Sharecropping is a form of land tenancy, in which the landowner permits the tenant to use his land in return for a stipulated fraction of the output (the ‘share’). It is an institutional arrangement which has prevailed in both developing countries and less-developed countries [LD(s)]. No doubt, sharecropping is most commonly found in LDCs. However, sharecropping arrangements exist even in more advanced countries such as the USA.

A Progmatic Compromise:

It may apparently seem that, since, under sharecropping, a certain portion of output has to be surrendered to the landowner; there is loss of incentives to invest. However, a close look reveals that it has certain advantages which have not been offered by tenant farming. Sharecropping seeks to achieve a compromise between peasant proprietorship and tenant farming.

Sharecropping is an institutional arrangement designed both to share risks and to provide incentives, in a situation when monitoring effort (labour supply) is costly. Sharecropping represents a compromise. While rental contracts provide (in the absence of bankruptcy) perfect incentives (since the sharecropper is able to retain all of his VMPL), it provides no risk-sharing. On the other hand, wage contracts shift all of the risk on to landlords, who are in the best position to bear.

In truth, the sharecropping contract has certain optimality properties: the contract seeks to maximise the welfare of the worker, subject to the landlord obtaining a particular value of expected rents from his land. Even the inefficiency associated with the worker receiving less than the value of his marginal product may be mitigated with long-term contracts; workers who fail to produce a sufficiently high level of output over an extended period of time run the risk of termination of their contract.

ADVERTISEMENTS:

Mainly for this reason we find the persistence of sharecropping, mainly in LDCs. Some of its important features are:

1. Cost Sharing:

The landowner has an incentive to encourage the tenant to use inputs such as fertilizer) which raise the workers’ marginal product, and which, therefore, result in the workers putting extra effort (i.e., working hard). This explains why the landlord might bear a fraction of the costs of inputs that exceed the fraction of the output that he receives. This is he principal-agent view of sharecropping.

2. Positive Externalities:

Important externalities might arise between land markets and credit markets. These externalities can explain the interlinking between credit and land markets that is frequently observed in LDCs (i.e., the landowner is also a money-lender).

An increase in the amount of outstanding debt affect both workers’ efforts and their choice of technique (risk). These, in truth affect the return to the landowner. Conversely, a change in the terms of the sharecropping contract will in general, affect the probability of default, and the return to the lender.

Current View of Sharecropping:

The current view is that sharecropping may not have the optimality properties associated with the ‘principal-agent’ view. Firstly, though the contracts are ‘locally efficient’ (that is they maximise the expected utility of the worker, given the expected rents to be received by the landlords), they are not ‘general equilibrium efficient’, that is, there exist, in general taxes and subsidies which could lead to Pareto improvements.

ADVERTISEMENTS:

Secondly, sharecropping is likely to have a deleterious effect on the level of production A sharecropping contract with a 50% share has the same effects as that of a 50% tax on output Such a tax is likely to reduce output significantly unless the labour supply curve is backward bending (in which case the worker is likely to put extra effort to maintain his income due to a tax-induced income fall). In such a situation, land reform in which workers receive the land which they formally cultivated as sharecroppers, may increase agricultural productivity significantly.

The sharecropping relationship may take a variety of forms. Some contractual forms may affect the adoption of innovations. In truth, innovations which increase output (at any level of input of labour), but which decrease the marginal product of labour (and, hence, reduce workers’ incentives to work), will be resisted by landlords who may impose restrictions on the use of such technologies. But these innovations will, at the same time, reduce agricultural productivity.

Hanumantha Rao provides the following rational of share cropping in India:

ADVERTISEMENTS:

“Owing to the continued pressure of population on limited land resources, tenancy has persisted through informal contracts. Because of the ceiling on-land holdings, sub-division and persisting pressure on land as a source of livelihood, there has been an increase in the operated area-owned as well as leased in-held by the small and marginal family. Moreover, with the widespread adoption of non-technology and rise in input intensity, the incentives for investment and for capturing the returns on investment seem to be predominating over the need for sharing yield risks leading to natural replacement of share-cropping tenancy by the fixed crop and cash rents.”

