In this article we will discuss about the examples of derivative markets.

Example # 1. Currency Futures and Options:

The best examples of derivative markets are currency futures and options U.S. and other developed countries. Futures contracts in currencies are contracts trade- able and contracts for specific quantities of given currencies, the exchange rate being fixed at the time that contract is entered into and delivery dates set by the controlling authority. The International Money Market Division of Chicago Mercantile Exchange (IMM) sets the terms of the contracts and contract specifications. The currencies in which they are available relate to most convertible currencies.

Although the volume of futures market is still smaller than the forward market but is growing at a rapid pace. Inter-bank call market and International Money market are all parts of the foreign Exchange Market. Here the traders charge commission which may work out to 0.05% of the value of the contract. There will not be bid- ask spreads as in the Euro-currency markets. Deals are struck by brokers on the trading floor and trading on Telephone and Telex is much less.

Example # 2. Futures and Forwards:

The futures have standardised specifications and trading takes place in an organised market. As contract sizes and maturities are standardised, all participants in the market are familiar with them and trading is well organised. The smaller size of a futures contract and freedom to liquidate the contract at any time before its maturity will differentiate them from the forward contracts.

ADVERTISEMENTS:

Forward contracts are private deals, mostly confined to between any two parties who can sign a type of contract they agree on. The amounts involved and maturities and other terms are specific to the individuals/parties concerned. They are not standardised as in the futures contracts.

In IMM, contract lots are all fixed and terms standardised. The trading volumes are large as default risk is eliminated. In contrast, private deals are forward contracts as between two specific parties and run the risk of default. As it is a contract, the law of contract will apply for any defaults or violation of the terms of the contract.

Futures trading is organised on a regular basis with a clearing House and default risks are reduced. Profits and losses of futures contracts are settled at the end of each day on a daily settlement basis with a practice called marking to the market.

Every day, futures investors must pay for any losses and receive any gains from the day’s price movements. This process of marking to the market on a daily basis goes on until the maturity date. A forward contract is not settled on a daily basis but at the time of maturity. Futures contracts are closed by taking delivery or with an offsetting trade. A long position in D.M., can be offset by a sale of a futures contracts of a like amount.

ADVERTISEMENTS:

The distinction between forward and futures contracts can be seen below:

Forward Contracts:

1. Traded on phone or Telex.

2. Self-Regulating.

ADVERTISEMENTS:

3. Tailor made sizes.

4. Delivery on any date and as per the requirements of the party.

5. Settlements on the due date.

6. Margins are not required.

7. Credit risk is borne by each party to the contract.

Future Contracts:

1. Traded in a competitive arena.

2. Regulated by an authority like IMM.

3. Standardised sizes.

ADVERTISEMENTS:

4. Delivery on specific dates fixed beforehand.

5. Settlement on a daily basis

6. Margins are required.

7. The clearing house is the counter party which reduces risk.

ADVERTISEMENTS:

In forward contracts, more than 90% of all contracts are settled by delivery. On the other hand less than 1% of all futures are settled by delivery. The quotes are in European style in forward contracts (local currency units per U.S. dollar). Futures contracts are quoted in American style (dollars per foreign currency unit). The transaction costs are based on bid-and ask spread in forward contracts; the same are based on brokerage fees for buy and sell orders for futures contracts.

Both Forward contracts and futures contracts, have their own advantages and disadvantages. Futures do not offer any sizes and any currency that we desire to have. They offer a well organised mechanism for speculation and hedge in Currencies. It offers a risk free contract, with freedom to liquidate the contract at any time before the maturity.

It is only by chance that corporate clients will get future contracts to their exact requirements. If forward contracts are entered into they can have size maturity and other specifications to their requirements. But these contracts carry a great risk which has to be covered again in futures market.

There is a regular arbitrage between the forwards offered by banks and IMM contracts offered by Chicago Mercantile Exchange. In practice the arbitrage operations bring about parity in terms offered or price of these contracts in forwards and futures.

ADVERTISEMENTS:

They will bid up futures price and bid down the forward price and approximate equality is brought about. Because of these arbitrage operations on a daily bases regularly, the futures and forwards prices do not differ significantly.

Example # 3. Currency Options:

Currency futures and forwards protect the holder against the risk of adverse exchange rate changes, but they also deny him the possibility of windfall gains. One can hedge against the risk of a possible loss, but the risk taking itself might reward the risk taker. An option would be profitable to exercise in certain situations when the option is in the money at the current exchange rate.

As applied to currencies, call options give a right but no obligation to buy while put options give a right but no obligation to sell, the contracted currencies at the exercise price. The option can be exercised at any time upto the expiration date under the American type of option, while the same can be exercised at the expiration date only under the European type of option.

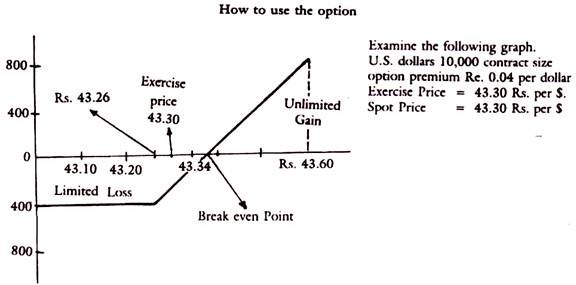

If an Indian importer has to pay three months hence $ 10,000 to U.S. exporter, he has purchased an option at a price (Premium) of dollars 0.04 per dollar or $ 400 for $ 10,000, contracted for. In this case he has hedged his currency risk for his payment due in U.S. $. If by chance the spot price of the time of his payment is Rs. 43.60 per $ he is in the money.

