Process Costing refers to a method of accumulating cost of production by process. It represents a method of cost procedure applicable to continuous or mass production industries producing standard products. Costs are compiled for each process or department by preparing a separate account for each process.

Process costing can be applied in chemical works, oil refining, food manufacturing, paint works, canning, textiles, paper, dairy, sugar, bakeries, breweries, mining industries, public utility services etc. When a product is manufactured through various processes, the output of each process is transferred to the subsequent process and that of the last process is transferred to the finished stock.

Contents

- Introduction and Meaning of Process Costing

- Definitions of Process Costing

- Meaning of Operation Costing

- Process Costing System

- Determination of Unit Cost

- Features of Process Costing

- Features of Process Industries

- Characteristics of Process Costing

- Objects of Process Costing

- Industries Where Process Costing is Commonly Used

- Elements of Production Cost

- Steps Involved to Solve Process Cost Problems

- Prerequisites of Process Costing

- Process Stocks

- Principles Used in Calculation of Process Costing

- Processing Methods

- Double Entry Book Keeping in Process Industries

- Procedure of Process Costing

- Costing Procedure

- Equivalent Production

- Valuation of Work-in-Progress

- Opening Work-in-Progress

- Reasons for Introducing the Concept of Profit

- By-Products and Joint Products

- Process Costing With Process Loss

- Loss in Weight and Sale of Scrap

- Similarities between Job Order Costing and Process Costing

- Forms of Process Accounts

- Difference between Job Costing and Process Costing

- Difference between Contract Costing and Process Costing

- Difficulties Confronted in the course of Working a System of Process Costing

- Advantages of Process Costing

- Disadvantages of Process Costing

What is Process Costing: Introduction, Meaning, Concept Features, Characteristics, Elements, Prerequisites, Principles, Procedure, Similarities, Advantages, Limitations, Difference, Examples, and Suitable For

What is Process Costing – Meaning and Concept

Process Costing is probably the most widely used costing system. Process Costing is a method of costing under which all costs are accumulated for each stage of production and the cost per unit of product is ascertained at each stage of production by dividing the total cost of each process by the normal output of that process.

ADVERTISEMENTS:

It represents a type of costing procedure for mass production industries producing standard products. Typically, in such industries all goods produced are for stock, units produced are identical, goods move down the production line in a continuous stream, and all factory procedures are standardised, costs are compiled for each process or department by preparing a separate account for each process. Thus, it is a method of costing used to ascertain the cost of product at each stage of manufacturing.

Process costing is an alternative method of cost accounting. Like job costing, even process costing is a basic method by which costs are accumulated by processes. In the case of job costing, costs are charged to each individual customer.

This becomes necessary since each order of an individual customer is different from that of the other. Being different, each order requires different amounts of material, labour and overhead. Process costing is not the same as specific order costing. Consequently, costs need not be collected and charged to a specific order.

In mass producing industries where like units pass through different stages of production, the adoption of process costing necessitates cost accumulation by these stages. Each stage is known as a process. Like units move from one process to another till the stage of completion. Output of the earlier process becomes the input of the later process.

ADVERTISEMENTS:

Process Costing refers to a method of accumulating cost of production by process. It represents a method of cost procedure applicable to continuous or mass production industries producing standard products. Costs are compiled for each process or department by preparing a separate account for each process.

Process Costing – Definitions

Process costing is used in mass production industries producing standard or identical products continuously through a series of processes or operations. It is assumed that the same amount of materials, labour and overhead is chargeable to each unit processed.

Each unit is processed similarly. It is not possible to trace the items of prime cost of a particular order, as its identity is lost in continuous production. The cost per unit can be ascertained at the end of any manufacturing process by dividing the total cost of a process by the number of units produced in that process.

Kohler has defined process costing as – “a method of cost accounting whereby costs are charged to processes or operations and averaged over units produced”.

ADVERTISEMENTS:

CIMA has defined process costing as – “the basic costing method applicable where goods or services result from a sequence of continuous or repetitive operations or processes. Costs are averaged over the units produced during the period.”

Process costing can be applied in chemical works, oil refining, food manufacturing, paint works, canning, textiles, paper, dairy, sugar, bakeries, breweries, mining industries, public utility services etc. When a product is manufactured through various processes, the output of each process is transferred to the subsequent process and that of last process is transferred to the finished stock.

