Everything you need to know about classification of incentive plans. Incentive plans envisage a basic rate usually on time basis applicable to all employees and incentive rates payable to the more efficient among them as extra compensation for their meritorious performance in terms of time, cost and quality.

The incentive rates may take the form of bonus or premium. Bonus means payment to employees of the entire benefit accruing from savings in cost, time, improvement in quality etc.

Premium benefits accruing to the firm as the result of higher output or better quality will be shared equally or on some agreed basis between the management and the workers.

The Incentive plans can be classified under the following heads:-

ADVERTISEMENTS:

1. Profit Sharing and Stock Options Plan 2. Team Based Pay 3. Group Incentive Plans 4. Individual Incentive Plans 5. Enterprise Incentive Plans 6. Straight Piece Rate Plan 7. Standard Piece Rate with Guaranteed Minimum Wages Plan

8. Differential Piece Rate 9. Non-Financial and Financial Incentives 10. Gantt Bonus Plan 11. Halsey Plan 12. Emerson Efficiency Plan 13. Commission 14. Special Incentives and a Few Others.

Classification or Types of Incentive Plans

Classification of Incentive Plans – 2 Common Plans: Profit Sharing and Stock Options and Team Based Pay

Incentive plans envisage a basic rate usually on time basis applicable to all employees and incentive rates payable to the more efficient among them as extra compensation for their meritorious performance in terms of time, cost and quality.

The incentive rates may take the form of bonus or premium. Bonus means payment to employees of the entire benefit accruing from savings in cost, time, improvement in quality etc. Premium benefits accruing to the firm as the result of higher output or better quality will be shared equally or on some agreed basis between the management and the workers.

ADVERTISEMENTS:

Common Incentive Plans:

1. Profit Sharing and Stock Options Plan:

Profit sharing is a scheme whereby employers undertake to pay a particular portion of net profits to their employees on compliance with certain service conditions and qualifications. The purpose of this profit sharing schemes had been mainly to strengthen the loyalty of the employees to the organization by offering them an annual bonus provided they are on the service rolls of the firm for a definite period of time.

The share of the profit can be given in cash or in the form of shares in the company, which is known as Employees’ Stock Option Plan (ESOP). The IT sector made ESOPs quite popular in the early part of this decade. ESOPs have emerged as an important tool to keep talents from spilling over.

2. Team Based Pay:

Team pay links payments to members of a formally established team to the performance of that team. The rewards are shared among the team members with respect to a specific formula as specified by the company policy or on an adhoc basis in the case of exceptional performance achievements. Individual rewards in this case are influenced by assessments of their contributions for achieving team goals and objectives.

ADVERTISEMENTS:

The basic objectives of team based pay are as follows:

a. To provide incentives and other means of recognizing team contributions in organizations.

b. To clarify what teams are expected to achieve by relating rewards to the attainment of predetermined and agreed targets and standards of performance.

c. To convey the message that one of the organization’s core values is effective teamwork.

Team Based Pay and Individual Pay:

Some organizations focus on paying team bonuses only. A minority pay individual bonuses as well, which are often related to an assessment of the competence of the individual, thus, it is thought, providing encouragement to develop skills and rewarding them for their contributions.

Classification of Incentive Plans – 3 Broad Categories: Group, Individual and Enterprise

Incentives are defined as “Variables rewards granted according to variations in the achievement of specific results.” Unlike wages and salaries which are relatively fixed, incentives generally vary from individual to individual and from period to period for the same individual. Incentives or payment by results (PER) are monetary benefits that are paid to workmen in recognition of their outstanding performance.

George R. Terry defines the term incentives as, “Incentives means that which incites or has tendency to incite action.”

Allcorn, states that “Organisational incentives refer to both the reason for staff to join an organisation and the way an organisation rewards and punishes its staff. Incentive systems can encourage or discourage employee and work group behaviour.”

ADVERTISEMENTS:

The incentive plans can be broadly classified under three categories as under:

Classification # 1. Group Incentive Plans:

Under group incentives plans bonus is paid to the workers on the basis of individual performance and the amount of bonus that is payable to a worker on the basis of individual performance. The amount of bonus payable to a worker is not affected by the performance of another or other workers. The bonus is made payable to all workers on a collective basis. Priestman’s production plan, Towne plan, gain-sharing plan are the main group incentive plan.

Classification # 2. Individual Incentive Plans:

These days’ individual incentive plans have become most accepted plan. Most of these contain provisions that encompass corporate and group objectives. However, the fact that makes them truly individual incentive plans is that the actual awards to employees are differentiated on the basis of individual performance criteria. Various individual incentive plans are straight piece work, examples are Halsey plan, Rowan plan, Emerson’s efficiency plan, etc.

