In this article we will discuss about:- 1. Option Pricing 2. Trading in Options 3. Risks of Buying and Selling 4. Transactions.

Option Pricing:

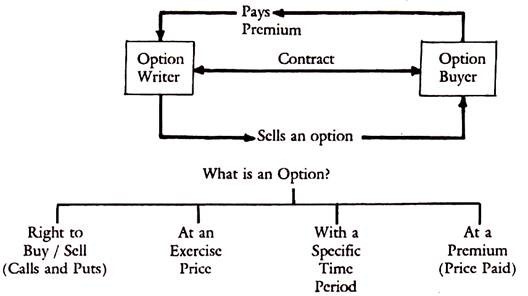

The option price is in the form of premium paid on a contract. The rupee amount of the premium is the price paid (debit) for an option when purchased or received (credit) for the option when sold. The actual amount paid for a contract is quoted price times the number of underlying shares, normally 100 shares, for each contract. The premium is determined by buying and selling pressures in the auction type of market. The exercise or striking price is the price to be paid or received for the underlying shares, when option is exercised.

Suppose, the exercise price of ACC is Rs. 250 for a call option and the actual market price is Rs. 240, then the call is said to be out-of-the money. If on the other hand, the market price of ACC is Rs. 260, which is above the exercise price (Rs. 250) then the option will have an intrinsic value or real worth and the call is said to be in the money. The reverse is true in the case of put options.

The premium for an option is almost always greater than the intrinsic value. This excess value, namely, premium minus intrinsic value is called the time value which is the speculative value of the premium paid on the option contract. This is what the buyer is willing to pay above the real worth for the expectation of future profits based on the underlying share. It is this time value which reflects the speculative element in option trading.

ADVERTISEMENTS:

Factors explaining the premium of an option are as follows:

(a) Movements in exercise price relative to market price.

(b) Time remaining for expiration.

(c) Volatility of the underlying security.

ADVERTISEMENTS:

(d) Market’s expectations for the underlying security.

(e) Quality and yield of the underlying security.

(f) Interest rates in general.

(g) Supply and demand position for the option.

ADVERTISEMENTS:

The intrinsic value depends on the share price of the underlying security and the exercise price of the option. This intrinsic value = actual share price — exercise price (call option).

The excess of the option premium over the intrinsic value is called the time value of option. The time value depends on length of the time to maturity or expiration date and optimistic expectations of a rise in price of the intrinsic security.

The time value of option thus depends on the speculative element and expectations of future. The more risky the underlying share like Reliance, the more attractive is the option on it. Such options will have a larger time value and the option price will rise with the risk on it, and the volatility of the price of underlying security.

Among the other factors, influencing the option premium are the risk free rate of return, the money market rate at which the investor can borrow and the general market risk and the risk of the underlying security.

Take for example, TISCO, March 2000, 200 put @ Rs. 10. The expiration price is 200 and the premium is Rs. 10 per contract of 100 shares. If the actual price is Rs. 210 the contract is out of the money and if the price is Rs. 190, it is in the money. The premium of Rs. 10 will vary depending upon the price of the underlying security and a host of other factors. If the actual price is above say Rs. 180 then the option contract will have intrinsic worth and the buyer may exercise his option to sell at Rs. 200 and after deduction of the premium paid Rs. 10 the buyer of the option gains Rs. 10 (200-190). If the market price of the underlying security is the same as the exercise price, it is said to be trading At-the-Money.

Take the example of put option. TISCO 180 put @ Rs. 5 March 2000. The expiration price is Rs. 180 and premium paid is Rs. 5/-, multiplied by 100 shares per contract, namely, Rs. 500.

If the actual price fell to less than Rs. 170 before the expiration, the buyer of the option may exercise the right to sell as he will gain by selling at Rs. 180 instead of at say Rs. 170. Depending upon whether the option is a call or put the premium will vary with the price. Take the example of TISCO, namely, TISCO 200, and March 2000 is sold as call option at a price of @ Rs. 10 for 100 shares. If you buy a contract, the minimum shares to be purchased are 100 and to purchase a contract, one has to pay Rs. 10 ×100 = 1,000.

But the actual cash price of underlying securities if purchased will be Rs. 185 × 100 = 18,500 that time. If the investor is bullish and expects the rise in price much more than Rs. 10, he will purchase the call option at Rs. 1,000. If the price of TISCO does rise at all, he will lose only Rs. 1,000 but if it rises beyond Rs. 210, he will gain and the gain will depend on the extent of the rise in TISCO price beyond Rs. 210, it’s the exercise price Rs. 200 plus premium paid Rs. 10.

