It is almost a settled fact that there is no exact equivalence between import tariffs and import quotas in the real life situation involving some monopoly element. But it cannot be denied that there are certain similarities between the two.

Firstly, both tariffs and quotas have the same objectives such as reduction in the volume of imports, protection of home industries, expansion of employment and economic activities and correction of balance of payments deficit.

Secondly, a certain rate of tariff causes reduction in the quantity by a specified extent and, therefore, it has a quota equivalent. The import quota, on the other hand, while restricting the quantity, causes a rise in import price. It has, therefore, an import tariff equivalent. Thirdly, tariff and quota both have similar price, protection, consumption, redistribution, welfare, balance of payments and income effects.

There is controversy concerning the import tariff and import quotas among the economists and policy-framers. On theoretical and practical grounds, tariffs seem to have an edge over the import quotas.

ADVERTISEMENTS:

In this connection, the following main arguments are advanced:

(i) Flexibility:

If the import quota is fixed, there is little possibility of an increase in imports even when the import capacity of the country has increased or the foreign product has become cheaper. In contrast, there can be larger inflow of imports under tariff in such conditions, provided the import duties prescribed by the government are paid.

(ii) Non-Discriminatory:

ADVERTISEMENTS:

The quota system tends to favour the established importers even when they are inefficient, lethargic and less innovative than the new and prospective importers. In the case of tariff system, the imports of raw materials, machinery and other categories of products can be made by every importer, provided he is willing to pay the prescribed rates of tariff.

(iii) No Interference with the Market Mechanism:

When the government prescribes the import quota, it amounts to a direct interference with the free working of the market system. On the contrary, when tariffs are relied upon, the domestic price of the commodity may go up and adjustments between demand and supply may still be brought through price system. In fact, the quota system tends to replace the price mechanism.

(iv) No Possibility of Growth of Monopolies:

ADVERTISEMENTS:

The imposition of import quotas leads to the emergence of monopolies not only in the importing countries but also in the exporting countries. These monopolies exploit the consumers in the exporting country. The import tariffs, on the other hand, don’t prohibit the imports and the competition continues to exist. The importers do not have any sound justification in changing prices higher than the price inclusive of import tariff.

(v) Easier Balance of Payments Adjustment:

If a country having a balance of payments surplus, fixes the import quota, it will become impossible for the deficit country to make the balance of payments adjustments. However, the earlier balance of payments adjustments can be possible in the absence of import quotas. Even if the surplus country imposes tariff, still the deficit country can have access to the market of that country. It may enlarge its exports through absorbing the tariff imposed by the surplus country.

(vi) Inflationary Effect:

If the government resorts to tariff, there will be some possibility of increase in the price of the given commodity. But there is possibility that the increase in price may be partly or wholly absorbed by the importers or exporters or the government of the importing country. In any way, the price of the tariff-ridden commodity may increase to a very limited extent.

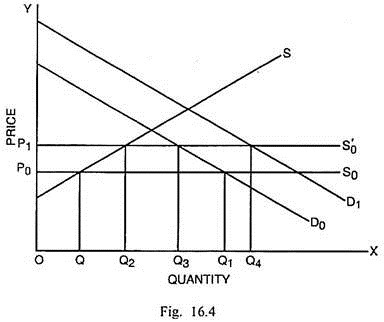

If there is an increase in demand, at a higher tariff- ridden price, the adjustment between demand and supply can be possible partly through increased domestic production and partly through increased imports at the higher (tariff-inclusive) price. However, if import quota is prescribed, the excess demand will continue to exist despite the increase in price and a rise in domestic production. As a result, the import quotas are likely to have greater inflationary potential than tariffs. It may be illustrated through Fig. 16.4.

In Fig. 16.4, Do is the original demand curve. So is the foreign supply curve and S is the domestic supply curve. At the free trade price P0, the gap between quantity demanded OQ1 and quantity supplied OQ is filled up by imports. If tariff is imposed, the price rises to OP1. The gap between domestic demand and supply is reduced only to Q2Q3.

It is met through additional imports. Alternatively, if the government enforces the import quota Q2Q3, the price still rises to P1 due to scarcity of product in the home country. If demand increases and the demand curve shifts to D1, the excess demand gap is Q2Q4. It is bridged up, in the event of tariff policy, by an additional import of Q3Q4.

ADVERTISEMENTS:

The inflow of more import will bring about adjustment between demand and supply without causing further inflationary push. On the opposite, if the government has relied upon the prescription of import quota which is determined at Q2Q3, the shift in demand curve signifies an excess demand of the magnitude of Q2Q4.

Out of this, imports to the extent of Q2Q3 are permitted. It means Q3Q4 excess demand gap is still present. It will tend to push up the prices. Therefore, import quota may have greater inflationary implications than the tariffs.

(vii) Revenue Effect:

Tariffs are better from the point of view of the state as they yield some revenues to the government. On the opposite, import quotas do not yield revenues to the state. Only situation in which revenue receipts can accrue is when the import licenses are auctioned. However, the practice is presently not followed in any country.

ADVERTISEMENTS:

(viii) Effect on Terms of Trade:

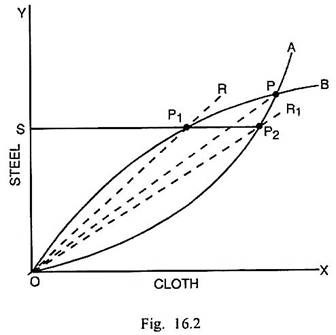

If a country resorts to the imposition of tariff, there is generally some improvement in the terms of trade. On the opposite, if import quota is prescribed, the effect on terms of trade may be uncertain and indeterminate. The terms of trade may or may not improve for the home country (Refer to Fig. 16.2).

(ix) Problem of Distribution of Licenses:

ADVERTISEMENTS:

When the import quota policy is followed, the government must decide the basis for distributing licences among the potential importers. The judgement is often made by the government officials on arbitrary and political grounds. Such judgements are influenced by lobbying from the pressure groups and even bribing of the officials. There are frequent charges of favouritism and nepotism. Thus the system of import licences is clearly wasteful and defective. In contrast, tariffs are more efficient and economical.

(x) Provocation to Retaliate:

It is, of course, true that both tariff and quota restrict exports of the foreign country and both are likely to provoke retaliation. But the effect of tariff is less restrictive. Despite high rates of tariff, the foreign countries can make some exports. Their exports may even remain unaffected, if they are prepared to absorb the incidence of tariff by reducing the export prices.

In contrast, the import quota can have more concentrated and restrictive effect upon the exports of particular countries. Therefore, the possibility of restriction is greater in case of quotas than tariffs.

To sum up, it must be pointed out that tariffs and quotas are both anti-trade as they reduce allocative efficiency and welfare and both are likely to provoke retaliation by the foreign countries. However, import quotas are considered more prohibitive, more obnoxious and more wasteful than tariffs. Therefore, it follows that tariffs are superior to quotas.