In this article we will discuss about:- 1. Meaning and Measurement of Gains from Trade 2. Gains from Trade for Large and Small Country 3. Potential and Actual Gain 4. Free Trade vs. No Trade 5. Static and Dynamic Gains.

Meaning and Measurement of Gains from Trade:

Just as two traders in the same country enter into exchange for the consideration of making some gain, in the same way two countries get engaged into transactions for deriving some gain. The economists have viewed the gains from trade from different angles. The classical theorists believed that gains from trade resulted from increased production and specialisation.

Jacob Viner pointed out that the gains from trade were measured by the classical economists in terms of:

(i) Increase in national income,

ADVERTISEMENTS:

(ii) Differences in comparative costs, and

(iii) Terms of trade.

The modern theorists considered the gains from trade as the gains resulting from exchange and specialisation.

Some approaches to the concept of gains from trade and their measurement are discussed below:

ADVERTISEMENTS:

(i) Adam Smith’s Approach:

In the opinion of Adam Smith, the gains from international trade are in the form of the increased value of product and improvement in the productive capacity of each trading country. The international trade leads to export of the commodity which is less in demand in the home market, and import of the commodity which is strong in demand. It enables each trading country to derive the maximum welfare and obtain maximum possible export earnings.

When each country specialises in the production of the commodity in which it has cost advantage, there is optimum allocation of productive resources. Coupled with increased division of labour, specialisation reduces the cost structure and enlarges the size of market for each trading country. As a consequence, the world production and welfare gets maximized through international trade.

(ii) Ricardo-Malthus Approach:

ADVERTISEMENTS:

Ricardo viewed the gain from trade as an objective entity. According to him, the specialisation in production and trade on the basis of the principle of comparative costs results in saving of resources or costs. Through the cheaper availability of commodities required by each country from abroad, every country can increase the ‘sum of enjoyments’ and also increase the ‘mass of commodities’.

In the words of David Ricardo, “The advantage to both places is not that they have any increase in value but with the same amount of value they are both able to consume and enjoy an increased quantity of commodities.” Malthus had expressed in this regard views similar to those of Adam Smith. The gain from trade, according to him, consists of “the increased value, which results from exchanging what is wanted less for what is wanted more.” The international exchange on this basis increases “exchangeable value of our possession, our means of enjoyment and our wealth.”

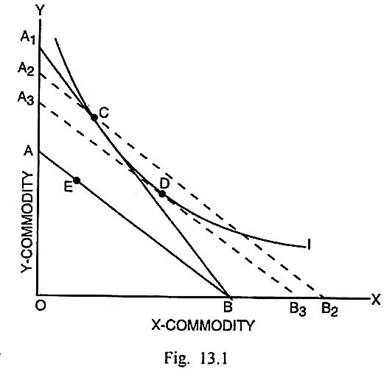

The Ricardo-Malthus approach to gains from trade was illustrated by Ronald Findlay in terms of Fig. 13.1.

In Fig. 13.1., the production possibility curve under constant cost conditions is AB before trade. The production, let us suppose, takes place at E. If this country enters into trade, the international exchange ratio line shifts to A1B and production of two commodities X and Y now takes place at C. The production at point C will be possible if the labour input increases to such a large extent that the production possibility curve shifts to A2B2. The gain from trade will be measured by BB2/OB.

Malthus criticized this measure of gain from trade as exaggerated. According to him, if the production possibility curve shifts to A2B2, the point C cannot be the point of equilibrium. The relative prices along A2B2 are more favourable to the export good X than along the line A1B. Some point to the right of C rather than C itself would be preferable to the community. Hence the gain from trade along the line A1B cannot be measured by an increase in the input of labour in the ratio BB2/OB. It tends only to overstate the gain from trade.

Ronald Findlay attempted a modification over the Ricardian measure of gain from trade by introducing in this analysis the community indifference curve. Given the community indifference curve I, the equilibrium does not take place at the Ricardian trade equilibrium position C but at D where the production possibility curve A3B3 became tangent to the community indifference curve I.

At point D each individual in the community is better off than at C. The gain from trade in this situation is BB3/OB rather than BB2/OB. The measure of gain from trade BB3/OB vindicates the Malthusian criticism that Ricardian measure of gain from trade was an over- estimation.

(iii) J.S. Mill’s Approach:

ADVERTISEMENTS:

A serious deficiency in the Ricardian approach was that it could not explain the distribution of gains from trade among the trading countries. J.S. Mill attempted to analyse both the gains from trade and distribution thereof among the trading countries. He emphasised upon the concept of reciprocal demand that determines terms of trade, which is a ratio of quantity imported to the quantity exported by a given country. The terms of trade decide how the gain from trade is distributed between the trading partners.

