is possible only when the entry to market is restricted and there are a small number of sellers. Before making any change in the price the oligopolist will have to consider the pricing strategies of competitors. Generally, the marketers do not like to make changes in price.

If the conditions of monopolistic competition exist in the maturity stage, the marketers will fix their prices on the basis of cost rather than on competitor’s prices. The firms may resort to product differentiation. Some firms raise their prices through production improvement and product differentiation. Some others may reduce the price to push up sales.

(4) Pricing at the Decline Stage:

During this stage the total sales start declining. It may reach to zero or at a very low level. This happens due to many reasons such as new technological innovation, change in consumer taste and habits etc. At this stage the company should adopt break-even point price policy so that the enterprise may continue its production activities.

If possible, price discrimination should also be adopted. At this stage, marginal cost or incremental cost price policy may also be adopted. As a final step, attempts should be made to cut cost of production, promotion and distribution.

(5) Pricing at the Abandonment Stage:

This is the last stage of a product. At this stage, there is almost no sale of the product. Practically, the product is out of market. At this stage, production should be discontinued and the resources employed in its production should be diverted to the production of other goods and services. Attempts should be made to sell the remaining stock at low prices or disposed off as junk.

Product Life Cycle Stages – Growth, Maturity and Decline Stages of PLC

Early adopters, followed by the early majority, begin to buy the product during the growth stage. Sales begin to rise, as do profits, as companies begin to take advantage of economies of scale in purchasing, manufacturing, and distribution. Competitors enter the market, which forces prices down.

During this stage, the firm has to promote the differences between its brand and the competition’s and may attempt to refine aspects of the product by improving quality or adding new features. Also during this phase, a company typically tries to focus its marketing efforts on showcasing the competitive advantage of its product over others.

Although promotional costs will still be substantial due to these efforts, they generally drop from the high levels of the introduction phase. The firm also must concentrate on building the distribution of the good or service to increase market share.

This is accomplished through intense efforts to enlist dealers, distributors, and retailers to carry the good or an expansion of the service distribution network through additional locations or personnel. If the product satisfies the market, repeat purchases help make the product profitable, and brand loyalty begins to develop.

Stage # 2. Maturity:

In the maturity stage of the PLC, late majority and repeat buyers make up an increasing percentage of the customer base. The main objectives of the maturity stage are profitability and maintaining the firm’s market share for as long as possible. Sales level off as the market becomes saturated and competition becomes fierce.

Companies not doing well will drop out of the market. Marketing costs rise due to competition as each firm tries to find ways to gain market share. The firm may need to make large promotional expenditures to show the differences between the firm’s product and the competition and feel pressure to reduce prices.

As a result, profits typically begin to decline during this stage. If the product is a good, the company begins to offer more versions in different styles and with different features. It also may continue to improve the good’s quality and performance features, which requires adjustments to the marketing mix to accommodate more product options.

Price reductions, more effective advertising, and trade promotions may be used to generate demand. Promotion to resellers often increases during this stage to entice them to continue to buy the company’s product rather than a competitor’s. Customer service and repairs begin to take on significance and can serve as a source of differentiation from competing products.

Services also attempt to differentiate themselves from competitors during this stage. For example, the airline industry promotes service quality through things like on-time deliveries, more favorable cancellation policies, and early boarding options. The maturity stage is usually the longest stage of the PLC.

Stage # 3. Decline:

The decline stage of the PLC is preceded by a falling off of sales and profits. Depending on the product, the decline in sales may be rapid or could occur over a long period of time. During the decline stage, competitors drop out of the market as the product becomes unprofitable.

The firm will likely cut prices to generate sales, curtail advertising, eliminate unprofitable items from the product line, and reduce or eliminate promotion to individual consumers and resellers. Little or no effort is put into changing a good’s appearance or functionality at this stage since consumers have moved on to other types of products.

The good usually becomes obsolete at this point, and the firm may sell it off to discount retailers, such as – Odd Lots. Coupons or buy-one-get-one-free promotions may be used to prolong sales and reduce existing inventories. If the firm keeps the product active, it may put little effort into selling or advertising it.

At this point the firm must decide whether to discontinue the product, reposition it, or find a niche market that may be small but profitable. For example, travel agency services are in far less demand than they were a generation ago, before travellers could research and book and plan trips online.

In response, many travel agencies have shifted their focus from general consumer markets to niche markets, such as – horseback-riding trips in South America or wine-tasting tours in Europe. Such trips generate limited demand but can still earn profits for the agency.