Labour cost constitutes a significant portion of the total cost of a product manufactured or service rendered. Efficient and effective utilisation of labour, therefore, is an important need of the modern business world. To this end, everything concerned with employment and utilisation of the labour force should be looked into carefully.

Contents

- Introduction to Labour Cost

- Scope of Labour Cost

- Classifications of Labour Cost

- Composition of Labour Cost

- Departments Associated with Labour and Labour Costs Directly or Indirectly

- Time-Keeping and Time Booking

- Payroll Department

- Labour Cost Control

- Labour Turnover

- Labour Remuneration

- Labour Productivity

- Co-Partnership Profit Sharing Scheme

- Systems of Wage Payment

- Characteristics of an Ideal System of Wage Payment

- Idle Time

- Overtime

- Fringe Benefits

- Types of Incentive Plans

- Work Study

- Job Analysis

- Job Evaluation

- Merit Rating

- Distinction between Job Evaluation and Merit Rating

- Multiple Choice Questions and Answers

What is Labour Cost: Meaning, Indirect Labour Cost, Control, Composition, Departments, Payroll Department, Labour Turnover, Idle Time, Overtime, Formula, Cost Accounting and MCQ

What is Labour Cost – Meaning

Labour cost constitutes a significant portion of the total cost of a product manufactured or service rendered. Efficient and effective utilisation of labour, therefore, is an important need of the modern business world. To this end, everything concerned with employment and utilisation of labour force should be looked into carefully.

A rational approach to the problems of labour-fair maintenance of wage records for wage ascertainment, fair wage policy and incentives for superior performance—will go a long way in providing a sense of security and stability to the workmen, in minimising labour turnover and in exercising effective labour cost control.

ADVERTISEMENTS:

Labour cost is an important element in a concern using more manual operations. The management objective of keeping labour cost as low as possible is achieved by balancing productivity with wages.

In the big organization the control of labour cost involves the coordinated efforts of the following departments:

1) In case of cost department it collects and classifies all cost data relating to labour utilization by departments and allocates them to respective job as per the available documents.

2) In case of payroll department, it undertakes responsibility for computing total and net earning of each worker, preparation of payroll and maintenance of various records relating to payroll.

ADVERTISEMENTS:

3) In case of time office it collects data relating to attendance, time spent on jobs or process by the workmen and providing information on attendance and leave to payroll department.

4) In industrial engineering department it process plans and specifications of each job, supervises production activities undertakes time and motion studies, performs job analysis etc.

5) In case of personal department, it undertakes the responsibility for manpower planning recruitment, training and maintaining records to staff and workmen reporting to chief inspector of factories and to top management on performance, overtime, absenteeism etc.

Top 5 Scope of Labour Cost

The scope of labour cost covers the following:

ADVERTISEMENTS:

1. Time keeping and Time booking.

2. Computation of earnings of each worker.

3. Charging of labour cost to individual jobs.

4. Controlling the cost of labour effectively.

5. The role of labour incentives increases the labour productivity and thereby resulting in lower cost of production.

Labour Cost Classifications – Direct and Indirect

Labour cost can be classified into the following two categories:

i. Direct Labour Cost –

It is the cost incurred in payment of labour who are directly engaged in the production process. It can be easily identified and allocated to cost unit. It usually varies proportionately with the production. Direct Labour Cost is also called Direct Wages, Productive Wages, Manufacturing Wages or Factory Wages.

ii. Indirect Labour Cost –

ADVERTISEMENTS:

It is the cost incurred for payment of labour who are not directly engaged in the production process. It is apportioned to cost unit on some appropriate basis. It may or may not vary with production.

Labour Cost Composition – Monetary and Non-Monetary Payments

The composition of labour cost are as follows:

1. Monetary Payments

1. Basic wage or salary

ADVERTISEMENTS:

2. Dearness allowance

3. Production or profit bonus

4. Employers contribution to Provident Fund

5. Employees’ State Insurance (ESI)

ADVERTISEMENTS:

6. Gratuity

7. Pension

8. Holiday Pay

9. Any other allowance such as Medical Allowance, Leave Travel Allowance etc.

2. Non-Monetary Payments

1. Medical and health facilities

ADVERTISEMENTS:

2. Canteen subsidised meals

3. Education facility to children of employees

4. Recreation facilities

Departments Associated with Labour and Labour Costs (Directly or Indirectly)

The following are the various departments which can be associated with labour and labour costs, directly or indirectly:

1. Personnel Department:

This department is responsible for searching the persons with required skills and qualification, on receipt of labour requisition from other departments. The department ensures that the people recruited possess the requisite qualification and skills required for the job, arranges for proper training for the newly recruited workers, and workshops for existing workers; maintains all personal and job related records of the employees; and conducts evaluation of performance in timely intervals.

ADVERTISEMENTS:

2. Engineering and Work Study Department:

This department is responsible for preparing plans and specifications for each job, providing training and guidance to the employees, supervising production activities, conducting time and motion studies, undertaking job analysis and conducting job evaluation.

3. Time-Keeping Department:

This department is responsible for maintaining attendance records of all the employees and the time spend by them on various jobs, etc.

4. Payroll Department:

This department is responsible for preparing payroll of employees and disbursing their salary and wage payments.

ADVERTISEMENTS:

5. Cost Accounting Department:

This department is responsible for the accumulation, analysis and allocation of labour costs to various jobs, processes, departments etc.

Time-Keeping and Time Booking

Time-keeping forms a most valuable link in a harmonious labour-management relationship. Most companies have a separate time-keeping department accumulating the total numbers of hours worked for each employee.

It embraces two functions:

i. Time-keeping, i.e. recording of time of workers for purpose of attendance and wage calculations.

ii. Time-booking, i.e. reporting of each worker’s time for each department, operation and job for the purpose of cost analysis and apportionment of labour costs between various jobs and departments.

ADVERTISEMENTS:

Purposes of Time-Keeping:

Recording of time is essential for the following purposes:

i. Preparation of pay rolls, where the workers are paid on time basis.

ii. Meeting the statutory requirements.

iii. For internal administration, like increments, pension, provident fund, gratuity and leave benefits.

iv. For proper distinction between direct and indirect costs, normal time and overtime, and regular and late comers.

v. For overhead rates, if based on labour hours.

vi. For enforcing regularity, discipline and ensuring daily requirement of labour force in the factory.

Advantages of mechanical methods of time-keeping:

1. They record correct attendance time at the gate of the factory.

2. They reduce chances of incorrect recording of attendance time and this avoids the disputes regarding time.

3. Possibility of inclusion of dummy or ghost workers in the muster roll is minimised.

4. The mechanical system is clean, safe and quick. The printed record is more reliable and avoids unnecessary disputes.

5. The system is economical, reduces workload in connection with the preparation of pay rolls.

6. The overtime, idle time and late time are recorded separately and correctly.

However, the most difficult problem of this system is initial capital outlay and secondly any mechanical defects may adversely affect the working of the entire time recording to system of the factory.

