In this article we will discuss about the concept of consumer’s sovereignty. Also learn about its drawbacks and limitations.

One of the important characteristics of capitalism is the existence of economic freedom, which implies not only freedom of enterprise but also consumer sovereignty. After World War II, incomes rose and people began to enjoy more goods and services. Instead of eating three square meals a day at home, families began to go to restaurants once in a while.

In the 1980s consumers wanted more and more restaurants and fast-food outlets flourished. In the 1980s, people chose to be spend more time at home with their families; the demand for restaurants decreased and was replaced by a demand for food delivered to the home.

By emphasising delivery various fast-food outlets, like Stopover Pizza Hut, Big Boy, White Castle, Berger King Hot Breads and above all McDonall’s, become very successful. However the star of this story is not a particular shop or outlet but the consumer. In a market system, if consumers are willing and able to pay for more restaurant meals, more restaurants appear. If consumers are willing and able to pay for food delivered to their homes, food is delivered to their homes.

ADVERTISEMENTS:

Why does the consumer wield such power? The word of the game for business is profit, and the only way business can make a profit is by satisfying consumer wants. The consumer, not that business firm or the government or its planning apparatus, ultimately determines what is to be produced.

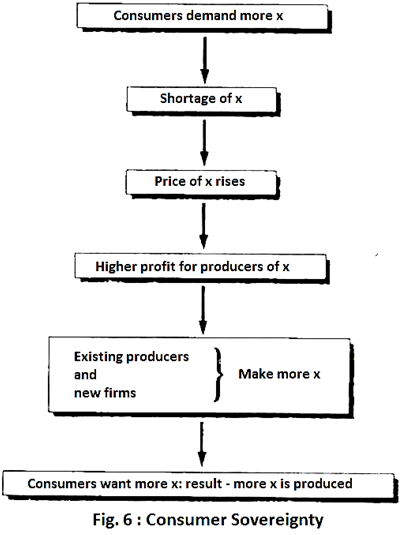

A firm that produces something that no consumers want will not remain in business very long. Consumer sovereignty refers to the authority of consumers to determine what is produced through their purchases of goods and services. It dictates what goods and services will be produced. See Fig. 6.

In a free market, or private enterprise economy, all the factors of production are owned by private individuals and the decisions of what, how and for whom are made unconsciously by the interaction of the market forces. Here we assume that consumers are rational and always attempt to maximise the utility they receive from their incomes, and that entrepreneurs are also rational and always attempt to maximise their profits.

ADVERTISEMENTS:

Given these assumptions, consumers are free to purchase whatever they wish in the market place. This is sometimes expressed as ‘consumer votes’ in the sense that they will spend more of their incomes (votes) on goods they prefer (favour).

As the demand for these goods increases their prices will rise, making them more profitable and entrepreneurs seeking greater profit will respond by entering into production of these goods thereby increasing their supply.

Hence, more of these goods for which consumers have expressed a preference are produced Production is, therefore, said to respond to the ‘price signals’ which indicates those goods which should be produced, and consumer sovereignty is said to prevail over the market.

ADVERTISEMENTS:

However the concept of consumer votes should not be equated with any concept of ‘fairness’ in the accepted sense; in a market economy some people have more ‘votes’ than others, and if this is seen as a problem then it is one of income distribution not the price mechanism in itself.

In short, the term ‘consumer sovereignty’ refers to the power of consumers to determine what is produced, since they are the ultimate purchasers of goods and services. In general terms, if consumers demand more of a good then more of it will be supplied.

This implies that producers are ‘passive agents’ in the price system, simply responding to what consumers want However, in certain kinds of market (notably, monopoly and oligopoly) producers are so powerful vis-a-vis consumers that it is they who effectively determine the range of choice open to the consumer.

1. Revised sequence:

In a modern economy the traditionally held view of firms responding to a unidirectional flow of instruction from consumers in the market place (i.e. consumer sovereignty) may be inappropriate due to the existence of large firms. And J.K. Galbraith suggests that in a market economy large corporations may have the means and ability to influence consumers’ market behaviour just as much as consumers affect corporate market behaviour. In perfectly competitive markets the traditional theory (the ‘accepted sequence’) may still be valid, but in an oligopoly or monopoly it is no longer valid.

2. Advertising:

In fact, the concept of consumer sovereignty in the modern economy has been challenged by several writers, in particular by Galbraith. Galbraith argues that consumer sovereignty is a myth and that the large corporations are in fact sovereign as they are able to create wants and impose them upon consumers by the use of advertising (which is a technique of demand manipulation).

Even if this overstates the case it is at least probable that advertising distorts consumers’ preferences. Opponents of this viewpoint show examples where consumers have resisted the attempts of large corporations to manipulate their preferences, in particular the failure of the Ford Motor Company to make the Edsel model in the 1950s or of India’s Standard Motor Co. to launch the car model Standard 2000 in a big way. Rather the model is a big failure.

3. Merit goods:

ADVERTISEMENTS:

Merit goods are an important category of allocation in which the government is involved. Merit goods are those goods of which consumers will not purchase enough unless forced by the government to do so. Safety features in cars and scooters (such as helmets, or seat belts) national health care and education are examples.

Most governments not only offer free public education, but in some countries governments require that people between certain ages attend schools. This is a very normative idea. Everyone has his own ideas about what other people ought to consume.

4. Income redistribution:

A modern economy does not rely exclusively on the market mechanism to settle the ‘for whom’ question. The government redistributes market incomes by taxing the rich and giving income transfers to the poor. Those income transfers include not only cash benefits (e.g., unemployment compensation or old-age pension,) but also in-kind benefits like food, public housing and free education. As a result of this government- directed redistribution, the poor end up with a larger share of output than the market alone would provide.