Let us first discuss the impact of tariff on production and consumption.

The above diagram 1 demonstrates that any tariff tends to raise the domestic price of a commodity above its free trade level and thereby stimulates domestic production and reduces domestic consumption of the commodity in question.

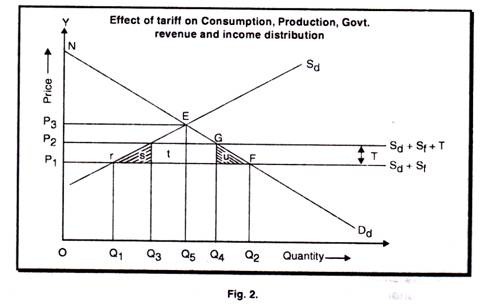

This is shown more clearly again in partial equilibrium analysis in the following diagram 2: curves Dd and Sd are the domestic demand and supply curves for the particular good under consideration. In Isolation, production, consumption and commodity price are determined by their intersection at the point E.

Under free trade conditions, however, the foreign supply here assumed to be perfectly elastic, must be added to the domestic supply resulting in the overall supply curve Sd + Sf. Equilibrium is now at point F with quantity OQ2 being consumed at price P1 of which OQ1 is produced at home and rest Q1Q2 imported. Now an ad valorem tariff T, is applied, which raise the free trade supply curve (assuming foreign prices remain unchanged as a result), by Sd + Sf + T.

Equilibrium now shifts to point Q. As a result of the tariff, the domestic price has gone up to P2 causing a reduction of consumption to OQ4. At the same time, the higher prices have encouraged domestic supplies to expand output to OQ3, so that imports are reduced from Q1Q2 to Q3Q4. Without the tariff, total consumer surplus is represented as the area NP1F. With the tariff, it is reduced to NP2G for an overall consumer surplus loss of P1P2GF. This loss to consumer is absorbed in a number of ways.

The tariff makes it possible for the government to collect revenues from the import duty. Tariff revenues always equal the amount of duty times the quantity of goods imported under it. Hence, here the revenue collected equals P1P2XQ3Q4, the area (r) in the figure. This represents that part of the loss in consumer surplus which is transferred to the government in the form of money, the revenue effect a tariff.

A second part of the loss in consumer surplus (P1P2WQF) is transferred again in money terms to domestic producers of the good in question. At the higher tariff imposed price, producers receive additional economic rent in the amount (f) in the figure. Since this represents a reduction in consumer surplus matched by an equivalent increase in producer surplus, it is tantamount to a redistribution of real income from consumers to producers, the redistribution effect of a tariff.

With the areas (r) and (t) of the overall loss of consumer surplus P1P2GF thus accounted for, we need only explain the remaining areas (s) and (u). By increasing the output in the amount Q1Q3, as a result of the tariff, producers find that they must operate at successively higher unit costs as they progress upward along their supply (marginal cost) curve.

ADVERTISEMENTS:

They must draw factors of production into the supply process at higher costs factors which are withdrawn from other sectors of the economy, in addition to possibly incurring diminishing returns. Hence, the areas (s) of the consumer surplus loss is diverted into resources being drawn into the protected sector from the other sectors and a reduction in productive efficiency. It represents real loss to the economy. This is usually called the protective effect of a tariff. Now (s) is transferred to producers, (t) is transferred to the government, (s) is a net loss to the economy resulting from the tariff induced expansion of domestic output.

The remainder area (u) is the residual loss of consumer satisfaction not accounted for in any of the above ways, the consumption effect of tariff. It too represents a real loss lo the economy. The total net loss imposed by the tariff upon the economy is thus a sum of the protective effect and the consumption effect area (s + u) in figure.

We may summaries this partial equilibrium analysis of the effects of a tariff briefly as follows:

Without Tariff:

ADVERTISEMENTS:

Consumption OQ2

Production OQ1

Imports Q1Q2

Price P1

With Tariff

Consumption OQ4

Production OQ3

Imports ‘ Q3Q4

Price P2

ADVERTISEMENTS:

Effects of the Tariff

Consumption effect u

Productive effect s

Revenue effect t

ADVERTISEMENTS:

Redistribution effect r

Cost of tariff s + u

Suppose, the tariff were raised to level that blocked all imports. Imposition of such a prohibitive tariff would return equilibrium to that prevailing in isolation (point E). The “cost” of the tariff-the combined consumption and protective effects would increase greatly, as would the redistribution effect. The revenues collected under the tariff would be zero, however, since no goods are imported to which a levy can be applied.

