Here is a term paper on the ‘Business Cycles’ for class 9, 10, 11 and 12. Find paragraphs, long and short term papers on the ‘Business Cycles’ especially written for commerce students.

Term Paper on the Business Cycles

Term Paper Contents:

- Term Paper on the Introduction to Business Cycles

- Term Paper on the Definition of Business (Trade) Cycle

- Term Paper on the Nature, Features and Characteristics of Business Cycle

- Term Paper on the Phases of Business Cycle

- Term Paper on the Classification of Business Fluctuations

Term Paper # 1. Introduction to the Business Cycles:

ADVERTISEMENTS:

The records of business activity world over indicate that the course of business is not smooth. A periodic fluctuation in business and economic activities at more or less regular intervals has been an important feature of all the capitalist economies. These fluctuations of business are of many kinds.

Some are abrupt and discontinuous as caused by war. Some are continuous in the same direction, when steady economic growth takes place. Other changes are fluctuations of a rhythmic nature which get manifested in the form of expansion and contraction of business activity.

These are commonly called “trade cycles” or “business cycles”. Business cycles are not limited to specific fields they tend to spread over the entire field of business activity. A trade cycle generally has a length of time varying from four to twelve years, while at certain times; trade cycles of twenty years length have also been witnessed. Normally, the duration of a trade cycle is of eight to nine years.

Term Paper # 2. Definition of Business (Trade) Cycle:

ADVERTISEMENTS:

A business cycle can be defined as wave like fluctuations of business activity characterised by recurring phase of expansion and contraction in periods varying from three to four years. This relatively simple definition of a business cycle suggests that business activity never takes place in a steady manner.

While the business makes progress over time, there are also fluctuations in it. This implies that the period of business expansion comes to an end sooner or later. After the turning point the business activity passes through the phase of contraction which also terminates in a few years and once again the business activity finds itself on the expansion path.

“Business cycles are a type of fluctuations found in the aggregate economic activity of nations that organise their work mainly in business enterprises. A cycle consists of expansions occurring at about the same time in many economic activities followed by similarly general recessions. Contractions and revivals which merge with the expansion phase of the next cycle. This sequence of change is recurrent but not periodic.”

Mitchell’s definition states that business cycles are fluctuations in economic activity as a whole. Hence, they are to be distinguished from the fluctuations which are limited to specific fields. Generally, because of sectoral linkage, fluctuations in particular fields do not remain confined to those sectors only where they originate.

ADVERTISEMENTS:

It is commonly observed that a recession in consumer goods manufacturing sector causes recession in the capital goods sector as well. Not only this, a decline in industrial activity leads to a slump in overall economic activity. Therefore, the point of distinction between the fluctuations taking place in individual sectors and the fluctuations in the aggregate economic activity should not be overstressed.

Term Paper # 3. Nature, Features and Characteristics of Business Cycle:

Features and characteristics of a business cycle are as follows:

1. Business cycle is characterised by fluctuations which occur periodically in a free rhythm. This implies that the recurrence of expansion and contraction has no fixed or invariable period.

2. A typical business cycle completes itself in a period of 3 to 4 years. In some cases, duration of business cycle is shorter or longer than those of normal business cycle. In any case, the period of business cycle is not shorter than one year. A business cycle in its character is distinctly different from fluctuations in economic activity which take place within the period of calendar year and are due to causes connected directly or indirectly with the physical season.

3. A business cycle is characterised by alternating forces leading an economy to prosperity and depression. These forces are in built in the system. The force of expansion when born, gathers momentum over time taking the economy to a high level of activity. This force is, however, first weekend and then completely replaced by a counter force which leads to contraction and the process ends up with depression.

4. According to Keynes, an important characteristic of the business cycle is the phenomenon of crisis. This implies that the peak and the through are asymmetrical. Normally the prosperity phase of business cycle comes to an end abruptly, whereas recovery after the depression is gradual and slow.

Term Paper # 4. Phases of Business Cycle:

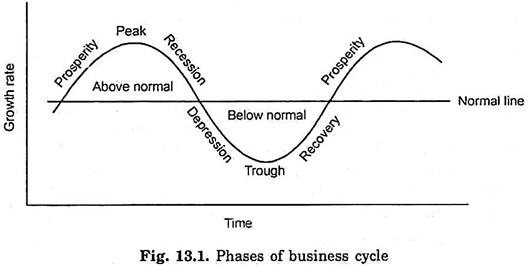

No business cycle is same as another. In other words, the details of cycles differ. However, all the cycles belong to the same family and thus have common characteristics. According to the Burus and Mitchell, every business cycle has the critical mark off points of peak and trough. From trough to peak there is the expansion phase and from peak to trough the contraction phase.