Classification # 3. Enterprise Incentive Plans:

Under enterprise incentive plans all organisational members participate in the plan’s compensation payout. Enterprise incentive plans reward employees on the basis of the success of the organisation over an extended time period-normally one year. However, when required the period can be longer.

ADVERTISEMENTS:

It seeks to create a “culture of ownership” by fostering a philosophy of cooperation and teamwork among all the organisational members. ESOP, stock options, profit-sharing plan, etc., are the main enterprise incentive plans.

Classification of Incentive Plans – With Advantages and Disadvantages

These are as follows:

1. Straight Piece Rate Plan:

Under the straight piece plan, workers are paid based on their output. For example, if the piece rate is Rs. 5 per piece of the product, then a worker who produces 50 pieces /day earns Rs.250 (Rs.5 x 50 pieces) as his wage for that day. Whereas another worker who produces 60 pieces /day earns Rs 300 (Rs.5 x 60 pieces). Hence a fast worker earns more compared to the slow worker.

Advantages:

ADVERTISEMENTS:

i. It motivates the workers to increase their output;

ii. It is simple and easy to understand;

iii. It improves productivity of an organization.

Disadvantages:

i. There is no guaranteed minimum wage. This makes workers insecure,

ii. There is great disparity of earning between slow and fast workers.

ADVERTISEMENTS:

iii. Quality of production may suffer as the workers concentrate on quantity.

iv. Interpersonal relationship suffers due to jealousy and competition to earn more.

2. Standard Piece Rate with Guaranteed Minimum Wages Plan:

Here the minimum guaranteed wage is fixed on hourly basis. A worker gets the minimum fixed wage per day plus the incentive for the number of pieces produced. To illustrate this, assume that there is 8 hour’s shift and the piece rate is Rs. 5 and a minimum fixed hourly rate is Rs. 10 and the worker produces 10 pieces then the total earning of that worker will be Rs.(10 x 8) + (5 x 10) = Rs. 130.

Advantages:

i. Minimum guaranteed wage improves sense of security among the workers,

ii. Disparity between slow and fast workers is reduced.

ADVERTISEMENTS:

Disadvantages:

i. It demotivates fast worker.

ii. Slow workers get higher piece rate.

3. Differential Piece Rate:

The differential piece rates are classified under two heads:

i. Individual Incentive Plans:

In an individual incentive plan, the rewards of incentives are based solely on individual performance, where an individual can increase the quantity and quality of his output by his own individual efforts and where his output can be measured. The rewards under such plan are almost immediate, that is, paid daily or weekly. Individual incentive plans are of two types. These are time based individual incentive and output based individual incentive plans.

ADVERTISEMENTS:

ii. Group Incentive Plan:

Group or area incentive schemes provide for the payment of a bonus either equally or proportionately to individuals within a group or area. It is related to output achieved over an agreed standard or to the time saved on a job.

Such schemes are appropriate:

(a) Where people have to work together and team work has to be encouraged.

(b) Where high level of production depends on the co-operation existing among a team of workers as compared with the individual efforts of team members. The reward earned in this case is divided among the members either equally or in specified proportions.

In some cases like an assembly line production it is not possible to determine the performance of an individual worker as several workers jointly perform a single operation. In such cases it is desirable to introduce a group incentive scheme. Here the bonus is calculated for a group of workers and the total amount is distributed among the group members in proportion to the wage earned by each.

4. Non-Financial and Financial Incentives:

ADVERTISEMENTS:

Incentives may be classified into monetary or non-monetary. Monetary incentive involves rewarding the worker over and above his regular remuneration for performing more than the targeted work. Some of the financial motivations are overtime wages, higher basic wages, incentive bonus, merit increments, suggestion rewards, various allowances and fringe benefits.

Some of the non-financial incentives are good human relations, self-respect, recognition, status, sense of belonging, appreciation, higher responsibility, greater authority, job satisfaction, improved working condition, greater leisure, etc. All these motivate workers to raise their productivity.

Classification of Incentive Plans – 7 Common Individual Schemes: Piece-Rate System, Differential Piece Rate, Gantt Bonus, Halsey and a Few Others

Incentive is an additional compensation for better performance. An organisation may choose a system to reward each individual on the basis of his or her performance or the group of workers as a whole employed in a workshop, department, section or unit.

The common individual incentive schemes are:

Classification # 1. Piece-Rate System:

Wage is determined by multiplying the number of units produced by the worker with the rate of wage per unit. It is easy to calculate, wage cost is easily predicted and the employee gets the satisfaction of reward based on his personal performance. But the system may result in the speeding up of work while sacrificing quality. It also may create tension at the workplace by promoting unhealthy competition.