Job Time Booking:

For proper labour cost analysis, it is essential that the worker records’, in details, his activities of production and time he spends on each job correctly. Time spent by a worker on the job, process or activity may be recorded manually or mechanically depending upon the nature and size of an enterprise. Recording of time spent by the worker on the job is better known as time booking.

The objects of time booking are:

1. To ensure that the time paid for is properly utilized.

2. To ascertain the labour cost for each individual job and the cost of work done.

3. To determine the rate of absorption of overhead expenses based on direct labour and machine hour methods against each job.

4. To ascertain and minimise idle time.

5. To evaluate each employee’s performance by comparing the actual time taken with the budgeted time.

For achieving these objectives, it is very important that clear instructions should be issued and proper forms designed for recording work-time.

The following are some important forms generally used for time booking:

1. Daily Time Sheet

2. Weekly Time Sheet

3. Job Card or Ticket

4. Labour Cost Card.

1. Daily Time Sheet:

This is the record of each day’s work done by a worker. Every worker is given a Daily Time Sheet on which he records the time spent by him on each job or work. At the end of the day, all these sheets, duly countersigned by the foreman, are collected.

This method of time booking is very simple and practicable but it suffers from many drawbacks. This method is suitable only for small concerns; secondly, if a daily time sheet is lost or misplaced then it becomes difficult to ascertain the daily wages of worker and finally it is very expensive since a large number of sheets have to be used for calculation of wages. It is time-consuming also.

2. Weekly Time Sheet:

Instead of recording time on daily time sheets, a worker is given a sheet on which he records his time for a week. This method of recording time is an improvement over the daily time sheet since the number of documents to be prepared is considerably reduced.

The weekly time sheet provides a consolidated time spent by a worker on a job and can conveniently be reconciled with the attendance record. Weekly time sheets are suitable where the worker has to handle a few jobs and the foreman can ascertain the work done by a worker during the week.

These sheets are liable to be mutilated or lost. The workers may fill wrong time and hence strict supervision is required. It is always advisable that these sheets are filled by the departmental clerk so that these disadvantages are avoided and the foreman exercises effective supervision on the jobs.

3. Job Card / Ticket:

A job or time card is a document made out for each job. Its basic function is to show the time spent by an employee on each job or process on which he works during the day. It shows the time an employee starts work on a particular job, the time he finishes, the department for which the worker is done, and the job number.

If he spends some of his time on work other than individual jobs or processes, for example, on maintenance and repairs, the time is shown as indirect labour on the time card. It is unlike time-sheets which are made out for each employee.

Generally, five different types of job cards are used and these are:

i. Job card for each job.

ii. Job card for each operation.

iii. Job card for each worker.

iv. Combined time and job card.

v. Piece work card.

i. Job Card for Each Job:

With this kind of job card, the card travels round with the job and labour times are recorded upon each after each operation. This has the advantage that when the card reaches the cost office, all labour times are listed, and the cost clerks have only to insert the labour rates, multiply and add to obtain the full labour cost.

It has, however, a serious disadvantage that unless the job is fully complete, none of the times are known in the cost office. As some jobs may take many weeks to get completed, it is virtually impossible to reconcile labour time with gate times each week.

ii. Job Card for Each Operation:

This method of recording means that a single job will have a number of job cards, one for each operation. This involves considerable paper work, but it does enable time bookings to reach the cost office quickly.

iii. Job Card for Each Worker:

This is a card issued to each worker for job at the beginning of each day or week depending upon the number of jobs he has to work on. The necessary job numbers are mentioned either by the foreman or the departmental clerk.

iv. Combined Time and Job Card:

Time-cum-Job card is used by small organisations where there is no need of recording time at the gate of the factory and then on the job. The special feature of the card is that it records both the attendance time and the job time of a worker on one card.

v. Piece Work Card:

This card is most suitable for an organisation where the workers are paid wages on piece rate basis. A record of units manufactured by a worker with reference to their quality and time is to be kept on this card. Besides wages, bonus is to be paid to worker for time saved and his efficiency is to be judged on the basis of units produced during the specified period.

Labour Cost – Payroll Department: Functions and Prevention of Payroll Fraud

The preparation of payroll or wage sheet is the work of the payroll department. In most cases, it is usual to see a separate payroll department functioning under the control of cost accounting section. In some cases, however, the work may be accomplished by the cost accounting department itself.

The Payroll:

This is written up with the necessary documents such as employee record cards, time cards, piece work cards and job cards. Time cards supply information regarding the time clocked by workers. In the case of overtime work, it is necessary to compare the details in the time cards with statements of overtime sent by foremen of departments. With these, the payroll department calculates ordinary and overtime wages.

Similarly, piece work wages are computed with the help of piece work cards. An overtime wages due to piece-workers can be ascertained from their time cards. The time and job cards also facilitate the calculation of incentive bonus.

The main purpose of preparing the payroll is to ascertain the net wages payable to each employee. To arrive at the net wages, certain deductions are made from gross wages. Information relating to authorised deductions is sent by the personnel department. Similarly, information relating to fines is sent by departmental heads.

The payroll may be prepared manually or mechanically. It may be prepared weekly or monthly. It is usual to prepare it for each department or cost center in order that the work involved may be distributed among as many people as possible.

The functions of the payroll department are the following:

(a) To maintain an employee record for every worker who is authorised for employment by the Personnel Department. This record shows names of workers, date of appointment, ticket number, nature of work, grade, rate of wages, etc.;

(b) To receive time cards, piece-work cards, etc., from the time office and various departments;

(c) To calculate wages, ordinary and overtime, on the basis of entries in the time cards;

(d) To compute additions to wages;

(e) To compute authorised deductions from wages;

(f) To arrive at the net wages payable;

(g) To prepare departmental payrolls;

(h) To prepare wage packets;

(i) To prepare pay-slips; and

(j) To send the necessary records to cash and cost accounting departments.

Prevention of Payroll Fraud:

There is ample scope for perpetrating fraud during the preparation of payroll and payment of wages. Inclusion of ‘dummy’ workers (those who do not exist) and payment of a higher wage than an employee is entitled to receive are the usual types of fraud. To prevent such types of fraud, it is necessary to exercise rigid control over payment of wages.

Control is exercised by distributing the work connected with preparation of payroll and payment of wages in such a way that the work of one is automatically checked by the other. Such an allocation and checking of work internally is known as internal check.

The procedural formalities to be observed in this connection are:

(a) Rigid control over time-keeping;

(b) Efficient organisation of time-keeping;

(c) Distribution of work connected with preparation of payroll;

(d) Scrutiny of payroll by the personnel or works manager;

(e) Proper authorisation procedures for overtime and incentives;

(f) Preparation of payroll to be outside cashier’s sphere;

(g) Cheques to be drawn for the exact amount of wages;

(h) Those who prepare payroll not to have anything to do with the preparation of wage packets;

(i) Distribution of pay packets to be supervised by senior officials who can identify the recipient; and

(j) Laying down proper procedure for dealing with wages.

