Let us make an in-depth study of the causes and effects of the inter-locking of Indian agricultural market.

Causes of Interlocking of Agricultural Markets:

1. Risk Reduction:

Interlocking often acts as a security (hedge) against risk. For example, when a landowner makes loan to a tenant, (or a sharecropper), he faces very little risk of default.

The reason is that, he can recover his loan from the tenants’ share of the crop. Thus, the risk of default is reduced through the interlocking of the land (lease) and the credit market.

Similarly, if there is crop failure due to adverse weather or some natural calamity, the landowner can recover his rent by forcing the tenant to supply his labour service free in the next agricultural season. This is possible due to interlocking of land (lease) market and labour market. This interlocking of different markets in agriculture leads to risk reduction to some extent.

2. Economies:

ADVERTISEMENTS:

Another reason for such interlocking is to derive some economies or advantages. For example, suppose the landowner gives loan to tied labour on the condition that the latter will supply labour service at a fixed wage for a specified time period.

During the peak season, the wage rate goes up due to high demand for labour. But due to inter-market contractual relations (in this case between the credit market and labour market) the landowner can get labour services from, the tied labourers at lower wage rates. In this way, the wage cost of the landowner becomes much less than it would be in the absence of interrelation between these two markets.

Borrowers also enjoy economies. For example, when a tenant owner borrows money from commercial banks or co-operative societies he has to incur some cost. He has to complete some rigid formalities and, in the process, spend time and money in order to get the loan. But if he borrows from the landowner he is not required to spend anything. Such cost saving is possible through such, interlocking.

3. Money-Substitute:

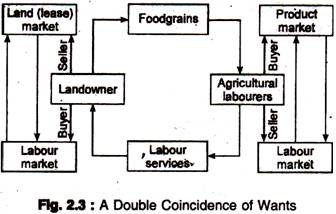

Finally, interlocking of different markets acts as a money-substitute. In most parts of rural India, the barter system still exists. Commodities are directly exchanged for commodities and money is not widely used as a medium of exchange. But the success of the barter system requires double coincidence of wants which is created through the interlocking of different markets in agriculture (Double coincidence of wants necessitates that the set of goods or commodities each individual is willing to exchange must be exactly what is required by the other party.).

ADVERTISEMENTS:

An example will make the concept clear. Let us suppose, the landlord engages agricultural workers and agrees, as per contract, to pay them wages in terms of crop. In this case, the landowner needs labour services which can be supplied by the labourer. On the other hand, the labourers require food-grains for consumption which can be supplied by the landowner. Fig. 2.3 illustrates a barter transaction between two individuals due to double coincidence of wants which again is due to the interlocking of the labour market and the product market. In this way, the interlocking system is used to facilitate barter (i.e., non-money using) transactions in a subsistence economy.

Effects of Market Interlocking:

(a) Distress Sale and Purchase:

Due to such interlocking farmers have to make distress sale of their crops immediately after harvest at low price to be able to pay kind rent. Again, they may require to take loan from the moneylenders in cash to be able to buy food from the market at a higher price in the lean season to be able to keep body and soul together.

(b) Involuntary Exchange:

Because of such interlocking, exchange is not always voluntary. When the tenant borrows for consumption from the landowners—either in cash or in kind—he is required to pay interest in kind. For that he may be forced to sell his output to the landowner at less than the market price (because the landowner may also be trader in commodities) or to agricultural supply, his labour power in the peak season at less than the market wage. In most cases, the exchange relations are not voluntary. Due to loan contract, the tenant or sharecropper can neither sell his portion of output (left after rent payment), at the market price, nor sell his labour in the peak season at the market wage.

(c) Monopolistic Control:

ADVERTISEMENTS:

Thirdly, as a result of interlocking, the control of the agricultural sectors gets into the hands of a few individuals who control all the markets. No such thing as free competition or voluntary exchange is found in any of the markets. Through the exercise of monopolistic control of all the four markets, it is possible to extract more surplus which is, ultimately, converted into property income.

