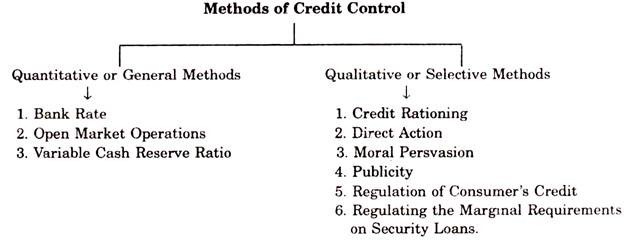

The following points highlight the two categories of methods of credit control by central bank.

The two categories are: I. Quantitative or General Methods II. Qualitative or Selective Methods.

Category # I. Quantitative or General Methods:

1. Bank Rate Policy:

The bank rate is the rate at which the Central Bank of a country is prepared to re-discount the first class securities.

ADVERTISEMENTS:

It means the bank is prepared to advance loans on approved securities to its member banks.

As the Central Bank is only the lender of the last resort the bank rate is normally higher than the market rate.

For example:

If the Central Bank wants to control credit, it will raise the bank rate. As a result, the market rate and other lending rates in the money-market will go up. Borrowing will be discouraged. The raising of bank rate will lead to contraction of credit.

ADVERTISEMENTS:

Similarly, a fall in bank rate mil lowers the lending rates in the money market which in turn will stimulate commercial and industrial activity, for which more credit will be required from the banks. Thus, there will be expansion of the volume of bank Credit.

2. Open Market Operations:

This method of credit control is used in two senses:

(i) In the narrow sense, and

(ii) In broad sense.

ADVERTISEMENTS:

In narrow sense—the Central Bank starts the purchase and sale of Government securities in the money market. But in the Broad Sense—the Central Bank purchases and sale not only Government securities but also of other proper and eligible securities like bills and securities of private concerns. When the banks and the private individuals purchase these securities they have to make payments for these securities to the Central Bank.

This gives result in the fall in the cash reserves of the Commercial Banks, which in turn reduces the ability of create credit. Through this way of working the Central Bank is able to exercise a check on the expansion of credit.

Further, if there is deflationary situation and the Commercial Banks are not creating as much credit as is desirable in the interest of the economy. Then in such situation the Central Bank will start purchasing securities in the open market from Commercial Banks and private individuals.

With this activity the cash will now move from the Central Bank to the Commercial Banks. With this increased cash reserves the Commercial Banks will be in a position to create more credit with the result that the volume of bank credit will expand in the economy.

3. Variable Cash Reserve Ratio:

Under this system the Central Bank controls credit by changing the Cash Reserves Ratio. For example—If the Commercial Banks have excessive cash reserves on the basis of which they are creating too much of credit which is harmful for the larger interest of the economy. So it will raise the cash reserve ratio which the Commercial Banks are required to maintain with the Central Bank.

This activity of the Central Bank will force the Commercial Banks to curtail the creation of credit in the economy. In this way by raising the cash reserve ratio of the Commercial Banks the Central Bank will be able to put an effective check on the inflationary expansion of credit in the economy.

Similarly, when the Central Bank desires that the Commercial Banks should increase the volume of credit in order to bring about an economic revival in the country. The Central Bank will lower down the Cash Reserve ratio with a view to expand the cash reserves of the Commercial Banks.

With this, the Commercial Banks will now be in a position to create more credit than what they were doing before. Thus, by varying the cash reserve ratio, the Central Bank can influence the creation of credit.

Which is Superior?

ADVERTISEMENTS:

Either variable cash reserve ratio or open market operations:

From the analysis and discussions made above of these two methods of credit, it can be said that the variable cash reserve ratio method is superior to open market operations on the following grounds:

(1) Open market operations is time consuming procedure while cash reserves ratio produces immediate effect in the economy.

(2) Open market operations can work successfully only where securities market in a country are well organised and well developed.

ADVERTISEMENTS:

While Cash Reserve Ratio does not require such type of securities market for the successful implementation.

(3) Open market operations will be successful where marginal adjustments in cash reserve are required.

But the variable cash reserve ratio method is more effective when the commercial banks happen to have excessive cash reserves with them.

These two methods are not rival, but they are complementary to each other.

Category # II. Qualitative or Selective Method of Credit Control:

ADVERTISEMENTS:

The qualitative or the selective methods are directed towards the diversion of credit into particular uses or channels in the economy. Their objective is mainly to control and regulate the flow of credit into particular industries or businesses.

The following are the important methods of credit control under selective method:

1. Rationing of Credit.

2. Direct Action.

3. Moral Persuasion.

4. Method of Publicity.

ADVERTISEMENTS:

5. Regulation of Consumer’s Credit.

6. Regulating the Marginal Requirements on Security Loans.

1. Rationing of Credit:

Under this method the credit is rationed by limiting the amount available to each applicant. The Central Bank puts restrictions on demands for accommodations made upon it during times of monetary stringency.

In this the Central Bank discourages the granting of loans to stock exchanges by refusing to re-discount the papers of the bank which have extended liberal loans to the speculators. This is an important method of credit control and this policy has been adopted by a number of countries like Russia and Germany.

2. Direct Action:

Under this method if the Commercial Banks do not follow the policy of the Central Bank, then the Central Bank has the only recourse to direct action. This method can be used to enforce both quantitatively and qualitatively credit controls by the Central Banks. This method is not used in isolation; it is used as a supplement to other methods of credit control.

Direct action may take the form either of a refusal on the part of the Central Bank to re-discount for banks whose credit policy is regarded as being inconsistent with the maintenance of sound credit conditions. Even then the Commercial Banks do not fall in line, the Central Bank has the constitutional power to order for their closure.

ADVERTISEMENTS:

This method can be successful only when the Central Bank is powerful enough and has cordial relations with the Commercial Banks. Mostly such circumstances are rare when the Central Bank is forced to resist to such measures.

3. Moral Persuasion:

This method is frequently adopted by the Central Bank to exercise control over the Commercial Banks. Under this method Central Bank gives advice, then request and persuasion to the Commercial Banks to co-operate with the Central Bank is implementing its credit policies.

If the Commercial Banks do not follow or do not abide by the advice or request of the Central Bank no gross action is taken against them. The Central Bank merely was its moral influence and pressure with the Commercial Banks to prevail upon them to accept and follow the policies.

4. Method of Publicity:

In modern times, Central Bank in order to make their policies successful, take the course of the medium of publicity. A policy can be effectively successful only when an effective public opinion is created in its favour.

Its officials through news-papers, journals, conferences and seminar’s present a correct picture of the economic conditions of the country before the public and give a prospective economic policies. In developed countries Commercial Banks automatically change their credit creation policy. But in developing countries Commercial Banks being lured by regional gains. Even the Reserve Bank of India follows this policy.

5. Regulation of Consumer’s Credit:

Under this method consumers are given credit in a little quantity and this period is fixed for 18 months; consequently credit creation expanded within the limit. This method was originally adopted by the U.S.A. as a protective and defensive measure, there after it has been used and adopted by various other countries.

6. Changes in the Marginal Requirements on Security Loans:

ADVERTISEMENTS:

This system is mostly followed in U.S.A. Under this system, the Board of Governors of the Federal Reserve System has been given the power to prescribe margin requirements for the purpose of preventing an excessive use of credit for stock exchange speculation.

This system is specially intended to help the Central Bank in controlling the volume of credit used for speculation in securities under the Securities Exchange Act, 1934.