In this article we will discuss about the three main weapons to control central bank.

Monetary (credit) policy is a tool of general macroeconomic policy under the control of the monetary authorities that seeks to achieve macro- economic objectives like full employment of resources (including manpower) and price level stability (which implies absence of inflation or deflation) by influencing the money supply and/or rate of interest (and, therefore, the cost and availability of credit).

The monetary authority in a modern economy consists of the Treasury and Central Bank (both under the control of government) which seek to achieve certain objectives such as price stability, high employment and economic growth. The means of changing money supply or rate of interest is the use of certain monetary (credit) instruments. Three main instruments are the bank rate, open market operations and the reserve ratio.

The bank (discount) rate is the oldest instrument of credit control. It is the rate of interest charged by a central bank to borrowers, mainly the commercial banks. This instrument is used to control the general level interest rates in the economy.

ADVERTISEMENTS:

If the bank rate rises there is an automatic increase in the market rate of interest, i.e., the rate paid by business firms and traders. A rise in the rate of interest chokes off investment demand. As a result, the aggregate demand (C + I + G) schedule shifts downward. A fall in aggregate demand acts as an anti-inflationary measure.

Open market operation is the second instrument of monetary (credit) control. It involves the sale or purchase of government treasury bills and bonds as a means of controlling the money supply. If, for instance, the central bank wishes to increase the money supply, it will have to buy bonds from the general public.

The money paid out to the public will increase their cash balances. Such cash balances are largely, if not entirely, deposited in commercial banks. As money flows into the banking system banks’ liquidity is increased. This enables them to increase their lending. This results in the multiple creation of new bank deposits and, hence, an expansion of the money supply.

The reserve (asset) ratio or the liquidity ratio is the third important instrument of credit control. It refers to the proportion of a commercial bank’s total assets which it keeps in the form of liquid assets. The object is to meet the day-to-day currency withdrawals by its customers and other financial commitments.

ADVERTISEMENTS:

In a modern economy assets held as a part of a bank’s reserve asset ratio include the following:

(1) Till money (notes and coins),

(2) Call money (short-term deposits with the discount house),

(3) Balances with the central bank of the country, and

ADVERTISEMENTS:

(4) Near-mature bills of exchange and treasury bills.

The ratio of liquid assets to total assets held can be dictated by two major principles of commercial banking — liquidity and profitability. However, the central bank usually prescribes mandatory and uniform minimum reserve-asset ratios for the banking sector.

The reason is easy to find out. The reserve-asset ratio of the banking sector determines the amount of new bank deposits that can be created and, hence, has an important influence on the size of money supply. We may now see how monetary policy works and affects the major macro-variables.

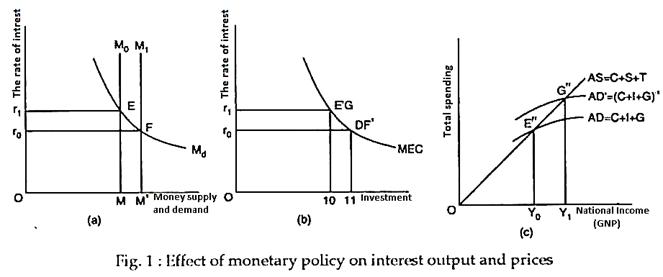

The rate of interest is regulated by affecting money supply. For example, if the central bank wishes to raise the interest rate, say, from Or0 to Or1 in Fig. 1, then it can do so by reducing the money supply from OM0 to OM1. With the given demand curve for money this would have the effect of raising interest rates as required.

As a result investment will fall and national income will fall through the multiplier. However, all the components of the money supply are not under the control of government and raising interest rates can, for example, encourage foreign lenders, raising domestic money supply, and frustrating the central bank’s attempts to restrict money supply.

In Keynes’ view, there is an indirect link between money supply and aggregate demand through the rate of interest. In short, an increase in the money supply from OM1 to OM2 [in Fig. 1(a)] leads to a fall in the rate of interest (from r1 to r0) which, in its turn, results in an increase in planned (desired) investment from I0 to I1 [Fig. 1(b)].

The rise in investment, in turn, increases aggregate demand and raises national income (through the multiplier) from Y0 to Y1 [Fig. 1 (c)]. It is also possible to show that a fall in interest rates leads to an increase in consumption expenditure. In fact, the low cost of borrowing encourages people to use more loan finance to buy cars televisions, refrigerators, etc.

The monetarists, led by Milton-Friedman and other members of the Chicago School, on the other hand, believe that there is a direct link between the money supply and the level of aggregate demand. In short, an increase in money supply leads directly to an increase in demand for final goods and services and not just for investment goods.

ADVERTISEMENTS:

This proposition is based on the assumption that when households and businesses hold more money than they need to hold, they will spend the excess on currently produced goods and services. Monetarists hold that inflation is caused mainly by an excessive increase in supply of money. In the words of Prof. Friedman “inflation is a purely monetary phenomenon”.

The monetarists view is based on quantity theory of money. According to this theory, an increase in the quantity of money (M) will cause the general price level (P) to rise proportionately. However, according to Keynes, the effect of an increase in money supply on the price level depends largely on the state of the economy.

Thus, in the most usual situation if M increases P will rise, but r will fall and y will increase. The converse is also true. A change in M, therefore produces opposite effect on national income, and employment on the one hand and the rate of interest on the other. And, if M increases beyond full employment P will rise.