Whether it is a bond or debenture with an option of convertibility or compulsory conversion at the end of a period of time, the value of that bond or debenture is related firstly to the value of equity into which it can be converted and secondly to the value of residual non-convertible portion of the debenture instrument, which remains as debt instrument.

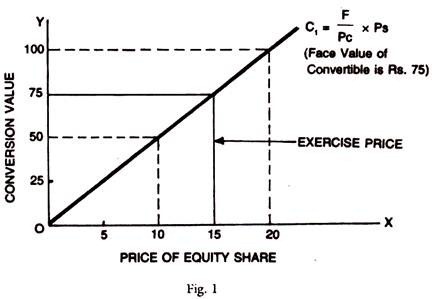

Both the above components vary with the market conditions, time to expiry of the bond, prevailing interest rates or yields, etc. Let us take the first component of convertible bond convertible into equity (say C1). This C1 depends on the number of equity shares into which that convertible portion can be converted. The face value of bond say Rs. 75, convertible into 5 equity shares at Rs. 15 each.

The bond face value is, normally Rs. 100 of which Rs. 75 is convertible at the end of three years into 5 equity shares at Rs. 15 per share the residual Rs. 25 will remain as bond and carry coupon rate of 12%, payable annually (here denoted as C2). Thus, Bond face value Rs. 100 consists of two components, namely, C1 + C2.

For the First Three Years Rs. 100, the face value of the Bond carries with it an interest return of 12% per bond. At the end of three years, Rs. 75 is converted into 5 equity shares. If the market price is Rs. 20 and exercise price for conversion is Rs. 15, then the convertible portion gains by Rs. 5 per share, say a total gain of 25 (5 × 5). Besides for the next two years, equity shares may show capital gains or losses plus dividends, if any declared for the rest of the period to maturity. The non- convertible portion of the Bond earns 12% per year, namely, Rs. 3 on Rs. 25 of the Bond of Rs.100.

ADVERTISEMENTS:

Graphical Presentation:

The price of the convertible bond and the conversion value of the bond are related by the equation C1 F/Pc × Ps, where, F is the principal value of the Convertible Bond Pc conversion price into equity. Ps Market price of equity.

Up to Rs. 15, the exercise price or the conversion price is the same as the market price. Thus, Pc = Ps; then C1= F, then the value convertible bond is the same as the market price.

If Ps is greater than Pc, that is, if market price is more than conversion price, than C1 is greater than F. If Pc > Ps, that is, if conversion price of 15 is more than the market price (say Rs. 10), then the C, < F.

ADVERTISEMENTS:

In the graph below, conversion value is shown on the Y-axis and price of equity share is represented on the X-axis:

If the price of equity in the market is Rs. 20, then the conversion value is Rs. 100 as against the face value of Rs. 75. During the first three years, when conversion has not become exercisable, it is as good as debt but the conversion value of the convertible bond will go up and down over the face value of Rs. 75 and after that, it depends on the market price of equity for 5 equity shares.

Suppose the conversion portion of the Bond is Rs. 75 and the non-conversable bond is Rs. 25; but it is possible that total bond value is Rs. 125, as against face value of bond of Rs. 100. The conversion value of convertible debenture sets the minimum market price of the convertible bond. If actual market price is higher, then arbitrageurs operate and buy equity shares and short sell the convertible bond. If the actual market price of the bond is less than its value as equity, the Arbitrageurs will purchase the bond and sell short the equity and the shares later purchased through the bond would cover the short sale of equity.

ADVERTISEMENTS:

To give an example, the convertible bond may be selling at Rs. 60, when the equity based price is Rs. 75 based on Rs. 15 as exercise price for 5 equity shares, then arbitrageurs will buy the convertible bond at Rs. 60 and exercise the option to get 5 equity shares at Rs. 15. The short position taken by the buyer will be covered by conversion option in which he makes a profit of Rs. 15.

The supply and demand factors operate to determine the price of the convertible bond, but is basically dependent on the conversion value of the convertible bond. Normally the convertible has also a debt component, namely, Rs. 25 and hence its actual price will be Rs. 60 + 25 = Rs. 85 and at the exercise price of Rs. 15, the bondholder gets Rs. 75 + 25 = 100. Then the conversion bond quotes at a premium over its face value, if the conversion value of the bond is less than the market price of corresponding equity shares.

Role of Interest Rate:

As regards the convertible bond, the coupon rate offered on it is generally lower than the market rate offered on non-convertible bonds of comparable maturity.

The reason is that such bonds are quoted at a premium due to the value added incentive following from the conversion facility. The value of bond as debt, is lower than that of the convertible bond which includes partly equity component and partly debt component. Since interest paid on convertible debenture is fixed, the value of this bond varies inversely with interest rate.