Process Costing – Meaning of Operation Costing

Operation costing is a refinement of process costing. It is concerned with the determination of the cost of each operation rather than the process. In those industries where a process consists of distinct operations, the method of costing may be called operation costing, though it is still process costing in approach and application.

In other words, in these industries, a process is subdivided into a number of parts, each of which is known as an operation. For example, when cycle mudguards are to be made, the steel sheets will be cut into proper strips and then shaped according to the design and machined before being finally polished.

Here each one of these activities is an operation and it is possible to determine the cost of each operation separately. In operation costing, each operation is treated as a cost centre and the costs are accumulated for each operation instead of each process.

For example, in case of mud-guard making, the various operations can be tin cutting, bending, colouring, etc. The material, labour and overhead costs accumulated for each operation are transferred to the next operation as in the case of process costing.

The waste, rejects and scrap are also accounted for in the same way as in- process costing. Thus, basically there is no difference between process costing and operation costing and the two terms are often used interchangeably.

Process Costing System (With Illustrations)

Process costing system is a type of costing procedure which is used in accounting for calculating cost in continuous or mass production industries such as food processing, cement, sugar or potato chips. In these industries it is not possible to identity separate units of production because of the continuous nature of production processes involved.

The products are essentially homogenous (similar) in nature. All units are processed in similar manner and it is assumed that the same amounts of materials, labour and overheads are chargeable to each unit processed.

ADVERTISEMENTS:

In the process costing system, costs are accumulated, period by period not per job or batch by batch. Cost of each unit is calculated at the end of the period (commonly one month or after one week as the case may be). Cost per unit (average) is obtained by dividing the total cost applicable to a production department during a particular period by the total number of units produced during that period.

If the product is processed in more than one process, the output of the first process is transferred to the second process. The output of the first process becomes the input of the second process. The output of second process is transferred to third process and so on. The output of the last process is transferred to Finished Stock Account.

Illustrating Process Costing:

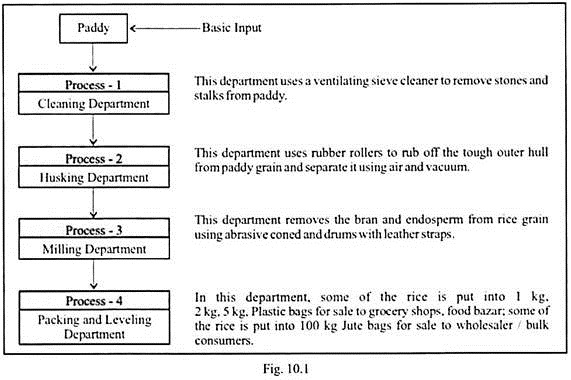

An example of a manufacturing process of rice is given in Fig. 10.1 (below):

ADVERTISEMENTS:

Illustrating Process Costing:

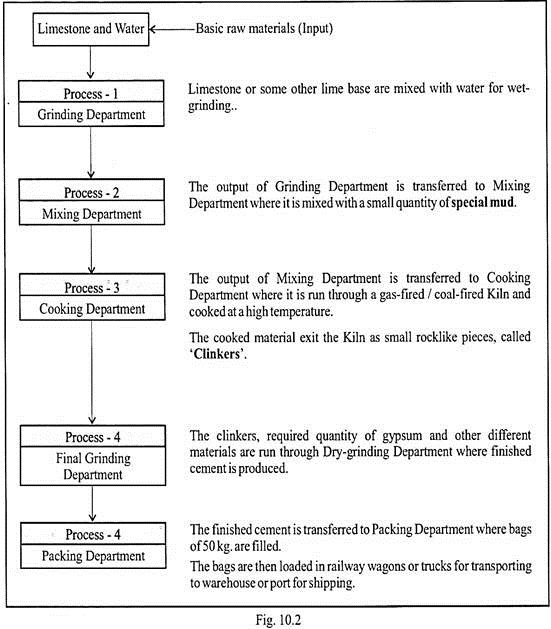

An example of manufacturing process of cement is given in Fig. 10.2 (below):

Process Costing – Determination of Unit Cost

ADVERTISEMENTS:

In process costing, the emphasis is on accumulation of costs for a process during a given period of time and the number of units produced in the process during that period. To determine the unit cost of output of each process, the total production cost of the process is divided by the total quantity of the output of the process during a given period. Process costs are generally calculated at the end of the period, on completion of manufacture.

Process industries may also have problems of joint/by-products. To ascertain the cost of each joint/by-product, common costs are apportioned among the joint-by-products on some equitable basis.