ADVERTISEMENTS:

Tariffs and Terms of Trade:

Since the terms of trade determine the relative size of the gains from international trade accruing to each country, an improvement in a country’s terms of trade represents an increase in its share of the gains from trade. If the terms of trade for one country improve, they must simultaneously deteriorate for one or more other countries.

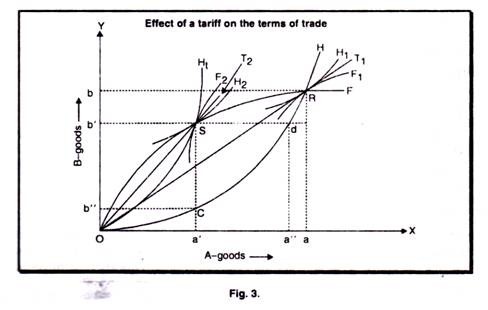

Let us use offer curves as analytical tool. In the following figure 3, offer curve OH is drawn for the home country exporting A-goods and importing B-goods, while offer curve OF is drawn for the foreign country (or the rest of the world), which exports B-goods and imports A-goods.

Under free trade conditions, intersection of the two countries, respective offer curves occurs at point R, with the prevailing terms of trade being given by the slope of the line OT1. At the free trade equilibrium point, the two countries respective trade indifference curves (F1 and H1) are tangent, meaning that neither of the two countries can gain further from international trade without the other losing. A shift in the trade point to the left means a higher trade indifference level for country (H) but a lower level for country (F) with the opposite being true, if the trade point shifts to the right now suppose the home country imposes a tariff on imports.

In doing so it in effect demands that the foreign nation gives up a larger quantity of its export good in order to receive a given quantity of imports, the home country’s export goods. Or putting it another way, the home country is willing to offer less of its export good in order for a certain quantity of imports from abroad.

The result, of course, is a shift in the home country’s offer curve to the left, say from OH to OH1 We shall assume for the moment that the foreign country does not retaliate, so that the new equilibrium of the foreign offer curve OF and the domestic tariff distorted offer curve OH+ occurs at point S.

ADVERTISEMENTS:

The new terms of trade OT2 are more favourable to the home country; it must now export fewer A-goods to get a given quantity of B- goods. The home country has reached a higher trade indifference level (H2) by imposing the tariff but the foreign country’s new trade indifference level (F2) is substantially inferior to that prevailing under free trade conditions.

The tariff itself can be measured in either of the two traded commodities. Without the tariff, country H was willing to offer oa11 of its A-goods in exchange for ob1 of B-goods under its free trade offer curve OH. With the imposition of the tariff, the tariff distorted offer curve shows that it is willing to offer only oa1 of A-goods in return for the same quantity of ob1 of B-goods.

Hence, the tariff measured in terms of the home country’s exports, A-goods, Sd (or a1 a11) i.e., that amount of its exports which it was willing to offer in the absence of the tariff but which it is not willing to offer with the tariff in return for an identical amount of imports. Alternatively the tariff can also be measured in terms of B-goods. Without the tariff, in return for quantity oa1 of its exports it was willing to accept a1 c (or ob11) of imports but now it wants a1 s (or ob1) of imports for the same amount of its exports.

Hence the tariff measured in terms of imported B-goods is CS (or b1 b11), i.e. the increase in the quantity of imports demanded in to return for a set amount of exports. As a result of the tariff, the volume of trade declines from oa exports plus ob imports to oa1 of exports plus ob1 of imports.

We can summarize all of this as follows:

ADVERTISEMENTS:

Free trade

Equilibrium R

H-exports oa

F exports ob

H-indifference curve H1

F-indifference curve F1

ADVERTISEMENTS:

Terms of trade OT1

With tariff

Equilibrium S

H-exports oa1

F exports ob1

H-indifference curve H2

ADVERTISEMENTS:

F-indifference curve F2

Terms of trade OT2

The tariff

Expressed in A-goods sd

Expressed in B-goods sc

Whereas the tariff may result in substantial improvement in terms of trade of the country imposing it, it need not do so. The other country may retaliate by imposing its own tariff. In addition, the extent of the improvement that one country can expect in (a) its terms of trade and (b) its trade indifference level by imposing a tariff, depends largely on the shape of the other country’s offer curve.