ADVERTISEMENTS:

Apart from these two relatively longer phases these are two other phases characterised by the turning points. The upper turning point located at the peak marks the beginning of recession, while the other turning point located at the trough is the venue of revival. Both recession and revival phases are relatively short in duration.

In general, the various phases of trade cycle can be stated as follows. (Fig. 13.1.):

1. Prosperity.

2. Recession.

ADVERTISEMENTS:

3. Depression.

4. Recovery.

In Fig. 13.1, the steady growth line shows the growth of the economy when there are no economic fluctuations. The various phases of business cycles are shown by the line of cycle which moves up and down the steady growth line. The line of cycle moving above the steady growth line marks the beginning of the period of ‘expansion’ or ‘prosperity’ in the economy.

The phase of expansion is characterised by increase in output, employment, investment, aggregate demand, sales profits, bank credits, wholesale and retail prices, per capita output and a rise in standard of living. The growth rate eventually slows down and reaches the peak. The phase of peak is generally characterised by slacking in expansion rate.

ADVERTISEMENTS:

The highest level of prosperity, and downward slide in the economic activities from the peak, the phase of recession begins when the downward slide in the growth rate becomes rapid and steady, output, employment, prices etc., register a rapid decline, though the realised growth rate may still remain above the steady growth line.

So long as growth rate exceeds or equals the expected steady growth rate, the economy enjoys the period of prosperity-high and low. When the growth rate goes below the steady growth rate, it marks the beginning of depression in the economy.

In a stagnated economy, depression begins when growth rate is less than zero, i.e., the total output, employment, prices, bank advances etc., decline during the subsequent periods. The span of depression spreads over the period when growth rate stays below the secular growth rate or zero growth rates in a stagnated economy. Trough is the phase during which the down trend in the economy slows down and eventually stops, and the economic activities once again register an upward movement. Tough is the period of most severe strain on the economy.

When the economy registers a continuous and rapid upward trend in output, employment, etc., it enters the phase of recovery though the growth rate may still remain below the steady growth rate. And, when it exceeds this rate, the economy once again enters the phase of expansion and prosperity. If economic fluctuations are not controlled by the government, the business cycles continue to recur.

Since business cycles are inherent in the very process of growth of the economy, it is always dangerous. The government should take immediate proper measures to counteract the dangers of business cycle so that the economy is not thrown out of gear. Inflation breeds inflation in its several phases, like creeping inflation, crawling inflation, walking inflation, running inflation, and hyperinflation.

ADVERTISEMENTS:

Recession is the most dangerous period, since it creates economic chaos and confusion in the economy. If inflation is bad, deflation is worse. If inflation is replaced by deflation, it is as good as exchanging a known devil with an unknown devil. During the period of hectic inflation, consumers go to the market with bags full of money and return home with pockets full of commodities and this is because of rocketing prices in the market.

Deflation is a very bad period of economic dislocation and distortions. Though prices are very low, people will have very little purchasing power. Due to the absence of profits during deflation, the investors will have no incentives or inducements to make investments. Thus, both the periods are dangerous and it will be the responsibility of the government to take steps to prevent the occurrence of these economic fluctuations.

Term Paper # 5. Classification of Business Fluctuations:

The most common classification of business fluctuations are as follows:

1. Seasonal Trends:

Seasonal fluctuations refer to the periodic movements in business activity that take place due to changing seasons within the period of a calendar year. These fluctuations are observed in various business and economic phenomenon like prices of industrial products, agricultural commodities, bank clearings, interest rates etc. Social customs are also the causes for seasonal variations in economic activities. Seasonal variations do not present any serious social or economic problems, since they are predictable well in advance.

ADVERTISEMENTS:

2. Secular Trends:

A persistent movement continuing in the same direction over a long period of time is called secular trend. A long period of secular trend generally encompasses within it a number of business cycles. In the study of economic fluctuations and business forecasting, secular trends are the best, since they have an impact on long term forces making for change. In the total economy, secular movements reflect changes in population growth, technology, accumulation of capital, propensity to consumer and saving which cause changes over a long term.

3. Random Trends:

The random trends are non-recurring and irregular, operating in the economy in bringing about revolutionary and sporadic changes. Floods, earthquakes, storms, famines, strikes, tornedos etc. are very good examples. Most of these factors are accidental in character. They are unpredictable, non-measurable and non-periodic. All these trends are inter-related and inter-woven. Cyclical fluctuations have attracted major attention of the economists, since their impact is very severe.

4. Cyclical Trends:

Economic activity moves continuously through alternations of rise and fall and they are called cyclical fluctuations, which are wave like fluctuations of economic activity characterised by recurring phases of expansion and contractions. Cycles are rhythmic and irregular, but they have stipulated pattern, but difficult to predict.