Process Costing – Top 11 Features

1. In process costing system the emphasis is on the period of time and the number of units completed during that period.

2. Costs, both direct and indirect, are accumulated in cost accounts on a regular basis. At the end of the costing period, costs are charged to different processes.

3. At the end of a costing period (generally a month) a document known as the Production report is prepared for each process, showing the number of units produced during that period.

4. Total cost of each process is divided by the total number of units produced in the process, to obtain an average cost per unit for the period.

5. There is often a loss in process due to spoilage, wastage, evaporation and so on. The loss may be normal or abnormal.

6. If there is normal loss, the loss is borne by the good units completed, thus increasing the average cost per unit.

7. If there is abnormal loss (actual loss is more than the normal loss), the abnormal loss is valued just like a ‘good’ unit and debited to the “Abnormal Loss Account”.

8. The output of one process becomes the input to the next process until the finished product is made in the final process. The output from the final process is transferred to the Finished Stock Account.

9. If the product is processed in more than one process or department, cost of one process is transferred to the next process. Total cost per unit is computed after the final process.

10. Product and processes are completely standardised (it means same quantity and quality of materials are used and all products are processed in the similar manner).

11. The factory is divided into departments / processes. Each department / process performs specific job regularly.

9 Important Features of Process Industries

The following are the important features of process industries:

1. Continuous Production – Production is on a continuous basis, except during shutdown for repairs, etc.

2. Output of Previous Process, Input of Next Process – The finished product of one process becomes the raw material for the next process.

3. Standardised Products – Products and processes are completely standardised.

ADVERTISEMENTS:

4. Simultaneous Production – Different products, with or without by-product, are simultaneously produced in one or more processes.

5. Production for Stock and Sale – Output is uniform and is usually manufactured for stock and then sell and not for the specific order.

6. Normal Process Loss – Unavoidable ‘normal’ wastage usually arises at different stages of manufacture, for reasons like evaporation and chemical reaction, etc.

7. Further Processing of By-Products – In certain industries, the by-products may require further processing before they can be sold.

8. Main Product may be By-Product of Other Firm – A main product of one firm may be a by-product of another firm, which may be available in the market at prices which are lower than the cost of the first mentioned firm.

It is therefore essential that the comparative costs are known so that advantage can be taken of market conditions.

ADVERTISEMENTS:

9. Equivalent Units – In order to obtain accurate average cost, it is necessary to measure the production at various stages of manufacture. For this, the work- in-progress in each process, if any, is converted into equivalent units of finished products to ascertain the cost of work-in-progress and finished goods.

Process Costing – Top 8 Characteristics

Characteristics of process costing in brief are as under:

1. The factory is divided into a number of process cost centers or departments and in each cost center an account is maintained—setting up progress cost centers.

2. All types of costs—direct and indirect relating to process are recorded for each process.

3. The finished product of one process is the raw material for the next process and this procedure continues until the final product arrives. The products and processes are standardised.

4. The cost of the previous process is transferred to the subsequent process along with the output.

ADVERTISEMENTS:

5. Total cost of the finished final product comprises of all costs incurred in all the processes.

6. Finished products at the end are homogeneous i.e., indistinguishable.

7. The cost of normal wastages is added to the good units produced. Apart from this, there occur abnormal wastages and abnormal gains.

8. In certain industries, there arise by-products or joint-products, which require further processing.

Process Costing – Objective

(i) To calculate the cost of production of each process and each unit in the different processes.

(ii) To calculate the cost of production of joint products and by-products separately.

ADVERTISEMENTS:

(iii) To distribute the joint expenses on the various products produced.

(iv) To know the wastage in each process of production. The wastage may be normal or abnormal. There can be abnormal gain also when the actual production is more than the expected production. The quantity as well as the values of these losses can be known through the process costing.

(v) To calculate the profit or loss of each process as the product may be sold after completing any of the process on the raw material.

(vi) To control the cost of production at the level of each process so that overall cost of production may remain under control or may be reduced.

(vii) The process costing of each process provides the base for the valuation of opening stock and closing stock of each next process. As the cost of production of the previous process is considered the cost per unit of opening as well as closing stock of the next process.

Industries Where Process Costing is Commonly Used (With Classification)

Process costing is most commonly used in industries that produce essentially homogeneous products on a continuous basis.