Suppose in country A, 2 units of labour can produce 20 units of X and 20 units of Y so that the domestic exchange ratio in country A is : 1 unit of X = 1 unit of Y. In country B, 2 units of labour can produce 12 units of X and 18 units of Y so that the domestic exchange ratio in this country is : 1 unit of X = 1.5 unit of Y. The domestic exchange ratios set the limits within which the actual exchange ratio or terms of trade will get determined.

The reciprocal demand or the strength of the elasticity of demand of the two trading countries for the products of each other will decide the actual rate of exchange of two commodities. If A’s demand for commodity Y is less elastic, the terms of trade will be closer to its domestic exchange ratio: 1 unit of X = 1 unit of Y. In this case the terms of trade will be favourable for country B and against country A.

The gain will be more for B than for A. On the contrary, if B’s demand for X commodity is less elastic, the terms of trade will be closer to the domestic exchange ratio of country B: 1 unit of X = 1.5 unit of Y. The terms of trade, in this situation, will be favourable for A and against B. Country A will have a larger share out of the gains from trade than country B.

ADVERTISEMENTS:

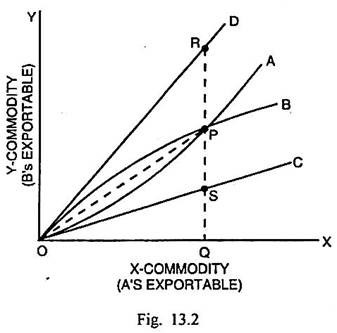

The distribution of gains from trade can be explained in terms of Marshall-Edgeworth offer curve through Fig. 13.2.

In Fig. 13.2., OC and OD are the domestic exchange ratio lines of countries A and B respectively. OA is the offer curve of country A and OB is the offer curve of country B. The exchange takes place at P where the two offer curves cut each other. Country A imports PQ quantity of Y and exports OQ quantity of X.

The terms of trade for country A at P = (QM/QX) = (PQ/OQ) = Slope of Line OP. If the line OP gets closer to OD, the terms of trade become favourable to country A and unfavourable to country B. On the opposite, if the line OP gets closer to the line OC, the domestic exchange ratio line of country A, the terms of trade turn against country A and become favourable to country B.

ADVERTISEMENTS:

Country A was willing to exchange before trade SQ units of Y for OQ units of X. After trade, it gets PQ units of Y for OQ units of X. Therefore, the gain from trade for country A, out of the total trade gain of RS, amounts to PQ – SQ = PS units of Y. In case of country B, RQ units of Y were being exchanged for OQ units of X before trade.

However, after trade it has to part with only PQ units of Y to import OQ units of X. Therefore, the gain from trade for this country amounts to RQ – PQ = RP units of Y. As the point of exchange P gets closer to the line OD, the share of country A in the gain from trade will rise and that of country B will fall and vice-versa.

(iv) Taussig’s Approach:

Taussig maintained that the gains from international trade can accrue to the trading country in the form of a rise in income. As trade brings about an expansion of the export industry, the employers start offering higher wages in order to absorb more labour in this industry. This leads to a rise in the money wages in other industries otherwise there will be accumulation of inefficiency in them. It signifies a general rise in money incomes. A higher level of income due to trade enables the people of a country to make larger purchases of both domestically produced and imported goods and reach a higher level of welfare.

(v) Modern Approach:

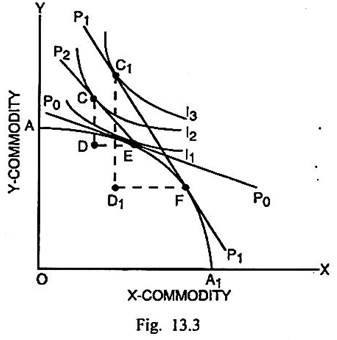

The modern approach stresses that the introduction of international trade brings two types of gains—gain from exchange and gains from specialisation. These two gains together constitute the gains from international trade. When trade commences, consumers enjoy a higher level of satisfaction, partly because of improvement in terms of trade and partly on account of greater specialisation in the use of economic resources of the country. These two types of gains from trade can be shown through Fig. 13.3.

ADVERTISEMENTS:

In Fig. 13.3., X-commodity is measured along the horizontal scale and Y-commodity is measured along the vertical scale. AA1 is the production possibility curve. P0P0 is the domestic price ratio line. It is tangent to the production possibility’ curve at E. Thus E is the point of production equilibrium in the absence of trade.

E is also the point of consumption equilibrium because P0P0 is tangent to the community indifference curve I1 at this point. When trade commences, P1P1 is the international exchange ratio line, which is tangent to the production possibility curve at F and to the community indifference curve I3 at C1.