Classification # 2. Differential Piece Rate:

Earning of an employee depends upon his ability to produce more or less than a standard predetermined output. One who produces less than the fixed standard, gets payment at a lower rate, and one who produces more than the prescribed norms, gets paid at a higher rate. It was devised by Taylor, the father of Scientific Management, to motivate people to achieve or exceed established standards. The method is difficult to implement in cases where the measurement of individual’s performance cannot be quantified accurately or where the norms of production cannot be fixed scientifically.

Classification # 3. Gantt Bonus Plan:

Worker who does the prescribed level of work in the allotted time or even less, gets wages for the standard time worked, plus bonus which may range from 20% to 50% of the time saved. This scheme guarantees a fixed time rate for all, and the bonus is earned only by those who save time and achieve targets.

Classification # 4. Halsey Plan:

Worker gets bonus for 50% of the time saved. The benefit of the other 50% goes to the company. In a straight piece rate, a worker’s earning will be much higher.

Classification # 5. Emerson Efficiency Plan:

Bonus is payable only for a fairly higher level of performance. Merely crossing the standard does not entitle the person for a better pay.

Classification # 6. Commission:

It is a widely used individual incentive system in sales job. It is computed as a percentage of sales in units or rupees. Sales personnel employed by the company may get it in addition to their salary. Sales agents not in permanent employment of the company may get only the commission on sales effected by them.

Classification # 7. Special Incentives:

Sales contests, productivity contests, cash your ideas schemes, etc. may be organised to motivate employees.

Individual incentive system is resisted by trade unions because it promotes unnecessary competition among employees and weakens trade union movement. Operational problems such as difficulty in fixing standards, sharing gains of time saved, etc. also make the system vulnerable to criticism.

Group incentive schemes have become more popular in recent years. Such schemes provide reward to all employees in a work unit, department, division or organisation. The productivity standards are fixed for departments or divisions and bonus may be paid to all the employees on reaching or exceeding the standards.

This promotes team spirit and better coordination at work. Organisation-wide incentive scheme is an extension of group incentive programme. All employees of the company, for instance, may be paid bonus if sales exceed the target fixed by the management.

The group incentive schemes, however, are not a perfect substitute for individual incentives. The connection between individual effort and reward is lost. The scheme may lead to conflict among groups if people in one department get a higher amount of bonus than those in other departments.

It may also result in over-emphasising one aspect of the job to the detriment of others. Marketing people may be rewarded on the basis of number of units sold, while production men may get bonus on the basis of reduction in cost and improved productivity. In a period of boom, a little effort by the salesmen may bring far better results and the sales personnel may get a handsome bonus. But if the factors governing reduction of cost are not favourable then production men may not be entitled to a bigger bonus.

A categorical verdict on the suitability of incentive systems is difficult. There have been many occasions where incentive systems have failed to produce any results. Discussion with many company chiefs/ directors have revealed three basic reasons for the success of an incentive plan-

1. A properly designed plan

2. Intelligent administration

3. Proper coverage

On the whole, it can be said that the incentive scheme of an organisation and its success depends upon the interaction of various factors, some of which are measurable and some are not.

Therefore, some of the simple rules which should govern incentive schemes could be:

(1) Management should recognize that the effectiveness of incentives depends upon the total situation, which includes worker-management confidence, relations with the union, quality of communication and supervision, and the traditions of the industry.

(2) Management should not introduce an incentive system without fully understanding its repercussions. This may require procedures for the participation of employees and negotiations with the union.

(3) Management should not adopt unfair practices. It must avoid actions that look like ‘rate-cutting’, which is not an easy task in view of the need to improve methods and rates from time to time.

(4) Management should pay in proportion to the output, once the output has risen above the level required for the guaranteed pay. Some of the employees are paid only half of the savings from extra output, but this is no longer acceptable to many unions or employees. Management may still find increased productivity profitable, even if it does not reduce wage costs per unit, for the overhead costs will be spread over a greater output.

(5) Management should train supervisors all the way down the line to understand the incentive system, so that the foremen and the department managers will be able to deal with problems within their own departments.

(6) Great care should be taken in setting die standards to avoid rates that are too low or too high. Without sound standards, it is impossible to have fair incentive rates.

This is not by any means a conclusive list and many more related factors could be added to it. A successful incentive scheme should provide for the best use of manpower; productive facilities; recognition of the needs of employees, the company and, at times, the public too. It should be fair and equitable to all concerned. It should promote good labour relations, reduce personnel problems and encourage initiative. Above all, it should be flexible and strong enough to withstand the test of time.