Labour Cost Control – Objectives and Reports

Labour cost is the most significant element of cost after material cost. In most business enterprises, labour cost is substantial in nature and forms a significant part of the cost. Further, this cost has peculiar characteristics which other elements of cost do not have.

There are many instances of companies failing and winding up on account of huge and unsubstantiated labour cost. Hence, it is necessary for every business enterprise to exercise control on labour cost.

Labour cost control means control over cost incurred on labour. Control over labour costs does not imply control over the size of the wage bill and it also does not imply that wages of each worker should be kept as low as possible. It means aiming to keep the wages cost per unit of output as low as possible.

The objectives of labour cost control are as follows:

(i) To motivate workers and utilise their skill and talent in increasing output, and thereby optimising production.

(ii) To minimise the wage cost per unit of output.

(iii) To contribute to overall organisational profitability and employee-welfare.

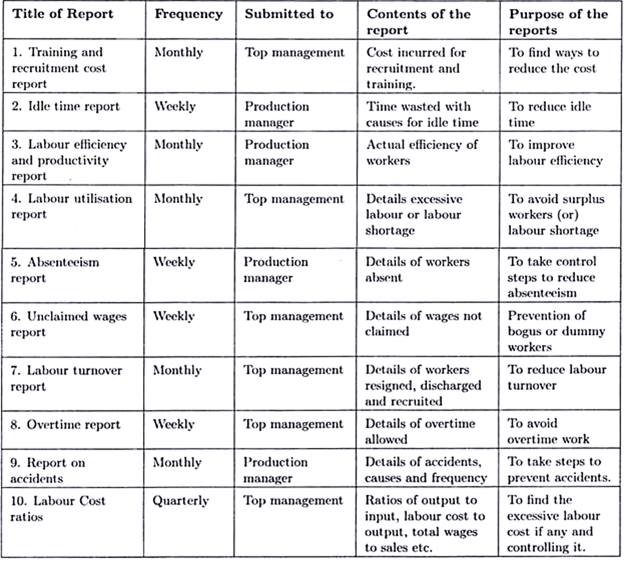

Labour Cost Control Reports:

Management has to take many steps to control cost. For this purpose it needs many information. Information required by the management is submitted through various reports. These reports may be submitted weekly, monthly or quarterly.

The following are important reports:

Labour Turnover – Meaning, Causes, Effect, Measurement, Cost, Methods, Treatment, Reduction and Control (with Formula)

Labour turnover is defined as the change in the labour force in an organization during the given period of time. The change in the labour force takes place mainly because of two reasons.

1) Due to separations and

2) Due to new appointments.

High labour turnover is not a good sign for the organization. The reason is it adds, to high cost and low productivity. Many factors contribute to the labour turnover rate like nature of industry; category of employee employed whether male or female, the size of the organization, location of the unit etc.

Causes of Labour Turnover:

Labour turnover arises because of various factors including dissatisfaction with job, low rate of wages, unsatisfactory working conditions, and non-availability of adequate basic amenities.

The causes of labour turnover may be subdivided into:

1. Personal causes,

2. Avoidable causes, and

3. Unavoidable causes.

1. Personal Causes:

These causes induce or compel workers to leave their jobs purely on personal grounds, including the following:

i. Change of job for betterment.

ii. Premature retirement due to ill health and old age.

iii. Domestic responsibilities—to look after old parents.

iv. Discontentment over the job and working environment.

v. Marriage, especially female workers or later on childbirth.

vi. During seasons of festivals, marriage or harvesting, the workers in the cities leave for home in large batches.

2. Avoidable Causes:

These include:

i. Low wages in the present organisation and the worker may look for higher wages elsewhere,

ii. Dissatisfaction with job,

iii. Bad working conditions,

iv. Long and odd working hours,

v. Unsatisfactory relationship with the supervisors,

vi. Bad relationship with the fellow workers,

vii. Lack of adequate recreational facilities,

viii. Inadequate housing, medical facilities,

ix. Unfair methods of promotion and lack of promotional avenues,

x. Lack of planning and foresight on the part of management, seasonal nature of industry, non-availability of raw materials, power, etc.

3. Unavoidable Causes:

These include:

i. Seasonal nature of business,

ii. Change in the plant location,

iii. Shortage of raw material; power; slack market for the product,

iv. Accident or illness rendering workers permanently incapable to work,

v. Dismissal or discharge due to insubordination, negligence, inefficiency, etc.,

vi. Marriage, specially in case of women workers.

Effect of Labour Turnover:

The higher rate of labour turnover results in increased cost of production.

This is due to:

1. Increased cost of new recruitment and training,

2. Interruption of production,

3. Decrease in production due to inefficiency and inexperience of newly recruited workers,

4. The new workers are more accident prone and are liable to cause more damage to machinery, tools than old employees,

5. Losses due to wastage, spoilage and defectives,

6. Increased number of accidents causing loss of output and increase in medical expenses and cost of repairs,

7. Lack of cooperation and coordination between old and new employees resulting in fall in output and increased cost of production.

Measurement:

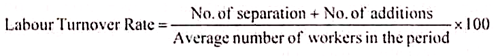

Labour turnover is measured by any of the following methods:

1. Separation Method:

This method takes into account only those workers who have left during a particular period.

It is calculated as-

2. Replacement Method:

This method takes into consideration only the actual replacement of labour irrespective of the number of persons leaving. If new workers are employed on account of expansion of business, they are not included in replacements.

It is calculated as-

3. Flux Method:

It denotes total change in the composition of labour force due to addition and separations of workers.

It is calculated as follows-

Cost of Labour Turnover:

From the management point of view, the cost of labour turnover can be divided into two groups:

1. Preventive costs,

2. Replacement costs.

1. Preventive Costs:

These include costs incurred to keep the labour turnover rate as low as possible. The object of incurring preventive costs is to keep the workers satisfied and induce them to stay in the organisation.

The preventive costs include:

(i) Cost of providing medical, housing and other recreational facilities,

(ii) Cost of providing benefits like pension, gratuity,

(iii) Cost of providing educational facilities to the children of the employees,

(iv) Cost of providing good working conditions, and

(v) Cost of providing other welfare facilities.

If a company incurs high preventive costs, the rate of labour turnover is likely to be low.

2. Replacement Costs:

These costs arise on account of labour turnover and consequential replacement of employees.

These costs include:

(i) Cost of recruitment and training of new workers,

(ii) Loss of output due to-

(a) interruption of production

(b) inefficiency of new workers,

(c) delay in obtaining new workers,

(d) abnormal breakage of tools, accidents and scrap, etc.

Methods of Determining the Cost of Labour Turnover:

Cost of labour turnover can be determined by the following methods:

1. Separation and Replacement method, and

2. Profit forgone method.

1. Separation and Replacement Method:

The specific costs applicable to separate and their replacements are accumulated. Separation costs include severance pay, gratuity and other social security benefits.

