Let us make an in-depth study of the Central Bank. After reading this article you will learn about: 1. Role of Central Bank 2. Policy Objectives of the Central Bank 3. Autonomy of the Central Bank.

Role of Central Bank:

The central bank, which is responsible for managing a country’s monetary affairs, determines the level of short-term interest rates, thereby profoundly affecting financial markets, wealth, output, employment and prices.

Indeed the central bank’s influents spreads not only within the domestic territory of a country but even, through financial and trade linkages — to virtually every corner of the globe.

The central bank’s main goal is low and stable inflation.

ADVERTISEMENTS:

It also seeks to promote steady growth in national output, low unemployment, and orderly financial markets. If output is growing rapidly and inflation is rising the central bank is likely to raise interest rates, as this puts a brake on the economy and reduces inflationary pressures.

If the economy is sluggish and business is languishing, an exactly opposite type of monetary action is called for. The central bank will lower interest rates — which is likely to boost aggregate demand, increase output and reduce unemployment.

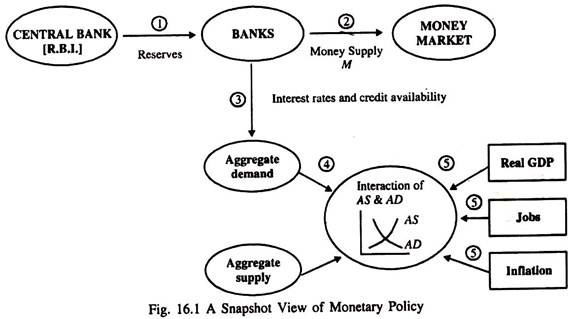

Fig. 16.1 shows the rule of central banking in the economy and depicts its relationship with the banks, financial markets, and interest rates.

The diagram shows graphically, through 5 steps, how the central bank affects economic activity. (1) is the change in reserves, which leads to changes in M in (2); leading to (3), changes in interest rates and credit availability. In (4) AD is changed in response to investment and other interest-sensitive components of desired expenditure.

ADVERTISEMENTS:

In (5) changes in output, employment and general price level follow. (It should not, however, be missed that fiscal policy also affects aggregate demand.)

Policy Objectives of the Central Bank:

The objectives of the central bank include economic growth in line with the economy’s potential to expand; a high level of employment; stable prices (that is, stability in the purchasing power of money); and moderate long-term interest rates.

The central bank is ultimately concerned with preserving the integrity of a country’s financial institutions, combating inflation, defending the exchange rate of the country’s currency and preventing excessive unemployment.

Central Bank’s Operations:

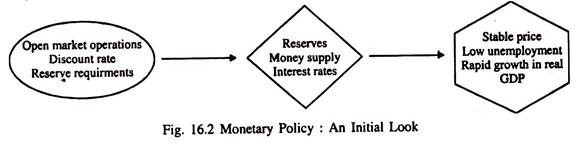

Fig. 16.2 shows various stages of central bank operations. The central bank has at its disposal a number of policy instruments. These can affect certain intermediate targets (such as reserves, the money supply, and interest rates).

ADVERTISEMENTS:

These instruments are directed towards achieving the ultimate objectives of monetary policy — low inflation, rapid growth in output and low unemployment which are the signs of a healthy economy. For the sake of analysis it is important to keep the different groups (policy instruments, intermediate targets and ultimate objectives) separate and clearly distinct.

The three instruments of monetary policy are open market operations, discount rate policy and reserve-requirements policy. The pros and cons of each will be discussed in detail in Ch. 20. In determining its monetary policy, the central bank directly manipulates these instruments or policy variables under its control.

These help determine bank reserves, the money supply and interest rates — the intermediate targets of monetary policy.

In managing money, the central bank must keep its eye on a set of variables known as intermediate targets. These are economic variables that are intermediate in the transmission mechanism between monetary policy instruments and ultimate policy goals. When the central bank seeks to affect its ultimate objectives, it first changes one of its instruments, such as the discount rate.

This change affects an intermediate variable such as interest rates, credit availability or the money supply. For maintaining a sound health of the economy the central bank keeps a close watch on its intermediate targets. Ultimately monetary and fiscal policies are partners in pursuing the measure objectives of rapid growth, low unemployment and stable prices.

Autonomy of the Central Bank:

In recent years there is a strong demand for central bank independence. Monetary policy independence is not necessary primarily in order to protect a ‘conservative’ central banker from the influence that a less ‘conservative’ government might seek to bring to bear, but rather to enable central bankers with a longer-term decision horizon (and/or a lower rate of time preference) to assert their authority when faced with a government with a shorter planning “horizon (and/or a higher rate of time preference).

Then, when the government ‘by a conscious act relinquishes its own power’, it does not mean that the institution to which the power of decision-making is transferred has different inflation and employment preferences from the population, but simply that it is operating with a longer time horizon than the government.

ADVERTISEMENTS:

Thus, it is quite possible that the central bank will react appropriately to temporary output shocks, if it is of the opinion that such a policy can be pursued without long-term disadvantages for price stability. From this standpoint, the economic rationale for independence is that it enables those deciding monetary policy to conduct their policy without being always scrutinised by the government for short-term results.

The longer term horizon in their decision-making implies that they make full allowance for the long time lags involved in the conduct of monetary policy, i.e., its formulation and implementation.

It is now felt that the most important aim of central bank legislation should be to create an incentive structure that guarantees a long-term time horizon of central bankers. As most politicians are characterised by rather myopic behaviour, this implies, above all, that the monetary policy decisions taken in the central bank have to be insulated from the general political process as far as possible.

This explains why central bank independence is now widely regarded as a prerequisite for an efficient monetary policy. The trick is to attain the appropriate balance between the need to be responsive to short-term pressures and the need to ensure that those pressures are exerted in a system that safeguards the long-term interest of the population. However, there are different definitions of central bank independence.

