The following points highlight the three possible mechanisms by which convergence is likely to occur in poor countries. The mechanisms are: 1. Absorption of Western Technology 2. Resource Shifts 3. Differences in Returns to Capital.

Mechanism # 1. Absorption of Western Technology:

The wider the gap between a country’s technology, productivity and per capita income on the one hand and level of productivity in advanced countries on the other, the greater the scope for a poor country to absorb existing technology and to catch up with the richer countries. Technology is a international public good, which generates positive externality even across national borders. LDCs can adapt modern western technology without bearing the cost of developing such technology.

So net returns from such technology is higher in LDCs since benefits far exceed costs. However, the opportunity to adapt western technology is not enough. An LDC must also have the willingness and ability to invest. This means that a productivity gap is a necessary but not a sufficient condition for catching up by absorbing existing western technology.

Mechanism # 2. Resource Shifts:

According to the Clark-Fisher hypothesis the process of development is characterised by a shift of resources from low-productivity agriculture to high-productivity industrial and service activities. Other things being equal, this should also generate a tendency towards convergence to the extent that the resource shifts are greater in poor countries than in rich countries.

ADVERTISEMENTS:

Mechanism # 3. Differences in Returns to Capital:

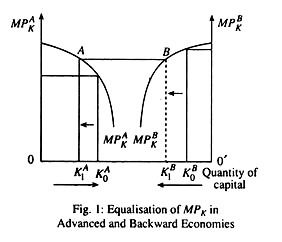

According to the neo-classical growth theory (captured by the Solow model) there is a strong possibility of convergence due to the assumption of diminishing returns to capital. Rich countries with a high per capita availability of capital are likely to have a lower productivity of capital than poor countries. Thus if tastes and preferences are the same, the same amount of saving and investment in poor countries is likely to lead to faster growth than in rich countries.

Fig. 1 shows through arrows, that if capital of a certain amount is transferred from advanced to backward countries the marginal product of capital will be the same in both, i.e., AK1A = BKB 1. Here O is the origin of advanced country and O’ is the origin of backward country.