In this article we will discuss about the Emmanuel’s unequal exchange theory of exchange theory.

Marxists like Emmanuel (1972) and Anderson (1976) have attempted to explain the uneven development of productive factors (mainly labour productivity) and the resulting income differences in the capitalist world by the means of the ‘surplus drain’ hypothes.

Adopting Raul Prebisch’s division of the world capitalist economy into the ‘centre’ and the ‘periphery Marxists have argued that surplus transfer has restrained the economic development of the periphery and exacerbated the income gap between the centre and the periphery.

Before Emmanuel’s work, the surplus transfer argument consisted of a loose intertwining of Prebisch’s thesis and the secular deterioration of the terms of trade in the periphery. Emmanuel introduced a coherent surplus drain theory by making the Marx’s scheme of transformation of values into output prices.

ADVERTISEMENTS:

He formulated his theory of surplus transfer through unequal exchange by comparing values with Marxian prices of material goods. We may now explain Emmanuel’s unequal exchange theory, within its original Marxist framework.

Component of Value and Price:

The value of a commodity has three components, viz, constant capital (C), variable capital (V) and surplus value (s); whereas its corresponding Marxist product price (p) includes the average rate of profit (π):

t = C + V + s ….(1)

ADVERTISEMENTS:

p = (1+ π) (1 + V)….(2)

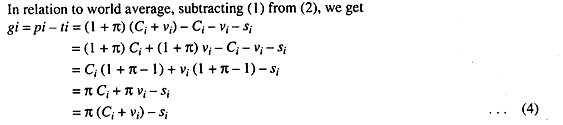

In a world capitalist system consisting of the centre (A) and periphery (B) as trading partners, unequal exchange is defined as the difference (d) between the Marxist product prices and values.

In truth, unequal exchange compares two terms of trade under different assumptions about the wage rate in each country:

di = Pi – ti ; i = A, B …(3)

ADVERTISEMENTS:

A positive ‘d’ denotes a surplus gain for exporters, while a negative ‘d’ denotes a surplus loss.

Three Assumptions:

Emmanuel’s theory is based on three assumptions:

(i) Due to international capital mobility there exists a single worldwide profit rate.

(ii) Due to immobility of labour from the periphery to the centre, there exists a wage gap between the two areas.

(iii) The wage rate is an independent variate.

Emmanuel showed, on the basis of these assumptions,that unequal exchange depends on a country’s rate of surplus value and on its organic composition of capital (i.e., the ratio of fixed to variable capital).

ADVERTISEMENTS:

Three Definitions:

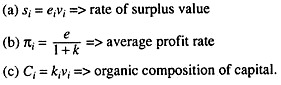

Now let us define the key terms:

Measurement of Unequal Exchange:

ADVERTISEMENTS:

If we substitute the definitions for the rate of surplus value, the average profit rate and the organic composites of capital into equation (4), we arrive at the following formula to measure unequal exchange:

Disappearance of Unequal Exchange:

Unequal exchange will disappear when the rate of profit of the centre or the periphery approach the world average profit rate, i.e., πi = π. This is satisfied when the following holds:

ADVERTISEMENTS:

(i) ei = e and ii) ki =k.

Now, equation (5) becomes

di = Vj {0} = 0

Broad and Strict Definitions:

Emmanuel suggests two definitions of unequal exchange in terms of equation (5). Even when the wage rate and prices, the rate of surplus are equalised between the centre and the periphery, unequal exchange in the ‘broad sense’ occurs due to differences in the organic composition of capital. This type of unequal exchange can also exist within a country if there are differences in the organic composites of capital among sectors.

Unequal exchange according to strict definition occurs when condition (i) is satisfied and the rates of surplus value in the centre and periphery are equalised. In this case the unequal exchange equation (5) becomes

ADVERTISEMENTS:

As a result, there will be surplus gain through trade when the individual organic composition of capital (ki, vi) exceeds the world average. In a like manner, if condition (ii) is satisfied and the organic composites of capital are equal in both the centre and periphery, the unequal exchange equation (5) becomes

di = vi (e- ei)……(7)

In this case, corresponding to Emmanuel’s unequal exchange in the ‘strict sense’, there will be surplus gain through trade where the world average rate of surplus value exceeds the individual rate.

The periphery tends to transfer surplus through trade because its rate of surplus value is higher than the world average due to an international wage gap, which favours workers in the centre. Therefore, even if the organic composites of capital are equalised, unequal exchange results from the existence of a wage gap between the centre and the periphery.

This gets reflected in the fact that the rate of surplus value is lower in the centre (due to higher wage) than is the periphery (where the wage rate is much lower) as the rate of surplus value can be expressed as

where, w = the wage rate, q = output, w = wL = total wage bill, p = price of product. Here we derive that 1 unit of labour is required to produce 1 unit of output therefore q = L. Thus we get

According to Emmanuel, unequal exchange in the ‘strict sense’ characterises the trade relation between the centre and periphery.

Emmanuel’s basic conclusion is that ‘the inequality of wages as such, all other things being equal, is alone the cause of the inequality of exchange.’

As a corollary, Emmanuel argued that “by transferring through non-equivalent exchange, a large part of its surplus to the rich countries, the periphery deprives itself of the means of accumulation and growth.” Thus an important implication of Emmanuel’s theory is that a widening wage gap leads to a deterioration of the periphery’s terms of trade, and a subsequent reduction in its rate of economic growth.

Criticisms:

ADVERTISEMENTS:

Critics have pointed out that Emmanuel’s theory does not sufficiently explain uneven distribution lay it omits the ‘blocking of the productive forces’ by entrenched and reactionary social class in the periphery.

Batheheim in particular argues that the rate of surplus value is higher in the centre due to its higher labour productivity. This leads to unequal exchange reversal.

At the same time, he has emphasised non-specialised trade between the centre and the periphery as the cause of unequal exchange. Others criticise unequal exchange as the theory of under development because capital mobility tends to eliminate wage differences by exhausting the reserve army of unemployed in the periphery.

Conclusion:

Looking ahead, D. Harris suggests that a convening theory of economic development should include a theory of value and distribution and a theory of accumulation on a world scale. Emmanuel’s theory of unequal exchange, especially its subsequently more rigourous formulation, can help explain the general character of the process of uneven development of the capitalist countries and backward economies which surround the capitalist world. In this way, Emmanuel’s theory of unequal exchange as inseparably linked to the original theory of Prebish singer Lewis and Baron on trade and development.