Name of some industries are given below:

1. Cement

2. Chemical

3. Sugar

4. Iron and Steel

5. Paper Manufacturing

6. Bricks Manufacturing

7. Oil Refinery

8. Food Processing.

In addition to the above, process costing is often employed in companies that use a form of process costing in their assembly operations. Examples are – Tata Motors (cars and trucks), Sony (T.V. and Video monitors) Compaq (personal computers), Nokia (mobile phones), etc.

Classification of Industries Using Process Costing:

Following attempt to classify industries using process costing will help to visualise the manufacturing conditions, under which process costing can be used:

- Single Product Plant:

Many firms manufacture single product continuously. This single product can be produced in one department or in several consecutive departments. The examples are electric power, steam, gas, cement, etc.

- Firms Manufacturing more than one Product:

There are several possible conditions, which may exist under this category:

(a) Production of a variety of products using the same production facilities.

(b) Separate products are produced, but the second product uses some of the first product in its manufacturing operations. In a fertiliser plant, acid phosphate is produced in one department. Some of this is sold and the rest is used in manufacturing fertiliser.

(c) A number of products are produced. In the course of manufacturing operations, the work done in one department is transferred to several departments, after which further production results in several products. This type of continuous process manufacture is used by rubber manufacturers, oil refineries and chemical producers.

Process Costing – 4 Main Elements of Production Cost

The following are the main elements of production cost in process costing:

(i) Direct Material.

(ii) Direct Labour

(iii) Direct Expenses

(iv) Overheads.

Element # (i) Direct Material:

Under process costing generally all the material required for production is purchased and issued to the first process. The output in whatever form of the first process becomes the raw material for the next process and so on. In different processes additional material may be added as per the nature and the requirement of the product. The whole of material issued or used for the process is shown in the debit side of the process account.

Element # (ii) Direct Labour:

The payment of wages or salaries to the workers engaged to carry out the work of that particular process is debited to that process for which it is paid. As the manufacturing procedure becomes more and more automatic or capital intensive there the labour expenses start decreasing and overheads start increasing. Whatever the labour cost of the process is shown in the debit of that process.

Element # (iii) Direct Expenses:

All those expenses which are specially incurred for a process like corks, bottles, bags or primary packing material is the direct expenses incurred for that product or process.

Element # (iv) Overheads:

Overheads can be factory overheads, office overheads and selling and distribution overheads. All these overheads expenses are distributed or apportioned among all the processes on a reasonable and relevant base.

If base of distribution is not given in the problem then these are distributed on the basis of labour cost because it is more scientific, relevant and appropriate as most of the overheads are related to the welfare of the workers. The share of the overheads of each process is shown in the debit of the concerned process account.

Process Costing – Steps Involved to Solve Process Cost Problems (With Illustrations)

Most process cost problems can be solved by a uniform approach involving following steps:

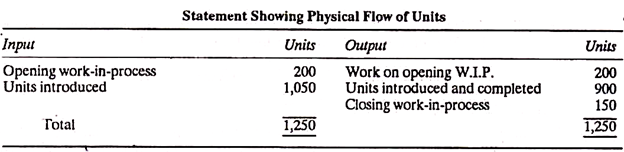

Step no. 1 — Physical flow of production:

First step is to trace the physical flow of production. For this purpose a statement is prepared showing input and output of the process in physical units.

Statement showing the physical flow of units is prepared in the following form:

Above statement shows:

(a) Units introduced in process both in the form of opening inventory and fresh units.

(b) How units introduced have been taken care of? Work done in process involves —

i. Completing 200 units of opening work-in-progress and

ii. Completing 900 newly introduced units.

(c) Work done on closing work-in-process.

Thus, it is necessary to quantitatively identify – (i) input in the form of opening inventory and fresh units (iii) output in the form of —

i. Completing opening work-in-process, i.e., opening W.I.P. which was completed during process.

ii. Completing fresh units introduced, i.e., fresh units which were introduced and completed during the process.

iii. Closing work-in-process.

The statement showing physical flow of units will also indicate normal or abnormal loss.

Step no. 2 – Note the inventory costing method followed:

The effect of using LIFO method, FIFO method and average method will be different on the unit cost of the process.

Step no. 3 — Note the state of introducing the material in process:

Material can be introduced in the beginning, in the middle or at the end of the process. The stage at which material is introduced will significantly affect cost per unit of the process.

