Let us make an in-depth study of the Investment as a Source of Instability of Output and Interest Rates.

The accelerator theory creates a paradox.

In Keynes’ theory investment varies inversely with the interest rate.

Low interest rates are associated with high investment and high interest rates with low investment. In Jorgenson’s theory a low rate of interest reduces the user cost of capital. This, in its turn, raises the desired capital stock and hence the level of gross investment.

ADVERTISEMENTS:

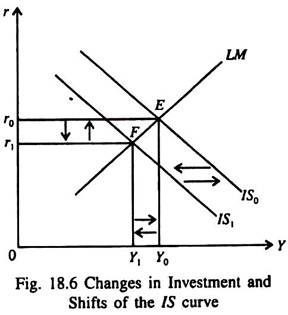

However, business cycles in every nation show a two-way relation between business investment and interest rates. The accelerator theory explains the positive relationship between investment and interest rates through income changes. Fig. 18.6 shows that shifts in business confidence or in user cost can shift the IS curve either to the right or to the left between IS0 and IS1.

As a result, the interest rates will be high when investment is high, and vice versa. This conclusion assumes that money supply, which fixes the position of the LM curve, remains unchanged. This relationship suggests that the depressing effect of low output on investment, working through the accelerator, dominates the stimulative effect of low interest rates on investment, at least in the short run.

Theory and Evidence:

ADVERTISEMENTS:

Investment behaviour still remains an unexplored area of economists and financial analysts. Most work on estimating investment functions in recent years has been on a disaggregative rather than an aggregative basis.

Thus estimates of investment functions have been made separately for plant or structures, for equipment, for inventory investment and for residential housing construction; or for various sectors of the economy, such as manufacturing, utilities, railroads and commerce. There have also been attempts to estimate investment functions for individual firms.

Empirical studies of the investment demand function have yielded conflicting results. The main reason for this is the strong dependence of investment on expectations of business people, which are not directly measurable, and to the complex lag structure between changes in the determining variables and the consequent changes in investment.

An assessment of the empirical literature on investment is also difficult due to the lack of comparability among various studies.

ADVERTISEMENTS:

All empirical studies suggest that output (sales) growth is an important determinant of investment. Estimates of the elasticity of demand for capital goods with reference to output suggest a value of unity, which is consistent with constant returns to scale.

However, empirical studies found no satisfactory relationship between investment in plant and machinery and cost of capital. More recently, Tobin’s g-ratio has been found to be significantly related to investment and to offer a slightly better explanation of investment than a pure accelerator model.

A major finding is that a change in an exogenous variable leads to a change in investment over a long period. The average lag as far as investment in fixed capital is concerned has been found to be 1.5 to 2 years in most cases. Another result is that there are shorter lags for output changes than for relative prices.