Group incentive plans enable employees to share the benefits of improved efficiency realized by major work teams and mainly aim to encourage a cooperative rather than individualistic spirit among the employees involved in the team. Many organizations have included group incentive schemes as a part of their performance based pay strategy.

The group incentive plans are as follows:

1. Scanlon Plan:

Scanlon plan is a bonus incentive scheme using employee and management committees so as to gain the cost reduction improvements in the organization. The main objective behind the Scanlon plan is to ensure involving the employees and all the teams in the organization to offer ideas and suggestions to the management so as to enhance the productivity of the organization.

This scheme demands good management, leadership, trust and respect between the work teams and the managers and when properly implemented can bring about drastic improvements in productivity and improved quality in the organization. The following model depicts the Scanlon plan model commonly practiced in organizations.

According to Scanlon plan, effective employee participation, which includes the use of committees, is crucial for the success of the scheme. As depicted in the given model, the shop and screening committees play a crucial role in the success of the Scanlon plan. Financial incentives under the Scanlon plan scheme are offered to the members of these committees on the basis of an established formula, which is based on increases in employee productivity.

2. Rucker Plan:

Rucker plan or share-of-production plan (SOP) is a bonus incentive plan based on the historic relationship between the total earnings of hourly employees and the production value created by the employees. It uses a far less elaborate participatory structure as compared to the Scanlon plan.

The financial incentive in the form of bonus is based on any improvement in the historic relationship between the total earnings of hourly employees and the production value that they create.

3. Improshare:

This is a gain sharing program under which bonuses are based upon the overall productivity of the work team. The concept was first developed by Mitchell Fain an industrial engineer. Improshare bonuses are based on the overall productivity of the work team and the output is measured by the number of finished products that a work team produces in a given period of time. Both production (direct) employees as well as non-production (indirect) employees are involved in this bonus scheme.

4. Earnings-at-Risk Plans:

These are incentive plans which involve placing a portion of the employee’s base pay at risk, but giving the opportunity to earn income above the base pay when goals are met or exceeded. The main objective of this scheme is to ensure that employees should not expect substantial rewards without assuming some risk for their performance. These plans allow employees to recapture lower wages, or reap additional income above full base pay when quality; service or productivity goals are met or exceeded.

5. Team Incentives:

These are compensation plans where all team members receive an incentive bonus payment when production or service standards are met or exceeded. This incentive scheme seeks to establish a psychological commitment and a sense of belongingness in the team and also to the organization as a whole.

The contribution of individual employees depends on the group or team level coordination. They tend to reduce employee complaints over individual or narrow interests and constantly encourage cross-training and acquiring of new interpersonal skills.

Classification of Incentive Plans – Better Known Plans of Incentive Wage Payment: Halsey, Rowan, Taylor’s Differential, Merrick Differential and a Few Others

Some of the better known plans of incentive wage payment have been discussed:

Classification # 1. Halsey Plan:

It is an American plan originated by F. A. Halsey to encourage efficiency amongst workers as well as to guarantee them wages according to time basis. The standard time required for a job is determined beforehand on the basis of time and motion studies and/or from past records.

Workers who perform the job in less than the standard time and thus save time are rewarded with a bonus, but the worker who takes longer than the standard time is not punished, and is paid wages according to time wage system. The total earnings of a worker under this plan consist of wages for the actual time plus a bonus which is equal to the money value of 33 per cent of the time saved in case of standard time set on previous experience, and 50 per cent of the time saved when the standards are scientifically set.

Thus, if a job requiring 20 hours is done in 16 hours, the workers will be paid wages for 16 hours + wage for 50 per cent of the time saved namely, 2 hours. In all, therefore, the worker will get wages for 18 hours. If a worker is paid at the rate of 50 P. per hour, his wages will be calculated as follows- 16 x 50 x 4/2 x .50, i.e., Rs.8.00 + 1.00 = Rs.9.00.

The Halsey-Weir Plan is a slightly modified version of the original Halsey plan in that the bonus under this plan is equal to the money value of 30 per cent of the time saved. It was adopted first by the Weir-Engineering Works, Cathcart on the Clyde in Britain.

The plan possesses a number of merits, chief among which are the following:

(i) It assures every worker a minimum hourly wage and thus gives him a feeling of security.

(ii) The efficient workers are rewarded for finishing the job before the standard time. Thus, efficiency is encouraged.

(iii) The worker can aim at a premium on every job, and the time saved by a worker on one job is not set off against any excess time spent on another job.

(iv) The value of time saved is divided equally between the employer and the worker.