On replacement, a company has to incur the costs on-

(a) recruitment,

(b) selection, and training.

These are called replacement costs.

2. Profit Forgone Method:

Under this method, the actual profit for the period is compared with the estimated profit that would have been obtained had no labour turnover occurred. The difference between the actual profit and estimated profit is thus treated as lost profit as a result of labour turnover.

Treatment of Labour Turnover Costs:

Labour turnover costs usually be treated as factory overhead costs. The preventive costs should be distributed among different departments on the basis of workers in each department. The replacement costs are to be shared by the departments affected by the labour turnover on the basis of number of workers replaced.

Reduction and Control of Labour Turnover:

It is important that labour turnover is kept as low as possible.

The following steps may be taken to reduce the labour turnover:

1. A suitable personnel policy should be framed for employing the right man for the right job.

2. Providing working conditions conductive to health and efficiency.

3. Fair rates of pay and allowances and other monetary benefits should be introduced.

4. Maximum non-monetary benefits (i.e. fringe benefits) should be introduced.

5. Distinction should be made between efficient and inefficient workers by introducing incentive plans.

6. Encouraging labour participation in management.

7. An employee suggestion box scheme should be introduced whereby workers who suggest improvements in the method of production should be suitably rewarded.

8. An effective employee-grievance redressal procedure should be introduced.

In addition to the above steps, the personnel department may be asked to prepare a report monthly or quarterly giving the turnover rate and the normal reasons given for leaving.

Labour Remuneration – Problem, Principles, Features and Characteristics

Problem of Labour Remuneration:

Labour cost or wages is, besides material cost, a significant element of total cost of a product or a unit of service. Ever increasing wage cost consequent upon inflationary trend, has pushed up cost of production in general. Labour remuneration is no longer a function of labour productivity. It is the result of diverse factors. One of them is the strong bargaining power of labour unions.

Although labour remuneration is a problem to be reckoned with by management, labour time has to be converted into money. This is necessary for purposes of preparation of payroll and labour cost distribution. Labour cost accounting thus necessitates the ascertainment of prevailing wage rates and the system of labour remuneration practiced by the organisation.

Principles of Labour Remuneration:

There are a number of methods of labour remuneration. The method adopted differs from concern to concern within the same industry. In spite of difference in the methods adopted, the principles governing them should be the same. In other words, the methods adopted should not be subject to management’s arbitrary decisions.

These principles are:

1. Wage rates in any industry should depend upon the prevailing rates in the area in which the industry is situated;

2. Wage rates in a geographical area should be based on the demand for labour, availability of labour, cost of living in that area, and the capacity of the industry to pay;

3. Wage rates should be the same for similar efforts and skill, and should be related to skill, initiative and effort;

4. As far as possible, minimum wages should be guaranteed specially when the working conditions are onerous;

5. Wage rates should ensure the maintenance of a reasonable standard of living;

6. Separate rates should be fixed for different categories of workers based on skill, experience, responsibility, education, training, physical and mental effort;

7. The rates should be such that they provide an opportunity to increase productivity through increased output by increased labour efficiency;

8. Any increase in wages, consequent upon increased output should go only to workers, unless the increased output is the result of co-operative effort of both workers and management.

Features of a Good Wage System:

Healthy industrial relations are an indispensable condition for industrial development. Labour-management relationship will be cordial if the prevailing system of wage payment is satisfactory. Any scheme of wage payment would be satisfactory if it results in low labour cost per unit.

At the same time, it should increase labour productivity also. Lower labour cost per unit does not mean low wages. In fact, high wages increase labour productivity and the consequent increase in output will certainly bring down the labour cost per unit.

A satisfactory system of wage payment should reflect the following characteristics:

1. The system should be based upon scientific time and motion study.

2. It should be simple and capable of being understood by workers.

3. It should be flexible and capable being adapted to changed circumstances.

4. The cost of administering the system should be low.

5. The system should be acceptable to trade unions.

6. It should boost employee morale.

7. It should be correlated to the earning capacity of the concern.

8. It should not be in violation of any government policy with regard to wages.

9. It should be related to the strategic importance of the firm and industry.

10. The system should be consistent with the dangerous working conditions prevailing in the concern.

11. It should depend upon the nature of work and effort and skill involved.

12. It should guarantee a minimum living wage to ensure a satisfactory standard of living.

13. Its incidence on the cost per unit should be low.

14. It should be consistent with wage rates prevailing locally and nationally.

15. The system should result in reduced labour turnover.

16. The system should bring about healthy industrial relations and increased labour productivity.

Labour Productivity – Meaning, Importance, Computation and Steps (with Formula)

Labour productivity is measured by comparing volume of output obtained from a given input. It helps to measure the efficiency of workers. Workers are paid on the basis of their efficiency. Measuring labour productivity helps in fixing suitable wages to workers with different efficiency ratings. Increase in labour productivity helps to increase the output and thus reduces cost of production per unit.

Labour productivity is computed as follows:

Steps for Improving Labour Productivity:

(a) Selection and employment of workers with suitable skill.

(b) Providing proper training to new workers as well as retraining to existing workers.

(c) Avoid employment of excessive workers or labour shortage by conducting work measurement study.

(d) Take steps to simplify and standardisation of work.

Co-Partnership Profit Sharing Scheme – Advantages and Disadvantages

Co-Partnership Profit Sharing Scheme:

Under this Scheme employees are given a share in the Profits of the company by contributing to the capital in some proportionate amount. The aim of these schemes is to get the cooperation of employees by sharing them to the Prosperity of business.

Advantages:

i. The employee management relations get strong and employee participation in management becomes possible.

ii. The turnover rate of employees decreases as minimum numbers of years of services are conditioned.

iii. These schemes make possible the proper utilization of material and other resources.

Disadvantages:

i. It is difficult to distribute the profits by some fixed %.

ii. The share of profit is not directly related to the efforts of the employees as it can increase or decrease due to change of management, market conditions. Thus these schemes fail to maintain a direct relationship between rewards (share in profit) and efforts.

iii. Sometimes employees object the profit declared by the company due to lack of Knowledge of Finance Accounts.

iv. The employees want to share profits in good years but do not want to share in loss.

v. The trade unions do not favour these schemes because it reduces the employees’ loyalty to trade Union.

Labour Cost – Basic Systems of Wage Payment

There are two basic systems of wage payment.

They are –

1. time based system, and

2. output or performance based system.

In the case of the former, time is the basis of payment. In the case of the latter, however, output, performance or speed is the basis. These systems are also known as time wage and piece wage systems.

Time Wage Systems or Payment Based on Time:

The basic feature of the methods falling under this system is the same. Wages are arrived at by multiplying the number of hours worked in a day by the hourly rate. The number of hours worked is the same as attendance time or clocked hours at the factory gates.

No account is taken either of idle time or the actual time taken to complete a job. Even the total quantity of work produced in a day or a week is not taken into consideration. It is the clocked time that is the basis of wage payment.