The higher is the interest rate, with coupon rate fixed at say 12 ½ %, the lower is the value of the convertible bond, for the same degree of risk and maturity. The market operators would buy convertible bond to attain the higher yield, if its price is lower than that floor. The operators cannot force down the price any more beyond the floor price of the non-convertible debt, even if the value of the equity into which the convertible portion is to be converted were to decline.

The reason is that at the floor point the whole Bond value is treated as equal to debt which sets the floor, but at the peak level, the limit is set by the market price of equity and conversion value of the convertible bond plus the face value of the non-convertible portion of the convertible bond. There is thus insurance at the floor level but with opportunity of gain the upper end of the bond price.

Graphical Depiction:

A warrant or convertible debenture or loyalty coupon which gives a right to a future equity is like non-voting share, if conversion is within 18 months in the case of convertible debentures and 3 years or less in the case warrants, loyalty coupons, etc., detachable or not.

ADVERTISEMENTS:

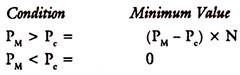

Prices of warrants are subject to the minimum and maximum limits.

PM = Current market price

Pc = Exercise price of warrant

ADVERTISEMENTS:

N = Number of common shares per warrant

Minimum value of warrant is zero, if market price is less than or equal to the exercise price. The maximum value is Pm x N. The discussion assumes that there is a market for the warrants and they are detachable. The minimum exercise price may be the book value or something based on intrinsic value of the share. The maximum price is the market price.

This is shown graphically below. The actual value lies along the dotted line in between the minimum and maximum values:

ADVERTISEMENTS:

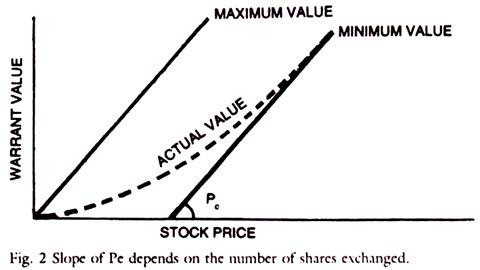

Convertible bond is assumed to be tradeable and has a market value. So is the case with convertible preference shares. It has both investment value and conversion value. Investment value (straight value) is based on the ytm in respect of a bond and dividend on preferred stock, in respect of Convertible Preference Share. Investment value is the face value for bonds; which is the minimum payable to bondholders.

The investment value of CPS is V = D/γ where D is dividend for preferred stock, and γ is the current yield or appropriate discount rate. For Bonds, we take ytm, instead of γ, for straight value. The conversion value will change with the market price. If the bond can be exchanged for 20 shares, and market price of each is 55, then the conversion value = 55 × 20 = Rs. 1,100.

Investment value = Rs. 1,000

Market Stock price = Rs. 55 and

Market Bond price Rs. 1,200.

Graphically, the values and market premium for a convertible bond are shown below:

ADVERTISEMENTS:

i. Premium over conversion value is = Bond Price – Conversion Value/ Conversion Value

ii. Premium over Investment value is = Bond Price – Investment Value / Bond Price

iii. Conversion parity price of stock = Bond Price/ No. of Shares on Conversion

Examples:

Premium over conversion value-

This suggests that the stock must rise by about 9.09% for the breakeven point to be reached.

If stock price is 55, then-

Rs. 55 + .0909 (55) = Rs. 60

Conversion parity of the stock is also the same, namely-

Premium over Investment value is calculated as-

This means that bond can fall in price by 16.67%, if the stock price fell and this provides floor price of bond. Suppose the stock price fell to Rs. 40. The conversion value is Rs. 40 × 20 = Rs. 800 but the bond floor price may remain at Rs. 1,000.

In the trading of convertibles, one has to look into the current yields on stock and bonds. Suppose the underlying stock is selling at Rs. 55 and annual dividend is Rs. 1.65, then-

Current yield on stock =1.65 × 100/55 = 3%. Interest on Bond is 6% and the current price of bond is Rs. 1,200.

Current yield on Bond = 60 × 100/1200 = 5%

If the current yield on bond is higher than on stock, why do people buy convertibles? The bond will fall to Rs. 1,000 only and not to Rs. 800 [as 40 x 20 is Rs. 800] even when the stock falls to Rs. 40. Which means there is a downward protection for bondholder in capital losses.

For the strategy of principal amount the bond is preferable; while the stock can fall to any extent, but not the bond. Besides, a convertible offers both the advantages of debt and ownership. However, if there is a capital appreciation the equity stock provides a better scope for appreciation than for bond.

ADVERTISEMENTS:

It will thus be seen that the investor preferences or the portfolio objectives are the guide for a decision to invest in Common Stock, bond or a convertible bond. In periods of falling prices, bonds and convertible bonds, and in times of rising prices equity or convertible bond will be chosen depending upon the expectations of interest rates and market prices.