Thus F is the point of production and C1 is the point of consumption. After trade takes place, D1F of X-commodity is exported and C1D1 quantity of Y-commodity is imported. The trade causes two types of shifts in the country. First, the production point shifts from E to F. It occurs because of specialisation in the production of X-commodity and specialisation in factor use. This can be called as the production effect. Second, the point of consumption shifts from E at I1 to C1 at the higher community indifference curve I3. It means an increase in the satisfaction of the commodity. This can be called as the consumption effect. Both together signify the gain from international trade.

If a line P2E is drawn parallel to P1P1 from the original equilibrium situation E, it signifies that there is no change in production but the consumption equilibrium shifts from E to C at a higher community indifference curve I2. In this situation, CD quantity of Y is imported at lower international price of Y. The quantity of X-commodity exported in exchange of CD quantity of Y is DE. Although production is the same as at point E but the consumption equilibrium shifting from E to C signifies the gain from trade. This is the trade gain from exchange.

After trade, as the specialisation in production and optimum factor use takes place, the production equilibrium shifts from E to F along the same production possibility curve and consumption equilibrium shifts to C1. In this situation, C1D1 quantity of Y is imported and D1F quantity of X is exported. As a result of specialisation in production after trade, the shift in consumption equilibrium from C to C1 reflects the trade gain from specialisation.

ADVERTISEMENTS:

To sum up, the total gain from trade is comprised of gain from exchange and the gain from specialization. The total gain from trade can be measured by the movement from E to C1. This movement takes place in two steps—the movement from E to C is the gain from exchange and the movement from C to C1 is the gain from specialization.

Gains from Trade for Large and Small Country:

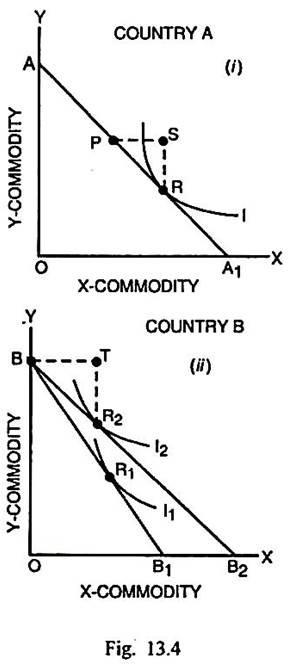

H.R. Heller discussed that under the conditions of constant opportunity cost and unchanged terms of trade, the large country receives no gain from trade and the entire trade gain goes to the small country. This case can be explained through Fig. 13.4.

In Fig. 13.4. (i) For a large country A, the production possibility curve under the conditions of constant costs is AA1. In the absence of trade, consumption and production takes place at R where the community indifference curve I is tangent to the production possibility curve. After trade takes place, there is no change in terms of trade for country A so that the international price ratio line remains AA1. This country will, however, modify its production pattern in such a way that some imports are made from country B. It may decide to move to P where it exports PS quantity of X commodity and imports SR quantity of Y. Since the terms of trade remain unchanged for country A, it fails to make any gain from trade.

In Fig. 13.4. (ii), for the small country B, the production possibility curve or domestic price ratio line under constant cost conditions is BB1. Its tangency with the community indifference curve I1 shows that production and consumption equilibrium in this country, in the absence of trade, takes place at R1. As trade commences, this country specialises completely in the production of Y commodity. The international price ratio line is BB2, which is parallel to AA1. This country produces at B. The consumption equilibrium occurs at R1.

So after trade it exports TR2 (= SR) of Y commodity to country A and imports BT (= PS) quantity of X from country A. The movement from R1 to R2 in country B reflects the gain from specialisation and exchange to the small country B from the international trade. Since this country is able to import X-commodity at the lower international price, the terms of trade turn in favour of it. That also shows that the gains from trade go to small country B alone and large country goes without any gain from trade.

Potential and Actual Gain from Trade:

ADVERTISEMENTS:

The potential gain from trade for the two trading countries A and B is determined technically on the basis of the difference in domestic cost ratios of producing two commodities, say X and Y.

Thus,

Thus the equalisation of actual gain and potential gain takes place when there is an absence of tariff and other trade restrictions. However, if there is imperfect competition and tariff or other trade restrictions are present, there arise differences in cost ratio and price ratio in each trading country. As the price ratio (PX/PY) is more than the cost ratio (CX/CY), the actual gain from trade exceeds the potential trade gain (Ga > GP).

Free Trade vs. No Trade:

Free trade is a trade situation in which no tariff or any other restriction is placed upon trade.

Assumptions:

ADVERTISEMENTS:

In such a situation, there is a tendency for the domestic factor and product prices to get equalised with international prices.

The proposition that free trade is superior to no trade is proved on the basis of the following assumptions:

(i) There is a state of perfect competition in the market.