Under this method fall the following three variants:

i. Flat Time Rate or Time Rate at Ordinary Levels:

This is the oldest method of remunerating labour on the basis of time. It seeks to pay workers at a particular rate on the number of hours worked or the time actually put in as per the muster roll or attendance record.

The amount of wages payable to a workman under this method is arrived at by multiplying the time taken by the time rate or hourly rate or day rate. The rate per hour or per day is usually fixed taking into consideration the rates prevailing in similar trades for the same grade and skill.

It is not necessary under this method, to compute the hourly rate. Payment can be made at a day rate or a rate per week. In some cases, an employee could be paid an annual salary also. Whatever be the period of time chosen, the principle remains the same.

If a worker works for larger number of hours than that is allowed, he is said to have worked overtime. In such a case, he is to be paid at double the hourly rate or ordinary rate payable.

Advantages:

(a) It is simple to operate;

(b) It is easy to understand;

(c) Quality of work is not affected;

(d) Wages become stabilised;

(e) Imparts a sense of security to workmen;

(f) Workmen do not feel discriminated;

(g) Less clerical work in operating the system.

Disadvantages:

(a) It does not recognise individual efficiency;

(b) No incentive to hard work and increased output;

(c) Workmen are inclined to produce as little as possible;

(d) There is a tendency to increase their wages by working overtime;

(e) Sense of discontentment amongst efficient workers since even an average workman gets the same amount;

(f) Involves high cost of supervision;

(g) Increases labour turnover;

(h) Standards cannot be set;

(i) Estimates and quotations give a wrong idea.

Suitability:

In spite of the above disadvantages, this method is suitable to:

(a) Certain types of work which cannot be quantitatively measured, e.g. supervisory and clerical staff;

(b) Quality work is an important factor;

(c) Strict supervision of work is possible;

(d) The number of indirect workers is more;

(e) Where workmen cannot increase their output due to work-flow regulated by machine speed;

(f) Existence of learners and apprentices.

ii. High Wage Plan or Time Rate at High Wage Levels:

Even this system is time based. The method of computing wages of workers is also the same. There is, however, one important difference between the two. Under this method, as an incentive to increased production, wages are paid at rates well above the normal basic time rates. This method was first introduced in Ford Motor Company of U.S.A. to induce workmen to put in more effort.

Under this method, wage rate with which time clocked is multiplied is higher than that prevailing in the area or in similar concerns. The purpose behind this is to attract efficient workers who can be motivated to achieve predetermined standards of efficiency and output.

Accordingly, this method is suitable where high quality work coupled with increased productivity are required. For its successful application, it is, however, necessary to ensure that the output levels are the result of detailed work study.

Advantages:

(a) It is equally simple;

(b) It is also easily understandable;

(c) It is inexpensive to operate;

(d) It attracts efficient workers;

(e) It demands less supervision;

(f) It increases labour productivity;

(g) It results in decreased labour cost per unit.

Disadvantages:

(a) Unsuitable to concerns in which output cannot be measured;

(b) It does not serve the desired purpose if output levels are not properly fixed;

(c) It does not benefit a less efficient worker;

(d) The purpose of this method may be defeated if other local employers also raise their rates of wages to attract efficient workers.

iii. Measured Day Work or Graduated Time Rates:

This method is a variant of the high wage plan. Under this method, the hourly rate of wages is made to comprise both fixed and variable elements. The fixed element is dependent upon the nature of the job.

The variable element, however, varies for each worker. It depends upon the worker’s merit rating and cost of living index. The aggregate of the fixed and variable part of wages for a day is known as ‘measured’ day work of a workman.

This method, thus envisages separate rates of wages for each worker and for each job. Consequently the system presents a problem when workers move from one job to another. Further, workers cannot understand the innumerable rates fixed under this method. Hence, its utility is very much restricted.

Labour Cost – Characteristics of an Ideal System of Wage Payment

The success of an industrial concern depends to a great extent upon the efficiency of labour and the efficiency of labour is considerably affected by the amount of remuneration paid to it.

Some persons are of the view that the profits of an industrial concern can be maximised only by reducing the wage rates payable to the workers. But this view is not correct.

It should be remembered that low-paid workers are usually inefficient and their inefficiency leads to wastage of materials, less economic use of tools, frequent break-down of machinery and loss of time as a result of which the cost of production goes up. Reasonable and fair wage rates allowed to the workers ultimately lead to more economic use of machines, tools, materials and time.

To quote H.J. Wheldon, “Low wages do not necessarily means low costs — in fact, it is now widely recognised that efficiently organised factories may pay the highest wages, and yet have the lowest wages costs”.

Therefore, the importance of the method of wage payment must never be under-estimated. Methods of wage payment should be carefully made out and put into action.

An ideal system of wage payment must possess the following characteristics:

(a) Simplicity:

The wage system should be simple to operate and easy to understand. It should avoid complications and should not have any element of uncertainty.

(b) Guarantee of Minimum Wages:

The system of wage payment should guarantee a minimum wage to every worker irrespective of his efficiency or output so that he can maintain a proper standard of living and enjoy proper health to carry on his duties efficiently.

(c) Beneficial to Employer and Employee:

The system of wage payment should be such which is gladly acceptable to the employer and the employee. From the view point of employer, the wage system should be economic. At the same time, it should enable the workers to get adequate and proper remuneration for their work.

(d) Flexibility:

The wage system should be flexible enough so that changes may be made according to the requirements of the industrial concerns.

(e) Incentives to Workmen:

The wage system should provide sufficient incentives to workers so that they may put in their best to maximise the output. It would encourage the workers to work hard.

(f) Establishment of Industrial Peace:

The wage system should ensure the establishment of industrial peace. It should help in promoting healthy and cordial relations between the employer and workers.

Idle Time – Meaning, Causes, Treatment, Control and Idle Capacity

Idle time is that time for which the worker has been paid without giving any production to the employer. Idle time normally results from poor production scheduling and lack of sales order.

It is necessary to identify the reasons for the idle time otherwise it would be difficult for the management to exercise effective control over the labour costs.

The idle time normally arises due to:

(i) Normal and

(ii) Abnormal causes.

(i) Normal Causes:

Some idle time is inherent in every situation.

Normal idle time arises due to:

a. Time lost between factory gate and place of work.

b. Time taken in picking up the work for the day.

c. The interval between one job and another.

d. The setting-up time for the machine.

e. Time taken for personal needs, and

f. Time lost due to normal fatigue.

(ii) Abnormal Causes:

Idle time may also arise due to some abnormal factors.

The abnormal causes are:

a. Temporary lack of work.

b. Breakdown of machinery.

c. Power failure.

d. Non-availability of raw materials, and.

e. Strikes, lockouts, floods, fires etc.

Treatment of Normal Idle Time Cost:

Normal idle time cost can be treated in the following two ways in the cost accounting:

1. The labour cost of normal idle time be treated as a part of the cost of production. Normal idle time cost of direct workers be treated as direct wages. Assuming a worker is paid Rs.1 per hour for 8 hours a day, he actually spends 7 hours on the job and one hour is lost due to routine work.