(v) The worker can easily follow the method of calculating the bonus so that there is little room for misunderstanding and bickering on this score.

(vi) Since the plan lays emphasis on the time saved and not on increased output, the workers do not offer much resistance to its adoption, because, besides guaranteeing wages on time basis, it also rewards efficiency.

The chief criticism made against the system is that the worker is not given the full benefit of his efficiency because he is paid only 50% of the wages for the time saved by him. If the saving of time results from the efforts of the worker alone this would be a valid criticism, but if the management has also co-operated with the worker through better machines, tools or materials, it is proper that the worker should take only a share of the benefit of the saving in time.

Further, the workers may be over-induced under this plan because the bonus continues to rise as the time saved increases; they may just rush through the job taking no care of the quality of products and spoiling and wasting materials.

This system is recommended for standardised job where the time can be determined beforehand on the basis of time and motion studies.

Classification # 2. Rowan Plan:

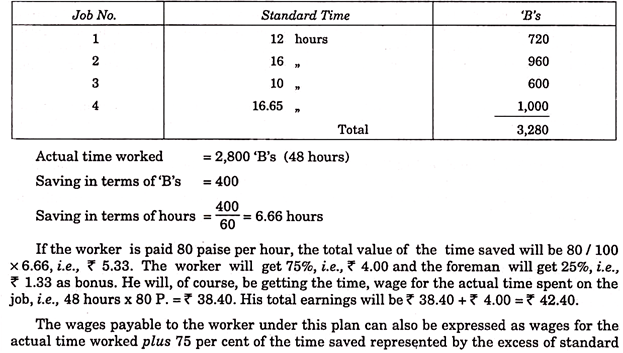

Introduced in 1901, by James Rowan of David Rowan and Sons, Glasgow, this plan is quite popular in England. Wages, according to time basis, are guaranteed and the slow worker is not made to suffer, a standard time is determined beforehand and a bonus is paid according to time saved.

The only difference between Halsey Plan and Rowan Plan relates to the calculation of the bonus. Under this plan, bonus is based on that proportion of the saved which the time taken bears to the standard time.

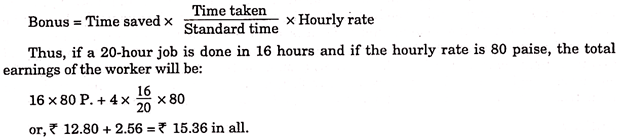

It can be expressed as follows:

Evaluation:

As the time saved increases, the time taken will naturally be reduced and, therefore, the bonus is always a decreasing proportion of an increasing figure. In this way, it checks over speeding and does away with a major drawback of Halsey’s plan. Under this system, the bonus earned by a worker cannot exceed 25% of the standard time.

Thus, it does not offer sufficient incentive to the more efficient workers. Moreover, the calculation of bonus under this plan is not easily followed by the workers. This may give rise to suspicion as to the intention of the employer.

Classification # 3. Taylor’s Differential Piece Wage Plan:

F.W. Taylor, the founder of Scientific Management, devised this system in 1880. He was opposed to the payment of wages on time basis and, therefore, under his system there was no guarantee of wages. On the other hand, Taylor was firmly of the view that the standard of performance in terms of a fair day’s work can be fixed quite accurately through careful time study.

Under Taylor’s plan, standard of output is fixed per hour or per day and two piece wage rates are laid. Those exceeding the standard, or even just attaining it, are entitled to the higher rate and those, whose output is less than the standard output are paid at a lower rate. For example, the standard may be fixed at 40 units per day and the piece rates may be 30 P. and 25 P. per unit.

If a worker produces 40 units, he should get wages at the rate of 30 P., i.e., Rs.12.00, but if he produces only 39 units he would be paid at the rate of 25 P. per unit only and his wages would come to Rs.9.75. This shows that the penalty of the output being less than the standard output is too severe and the worker would be prompted to try to produce as much as the standard output.

Moreover, the workman receives the full piece rate per unit as production rises after he attains the standard output. Under other schemes like that of Halsey, the worker gets only a part or the wages for the time saved.

The basic idea underlying Taylor’s scheme is that the good workman should attain the high standard of output set by the management through careful time and motion studies. Steps are taken to standardise conditions of work and plan every task thoroughly. It must be said to the credit of the system that it is does make a distinction between the efficient workers and the inefficient ones.

By imposing a heavy penalty on the inefficient workers, and giving a handsome reward to the good workmen in the shape of increased wages, it encourages high standards of performance. In fact, if the system remains in operation in an industrial concern for some time, it will gradually eliminate the inefficient workers.