ADVERTISEMENTS:

Two main types of independence are — ‘goal independence’ and ‘instrument independence’. A central bank enjoys goal independence when it is free to choose its goals or, at least, free to decide the actual target values for a given goal. A central bank has instrument independence when it ‘is given control over the levers of monetary policy and allowed to use them’.

An alternative definition distinguishes between political and economic independence. By political independence we mean a central bank’s ability to pursue the goal of price stability unfettered by formal or informal instructions emanating from the ruling government. Independence refers to autonomy to pursue the goal of low inflation.

Any institutional feature that enhances the central bank’s capacity to pursue this goal will increase central bank independence. Economic independence means that a central bank has unlimited freedom to determine all monetary policy transactions that lead to changes in its operating targets.

Since all these definitions have both merits and shortcomings it is necessary to make a synthesis of both approaches, which distinguishes three different notions of independence.

ADVERTISEMENTS:

1. Goal independence:

Goal independence requires that the government has no direct influence on the goals of monetary policy.

2. Instrument independence:

Instrument independence requires that the central bank is able to set its operating targets (interest rate, exchange rate) autonomously. This notion of instrument independence is identical with the concept of ‘economic independence’.

3. Personal independence:

Personal independence requires that the decision-making body of a central bank be in a position to resist formal directives as well as informal pressure from the government.

1. Goal Independence:

ADVERTISEMENTS:

The definition of the goals of monetary policy includes not only the choice between price stability and nominal GDP, but also a definition of the time horizon for their realisation, the definition of concrete indices, their numerical target values and the definition of escape clauses.

Thus, ‘goal independence’ can take various different forms. It can include a framework wherein the central bank has complete freedom on all these issues, as well as a framework wherein it can decide on only some of these issues. In reality, one can find three variants of the definition of goal independence.

In the USA monetary policy seeks to promote effectively the goals of maximum employment, stable prices, and moderate long-term interest rates. But ‘stable long-term interest rates’ is not compatible with the standard definition of the goals of monetary policy. Long-term interest rates are, at best, an intermediate target.

The European Central Bank is granted a somewhat more limited degree of goal independence. Similar arrangements are found in Japan and, to some extent, in Sweden.

A low degree of goal independence characterises the central bank legislation of the United Kingdom, Canada, and New Zealand. In these countries, the central bank legislation defines price stability as the main goal of monetary policy, but gives the government the right to determine the concrete target values.

The most important prediction of both theoretical and empirical literatures is that a central bank should have instrument independence, but should not have goal independence.

ADVERTISEMENTS:

There are no permanent trade-offs between price stability and other macroeconomic targets. Therefore, there is no real choice that ‘elected officials’ could make for the population in the long run. In the short-term, supply shocks make it necessary to allow for deviations from a medium-term inflation target. But entrusting the government or the parliament with this decision could clearly lead to the risk of an inflation bias.

This leads to a possible trade-off between:

i. A more flexible response of monetary policy in the case of supply shocks, but only if the central bank is overly committed to price stability, and

ii. Reduced political independence of monetary policy with all the attendant risks.

2. Instrument Independence:

Instrument independence implies that a central bank is able to set its operating targets without any interference from the government.

It includes three important elements:

ADVERTISEMENTS:

1. Control of the short-term interest rate as the most important operating target of monetary policy;

2. Control of the exchange rate, which can be used as an additional operating target, especially in a relatively open economy;

3. Restrictions of central bank credits to the government, which could undermine the control over the monetary base and, thus, over short-term interest rates.

Instrument independence constitutes an indispensable element of a stability-oriented central bank legislation. Inflation targeting seems to be the most effective and it leads to the most democratically accountable policy-making when the central bank is instrument independent but not fully goal dependent.

In most countries monetary policy can determine interest rates in an autonomous way. However, as in the case of goal independence, there are countries where the government can still override the central bank’s decisions.

As far as the control over the exchange rate is concerned, there is at present no central bank that has unlimited responsibility for this target of monetary policy. Only the ECB makes a distinction between formal exchange arrangements and a policy of managed floating.

ADVERTISEMENTS:

The central banks in all other countries have very limited responsibilities in the field of exchange rate policy. All central bank acts assign this responsibility’ without qualifications to the government.

A third element of instrument independence concerns the explicit limitations for central bank lending to the government. This relates exclusively to direct lending to the public sector. It is, therefore, perfectly compatible with the EC Treaty.

By purchasing government bonds from the commercial banks as part of its open-market policy a central bank can easily bypass the prohibition on deficit financing and conduct its money market management essentially on outright open-market operations.

In other central bank acts, no similar regulations can be found. However, it is ‘conceivable that a monetary policy geared to price stability might be guaranteed simply by giving a politically independent central bank the power to decide of its own accord when and how much to lend to public sector borrowers’.

But then there is always the danger of a central bank giving in to political pressure and thus promoting inflationary financing of government-expenditure.

3. Personal Independence:

Even if central bankers are granted instrument and/or goal independence, the government could try to exert some informal pressure on monetary policy. For instance, if the central bank governor could be dismissed at any time, and without specific reasons at the discretion of the government, he or she would be in a rather weak position vis-a-vis the minister of finance or the head of the government.

A strong informal influence on the central bank can also be exerted if only one person, i.e., the governor, is in charge of monetary policy decisions. In this case it is sufficient that the government sends a depicted partisan to the top of the central bank.

To sum up, there is an inherent inflation bias mainly due to a short-term time horizon of politicians. This calls for a central bank legislation that provides central bankers with independence from politicians and with long-terms of office, which is a very efficient means of insulating central bankers from the government.