Efficiency of Share-Cropping (Under Land Reforms):

According to T. Schultz, farm lease contracts are essentially institutional devices for allocating risk among landowners and tenants. In the opinion of Hanumantha Rao, cash rents guaranteed in advance of production that the risks of production are shared entirely by the tents, while crop-sharing rentals indicate the distribution of such risks among the tenants and the landlords in proportion to their respective shares in output. In contrast, fixed-kind rents settled in advance of production imply the sharing of price and allocate the yield risks entirely to the tenants.

Fixed cost rents are preferred by landowners where there exists a significant scope for entrepreneurship. The reason is that such rents offer a foretold advantage: they permit the tenants also to capture the returns expected from their own decision-making. Such rent also protects those who lease out their land against the possible risks arising from the production decisions of the tenants.

Under uncertain situations, there is limited scope for entrepreneurial functions. In such situations there may be a requirement for the tenants to reduce fluctuations in their income by shifting part of their risk to the landowners through share cropping arrangements.

Thus it logically follows that in situations where the element of uncertainty is smaller and there is hardly any role of the entrepreneur, the landowners find it profitable to lease out a portion of land on a share-rent basis, rather than cultivate the entire holding by using hired labours.

While referring to the inefficiency of share-cropping, Alfred Marshall brought into focus a very important point: the rent under this system would be lower than the fixed rent or net income from own cultivation if the tenants were free to restrict their household income.

In Marshall’s view:

” When the cultivator has to give his landlord half of the returns to each dose of capital and labour that he applied to the land, it will not be to his interest to apply any doses the total return to which is less than twice enough to reward him. If, then, he is free to cultivate as he chooses … he will apply only so much capital and labour as will give him returns more than twice enough to repay himself; so that his landlord will get a smaller share even of those returns than he would have on the plan of a fixed payment.”

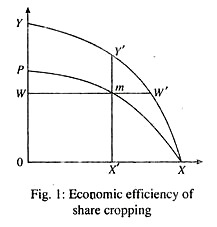

Fig. 2 illustrates this proposition with labour as a variable resource applied to a unit of land. Under own cultivation, ∂Y/∂x = w, output from a unit of land, say one acre, is equal to the area OXW’Y, and net income is equal to WW’Y, which would also be the amount under a fixed-rent contract.

ADVERTISEMENTS:

Under share-cropping, where rent constitutes 50% of output, it will not be to the advantage of the tenant to extend input beyond X’ where ∂Y/∂x = 2W, output per acre will not exceed the area OX’ YY’, and rent will not exceed one-half of this area or PmYY which is less than WW’Y. The share-tenant can get additional income to the extent of the area WmP as compared with what he would otherwise get as a wage-earner.

In Marshall’s view, share-cropping (tenancy) may be advantageous when the holdings are very small and is not suitable for holdings large enough to give scope to the enterprise of an able and responsible tenant. In 1969, Cheung presented an interesting theory of the choice of contracts on the basis of the ‘gains from risk dispersion.’

However, his theory suggests that share contracts can be expected to be more widespread in areas characterised by a high degree of uncertainty than in areas of relative certainty, if transaction costs are equal. However, in the Indian context, Hanumantha Rao has reached a different conclusion.

ADVERTISEMENTS:

As he puts it- “Relative economic certainty in the sense of limited scope for decision-making seems to be necessary for the prevalence of share-cropping. Otherwise, individual anticipations regarding input-output rates and prices may differ, making it difficult for the parties concerned to arrive at an agreed choice as to the product mix and the amount of inputs to be committed.” In contrast, situations of high uncertainty call for fixed-cash rents.

Cheung notes: ‘the tenant’s incentive to use an amount of input less than that stipulated in a share contract’ and suggests the role of transaction costs in determining the lease arrangements In making this suggestion Cheung implicitly assumes that the proposition between land and labour inputs can be varied over a significant range for share-rented crops.

However; if production functions are characterised by relatively inflexible input combinations, then the costs of enforcing tenants’ input would be lower and the incentives for share-contract would be in areas where share-cropping is widely practiced and where landowners prefer to leave out land, owing to managerial discounts of crop cultivation with hired labours.