Read this essay to learn about the meaning, functions and role of money.

Meaning of Money:

Money has been defined differently by different economists. Some, like F.A. Walker, define it in terms of its functions, while others like G.D.H. Cole, J.M. Keynes, Seligman and D.H. Robertson lay stress on the ‘general acceptability’ aspect of money.

According to Prof. D.H. Robertson, “anything which is widely accepted in payment for goods or in discharge of other kinds of business obligation, is called money.” Seligman defines money as “one thing that possesses general acceptability.” Prof. Ely says: “Money is anything that passes freely from hand to hand as a medium of exchange and is generally received in final discharge of debts.”

Prof. A. Walker says “Money is that money does.” But these definitions are defective because they do not lay proper emphasis on all the essential functions of money. Prof. Crowther’s definition of money is considered better as it takes into account all the important functions of money. He defines money as “anything that is generally acceptable as a means of exchange (i.e., as a means of setting debts) and at the same lime, acts as a measure and a store of value.”

ADVERTISEMENTS:

It is a fact that although money was the first economic object to attract men’s thoughtful attention…there is at the present day not even an approximate agreement as to what ought to be designated by the world…the business world makes use of the term in several senses; while amongst economists there are almost as many different conceptions as there are writers on the subject.’

Functions of Money:

Money is a matter of functions four, a medium, a measure, a standard, a store.

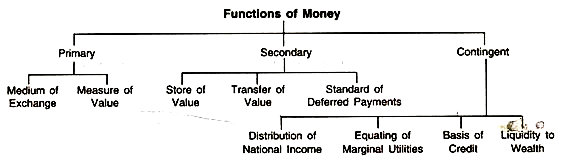

Money in a modern economy performs important functions which have been classified by Kinley as follows:

(a) Primary functions also called fundamental and original functions like the medium of exchange and measure of value.

ADVERTISEMENTS:

(b) Secondary functions like standard of deferred payments, store of value and transfer of value.

(c) Contingent functions like distribution of income, measurement and maximisation of utility etc.

Medium of exchange:

Money serves as a medium of exchange and facilitates the buying and selling of goods, thereby eliminating the need for double coincidence of wants as under barter. A man who wants to sell wheat in exchange for rice can sell it for money and purchase rice.

ADVERTISEMENTS:

Measure of value:

Money has also removed the difficulty of barter system by serving as a common measure of value. The values of various commodities are expressed in terms of money. Money as a measure of value has made transactions simple and easy. It may be understood that this function of money follows from the first basic function (medium of exchange). It is because money is used as a medium to exchange goods, that each good gets a value in terms of money (called price). As such, money also serves as a unit of account. In India, the unit of account is the Rupee, in USA, the Dollar; in USSR, the Rouble and the Yen in Japan.

Store of Value:

Classical economists did not recognize the store of value function of money. Keynes laid stress on this function of money. People store money to provide again the rainy day and to meet unforeseen contingencies. According to Keynes, people also store money to take advantage of the changes in the rate of interest. Money as a store preserves value through time and space. Money as a store of value through time means the shifting of purchasing power from the present to the future and as such it serves as an important link between the present and the future.

Money in this case is stored as a form of ‘asset’. Money is an asset or a form of wealth because it is a claim. It is the most convenient way of laying claim to such goods and services as one wishes to buy. Thus, rather than keeping their wealth in the form of non-liquid assets like houses, shares, etc., people prefer to keep their wealth in the form of money.

Money is the most liquid of all assets i.e., money can be readily exchanged for goods and services without any difficulty and the price of money or its value is stable at least over a short period. In fact, all assets like bonds, saving accounts, treasury bills, government securities, inventories and real estate do serve as stores of value, but they differ in the degree of liquidity; money amongst these possesses highest degree of liquidity and that is why people prefer it most as a store of value.

However, we should not give it undue importance because the value of money does not remain stable through time. As prices rise, people try to get rid of money as its value falls. Moreover, in modern economies storing wealth in the form of money is unimportant as it is done in the form of interest-bearing securities.

