In this article we will discuss about the concept of consumer’s surplus. Also learn about the difficulties involved in measuring consumer’s surplus.

Concept of Consumer’s Surplus:

Introduction, consumer’s surplus was introduced in economics by Alfred Marshall, although the use of the concept goes back at least to the Freanch economist Dupuit writing in the first half of the nineteenth century.

Two Nobel Prize winners in economics disagree fundamentally about the utility of the concept; John Hicks saw great use for the concept as a cornerstone of welfare economics, whereas Paul Samuelson believes that we can talk of discard the concept without loss. There is also the question of whether we can talk of consumer’s surplus or only of consumer’s surplus—whether we can use the concept for a whole group of consumers of a product or only for an individual household.

The doctrine of consumer’s surplus is a deduction from the law of diminishing marginal utility. The price that we pay for a thing measures only the marginal utility, but not the total utility. Only on the marginal unit, which a man is just induced to buy, the price is exactly equal to the satisfaction that he expects to get from that unit. But, on other units that he buys, he enjoys some extra amount of satisfaction.

ADVERTISEMENTS:

He would be willing to pay higher prices for these units than what he actually pays for them. The difference between the amount of satisfaction which a consumer obtains from purchasing things over that which he actually pays for them is the economic measure of consumer’s surplus.

It represents the excess of satisfaction that he secures, the excess being equal to the difference between the utility of the goods acquired and that of the money sacrificed. Had he been deprived of the commodity, he would then have been forced to spend the money on the purchase of other commodities from which he does not derive the same amount of satisfaction, but less.

Alfred Marshall has introduced the term ‘consumer’s surplus’ in economic theory to show that, in various situations consumer receives more from a commodity than he pays for it.

Marshall explained consumer’s surplus thus:

ADVERTISEMENTS:

“The price which a person pays for a thing can never exceed and seldom comes up to that which he would be willing to pay rather than go without it – so that the satisfaction which he gets from its purchase generally exceeds that which he gives up in paying away its price: and he thus derives from the purchase a surplus of satisfaction”.

The excess of the price which he would be willing to pay rather than go without the thing, over that which he actually does pay, is the economic measure of this surplus satisfaction. In short, the benefit which a person derives from purchasing, at a low price, thing for which he would rather pay a high price, than go without it may be called his consumer’s surplus.

At times, we find that a consumer’s willingness to pay for a commodity may be greater than the price he actually pays for it. The price that he is ready to pay for a commodity is his individual demand price and the price he actually pays for it is the market price. According to Paul Samuelson, consumer’s surplus is nothing but the excess of the individual demand price over the market price of a commodity (or, the positive difference between the potential price and the actual price of a commodity).

Example:

ADVERTISEMENTS:

In order to give definiteness to our idea, let us take the example of shoes. Suppose, from the first pair of shoes a man expects to get satisfaction worth at least Rs. 500, from the second he expects additional satisfaction worth Rs. 400, from the third he expects additional satisfaction worth Rs. 300. Suppose, he is just induced to buy three pairs and no more.

Since in a market there cannot be more than one price, the price that he pays for each pair is measured by that of the marginal pair, i.e., by Rs. 300. He will pay (Rs. 300 x 3) or Rs. 900 in all for the three pairs. But, by hypothesis, he is enjoying from the three pairs an amount of satisfaction worth (Rs. 500 + Rs. 400 + Rs. 300) = Rs. 1200.

Hence, he enjoys a surplus of satisfaction from his purchase worth (Rs. 1200 – Rs. 900) = Rs. 300. Consumer’s surplus is then measured by the difference between the total utility and the total expenditure made by the consumer on a commodity (shoes). It is the difference between individual demand price and market price.

Hence, the consumer’s surplus may be shown in another way:

Consumer’s Surplus = Total Utility – (Total units purchased x marginal utility or price). In short, consumer’s surplus is the positive difference between the total utility from a commodity and the total payments made for it.

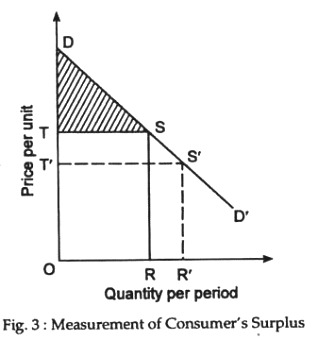

The concept of consumer’s surplus can also be illustrated with the help of Fig. 3:

In Fig. 3, the quality of a particular commodity is measure on the horizontal axis and its marginal utility or production on the vertical axis. Here DD’ is the demand price for it. If a consumer buys all the units (OR) at RS price per unit, he gets a total satisfaction equal to the area DORS. But, he spends only ORST amount of money, so his surplus satisfaction is DTS (i.e., the shaded area). If the price falls to R’ S’, he would buy OR’ and his surplus would increase to DTS’.

So, consumer’s surplus is measured by the area under the demand curve but above the market price. A difficulty is that as the price falls the demand where, the real income of the consumer increases. To get a more accurate measure of the benefit of the surplus; therefore, an adjustment must be made to offset the effect of the difference in real income at the higher price (RS) and the lower price (R’S’).

Difficulties of Measurement:

Consumer’s surplus is measured by the area under an individual’s demand curve between two prices. It is a monetary measure, although originally represented in terms of surplus utility by Marshall. It is a measure of the benefit to the consumer, net of the sacrifice he has to make from being able to buy a commodity at a particular price. However, Marshall’s doctrine of consumer’s surplus is subject to a number of criticisms, mainly due to various difficulties associated with this measurement.