The system is too harsh for the relatively less efficient workers. The penalty for the slight fall in the output of an individual worker below the standard is much too heavy. Since the system does not lay down any basic guaranteed time wage, it creates insecurity for the workers.

Moreover, the system leaves nothing to the worker’s initiative and treats him more or less like an automatic machine. The trade unions will not accept such a scheme easily because it creates distinctions in the working class, and makes no allowance for such reductions of output as cannot be helped by the worker, say due to prolonged illness, or accident, etc.

Because of its severity, the scheme has not been adopted by many concerns. But the importance of the scheme lies in the fact that it has become the basis of many other incentive schemes which provide for bonus on output rather than on time saved.

Classification # 4. Merrick Differential or Multiple Piece-Rate Plan:

It is a modification of the Taylor’s scheme. While Taylor prescribes two rates—one, for the slow and the inefficient workers and the second, for the efficient ones, this plan lays down three rates- one for the beginners, the second for the developing workers and the third for the highly skilled and efficient workers. Like Taylor’s plan, it lays down a standard output through time studies and expects the workers to attain it.

No guaranteed time rate is set. Those who are able to produce up to 83% of the standard output become entitled to the first and the lowest piece rate. Those whose output exceeds 83% of the standard but does not reach the standard are paid the second higher rate which includes an increase of 10%.

Those who attain or exceed the standard get the third, i.e., the highest piece rate on their output which includes a further increase of 10% in the basic rate. Thus, if the basic piece rate is 50 P. per unit, wages at this rate will be paid to those who produce below 83% of the standard task. Those producing 83% of the standard task will get a step-up of 10% (i.e., 55 P. per unit) while those attaining or exceeding the standard task will be entitled to another increment of 10% (i.e., 60 P. per unit).

If 25 units is the standard task, wages will be paid as follows:

Evaluation:

Under this plan, there is no sudden rise in the wages at one point, and the penalty for inefficiency is relatively lighter. Apart from these features, the general criticism levelled against Taylor’s plan also applies to it.

Classification # 5. Emerson’s Efficiency Plan:

Emerson was also a proponent of scientific management and he devised this system of wages to encourage efficiency amongst workers. Under this system, wages on the time basis are guaranteed even to those workers whose output is below the standard. The workers who prove efficient are paid a bonus. For the purpose of determining efficiency, either the standard output per unit of time is fixed, or the standard time for a job is determined, and efficiency is determined on the basis of a comparison of actual performance against the standard. Suppose, the standard output per day is 40 units and the actual output is only 30, then the efficiency is 75 per cent. If the output is 45, the efficiency is 112.5 per cent.

Emerson proposed that no bonus should be payable if the efficiency was less than 66⅔ per cent. At 66⅔ per cent efficiency, a bonus of 1 per cent on wages earned according to time rate would be paid. This rate of bonus would increase as efficiency rises, so that at 90 per cent efficiency, the bonus would be 10 per cent and at 100 per cent efficiency, the bonus would rise to 20 per cent. Beyond 100 per cent efficiency, a bonus of 30 per cent will be payable. For the sake of illustration, let us assume the standard output to be 1,500 units. If the worker produces 750 units, efficiency will be equal to 50 per cent. Since it is less than 66⅔ per cent of the standard, the worker will get the time wage (say, Rs.30 a week). If production is 1,350 units, efficiency will be 90 per cent, and the worker will get the time wage plus 10 per cent, i.e., ? 30 + (30 x 10/100) = Rs. 33. If production is 1,500 units, total wage will be Rs. 30 + (30 x 20/100) = Rs. 36.

Evaluation:

The Emerson plan offers the following advantages:

(i) It is easy to understand,

(ii) It provides an encouraging reward to the beginners, besides giving incentive to the skilled and efficient labour,

(iii) The calculation of efficiency under this system is logical enough, and can be used as a fair basis for the provision of incentives to the efficient workers,

(iv) The plan can be applied to individual workers or to groups of workers.

As against these advantages, however, the plan suffers from a major drawback. Once a worker reaches the point of standard efficiency, the incentive beyond it becomes too mild. The less ambitious workers pre, therefore, tempted to rely on the guaranteed rate plus bonus up to standard efficiency.

Classification # 6. Gantt’s Task and Bonus Plan:

In order to moderate Taylor’s plan, Mr. H. L. Gantt, one of his associates, put forth a plan which tries to avoid this difficulty and yet provides a reward to the efficient worker. In fact this is similar to Emerson’s plan. Under it, wages on time basis are guaranteed to every worker. On the basis of careful study of workers and conditions of work, a good standard of performance under the best conditions is determined. Efficiency of workers is measured in the same manner as discussed above and a bonus is paid to those workers who show cent per cent efficiency. The main difference is that no bonus is payable to a worker if his efficiency is less than 100%.