(ii) The government does not interfere in trade through tariffs, quotas and subsidies.

(iii) The given country has no monopoly power in trade.

(iv) The factors of production are fixed in supply.

(v) The technology is such that the production possibility curve is concave to the origin.

(vi) The country is small.

(vii) Transport costs are absent.

On the basis of the assumptions given above, it is possible to show that the free international trade is much superior to autarchy (absence of trade). The diagram, to demonstrate it, is adapted from the diagram given by Jagdish Bhagwati.

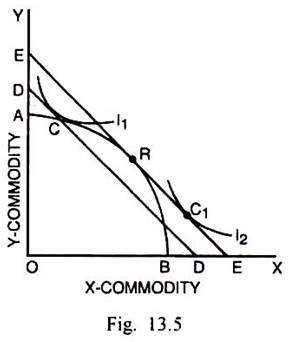

In Fig. 13.5., X commodity is measured along X axis and Y commodity along the Y arise. AB is the production possibility curve of the home country. In the absence of trade, the domestic price ratio is given by the line DD. C is the point of production and consumption equilibrium. As the trade commences and there is no restriction on trade, the international price ratio is given by the slope of the line EE which runs parallel to DD. The line EE represent consumption possibility curve.

This determines the new availability frontier in the country. The point R, where the consumption possibility curve is tangent to the production possibility curve, represents the most efficient production point.

Consumption point on the other hand is determined at C1 where the international price ratio line EE is tangent to the higher community indifference curve I2. Since after free trade, the production is optimised at R and consumption is optimised at C1, it follows that the free trade is definitely superior to no trade.

Static and Dynamic Gains from Trade:

The gains from international trade are of two types:

1. Static Gains from Trade:

The static gains from trade are as under:

(i) Expansion in Production:

International trade based on the principle of comparative cost advantage, according to classical economists, assures the benefits of international specialisation and division of labour. All the available productive resources in the trading countries get optimally utilized resulting in the maximisation of production not only for the individual trading countries but also for the whole world.

(ii) Increase in Welfare:

International trade results in the increased production of consumable goods in both home country and foreign country due to large world demand for products. Specialization also leads to improvement in the .quality of consumer products. As cheaper consumer products of superior varieties become easily available, there is definite rise in welfare of the people. “The extension of international trade”, opined Ricardo, “very powerfully contributes to increase the mass commodities and, therefore, the sum of enjoyments.”

(iii) Rise in National Income:

International specialisation results in expansion of production in the trading countries. More and more employment opportunities become available to the people. The expansion of production and employment leads to a rise in national income of the trading countries.

(iv) Vent for Surplus:

According to Adam Smith, international trade leads to the fullest utilisation of productive resources of the country. It becomes capable of creating a surplus of goods, which can be easily disposed of in the foreign market. Thus, the vent for surplus also constitutes a gain from international trade.

2. Dynamic Gains from Trade:

The major dynamic gains from international trade are as follows:

(i) Technological Development:

The international trade stimulates technical and scientific inventions and innovations as the producers in all the counties attempt to develop such techniques of production through which costs can be minimised and the speed of production can be accelerated. Trade facilitates the transfer of advanced technology from the developed to less developed countries. New ways of producing and organising production are spread to local economies through trade.

(ii) Increased Competition:

Trade stimulates competition, which makes the producers in all the countries to improve the quality of products and secure production at the least costs. The international competition promotes efficiency of all the industries in the trading countries.

(iii) Widening of Market:

International trade enlarges the size of market. It induces the producers to expand the scale of production, volume of investment and employment. Consequently, the production frontiers in the trading countries can continuously be expanded.

(iv) Increase in Investment:

As the demand for the home produced goods increases due to international trade, there is strong impetus to investment. The growth of export sector leads to the expansion of several allied ancillary industries creating more and more opportunities for investment. There is also substantial increase in foreign direct investments in the export sector of the economy.

(v) Efficient Use of Resources:

International trade paves the way for more efficient use of productive resources. The exploitation and use of the resources, previously considered economically non-viable, becomes economically viable due to increased demand in the foreign markets.

(vi) Stimulus to Growth:

Production for exports and increased imports of goods bring about a series of adjustments within the economic system that ultimately have stimulating effect upon the overall growth in the trading countries. Trade not only induces the growth of export industries, but also promotes the growth of infrastructure and services sector.

Ellsworth and Clark Leith summed up the dynamic gain from trade in these words, “Trade is a dynamic force that stimulates innovation. New ways of producing and organising production are spread to the local economy through trade and the competitive force of trade stimulates adoption of cost saving techniques. Trade also makes possible economical local production of many goods that would be prohibitive to produce locally.”