In this article we will discuss about the loanable funds theory of interest.

Introduction to the Loanable Funds Theory:

The rate of interest is price paid for using someone else’s money for a specified time period. According to Dennis Roberston and neo-classical economists this price or the rate of interest is determined by the demand for and supply of loanable funds. The market for loanable funds consists of arrangements and procedures to carry out transactions between people who want to borrow money and people who want to lend money.

Demand:

The demand for loanable funds originally from two basic units of the economy, viz., consumers and business firms, (a) Consumers demand loanable funds because they prefer current goods to the same amount of future goods. According to Bohm-Bawerk, on average, people have a positive rate of time preference.

ADVERTISEMENTS:

This simply means that people subjectively value goods to be obtained in the immediate or near future more highly than goods obtained in the distant future. Most people would prefer to have a new television set today rather than the same set after ten years.

There is nothing unusual about a positive rate of time preference. In a world characterised by uncertainty most people prefer the reality of current consumption to the uncertainty of some large amount (in physical or monetary terms) of future consumption.

As the old saying goes:

“A bird in hand is worth two in the bush.” Consumers are also ready to pay interest for earlier availability of durable goods like cars or refrigerators. Thus, from consumers’ point of view, interest is the cost of easier and earlier availability of goods.

ADVERTISEMENTS:

Business firms or investors demand loanable funds because they are a form of capital (i.e., money capital). Capital is demanded because it is productive. Capital makes other factors more productive. In other words, investors demand loanable funds so that they can invest in capital goods and finance roundabout methods of production.

Such methods of production are usually more productive than simple methods of production Since roundabout methods of production often make impossible to produce a larger output at the lowest cost, investors can gain—even if they pay interest to purchase the machines, buildings and other resources required by the production process.

Thus, an investor’s demand for loanable funds arises due to the productivity of the capital investment. An increase in the rate of interest is, in essence, an increase in the cost of capital. But it is to be seen against the larger availability of consumption goods made possible by a machine.

Consumers and investors would borrow more at low rates of interest (or curtail their borrowing in response to increase in the rate of interest). Likewise, some investment projects that would be profitable at a lower interest rate will not be so at higher rates. Thus, the amount of loanable funds demanded varies inversely with the rate of interest.

ADVERTISEMENTS:

Supply:

Even though higher interest rates lead to a fall in the amount of borrowing by consumers and investors, they encourage lenders to make a larger volume of funds available to the market. Even individuals with a positive rate of time preference will curtail current consumption to supply more loanable funds in the market if the rate of interest is reasonably high or sufficiently attractive.

People no doubt prefer current (earlier) consumption to future (deferred) consumption. But they also prefer more goods to few goods. So they are ready to sacrifice current consumption if they expect to get more consumption goods in exchange at some future date.

A rise in the rate of interest increases the quantity of future goods available to people willing to sacrifice current consumption. Due to the increase in the quantity of future goods that can be acquired for each rupee supplied the supply curve of loanable funds slopes upward from left to right.

Interest Rate Determination:

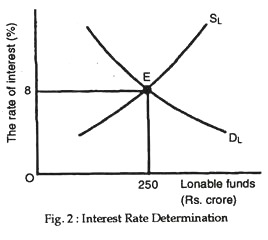

In Fig. 2 the demand curve for loanable funds intersects the supply curve at point E and the equilibrium rate of interest (8%) is automatically determined (by market forces). The interest rate (8%) brings the plans of borrowers in harmony with the plans of lenders. In equilibrium, the quantity of funds demanded by borrowers is equal to the amount supplied by lender (Rs. 250 crores) as Fig. 2 shows.

Criticisms of the Loanable Funds Theory:

Three major criticisms of the loanable funds theory are:

1. The classical writers noted the effect of money as the rate of interest through the saving-interest process. Hence the loanable funds theory is not a new theory.

2. Secondly, the loanable funds theory ignores certain real forces exerting influence on the rate of interest such as the marginal productivity of capital, the abstinence, and time preference.

ADVERTISEMENTS:

3. In most modern economies, the rate of interest is not determined by the market forces, i.e., by the forces of demand and supply. Instead, it is the determined largely by institutional forces, i.e., by the policies and actions of the central bank and the government. Their policies exert the most important influence on the rate of interest by determining both the demand for and supply of loanable funds in the country.

Conclusion:

However, modern economists claim that the loanable funds theory is better than the liquidity preference theory “because it corresponds more closely to the way in which the business world thinks of the determinants of the rate of interest and because it shows more directly the relation between the marginal efficiency of investment and the rate of interest.”

The points to be said in favour of loanable funds theory are:

ADVERTISEMENTS:

1. Firstly, it appeals to common sense.

2. Secondly, it is related to money.

3. Thirdly, it gives due recognition to the role palyed by the banking system in the determination of interest.

4. Fourthly, due importance is assigned in this theory to demand for cash balances for precautionary and speculative purposes.

ADVERTISEMENTS:

5. Finally, it admits the fact that the volume of saving is positively related to the level of income.