The below mentioned article provides quick notes on the Residential (Housing) Investment.

Investment in housing is much riskier than having a fixed deposit in a bank.

The reason is that prices of houses and flats rise most of the time, but at times such prices remain constant or even fall, as in a period of recession.

No doubt a bank provides most of the funds needed for the purchase of a house.

ADVERTISEMENTS:

But the house-owner bears the risk, since he (she) is responsible for paying back the loan, regardless of the market price of the house.

The Effect of Interest Rate Changes and Tax Benefits:

The demand for houses and flats depends to a large extent on real interest rate. For most people, who buy houses by taking loans, the interest rate is the cost of the loan. Some people do not borrow funds to buy houses. For them also the rate of interest affects the decision to buy or construct houses.

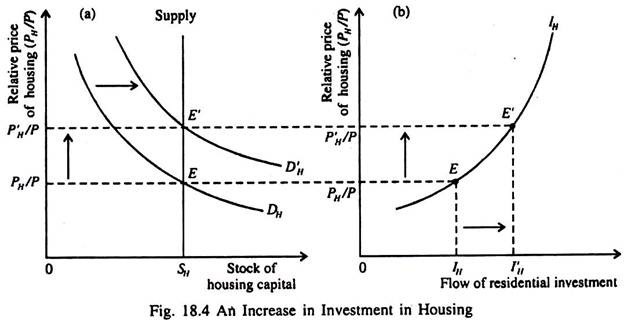

The reason is that the interest rate is the opportunity cost of holding their wealth in housing (a real asset) rather than in financial assets such as bonds or bank deposits. A fall in the interest rate, therefore, raises the demand for houses, the prices of houses and the volume of residential investment per period. This point is illustrated in Fig. 18. 4.

One attractive aspect of investment in housing is that interest on mortgage is tax- deductible. This is why even if the rate of interest rises people buy houses.

Investment in residential housing is a tax- favoured form of investment enjoyed by most people in India. An investor can deduct the interest payments on his mortgage, and wealth tax such as municipal corporation tax when he considers his income for tax purposes. In addition, the capital gain from owning the house is not taxed until the same is sold.

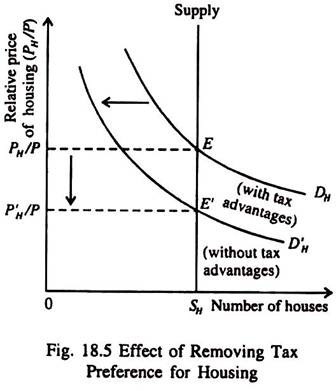

Even then the capital gain (up to Rs. 5 lakhs for a married couple) from selling their house is not taxed at all. If these tax advantages of home ownership were ever withdrawn, housing prices would fall sharply in the short-run (during which supply is compiled inelastic).

This point is illustrated in Fig. 18.5. Removing tax preferences for housing will shift the demand curve for housing down and thus will lead to a fall in the price of housing in the short run.