Thus, if a 10-hour job is done in 10½ hours showing an efficiency of 95 per cent, the worker concerned will get wages on time basis for 10½ hours without any bonus. But, at 100 per cent efficiency, a bonus of 20 per cent is paid, so that if a 10-hour job is done in 10 hours and if the hourly rate is 50 P., the worker would get wages for 10 hours, namely,Rs.500 plus a bonus of 20 per cent, namely, Rs.100 making a total of Rs. 600. If the output reaches the standard task in less than the time set for it, the piece rate will be paid. This system is, therefore, essentially a piece rate system with a guarantee of wages on time basis.

Evaluation:

It is a plan of considerable merit on account of the following strong points:

(i) It is simple to understand for the workers and can be quite easily introduced.

(ii) It provides both security and incentive to the workers by laying down a guaranteed time rate and a bonus for those who can reach the standard output. Thus, it is human in its operation.

(iii) It encourages planning and better supervision. Under the plan, a careful study of all conditions of work is made with the object of assisting the worker by removing all obstacles. A further incentive for supervision is provided by giving bonus to the foreman when a given proportion of workers under him earn the bonus.

(iv) It satisfies the workers, because the bonus is handsome and they get all the apparent gains of increased output.

(v) From the point of view of the employer, the plan is of particular utility if the overhead expenses (fixed costs) and machine rates are high. These charges will get spread over a larger number of units of output as the production rises towards the task which is set quite high.

(vi) Under this plan and other methods advocated by Mr. Gantt, special attention is given to the training of the workmen in the skill necessary to earn the bonus.

Inspite of the numerous merits of the plan outlined above, the plan is not without its critics. It is argued that like Taylor’s plan, it divides workers into two distinct and competing categories—those who earn the bonus and others who are not able to do so. This creates disunity in the ranks of labour and the plan does not, therefore, meet with the union approval.

Moreover, if under the pressure of the labour union, or otherwise, the guaranteed time rates are kept high, the workers may lose all incentive to reach the standard output for the sake of bonus.

All said and done, the plan has undoubted merit. In fact, it proved very successful in many plants under Mr. Gantt’s personal direction.

Classification # 7. Bedeaux Point Premium Plan:

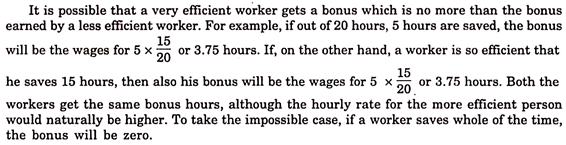

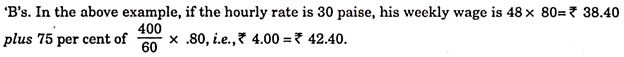

The chief novelty of this plan is that the value of time saved is divided between workers and foreman, three-fourths to workers and one-fourth to foreman. This is done on the basis that a worker cannot grow good results if this foreman does not fully co-operate with him; therefore, the foreman is also entitled to an incentive.

The method of reckoning the time saved is slightly different from that discussed above. In this case, the standard time of various jobs is determined beforehand and is expressed in terms of minutes which are called ‘B’s. Each ‘B’ represents a point equal to one minute. Thus, if the standard time for a job is 10 hours, under this plan, it would be expressed as 600 ‘B’s. The standard ‘B’s of various jobs done by a worker in a week are calculated and compared with the actual time.

If the actual time exceeds the standard time the worker gets wages for the actual time worked. Thus, wages on the time basis are guaranteed. If the standard ‘B’s exceed the actual time, the difference is divided by 60 to give hours saved and then three-fourths of the wages of the time saved go to the worker concerned and one-fourth to the foreman.

Suppose, a worker does the following jobs in a week:

Evaluation:

The main criticism bf this system is that a worker may not understand how the standard time is determined because of the introduction of ‘B’s. Moreover, a worker may resent that part of the saving of time by him is paid to his foreman. Much depends upon the attitude of the worker towards his foreman, but normally, a worker does not like that the foreman should also be rewarded because the worker has shown efficiency.

Classification # 8. Hayne’s Plan:

Under this plan the standard time of a job is fixed in terms of Manits which is the short form of man-minutes. The worker is paid wages on time basis in any case, but if the standard time of various jobs done by him exceeds the actual time, that is to say, if there is a saving of time, the worker will be paid a share of it.