Money as a store of value through space continues to be important; for instance, an Indian businessman who sells his business and property and goes to USA and settles down there is a case of exporting value through space. In ancient times, gold and silver coins were used as a store of value followed by currency notes. In advanced countries today money is stored in the form of bank deposits.

Standard of Deferred Payments:

ADVERTISEMENTS:

Money has always been used as a standard of deferred payment. This function of money has attained more importance in modern times with the extension of trade based on credit. As a result of this function, it has become possible to express future payments in terms of money. A borrower who borrows a certain sum in the present undertakes to pay the same in future. Similarly, a person who purchases on credit agrees to pay in future when his bills become due. Money as a standard of deferred payments is performing useful function enabling the current and present transactions to be discharged in future.

Contingent Functions:

Besides, the primary and secondary functions of money, Prof. Kinley lays stress on the contingent functions of money. Money facilitates the distribution of national income among the various factors of production. Land, labour, capital and organization all co-operate in an act of production and the product is the result of their joint efforts, which belongs to all of them.

Money makes the distribution of joint production, amongst various factors easy and paves the way for economic progress. Further, a concept like utility is measured in terms of money. A consumer as well as a producer measures the utilities of different goods and factors of production with the help of money and try to get maximum satisfaction or maximum returns.

ADVERTISEMENTS:

Again, credit is the basis of modern economic progress. Money constitutes the basis of credit. Banks create credit not out of thin air but with the help of money. Moreover, money gives liquidity to various forms of wealth. A person by keeping his wealth in the form of money renders it most liquid.

Thus, we find that money performs many functions—a medium of exchange, a measure of value, a store of value, a standard of deferred payments and serves as a basis for credit and distribution of national income. These functions of money are not all of the same importance. Of all the functions, the most important function of money is that it serves as a medium of exchange and as such also becomes a means of payment. Money in the form of a generally acceptable commodity, in the process of exchange between goods, at once, becomes a unit of account and a measure of value. The following table clearly shows the various functions of money.

Role of Money:

Money plays a vital role in the determination of income and employment. The basic problems of macroeconomics are the determination of income, output, employment and the general price levels, including the determination of the long-run rate of growth of income. As far as the growth theory is concerned, the supply and demand for money have been largely ignored until recently, yet all but the very simplest short-run income and price level determination models have a money market included in them.

As such, money becomes an economic force in its own right, which under certain circumstances, powerfully affects economic activities. This is the main subject matter of monetary economics. Monetary theory is that branch of economics which aims at discovering and explaining how the use of money in its various forms affects production, consumption and distribution of goods. As a matter of fact, the advocates of monetary theory plead that a large number of factors affect the volume of production, consumption and distribution. To them, money is no more a veil, a medium to facilitate exchange of goods: but something more vital, more crucial and more important, which affects the general level of economic activity.

ADVERTISEMENTS:

Monetary theorists hold that the use of money as a medium of exchange, as a store of value, as a measure of value, as a standard of deferred payments along with its contingent functions has the capacity of influencing the volume and direction of economic activity that would not occur in a barter economy. In a monetary economy, according to Keynes, “money plays a part of its own and affects motives and decisions and is, in short, one of the operative factors in the situation, so that the course of events cannot be predicted, either in the long period or in the short, without a knowledge of the behaviour of money between the first state and the last.” In such a world, money is not a neutral phenomenon rather a phenomenon governed by principles very different from those that hold sway over the process of production and exchange.

In modern income and employment analysis, these are two spheres of economic activity. There is, on the one hand, the real or goods sector, which has to do with forces of aggregate demand and supply and the conditions under which an equilibrium of output and employment is achieved. On the other hand, there is the monetary sphere in which the economic forces at work are those centering around the demand for money.

According to the modern view, the existence of a separate monetary sphere of activity is a fact of profound significance; what takes place in the monetary sphere may suddenly and dramatically influence the level of both output and employment. The method by which Keynes brings money into the picture is through the development of a theory of interest in which the demand for money is dominant. The rate of interest is the link between the real sphere and the monetary sphere. It is a factor around which the theory of investment is constructed and investment expenditure is one of the key determinants of income and employment.