The terms used in options markets are as follows:

ADVERTISEMENTS:

Writer of Options:

The uncovered options are called naked options. To cover calls pay the underlying security or go long in a put of equal or higher premium maturity. To cover puts, go short in the underlying security or go long in a put.

Normally option contracts are settled on the next day. If you exercise an option, settlement takes place in T + 5 days. The OCC makes arrangements for the settlement of these contracts in the U.S.A. The collection of margins and regulation of writing of contracts in options and in their trading and related matters, including settlement and clearance are the responsibility of the regulatory authority, namely, the Options Clearing Corporation, in the U.S.A.

Trading in Options:

ADVERTISEMENTS:

The options market is an example of the derivative market. It is a hedge and leveraged instrument. It provides needed diversification and duration adjustment in portfolio management. The advantages of the market are many. It caters to the instinct of pure speculation. It provides a hedge to the risk of the cash market. It lowers transactions costs and enhances price discover)’ process.

It leads to increased liquidity, greater volumes and turnover and sophistication of the markets. Arbitrage and hedge go together in the market, which leads to greater stability and competition in the markets. Arbitrage is to buy in one market and sell on another market, there by equalising the prices and returns. Hedging is covering up operations to reduce or eliminate risk.

These derivative markets complement the cash markets and promotes sophistication of the market structure and integration of the markets leading to the globalisation trend to move faster. This market helps higher yields and efficient asset allocation.

These markets are all complementary and arbitrage brings about uniformity in pricing and interest rates in each of sub-segments and segments.

ADVERTISEMENTS:

There are three major categories of players other than investors, namely, write who write or make the options as approved by the Exchange authorities, dealers who are wholesalers and trade for themselves and traders who are retail agents of the customers.

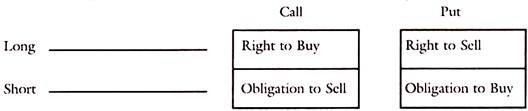

The options have two varieties of trades, namely, calls and puts.

A call is a right to buy without any objection.

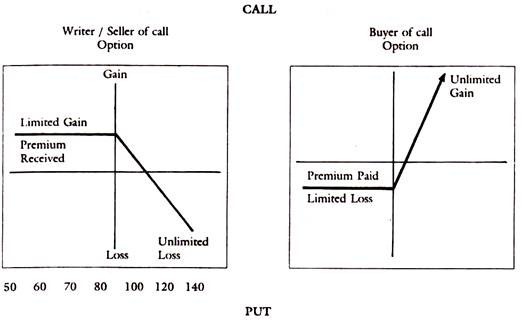

The following charts will explain the call options:

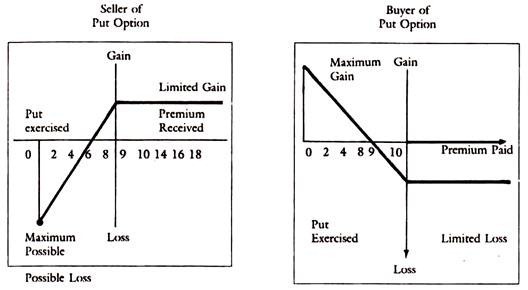

A right to sell is the put options.

ADVERTISEMENTS:

An option contract can be represented diagrammatically as follows:

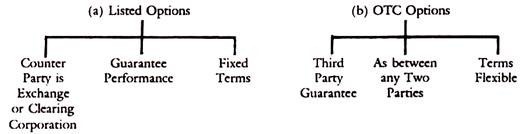

Types of options are two as shown below:

Pricing of options depends on the supply and demand as in any auction market. But basically it depends on the intrinsic value of the underlying security or stock.

ADVERTISEMENTS:

But in addition, there is also time value in many cases which depends on the following factors:

(i) Stock Price

(ii) Time to Expiry of the Contract

(iii) Interest Rates Prevailing

(iv) Volatility of the Underlying Security

(v) Dividends Paid

ADVERTISEMENTS:

(vi) Type of Option — say European or American Types of Option.

Price Changes:

The price of an option is the premium paid per 100 shares of the underlying security. The purchase of an option involves the payment of the price per contract, of 100 shares, multiplied by the number of such contracts purchased. In the event the price of the underlying security goes against the option price, fixed at the time of writing the option, the loss to the buyer is only the premium paid by the contracts purchased. The gain will be in the rise in option price, depending on the price movements of the underlying security.