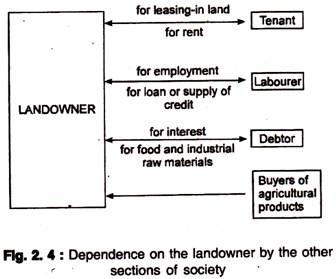

(d) Greater Dependence on a Few Individuals:

Due to such interlocking the majority of people in rural areas have to depend for more and more on few such powerful and influential individuals.

For example, the tenants will have to depend on the landowner for leasing in land. The labourers will have to depend on the landowner for employment and wages, the debtors will have to depend on the landowners for the supply of credit. Similarly, the buyers of agricultural products will have to depend on the landowner for food and industrial raw materials. For these reasons, the landowner becomes a strong force in the rural areas.

The landowner, in his turn, gets rent, labour service, interest and profit (from sales of marketed surplus).

(e) Greater Surplus Extraction:

Fifthly, as a result of such interlocking the landowner, who is usually most powerful in the rural sector, extracts surplus from different markets. If the same person extracts surplus from all the four markets, the amount of surplus extracted becomes very large. If, for example, the tenant refuses to pay higher rents (as demanded by the landowners), the landowner will refuse to lend him money in times of necessity.

At the same time, the tenant may be asked to pay higher interests. If he refuses to pay it, he may be given the threat of eviction. These examples are just enough to prove that interlocking of product and factor market in agriculture leads to greater surplus extraction.

(f) Obstacle to Technological Progress:

Some economists like Prof. Amit Bhaduri have opined that interlocking of different markets in agriculture acts as an obstacle to technological progress. If the landowner gives loans to the tenants at high rates of interest and if the former can make profits by selling agricultural products or if he can raise the level of rent, then he does not have any desire or inclination to apply modern (sophisticated) techniques in agriculture. He may live a quiet life without being bothered about the increase in land productivity.

The landowner gives only consumption loans to the tenants. So production loan is not given because it is feared that the tenant can use the loan to adopt modern technology and produce more output with the same amount of inputs. If output increases, he may not be required to borrow from the landowners for consumption purposes only.

ADVERTISEMENTS:

Thus, the landowner can prevent the adoption of modern techniques. This is how the interlocking of different markets in agriculture—in this case land (lease) market and credit market—stands in the way of productivity- raising improvements (such as use of modern techniques).

However, in reality, we often find that landlords not only provide production loans to cultivators, but encourage them to adopt improved technique as well. Moreover, after the initial success of new agricultural strategy (which brought about the green revolution) new technique has become less costly and more attractive than before.

As things stand today, the landowner will induce the tenant to adopt new technique so that output of agricultural products and, consequently, his income, increases. Thus, the view that interlocking of different markets in agriculture is a major obstacle to technological progress does not stand to reason.

Conclusion:

Various studies and surveys have found interlocking among various markets in agriculture. However, much like the law of diminishing returns, interlocking is not something peculiar to-agriculture. Instead, interlocking is observable in the industrial sector as well. In case of the corporate form of business (or joint stock companies, as they are called) the same individual is found to be on the Board of Directors of several unrelated companies.

ADVERTISEMENTS:

This is known as the interlink directorate—a situation in which one or more person(s) sit on the board of two or more companies, where these firms have similar products, such as oil and electricity or gas. Such conditions can lead to collusion or formation of cartels. Again, the director of an industrial company may be on the board of a financial organisation such as the Industrial Development Bank of India. This is how industrial and financial sectors of the economy get interlocked.

In the final analysis, it appears that the most notable and common feature of interlocking is that the same two persons confront each other in different (product and factor) markets. Such interlocking initially develops due to formal relations. But, over time, these formal relations gradually become social relations which get reflected in different markets (which are essentially social institutions).

Such interlocking existed in pre-market economies and continues to exist in today’s market-based economies. So the truth is that interlocking of different markets in agriculture is not anything new or unique to agriculture. It is universal in its application. Such interlocking relation was and is found in almost all sectors of the economy.