In this article we will discuss about Infrastructure development in India. After reading this article you will learn about: 1. Subject-Matter of Infrastructure 2. Growth of Infrastructure during the Planning Period 3. Recent Strategy Adopted by the Government.

Subject-Matter of Infrastructure:

Development of a country depends very much on the availability of its infrastructural facilities. The development of agriculture and industry depends solely on its infrastructure. Without having a sound infrastructural base a country cannot develop its economy. More important and difficult job in the development process of the country is to provide the basic infrastructural facilities.

These infrastructural facilities include various economic and social overhead viz., Energy (Coal, Oil, Electricity), Irrigation, Transportation and Communication, Banking, Finance and Insurance, Science and Technology and other social overheads like education, health and hygiene.

All these facilities jointly constitute the infrastructure of the country. Like other countries, the developmental process of India put much emphasis on the growth of infrastructure.

ADVERTISEMENTS:

In this connection Dr. V.K.R.V. Rao observed, “The link between infrastructure and development is not a once for all affair. It is a continuous process and progress in development has to be preceded, accompanied and followed by progress in infrastructure, if we are to fulfil our declared objectives of a self-accelerating process of economic development.”

However, the prosperity and progress of a country largely depends upon the development of agriculture and industry. While the agricultural development requires facilities like irrigation, power, credit, transportation etc. but the industrial production also needs machines, equipment, energy, skilled manpower, management personnel, marketing, banking and insurance facilities, transportation services etc.

All these facilities and services helping the agricultural and industrial sector jointly constitute the infrastructure of a country. During the last 200 year or more, industrial and agricultural revolutions in England and other countries were accompanied by large scale development of infrastructural facilities.

Growth of Infrastructure during the Planning Period:

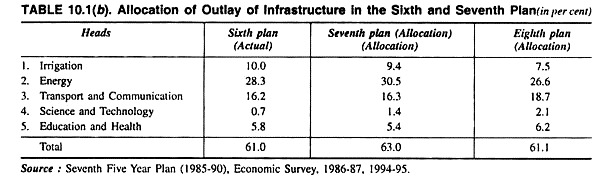

In Indian planning high priority was given to the development of infrastructure from the very beginning, thus a huge amount of fund was allocated in different plans for building various infrastructural facilities. In the First Six Plans, about 55 to 61 per cent of the total plan outlay was devoted to the development of infrastructure.

ADVERTISEMENTS:

Seventh Plan allocated about 63 per cent of the total plan outlay to infrastructure. Eighth plan also allocated about 16.1 per cent of the total outlay to infrastructure. Table 10.1 shows the allocation of outlay of the Sixth, Seventh and Eighth plan to infrastructure.

Due to continuous heavy investment of the infrastructural projects during the four decades of planning, infrastructural facilities in the country has recorded a phenomenal increase. Accordingly, the gross irrigated area has increased significantly from 23 million hectares or 17 per cent of gross cropped area in 1950-51 to 89.4 million hectares or 53 per cent in 1995-96.

Similarly, power generation also increased from 5 billion kWh in 1950-51 to 380 billion kWh in 1995-96. Similarly, tremendous growth of other infrastructural facilities has also been recorded during these plan periods.

This is mainly due to this rapid development of these infrastructural facilities in India. The agricultural production has recorded a three-fold increase and industrial output has also recorded more than seven fold increase during these four decades of planning.

ADVERTISEMENTS:

Whatever infrastructural facilities that have been developed in the country have mostly benefitted the urban areas and the richer section of the population has derived maximum benefit out of it.

Recent Strategy Adopted by the Government for Infrastructure Development:

In the past, the responsibility for providing infrastructure services was vested solely with the Government. This was mostly due to a number of reasons including lumpiness of capital investments, long gestation periods, externalities, high risks and low rates of return.

But in recent times the old paradigm of infrastructure being a public sector monopoly has been challenged by fiscal constraints and technological innovations. Limits on budgetary allocations and public debt, and the dismantling of the allocated system of credit have catalysed the encouragement of private entry in infrastructure provision.

The Government has recently announced guidelines for private investment in highway development through the Build Operate Transfer (BOT) route. Besides simplifying procedures and providing more financial concessions, these measures would facilitate preparation of detailed feasibility reports, clearances for the right way of land, relocation of utility services, resettlement and relocation of the effected establishments, environmental clearance and equity participation in the highway sector. The Government has also approved clear and transparent guidelines for encouraging private sector participation in ports and is in the process of setting up a tariff regulatory authority in 11 major ports.