ADVERTISEMENTS:

The main criticisms of the doctrine are the following:

(1) Constant Marginal Utility of Money:

Marshall’s doctrine of consumer’s surplus is based on the assumption of constant marginal utility of money. Hicks considers this to be the greatest difficulty in accepting the concept of consumer’s surplus. As he put it, “A stronger incentive will be required to induce a person to pay a given price for anything if he is poor than if he is rich. A pound is the measure of the less pleasure, or satisfaction, of any kind, to a rich man than to a poor one.”

When a consumer buys more of a particular thing, his stock of money falls and the marginal utility of money to him will increase. Such a reduction in the marginal utility of money will automatically involve the revaluation of the utilities from the earlier units of the commodity!

ADVERTISEMENTS:

It is true that Marshall’s assumption of constant marginal utility of money becomes valid when a consumer spends a very small proportion of his income for a commodity. But, this assumption is not always realistic, for a consumer is often required to spend a large portion of his income for a commodity (e.g., expenditure on foodstuff by a poor household).

(2) Lack of Precise Measurement:

The accurate measurement of consumer’s surplus is not possible as we have no knowledge of the potential prices that a consumer is willing to pay for the earlier units of the commodity purchased. In fact, the individual demand prices for the earlier units of the commodity are merely hypothetical and imaginary. For this reason, Prof. Nicholson remarks that the concept of consumer’s surplus is purely hypothetical and more a figment than a fact.

(3) Difficulties in Measuring Consumer’s Surplus:

Further difficulties arise when we try to increase of consumer’s surpluses of a group or of a community by means of adding up the consumer’s surplus of different individuals. Such difficulties arise because the individual demand price for a thing varies from person to person owing to differences in their incomes, tastes, preferences, etc.

(4) Unlimited Consumer’s Surplus in the Case of Necessities:

It is also pointed out that the consumer’s surplus cannot be measured in the case of necessaries and of conventional necessaries of life as their utility (or the individual demand prices for these goods) is infinite or indefinite to a consumer. It is very often found that a consumer is sometimes willing to pay anything under his possession for these goods when he is in urgent need of them, and this makes the individual demand prices for these goods to be infinite. Examples of such goods are textbooks or life-saving drugs.

(5) Conspicuous Consumption Goods:

ADVERTISEMENTS:

Tausig has pointed out that the concept of consumer’s surplus cannot be applied in the case of articles of conspicuous consumption (e.g., for coats of diamonds). The term was used by Thorstesin Veblem (1857-1929) to identify that ostentatious personal expenditure which satisfies no physical need but rather a psychological need for the esteem of others.

Goods may be purchased not for their practical use but as ‘status symbols’ and to ‘keep up with the Joneses’. These goods have a high prestige value to their users, but their utility falls when their prices fall. In such cases, a fall in the prices causes a fall in consumer’s surplus — a result which becomes inconsistent with the definition of consumer’s surplus.

(6) Impossibility of Meaning Cardinal Utility:

Furthermore, Marshall’s analysis of consumer’s surplus is based on an important premise that the utility of a thing can be measured and numbered. But, most of the modern writers have shown that utility, being a psychological concept, cannot be cardinally (objectively) measured and quantified.

(7) Difficulties in the Case of Complements and Substitutes:

Again, consumer’s surplus cannot be measured in the case of complementary goods (e.g., tea and coffee, etc.) Because, in such cases the utility of a thing depends not only on its total stock but also on the supply of other related goods. Marshall has tried to overcome this difficulty by suggesting that we should treat the related goods as one commodity and group them under one common demand schedule. But, actually, it is not possible to do so.

(8) Purely Hypothetical and Unreal Concept:

Prof. Nicholson has expressed serious doubts about the utility of the whole doctrine. He asked, “Of what avail is it to say that the utility of an income of (say) £ 100 a year is worth (say) £ 1000 a year?” According to him, the doctrine is thus purely hypothetical and unreal.

But, Marshall points out that the question raised by Nicholson would have some relevance if we compare the living conditions in Central Africa with those in London. There are many things, many amenities of life which are available in London, but not in Central Africa. The living conditions at those two places may be measured by the statement that £ 100 in London yields the same benefits to the consumer as £ 1000 in Central Africa.

(9) Useless Theoretical Toy:

ADVERTISEMENTS:

Prof. Little has characterised the concept of consumer’s surplus as “a totally useless theoretical toy” as it cannot provide us any practical objective criterion for measuring economic welfare.

(10) Historical and Doctrinal Interest:

Samuelson has not attached much importance to the doctrine of consumer’s surplus in the study of economics. He remarks, “The subject (the concept of consumer’s surplus) is of historical and doctrinal interest, with a limited amount of appeal as a mathematical puzzle”.

Hicks’s Concept of consumer’s surplus:

Owing to various difficulties in measuring consumer’s surplus as explained by Marshall, J.R. Hicks has formulated the concept of consumer’s surplus in a different way. In his opinion, “the best way of looking at consumer surplus is to regard it as a means of expressing, in terms of money income, the gain which accrues to the consumer as a result of a fall in price”.

Thus, when a thing (say, sugar or edible oil) becomes cheaper as a result of a fall in its price, a consumer gets the same amount at a lower price. Because of such a gain in money income, he may buy more of that thing or he may buy another thing; in any case he is now better off than before. To Hicks such a gain in money income as a result of a fall in the price of a thing is consumer’s surplus.