The below mentioned article provides a close view on the marginal productivity theory of distribution.

Subject Matter:

The marginal productivity theory of distribution, as developed by J. B. Clark, at the end of the 19th century, provides a general explanation of how the price (of the earnings) of a factor of production is determined.

In other words, it suggests some broad principles regarding the distribution of the national income among the four factors of production.

According to this theory, the price (or the earnings) of a factor tends to equal the value of its marginal product. Thus, rent is equal to the value of the marginal product (VMP) of land; wages are equal to the VMP of labour and so on. The neo-classical economists have applied the same principle of profit maximisation (MC = MR) to determine the factor price. Just as an entrepreneur maximises his total profits by equating MC and MR, he also maximises profits by equating the marginal product of each factor with its marginal cost.

Assumptions of the Theory:

ADVERTISEMENTS:

The marginal productivity theory of distribution is based on the following seven assumptions:

1. Perfect competition in both product and factor markets:

Firstly, the theory assumes the perfect competition in both product and factor markets. It means that both the price of the product and the price of the factor (say, labour) remains unchanged.

2. Operation of the law of diminishing returns:

ADVERTISEMENTS:

Secondly, the theory assumes that the marginal product of a factor would diminish as additional units of the factor are employed while keeping other factors constant.

3. Homogeneity and divisibility of the factor:

Thirdly, all the units of a factor are assumed to be divisible and homogeneous. It means that a factor can be divided into small units and each unit of it will be of the same kind and of the same quality.

4. Operation of the law of substitution:

ADVERTISEMENTS:

Fourthly, the theory assumes the possibility of the substitution of different factors. It means that the factors like labour, capital and others can be freely and easily substituted for one another. For example, land can be substituted by labour and labour by capital.

5. Profit maximisation:

Fifthly, the employer is assumed to employ the different factors in such a way and in such a proportion that he gets the maximum profits. This can be achieved by employing each factor up to that level at which the price of each is equal to the value of its marginal product.

6. Full employment of factors:

Sixthly, the theory assumes full employment for factors. Otherwise each factor cannot be paid in accordance with its marginal product. If some units of a particular factor remain unemployed, they would be then willing to accept the employment at a price less than the value of their marginal product.

7. Exhaustion of the total product:

Finally, the theory assumes that the payment to each factor according to its marginal productivity completely exhausts the total product, leaving neither a surplus nor a deficit at the end.

Some Key Concepts:

The theory is also based on key certain concepts.

These are the following:

ADVERTISEMENTS:

1. MPP:

The first is marginal physical product of a factor. The marginal physical product (MPP) of a factor, say, of labour, is the increase in the total product of the firm as additional workers are employed by it.

2. VMP:

The second concept is value of marginal product. If we multiply the MPP of a factor by the price of the product, we would get the value of the marginal product (VMP) of that factor.

ADVERTISEMENTS:

3. MRP:

The third concept is marginal revenue product (MRP). Under perfect competition, the VMP of the factor is equal to its marginal revenue product (MRP), which is the addition to the total revenue when more and more units of a factor are added to the fixed amount of other factors, or MRP = MPP x MR under perfect competition. It is simply MPP multiplied by constant price, as P = MR. [VMP of a factor = MPP of the factor x price of the product per unit, and MRP of a factor=MPP of the factor x MR under perfect competition. So under perfect competition VMP of a factor = MRP of that factor.]

The Essence of the Theory:

The theory states that the firm employs each factor up to that number where its price is equal to its VMP. Thus, wages tend to be equal to the VMP of labour; interest is equal to VMP of capital and so on. By equating VMP of each factor with its cost a profit- seeking firm maximises its total profits. Let us illustrate the theory with reference to the determination of the price of labour, i.e., wages.

Let us suppose that the price of the product is Rs. 5 (constant) and the wages per unit of labour are Rs. 200 (constant). As the number of factors other than labour remain unchanged, wages represent the marginal cost (MC).

ADVERTISEMENTS:

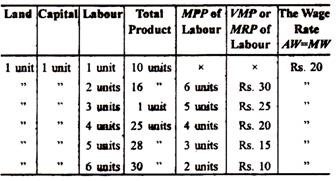

Table 12.1: Calculation of MPP, VMP and MRP of a Variable Factor (Labour)

Table 12.1 shows that at 2 or 3 labourers, the VMP or MRP of labour is greater than wages; so the firm can earn more profits by employing an additional labour. But at 5 or 6 labourers, the VMP or MRP of labour is less than wages, so it would reduce the number of labourers. But when it employs 4 labourers, the wage rate (Rs. 20) becomes equal to the VMP or MRP of labour (also Rs. 20). Here the firm gets the maximum profits because its marginal cost of labour (or marginal wage Rs. 12) is equal to its marginal revenue (VMP or MRP, Rs. 20).

Thus, under the assumption of perfect competition a firm employs a factor up to that number at which the price of the factor is just equal to the value of the marginal product (=MRP of the factor). In the same way it can be shown that rent is equal to the VMP of land, interest is equal to the VMP of capital, and so forth.

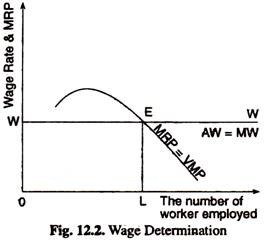

The theory may now be illustrated diagrammatically. See Fig. 12.2. Here WW is the wage line indicating the constant rate of wages at each level of employment (AW = MW. Here AW is average wage and MW is marginal wage). The VMP line shows the value of marginal product curve of labour, and it goes downwards from left to right indicating diminishing MPP of labour. Fig. 12.2 shows that the firm employs OL number of labourers, because by doing so it equates the MRP of labour with the wage ratio, and makes optimum purchase of labour.

Criticisms of the Theory:

ADVERTISEMENTS:

The marginal productivity theory of distribution has been subjected to a number of criticisms:

1. In determination of marginal product:

Firstly, main product is a joint product— produced by all the factors jointly. Hence the marginal product of any particular factor (say, land or labour) cannot be separately determined. As William Petty pointed out as early in 1662: Labour is the father and active principle of wealth, as lands are the mother.

2. Unrealistic:

It is also shown that the employment of one additional unit of a factor may cause an improvement in the whole of organisation in which case the MPP of the variable factors may increase. In such circumstances, if the factor is paid in accordance with the VMP, the total product will get exhausted before the distribution is completed. This is absurd. We cannot think of such a situation in reality.

3. Market imperfection:

ADVERTISEMENTS:

The theory assumes the existence of perfect competition, which is rarely found in the real world. But E. Chamberlin has shown that the theory can also be applied in the case of monopoly and imperfect competition, where the marginal price of a factor would be equal to its MRP (not to its VMP).

4. Full employment:

Again, the assumption of full employment is also unrealistic. Full employment is also a myth, not a reflection of reality.

5. Difficulties of factor substitution:

W. W. Leontief, the Nobel economist, denies the possibility of free substitution of the factors always owing to the technical conditions of production. In some products process, one factor cannot be substituted by another. Moreover organisation or entrepreneurship is a specific factor which cannot be substituted by any other factor.

6. Emphasis on the demand side only:

ADVERTISEMENTS:

The theory is one-sided as it ignores the supply side of a factor; it has emphasised only the demand side i.e., the employer’s side, hi the opinion of Samuelson, the marginal productivity theory is simply a theory of one aspect of the demand for productive services by the firm.

7. Inhuman theory:

Finally, the theory is often described as ‘inhuman’ as it treats human and non-human factors in the same way for the determination of factor prices.