New Initiatives for Infrastructure Development, 1999-2000 and thereafter:

Following are some of the new initiatives undertaken by the Government for the development of infrastructure sector:

General Measures:

The Government has introduced certain general measures:

(a) Introduction of uniform tax holiday for 15 years for all infrastructure projects;

ADVERTISEMENTS:

(b) Creation of Foreign Investment Implementation Authority to smoothen flow of FDI into the infrastructure sector;

(c) The import duty structure for project imports rationalised;

(d) Progressive corporatization of public sector service providers in the areas of telecommunication and ports;

(e) Custom duty has been reduced to boost InfoTech, Telecom industries and other knowledge based industries.

ADVERTISEMENTS:

Power:

New initiatives for the power sector include:

(a) Announcement of Mega Power Project policy;

(b) Restructuring of SEBs to be encouraged;

ADVERTISEMENTS:

(c) New transmission and distribution system to get fiscal benefits given to infrastructure sector;

(d) Increased budgetary support provided for the Tehri Hydro and the Naptha Jakhri Hydro Projects to ensure its commissioning by March 2002;

(e) Assistance provided to States’ power sector reforms and for undertaking investments or renovation and modernisation of old and inefficient plants and for strengthening the distribution system;

(f) Scheme for securitization of dues of Central Sector Power and Coal utilities to assist the SEBs to clear these dues. Central Government support is linked to reforms in the operation of SEBs.

Telecom:

The Government has announced the New Telecom Policy and thereby the policy observed:

ADVERTISEMENTS:

(a) Domestic long distance calls to be opened up;

(b) Department of Telecom Services (DTS) is to be corporatized by 2001;

(c) DTS/MTNL are to enter as third cellular operators;

(d) TRAI reconstructed through an ordinance;

(e) Specific targets for Telecom is announced so as to provide phone on demand by 2002, achieve telecom coverage of all villages in the country by 2002, provide internet access to all district headquarters by 2002 etc.

(f) Domestic Long Distance Service has been opened up without any restriction on the number of operators;

ADVERTISEMENTS:

(g) Department of Telecom Services (DTS) and Department of Telecom Operations (DTO) have been corporatized; and

(h) BSNL and MTNL are permitted to enter as third cellular operator in their respective circles.

Roads:

A new cess of Rs 1 per litre on HSD is imposed by the Government to generate funds which will be transferred to Central Road Fund. Most of it will be used for development and maintenance of State Roads and National Highways etc.

The Government has announced a major initiative for road development, the National Highways Development Project (NHDP). The cost of the project is estimated at around Rs 54,000 crore. Moreover, steps are taken for accelerated implementation of Prime Minister’s NHDP project from Petrol and Diesel cess and additional fund raising measures are undertaken for NHAI.

Railways:

ADVERTISEMENTS:

Indian Railway Catering & Tourism Corporation (IRTC) Ltd. is incorporated as a Government Company with the objective of upgrading and managing rail catering and hospitality. Indian Railways have issued letters of intent for ownership, operation and management of two luxury trains in private sector.

For improving passenger’s safety and comfort the following measures are undertaken by the Government:

(a) For improving safety, riding comfort and reliability, planned up-gradation of track structure is being undertaken using heavier and higher tensile strength rails;

(b) For detection of any hidden flows in the rails not visible in the naked eye, Ultrasonic Flaw Detectors (USFD) are now being used;

(c) Track circuiting has been completed on berthing portion at all stations on A, B, C, D spl. and D routes of Indian Railways;

(d) Walkie-talkie sets have been provided to drivers and guards of all trains for faster and better means of communication;

ADVERTISEMENTS:

(e) Simulators ate being installed for training of drivers.

Civil Aviation:

The Government has made necessary arrangement for restructuring of airports and Airport Authority of India (AAI) through long term leasing route:

(a) It is proposed to divest government equity in Indian Airlines and Air India;

(b) It is proposed to lease out international airport at Mumbai, Delhi, Chennai and Kolkata on long term basis;

(c) It is decided to set up new international airport at Bangalore, Hyderabad and Goa with private sector participation.

Urban Infrastructure:

The Government has introduced special package for Housing Construction and Services, which will facilitate development of urban infrastructure. In order to improve urban infrastructure, the Government enhanced the tax benefits for housing and also extended tax holiday to urban infrastructure.