Since it is a case of normal idle time, the worker will be paid Rs.8 for the day. Thus, in case of direct workers an allowance for normal idle time is built into the labour costing rates.

In case of indirect workers, the normal idle time is spread over all the products or jobs. In this case, it is treated as factory indirect wages and is distributed through the process of absorption of factory overheads.

2. The entire normal idle time cost be treated as an item of factory expenses and be recovered as indirect charge.

Treatment of Abnormal Idle Time Cost:

A basic principle of cost accounting is that abnormal expenses and losses should not be included in costs while ascertaining the cost of a unit or activity. It is on the principle that the abnormal idle time costs are excluded from the cost of production.

Abnormal idle time cost is directly transferred to Costing Profit and Loss Account without disturbing the normal costs. Such treatment at once attracts the attention of the management towards the losses due to abnormal idle time.

Control of Idle Time:

The abnormal idle time costs should be further categorised into controllable and uncontrollable. This would help the management in fixing responsibility of controllable idle time. Idle time cards should be prepared to know the reasons which are responsible for such a time.

Timely provisioning of materials and regular maintenance of plant and machinery will also help in reducing the idle time. The management should aim at eliminating abnormal idle time and reducing the normal idle time to the minimum.

Idle Time and Idle Capacity:

Idle capacity means that plant and machinery is available for utilisation but is not fully used due to normal or abnormal reasons. This generally arises from market constraints or defective management policy.

The normal reasons for idle facilities are, generally, preventive maintenance and intermittent use of machine during processes. The abnormal reasons may be trade depression, flood, recession etc.

The cost of normal idle facilities should be charged as overhead expenses and the abnormal idle facilities should be charged to Costing Profit and Loss Account. It should be noted that idle time of labour is different from idle capacity of the plant.

Idleness of labour is due to such causes as-

(i) waiting for work,

(ii) waiting for foreman’s instructions,

(iii) breakdown of machinery etc.

Care should be taken to calculate the capacity usage ratio of each machine and adopt measures to raise the ratio to unity wherever possible.

Labour Cost – Overtime: Authority, Principal Causes, Treatment, Disadvantages and Control

Overtime work represents the work done beyond normal working hours. For overtime work, a worker is paid at a higher rate than the normal time rate. Usually it is double the normal rate. The additional amount expended on overtime work is known as overtime premium.

Overtime premium is paid for extra shift work, performance of hazardous task and work beyond normal hours. All overtime work should be properly authorised.

Authority for overtime payment comes from:

a. Attendance card and time ticket report of overtime work,

b. Authorisation of the overtime by the executive of the department in which work is performed.

In fairly large plants, a form known as “Request for overtime” is used as a means of showing executive approval. This form should be prepared and signed by the departmental foreman, Superintendent and the departmental head. Where overtime operations are regularly scheduled, a blanket authorisation of overtime is generally given.

Overtime premium is calculated with reference to overtime rate available for the workmen put on overtime. Uses of tables simplify the work of overtime calculations.

Principal Causes of Overtime:

The treatment of overtime depends a good deal on the causes that give rise to overtime working.

Following are the two principal causes of overtime working:

a. Scheduling more production.

b. Rush orders

a. Scheduling more Production:

When organisations schedule more production than can be justified by normal working hours, overtime working is resorted to. For example, a company has normal capacity of 10,000 units to be completed in 1,000 labour hours. It may accept an order for 12,000 units, which require 1,200 labour hours. In this situation, the company will have to resort to overtime working for 200 labour hours. This is known as overtime due to general business conditions or labour shortages.

It is also termed as regular overtime. It is a customary charge to production and normal practice is to collect overtime separately under a separate standing order number. Afterwards, it should be distributed to all orders during that particular period.

Overtime premium to factory workers is charged to factory overhead account. Overtime to office staff is charged to administration overhead and on the same lines the overtime premium to sales force is charged to selling overhead.

In the above mentioned example, each of the 12,000 units completed during a particular period should bear a share of overtime premium. Logic would not support charging the overtime allowance to 2,000 units that ‘caught’ in overtime working through sheer circumstances.

b. Rush Orders:

Accepting rush orders which cannot be finished in regular working hours also leads to overtime working. For example, a customer may place an order on Saturday afternoon for delivery on Monday. Company may have to ask the employees to work on Sunday.

In this situation, overtime working was necessitated by one particular order and that particular order should be logically charged with the full labour cost.

In this situation, no other order received the benefit of overtime working and, therefore, no part of overtime premium be charged to any other order.

Treatment of Overtime Cost:

There are a number of methods of treatment of overtime premium. Some concerns treat the overtime bonus as an element of cost and it is reflected in inventory values of work-in-progress and finished goods. Others exclude all overtime premium from cost of production because its inclusion in cost will vitiate cost comparison.

There are following methods of treatment of overtime cost:

a. As part of direct labour cost –

When this method is used, overtime premium is directly added to the job or the department for which the work is done. This method undoubtedly distorts the direct labour cost, when similar jobs are compared and some incur overtime and others do not.

b. As an element of manufacturing overhead –

When this method is used, overtime premium is pro-rated equitably for all work done during the given period.

c. Debiting directly to profit and loss account –

Some concerns hold the view that overtime premium should not form part of cost of production. It should be collected separately understanding order number and then it should be debited to profit and loss account.

Disadvantages of Overtime Working:

It is a common experience that overtime working is not a healthy practice. It –

a. Results in excess labour cost,

b. Decreases productivity during normal working hours,

c. Gives rise to associated cost like lighting, etc.

d. Adversely affects the health of workers in the the long run,

e. Promotes a tendency among the workers to keep the work pending so that overtime work is necessitated,

f. Increases the wear and tear of the machinery,

g. Promotes dissatisfaction among the workers who do not get the opportunity of overtime,

h. Creates difficulty in discontinuance of the practice of overtime work if it is once allowed.

Control on Overtime Working:

It is difficult to completely eliminate overtime working.

Following steps should be taken to reduce the overtime cost:

a. There should be a system of authorising overtime working. This system should be strictly adhered to.

b. Overtime premium should be collected under a separate standing order number and it should be shown against the department incurring it.

c. If overtime working is a regular feature, steps should be taken to recruit more workers to stop overtime.

d. The officer entitled to sanction the overtime should be under instruction to authorise it only under very compelling circumstances because it is a contagious disease in a healthy industrial atmosphere.

e. Periodical reports should be made revealing the overtime working in different departments.

Labour Cost – Fringe Benefits

Basic wages, computed according to any of the methods or systems of wage payment, constitute direct monetary compensation for services rendered by workers. Besides these wages, there are a number of indirect forms of compensation in terms of money, paid to workers. These additional monetary benefits are known as ‘Fringe benefits’ or supplementary wages.

These benefits are not related to labour productivity. They are paid either because of their imposition by appropriate legislative measure, or because of collective bargaining.