The saving is naturally calculated in terms of Manits (as in case of Bedeaux’s plan). The resultant saving is divided by 60 to convert it into hours. By multiplying hours so calculated by the time rate, the total value of the time saved is determined. The benefit of time saved is divided as follows- (a) if the work is standardised, 5/6ths to the worker and 1/6th to the foreman, (b) if the work is non- standardised, 5/10ths to the worker, 1/10th to the foreman and 4/10ths to management.

Standardised work means work which is of a repetitive nature and non-standardised work means work of different nature every time. The bonus payable to the foreman is credited to a fund. If the worker loses time due to a fault of the foreman, the foreman will lose his bonus to the extent worker has to be paid wages for idle time. No Manits are credited to the worker for a product that does not pass inspection.

Classification # 9. Priestman Bonus System:

This is a plan which takes the productivity of all workers as a whole into account. If, during a year, the output rises either above the standard output or the output of the previous year, the wages of the workers are increased in the same ratio. Thus, if in 1977 the output per worker per hour came to 10 units while in 1978 the hourly output per worker is, on the average, 11 units, the wages in 1978 would be 10 per cent higher than in 1977.

Since this system does not take into account individual efficiency, it will not have a good effect upon individual initiative though workers as a whole may begin to feel that there is some benefit from increased output.

10. Barth Variable Sharing Plan:

This plan is similar to the Halsey and Rowan plans because it is also based on standard time set for the completion of a job. Unlike those plans, however, it does not guarantee a time rate.

Wages under this plan are calculated according to the following formula:

If we assume that the standard time for finishing a job is 10 hours, the actual time taken by a worker for doing it is 8 hours, and the hourly rate of pay is 50 P., the earnings of the worker will be calculated as under-

Under this plan, the earnings of a worker rise steeply though at a decreasing rate. It is, therefore, particularly suitable for the period of learning, though it can be used also for encouraging less skilled workers. But, it cannot be recommended where high production from skilled workers is required. Moreover, the formula is difficult to explain to the workers.

Classification # 11. Group Incentive Plans:

Incentive plans for individual workers but certain pieces of work can be done only by groups of workers. Group incentive plans are, therefore, necessary for efficient completion of such tasks. But it should be remembered that, as far as possible, group-work should be avoided because all the members of a group would receive bonus on the same basis even if some of them did not contribute effectively to the completion of the job.

This has an undesirable effect on other members of the group and generally, therefore, it is found that group-work is not done efficiently. But, if there is group-work and incentive is to be provided, it is generally done by fixing a piece rate for the entire job for all the workers. Care should be taken to divide the piece rate bonus amongst the members of the group according to their skill and to the time devoted by them.

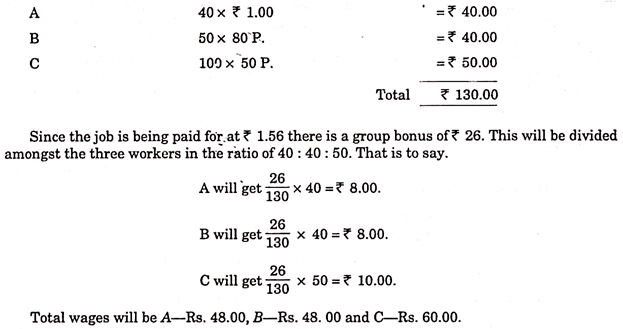

For this purpose, the wages of various workers should be calculated first according to time basis and then the extra wage which the group might earn on piece basis should be divided amongst the members in the ratio of wages calculated on time basis. Suppose- (a) a job is done by three workers who are paid at the rate of Rs.1.00, 80 P. and 50 P. per hour; (b) A devotes 40 hours, B devotes 50 hours and C devotes 100 hours to the job; and (c) the piece rate for the job for all the workers combined is Rs.1.56.

The wages of the various workers on time basis will be as follows:

Classification # 12. The Scanlon Plan:

The plan which bears the name of Mr. Joseph Scanlon of the United Steel Works of America is among the most popular plans for sharing the gains from improvements in productivity. Although the originator of the plan and his associates argue that the actual sharing formula for wage payment should be devised on the basis of the conditions actually found in a plant, it would be useful to take stock of the formula used by the Lapointe Machine Tools Company under this plan.

According to this formula, for each 1% of increase in productive efficiency, a 1% participating bonus is paid to each employee covered by the plan. All employees except the top management share in the bonus. Thus, foremen, superintendents, engineers and other managerial staff have a recognised part in the plan.

The workers who were previously working on piece rates were guaranteed their regular hourly rate plus their average incentive earnings before the operation of the plan. One-half of the first 15% of any bonus earned in any month is set aside as a reserve. Such a reserve fund is to be used to meet fluctuations in labour costs. Any “unused portion” of this reserve by November of the given year is paid out in December and a new reserve fund is created.