Thus, each contract of 100 shares will have a price, which varies with the price of the underlying security and the unexpired time to maturity. The maturity of the option contract is generally a 3 or 4 months and as the time goes on the price varies from day-to-day and even minute to minute during trading time depending upon the demand and supply pressures.

The value of option has two components:

(a) Intrinsic value, based on the underlying security.

ADVERTISEMENTS:

(b) Time value based on the time available before expiry.

Risks of Buying and Selling Options:

Depending on how options are used, investors can be subject to substantial risks or reduced risks. Losing the entire amount spent to purchase a call option or a put option is not an unusual event. Investors who write options are subject to the possibility of losing substantially more than the premium received.

Option prices are volatile to the point that their relative values change by a multiple of the change in the underlying stock. Thus, anything that can bring about a change in the price of the underlying stock in a short period of time has the potential for producing great losses (or profits) for the owner of a stock option.

If an option position is established in combination with another investment that is purchased or is already owned, the result may be that an investor’s risk is reduced. For example, an owner of 500 shares of TISCO may purchase five puts on this stock and guarantee a selling price in the event that the market price of the stock declines.

Thus, the puts act as price insurance on the investment position. So is the case of call options. Likewise, investors will frequently write calls on stocks that they own to generate additional income. Because the stock is already owned by the writer, the required shares can be delivered in case the option buyer exercises the call.

While options can be used in conjunction with other securities to reduce the overall risk of an investment position, it is unlikely that this is the use to which most individual investors put options. The speculative investor satisfying his urge may however prefer this derivative market, which does not involve delivery.

Brokers and investment advisors frequently make the case that options expose investors to less risk than an investment in the underlying common stock, because the potential losses are smaller. This is true only for the rupee amount of the loss.

An investor stands to lose less on options only because less money is initially invested. From this standpoint, the investor also generally stands to make less than would be the case if the underlying stock was purchased. An investment in options is substantially riskier than an investment in the underlying stock, unless this is combined with other investment or option combinations.

The bottom line for investors is that stock options should be avoided by anyone who doesn’t have a thorough understanding of the fundamentals and potential risks of these volatile investments. The short-term nature of options frequently results in heavy trading and high commissions and only intelligent traders should get into this trade.

Transactions in Options:

The index options are traded during the permitted time period on auction principles. Only regular authorised members can trade in these options on their own account or on account of their clients. There can be jobbers or specialists who deal with the authorised members as market makers. In most developed markets as in Tokyo or New York, trading in options is routed through the computer assisted order Routing and Execution System (CORES-O).

Contract Unit:

The contract multiplier can be fixed at 100, 1,000 or 10,000. In Tokyo the contract multiplier is 10,000. If the contract is a three month call option priced at 30 and the underlying index is 2,480 and the exercise price 2,500. The actual price paid by the call buyer is 30 × 10,000 = 30,000 Yen.

The Exchange can set an upper or lower limit for the price fluctuation at say 60 to 120 points depending upon the closing price of the previous day. The expiration cycle is 3 or 4 months in Tokyo. The expiration dates are second Friday, which is the day prior to the second Friday of the expiration month.

In Tokyo, there are five exercise prices for both call and put options. First a central exercise price is set by rounding the current value of the index to the nearest 50 or 100. Then two upper and lower exercise prices are set at 50 point intervals to bracket the central exercise price. The Exchange may when necessary change the number of exercise prices and their intervals.

Terms of Contracts:

(a) Underlying Security can be any index or marketable security.

(b) Term to expiration is one day to 9 months in the U.S. There are standard expiration dates such as second Friday of every month.

(c) Exercise price is the current market price — normally standardised by OCC.

(d) Premium is negotiable.

The Options clearing corporation of the U.S. (OCC) has standardised the following items in respect of Options:

(a) Exercise prices, based on the prices of underlying Securities.

(b) Expiration cycles and expiration dates of the options contracts.

(c) Trading pattern and trading times.

(d) There are both an initial or maintenance margin calculation and a minimum margin calculation, standardised by the OCC.

Exercise Dates:

Exercise is the act of converting a call option into a purchase and a put option into a sale of the underlying security. The holder has a right of such conversion but no obligation. Normally options are not exercised but brought and sold through the auction system. The premium is the price paid for the option. If the option is held upto the last day of trading, and as the expiration date is the next day to the last day of trading it becomes worthless on the day following the third Friday of the expiration month.

Regulation of options rests with the OCC. In U.S.A. the issuer or writer of options should be a member of the OCC which provides the service of guarantor and middleman between the issuer and the trader. In return the issuer has to keep margins in the form of underlying securities with the OCC.