Here is a term paper on ‘High Powered Money’ especially written for school and banking students.

Term Paper # 1. High Powered Money:

High powered money or powerful money refers to that currency that has been issued by the Government and Reserve Bank of India. Some portion of this currency is kept along with the public while rest is kept as funds in Reserve Bank.

Thus, we get the equation as:

H = C + R

ADVERTISEMENTS:

Where H = High Powered Money

C = Currency with the public (Paper money + coins)

R = Government and bank deposits with RBI

Thus the sum total of money deposited with the public and the funds of banks is termed as powerful money. It is mainly created by the central bank. Since funds of commercial banks play an important role in the creation of credit, so it is very important to study about funds.

ADVERTISEMENTS:

Reserve Fund is of two types:

(i) Statutory Reserve Funds of banks which is with the central bank (RR), and

(ii) Extra Reserve Fund(ER).

Thus H = C + RR + ER

ADVERTISEMENTS:

High powered money is also known as secured money (RM) because banks keep with them Reserve Fund(R) and on the bases of this Demand deposits (DD) are created. Since the bases of creation of credit is Reserve Fund (R) and R is obtained as a part of high powered money (H) Security fund so high powered money is termed as Base money.

Term Paper # 2. Components of High Powered Money:

The following are the important components which determine high power money:

1. Currency with the public

2. Other Deposits with RBI

3. Cash with Banks

4. Banker’s Deposits with RBI.

High powered Money (H) includes currency with Public (C), important reserves of Commercial banks and other reserve (ER).

Thus we get the equation:

H = C + RR + ER

ADVERTISEMENTS:

Supply of money (M) includes bank deposits (D) and currency with public (C).

Thus,

M = C + D

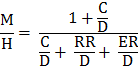

Dividing both the equations, we get:

ADVERTISEMENTS:

Now, dividing the numerator and the denominator by D we get:

ADVERTISEMENTS:

Now if necessary reserve ratio is RRr and necessary reserves of deposits ratio is RR/D and extra reserve ratio is ERr then revised equation will be:

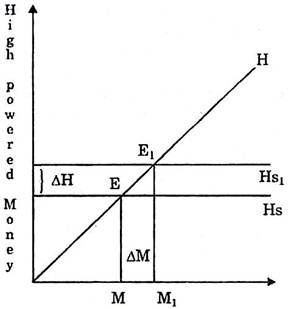

Enclosed figure clears that if supply of high powered money increases ΔH then Hs1 curve jumps up to Hs1 demand and supply of high powered money is in equilibrium condition on E. supply of money is ON when supply of high powered money goes to Hs1 then new point of equilibrium is E1 and supply of money in these two OM1. From the enclosed figure it is also clear that when high powered money increases ΔH then supply of money increases to ΔM.

Term Paper # 3. Sources of High Powered Money:

The following are the sources of High Powered Money:

ADVERTISEMENTS:

(1) Claims of Reserve Bank of India:

Reserve Bank also provides loans to the government. This loan is in the form of investment in government securities by the Reserve Bank. After deducting the deposits of government from quantity of loan of Reserve Bank quantity of net bank credit to government is calculated. It is also a source of High Powered Money.

(2) Net Foreign Exchange Assets of Reserve Bank:

It is the work of Reserve Bank to make arrangement for foreign exchange funds. When, Reserve Bank purchases foreign securities by paying the money of the country, then the quantity of foreign exchange increases which increases high powered money. On the contrary, when Reserve Bank sells foreign securities, then the quantity of foreign exchange with the central bank of the country decreases. It results decrease in high powered money.

(3) Government’s Currency Liabilities to the Public:

Finance Ministry of the Indian Government is responsible for printing one rupee note and also for coinage. This function is done through the government for completing money related responsibilities towards the public. Thus with the increase in these liabilities, quantity of supply of money will increase and the quantity of High Powered money will also increase.

ADVERTISEMENTS:

(4) Net Non-Monetary Liabilities of Reserve Bank:

The non-monetary liability of Reserve Bank is in the form of capital introduced in national fund and statutory fund. Its main items are-Paid-up Capital, Reserve Fund, Provided Fund and pension fund of the employees of Reserve Bank of India.

Non-monetary liabilities of Reserve Bank are inversely proportional to high Powered Money i.e. with the increase in non-monetary liabilities, there will be a decrease in the quantity of new high powered money.

Thus,

H = 1 + 2 + 3 – 4

From the above discussion we get information about the source of High Powered Money but it is also necessary to know that with the changes in these sources or factors, what changes takes place in the supply of money etc. In fact supply of money is the result of H. Size of H depends upon the ratio between reserve fund and deposits, and the ratio between time deposits and demand deposit.

Term Paper # 4. Importance of High Powered Money:

ADVERTISEMENTS:

The following are the importance of High Powered Money:

(1) Base Money:

Deposit of Public in a bank and expansion of credit is the base of supply of money. That is why some economists considered it as base money.

(2) Source of Changes:

The direction in which change in the high power money takes place is powered to the direction of change in the supply of money. Thus from this point of view High Powered Money is also important.

(3) Money Multiplier:

ADVERTISEMENTS:

What will be money multiplier (M) is declared in economy on the bases of High Powered Money because supply of money is far more than high power money.

(4) Monetary Control:

A Special attention is paid by the central bank of any country on High Powered Money at the time of monetary control. Because, it is a big part of total supply of money in a country.