Indirect monetary incentives or fringe benefits are:

(a) Dearness allowance,

(b) House rent allowance,

(c) City Compensatory allowance,

(d) Children’s education allowance,

(e) Night shift allowance,

(f) Holiday pay,

(g) Leave pay,

(h) Employer’s contribution to State Insurance,

(i) Employer’s contribution to Provident Fund,

(j) Retirement benefits such as gratuity, pension etc.

(k) Accident compensation, etc.

In addition to the above monetary payments, there are a few others which do not form part of wages, and which are non-monetary. They represent costs necessary to be incurred by the employer in maintaining a contented labour force.

These non-financial incentives are known as ‘labour-based costs’. Canteen facility, subsidised food, housing, education, recreation, medical facilities, etc., are some examples of non-financial incentives.

Labour Cost – Types of Incentive Plans (With Advantages and Disadvantages)

The types of incentive plans are as follows:

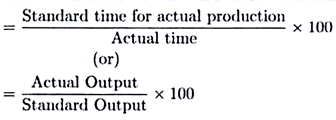

Type # 1. “Halsey” Premium Plan:

Under this plan, a standard time is fixed for each job or work and a worker is given to hourly wages for the actual time he takes to complete the job. If actual time is less than the standard time, bonus is paid i.e., equal to 50% of the time wage of time saved.

According to Halsey Premium Plan:

Total Earning = Time wage rate + Bonus

= Actual time taken x Time rate + 50% of (Time saved x Time rate)

Advantages:

i. This plan is easy to operate as there are no calculations.

ii. It guarantees the hourly wages for the actual time.

iii. Efficient workers are motivated by getting incentives for the hours saved.

iv. The profit of time saved is divided by both employer and employee. Employer gets more production and employee is paid more wages.

Disadvantages:

i. It is difficult to determine a standard time and require proper time and motion studies.

ii. Quality of work can suffer because workers will try to save more time.

iii. Workers do not like this method because they think that they are not getting full benefit of time saved.

iv. Workers also criticises that the employer gets more share of time saved.

Type # 2. Rowan Plan:

The difference between the Halsey Premium Plan and Rowan Premium Plan is only about payment of bonus .Under Rowan plan, the worker is guaranteed minimum wages and bonus, if work is finished before the standard time. Under the Rowan Plan Bonus is a fixed as % of the time wages as time saved bears to the standard time.

Total Earnings = Time wage Rate + Bonus

Or

= Actual time taken x Time Rate + Time Saved/Time allowed x Actual time x Time Rate

Advantages:

i. Like Halsey Plan, it also guarantees the time/hourly wages to workers.

ii. More incentives are given to efficient workers who save time up to 50% of Standard time in comparison to Halsey Plan.

iii. It is liked by workers as Bonus can reach up to 100% of Time wages.

iv. The quality of work is maintained as workers do not rush to more work because bonus increases at a decreasing rate at higher efficiency level.

Disadvantages:

i. Again fixing of standard time is a difficult task.

ii. The calculations are not simple to understand to the workers.

iii. It does not give proper incentives for efficient worker who saves more than 50% of standard time because bonus will decrease after every increase in time saved after 50% of standard time.

Type # 3. Taylor Differential Piece Rate System:

This system of wage payment was introduced by FW Taylor which means that low output should be paid less and high output should be paid high rates. A standard time is fixed and worker who completes his work before the standard time is paid at higher rates. Standard time is to be fixed accurate with the help of time and motion studies.

Thus in Taylor’s differential piece rate system, two piece rates are fixed:

1. High piece wage rate; who completes the standard work in standard time.

2. Low piece wage rate; for those inefficient workers who cannot complete his work in standard time.

Advantages:

i. This plan is simple to understand and easy to operate.

ii. More incentives are given efficient workers.

iii. Production can be increased by giving more rates to efficient workers.

iv. Due to increased production, overhead cost can be reduced.

Disadvantages:

i. To efficient workers suffer, because reduced output leads to reduction in their earnings.

ii. For both type of workers-efficient and inefficient, labour cost will differ.

iii. Two different rates will cause conflict among the workers.

iv. Workers will not get hourly wages and their morale will be decreased.

Type # 4. Merrick Differential/Multiple Piece Rate:

This incentive plan is similar to Taylor’s differential piece rate. The only difference is that there are three differential piece rates in place of two as in Taylor’s.

Advantages:

i. This incentive plan does not punish the workers for producing less output than of standard output by paying low piece rate.

Disadvantages:

i. It suffers from same disadvantages as Taylor’s differential piece rate system.

Type # 5. Emerson Efficiency System:

In Emerson Efficiency Plan the combination of both minimum day wages and the differential rate is taken. This Scheme was founded by Emerson, who was one of Taylor’s Associate. In this scheme, a standard task or standard time for a job is fixed first.

On the basis of this standard time, a level of worker efficiency is decided. These are up to 66 2/3%, above 66 2/3% & up to 100% and above 100%.

In this system, the bonus is paid to a worker at a nominal rate, if he achieves the level of 66 2/3% efficiency and accordingly bonus increases. If his output increases from 66 2/3%. Bonus is paid at different rates at different levels of efficiency. Emerson used 32 different rates of bonus at different levels of efficiency between the range of 66 2/3% and 100%.

Advantages:

i. It provides guarantee of minimum wages to the workers.

ii. It provides different incentives to the workers between efficiency levels of 66 2/3 % and 100%.

iii. Additional incentive is given beyond the level of 100%.

Labour Cost – Work Study: Methods, Time and Motion Study

Work study is conducted to find the best way of doing a job. It is a detailed analysis of nature of jobs, methods of production and equipment and tools used.

Work study includes:

(i) Methods study and

(ii) Time and motion study.

(i) Methods Study:

It aims at improving the method of production, remove unnecessary operations and standardising the work procedure. It helps in better utilisation of materials, men and machines. It helps in maximising the production.

(ii) Time and Motion Study:

Time Study:

Its aim is to find the effective time required to do a job. Total work is divided into small operations. The time taken by a worker of average efficiency to do the various operations are calculated and totaled to find the time needed to complete the job. Time taken by an efficient or slow worker is not taken.

Some additional time should also be allowed for fatigue and for attending to personal needs. Total time so arrived is called standard time for the job. Fixing standard time helps in introducing incentive wage payment schemes.

Motion Study:

It is a study of the workers while they are at their job. The bodily movement of workers are recorded with the help of a camera and their movements are analysed. It helps to identify the necessary and best bodily movements and helps avoiding unnecessary and wasteful movements.

Job Analysis

Job Analysis is a process of finding the nature of the job, tasks involved and qualification, skill and experience required for doing the job. The responsibility involved in the job is also determined.

Job analysis helps the personnel department to recruit suitable workers for the job. It also helps in fixing the position of a job and its relationship with other positions. It includes job description and job specification.

Job Evaluation – Aspects and Objectives

‘Job evaluation’ is a process by which the following aspects of a job are analyzed and evaluated:

(a) Nature and importance of tasks to be performed.