He would exercise this option and buy $ 10,000 at the option Exercise price of Rs. 43.30, when the spot price is 43.60 a gain of $ 3000, which more than offsets the premium of $ 400 that he paid. If at the time of payment, the spot price is less than Rs. 43.30 the option is out of money and he will not exercise the option; he will buy the required dollars from the spot market and his loss on the contract is $ 400 only. The importer will exercise the option only when the spot price is more than Rs. 43.34 per dollar inclusive of the premium paid for option ($ 0.04) (spot 43.30 + 0.04 = 43.34).

ADVERTISEMENTS:

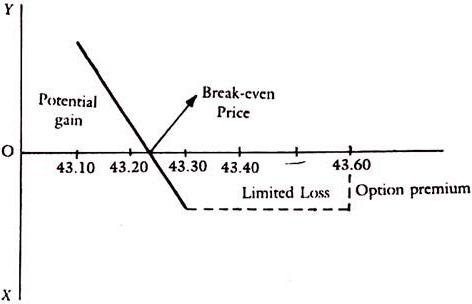

The reverse is the case of put option. The exercise price and premium paid may remain the same. Here the exporter wants to sell his $ 10,000 due to be received at the end of 3 months. The put option would be “in-the-money” at any price of Rs. 43.26 or less. Break-even point is Rs. 43.26.

At any price of Rs. 43.34 and above, the option would be out-of-money. If the spot price at the time of expiration date and the date of receipt of dollars, is Rs. 43.10, he will exercise the option and sell $ 10,000 to writer of the option at Rs. 43.30. That means that he will receive Rs. 4,33,000, but if he has sold in the spot market at that time, he would have received only Rs. 4,31,000.

His notional gain is the difference between the above two figures, adjusted for the premium price paid for the put option. This means that he would have gained Rs. 2,000 minus Rs. 400, viz., Rs. 1,600 in the options contract. If on the other hand, the spot price has gone up to Rs. 43.60 he would not exercise his option but sell in the market and get Rs. 4,36,000 instead of Rs. 4,33,000, which he would have got under the option, from this gain, he would have to deduct the option premium paid for the contract, namely, Rs. 400/. Either way, he does not lose but may gain, if at all, the loss may be only the premium paid for the option.

Currency options serve two purposes. They provide a hedge against a possible adverse moment of exchange rates. Secondly, they can be used by pure speculators whose presence in the options market adds breadth and depth to those markets.

The chart below presents the operation of the put options in the currency market:

Contract size = $ 10,000

ADVERTISEMENTS:

Option premium = Re. 0.04 per dollar

Exercise price = Rs. 43.30 per dollar

Premium paid Rs. 400/ = for the contract

The option holder’s profit, net of the option premium paid is higher, the larger is the fall in the spot rate. If the spot rate rises above the Exercise price, the option becomes valueless as he would better sell in the spot market after that, where he would get a higher price than at the Exercise price.

The main users of currency options for genuine hedge are traders — exporters and importers. Many MNC affiliates buy these options if they want to be certain of how much to receive or pay in the future when the exchange rates may be uncertain. Investors or bidders for overseas firms or joint ventures or takeovers, whose requirement for funds, comes on the acceptance of bids, buy call and put options which are safer hedges than the futures and forwards. Many speculators find it better to operate in the options market where they can get better returns than in the futures and forwards.

ADVERTISEMENTS:

Differences between Futures and Options:

Futures hedge offers the closest offset to the loss due to the decline in Rupee value. With rapidly rising exchange rates, the company would benefit most from hedging with a long position in an option market as opposed to a futures contract. Conversely with rapidly falling exchange rates, the company would benefit most from hedging a futures contract.

Each of them, namely, futures and options have their advantages and disadvantages and each has a role in providing product differentiation in the financial markets. They deepen and widen the market and improve the liquidity and volumes in the market.

Market Structure of Derivative Markets:

Options are traded in an organized exchange or over the counter market. Exchange traded options are listed options which are standardised contracts with predetermined Exercise price, standard maturities — upto 12 months each maturing in every month in most convertible currencies, which are major trading currencies of the world. Traded options are available in major Exchanges like Amsterdam Chicago and Montreal since 1983. They have grown in volume year after year.

OTC options are contracts whose specification is generally negotiated as to amount, exercise price and rights and expiration. OTC currency options are traded by Commercial and Investment banks in many world financial centres. The branches of International Banks in major financial centres are willing to write these options against the currency of the home country as per the demand for them.

ADVERTISEMENTS:

The principles governing traded options are the same as those of OTC options. American types of options are widely used and options in major international Currencies are available for corporates from the multinational banks operating in Euro-markets and international Capital markets and having subsidiaries branches in many countries.

OTC options market has two segments, namely, wholesale segment for interbank deals and retail segment for non-bank customers. The interbank market in currency option is similar to the interbank market in short and forward exchange. Banks provide the needed currency options to customers in retail market and cover them up in the wholesale-interbank market. Many MNCs and affiliates turn to the banks for hedges through options in order to find precisely the terms that match their needs.

It is this retail market which is most useful to the multinational corporations. But the writers are also the multinational banks in respect of OTC options. Unlike in the spot and forward exchange, the options market exposes the writers to more risk and there is an asymmetry between the demand and supply in the option market.

Example # 4. Futures Options:

These are options written on futures contracts. Here the option gives the right to buy or sell the standard futures contracts, in a currency rather than the currency itself. When exercised, the holder receives a short or long position in a currency futures contract that expires one week after expiration of the option contract. The future contract is delivered exactly like the delivery of a currency, if the option is exercised. If it is not excised, trading is done on a daily basis and profit or loss is booked from time to time.

The introduction of the futures options has been hailed as an important landmark in the development of the financial markets and provides the traders, investors and speculators a wider variety of instruments to reduce the risks, or take risks for speculative instinct. This wide variety of instruments has improved the breadth and depth of the financial markets in the world over.