(b) Skill requirements of job holder like technical background, experience etc.

(c) Responsibilities of the job holder, superior-subordinate reporting relationships, etc.

(d) Importance of the job in relation to other jobs.

The purpose or objectives of job evaluation are as follows:

(a) To assess the importance of each job.

(b) To determine the skill requirements of the job holder and fit the right person in the right job.

(c) To provide a basis for determining wage and salary structure for various job positions in the firm.

(d) To provide a basis for superior-subordinate relationships i.e., managerial hierarchy.

Labour Cost – Merit Rating (With Its Purpose)

‘Merit Rating’ is the systematic evaluation of the performance of each employee. Performance Evaluation i.e., Merit Rating may be done by the supervisor or any other authorized person.

The purpose or objectives of merit rating are as follows:

(a) To identify efficient workers and reward them suitably.

(b) To determine training and development needs.

(c) To provide a basis for promotion and transfers.

(d) To assess the worth of the worker to the firm.

Distinction between Job Evaluation and Merit Rating

The following are the points of distinction between job evaluation and merit rating:

Job Evaluation:

(i) It means rating or evaluating the job itself.

(ii) It is intended to create a rational wage and salary structure.

(iii) It simplifies wage administration by bringing uniformity in wage rates.

Merit Rating:

(i) It means rating or evaluating the workers on their jobs.

(ii) It provides a basis for providing incentives to workers on the basis of their ability and performance.

(iii) It determines the total wages payable to workers, which includes performance-linked bonus.

Labour Cost – Multiple Choice Questions and Answers

1. Direct labour means

(a) Labour which can be conveniently associated with a particular cost unit

(b) Labour which completes the work manually

(c) Permanent labour in the production department

(d) Labour which is recruited directly and not through contractors

Ans. (a)

2. Labour turnover is measured by

(a) No. of workers joining / No. of workers in the beginning of the period

(b) No. of workers left / No. of workers in the beginning plus at the end

(c) No. of workers replaced / Average no. of workers

(d) All of these

Ans. (c)

3. Time and motion study is conducted by

(a) Payroll department

(b) Personnel department

(c) Time keeping department

(d) Engineering department

Ans. (d)

4. Time and motion study is essential for

(a) Determining the standard time and the correct method of completing a task

(b) Rational promotion policy

(c) Completing a job on time

(d) Determining prices of products

Ans. (a)

5. Labour productivity is measured by comparing

(a) Total output with total man-hours

(b) Actual time with standard time

(c) Added value for the product with total wage cost

(d) All of the above

Ans. (d)

6. Job evaluation aims at

(a) Establishing the hierarchical position of the holders of the job

(b) Comparing a job with others so as to ascertain the proper scale of remuneration for the job

(c) Assessing the requirement in terms of personnel required

(d) Assessing the profitability of the job

Ans. (b)

7. Wage sheet is prepared by

(a) Cost accounting department

(b) Payroll department

(c) Personnel department

(d) Time-keeping department

Ans. (b)

8. The input-output ratio in case of labour means the ratio of

(a) Number of workers employed to the sanctioned strength

(b) Abnormal idle time to normal idle time

(c) Standard time of the production to the actual time paid for

(d) The value of output to the wages paid

Ans. (c)

9. A satisfactory system of wage payment should

(a) Deprive the employer of a fair margin of profit

(b) Guarantee a minimum living wage

(c) Provide non-financial incentives

(d) None of the above

Ans. (b)

10. The time wage system

(a) Satisfies trade unions

(b) Increases cost of production

(c) Benefits the less efficient workers

(d) None of the above

Ans. (c)

11. The straight piece rate system

(a) Is opposed by trade unions

(b) Recognises individual efficiency

(c) Benefits the employer

(d) None of the above

Ans. (b)

12. Which of the following methods of remuneration is most likely to give stability of labour cost to the employer?

(a) Group bonus scheme

(b) Measured day work

(c) Premium bonus scheme

(d) Straight piece work.

Ans. (b)

13. Differential piece rate systems

(a) Are complicated

(b) Are discriminatory

(c) Pay workers in proportion to their efficiency

(d) None of the above

Ans. (c)

14. Which one of the following is a system, which combines both time and piece rate system?

(a) Emerson’s system

(b) Merrick’s differential system

(c) Halsey system

(d) Bedaux system

Ans. (a)

15. Which of the following incentive methods of wage payment should be used for indirect workers?

(a) Gantt’s task and bonus plan

(b) Rowan plan

(c) Taylor’s differential piece rate system

(d) None of the above.

Ans. (d)

16. The Halsey plan

(a) Is intended to improve the quality of work

(b) Pays higher bonus at higher levels of efficiency

(c) Divides the benefit of time saved equally between the employer and the employee

(d) None of the above

Ans. (c)

17. The Rowan plan

(a) Is the best for efficient workers?

(b) Pays lower bonus than that of Halsey beyond 50% saving in time

(c) Pays increased bonus at an increasing rate as the efficiency

(d) None of the above

Ans. (b)

18. Under Emerson’s efficiency plan, the worker gets normal wages at

(a) 100% efficiency

(b) 80% efficiency

(c) 331/3% efficiency

(d) 662/3% efficiency

Ans. (c)

19. The payroll

(a) Is the wage analysis sheet

(b) Is the wage sheet

(c) Is a rolled sheet of paper fastened around the drum of the dial time recorder?

(d) None of the above

Ans. (b)

20. Under Gantt task and bonus plan, no bonus is available to a worker if his efficiency is below

(a) 100%

(b) 50%

(c) 75%

(d) 662/3%

Ans. (a)

21. Under Bedaux system, the point obtained as ‘B’ represents

(a) No. of minutes taken for a job

(b) No. of hours taken for a job

(c) No. of units produced

(d) No. of workers required for a job

Ans. (a)

22. In which of the following incentive plans of wage payment, wages on time basis are not guaranteed?

(a) Gantt’s task and bonus system

(b) Halsey plan

(c) Rowan plan

(d) Taylor’s differential piece rate system

Ans. (d)

23. Fringe benefits

(a) Are contract labour costs

(b) Are related to labour productivity

(c) Are indirect forms of employee compensation?

(d) None of the above

Ans. (c)

24. Under which of the following bonus system, production budget of the department is taken as standard and the actual production, if exceeds the standard, bonus is paid to all the workers

(a) Priestman’s plan

(b) Scanlon plan

(c) Bush plan

(d) Rucker plan

Ans. (a)

25. Under the high wage plan, a worker is paid

(a) Normal wages plus bonus

(b) At a double rate for overtime

(c) According to his efficiency

(d) At a time rate higher than the usual rate

Ans. (d)

26. The benefit of time saved by a worker against the standard should

(a) Go wholly to the employer

(b) Go wholly to the employee

(c) Be shared by the two if it is not standardised

(d) Be shared by the employer and the employee if the work is standardized

Ans. (c)