Step no. 4 — Work done on unfinished units should be expressed in terms of “equivalent production”:

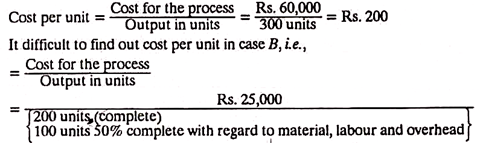

Work done in process is represented by completed units as well as partly finished units. The difficulty experienced in allocating the cost, when work done is expressed both in terms of finished units and unfinished units, can be visualised by comparative study of statements in case A and case B.

Case A:

Work done in process P by SV & Co. during the period from Jan. 1 to Jan. 31 is as follows:

300 units complete in all respects.

The cost incurred in the process during the period is Rs.60,000.

Case B:

Work done in process P by SV & Co. during the period from Jan. 1 to Jan 31 is as follows:

200 units complete in all respects.

100 units 50% complete with regard to material, labour and overhead.

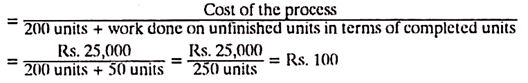

The cost incurred in this process during the period is Rs.25,000.

It is easy to find out cost per unit in case A, i.e.,

In this case denominator is not one figure. This difficulty will always be experienced, when work done is represented both by finished and unfinished units. To avoid this difficulty, work done on unfinished units is expressed in terms of equivalent completed units, 100 units, which are half finished with regard to material, labour and overhead.

Therefore, in case B, work done is equal to 250 complete units, cost per unit for case B will be:

“Equivalent production” is a technique by which work done on unfinished units is expressed in terms of “completed units” only. This idea to find out units, which would have been completed, if the work done on unfinished units had been done for finished units only. The concept of “equivalent production” is used for assigning cost of process to both finished units and unfinished units.

When work done in process includes work done on unfinished units also, it is advisable to prepare a statement of equivalent production. This statement shows element wise details of work done in terms of completed units only.

Equivalent Units:

CIMA defines this term as – “notional whole units representing completed work. Used to apportion costs between work in process and completed output”.

Step no. 5 — Determining element-wise details of total cost of process to be accounted for:

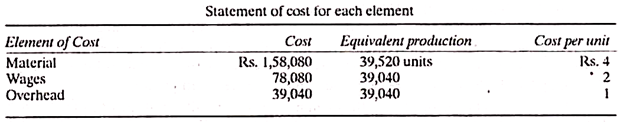

This can be done by preparing a statement of cost for each element.

This statement is prepared on the following pattern:

From the above statement it is clear that element-wise details of cost should be collected and it should be divided by number of equivalent units to arrive at cost per unit for each element.

Step no. 6 — Apportionment of process cost:

Output of process can be broadly expressed in the following categories:

(a) Units completed,

(b) Abnormal loss/Abnormal gain,

(c) Closing work-in-process.

No reference is made to normal loss in process, because it is shared by good production.

A statement prepared showing apportionment of process cost is as follows:

(a) Cost of units introduced and completed,

(b) Cost of abnormal loss/abnormal gain,

(c) Cost of closing work-in-process.

1. Determination of Cost of Process with no Process Loss:

When no complexity of process costing is involved, process cost determination is a very simple exercise. All material, labour, direct expenses and proportionate share of overhead are debited to the process account and total accumulated cost is transferred to the following process as the raw material cost of that process.

2. Process Costing with Normal Loss:

Certain production techniques are of such a nature that some loss is inherent to the production. When product components are made out of a sheet of the metal, some waste of metal is unavoidable. Similarly, there are weight losses in processes due to evaporation, burning and melting.

By past experience and data available relating to industry, a rate of normal loss is always mentioned with specification of production techniques. If the loss is within the specified limit, it is referred to as normal loss. A company may state that normal loss in process A will be 5% of input or throughput.

In a case like this losses up to 5% of input will be categorised as normal loss of the process. The cost of normal loss in process is absorbed as additional cost by good production in the process.

If it is given in problem that normal loss will form a particular percentage of production in the process, then production figure will be arrived at as follows:

Production = (Opening Stock + units transferred in process – Closing Stock.)

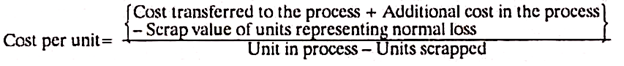

If the scrap relating to units representing normal loss fetches some value, process account is credited with the same and process cost per unit of that process is determined as follows:

3. Process Costing with Abnormal Loss:

Abnormal loss refers to the loss which is not inherent to manufacturing operations. Cost of normal loss is shared by good production in the process, but the same treatment cannot be given to abnormal loss.

Abnormal loss cannot be treated like overhead of the process to be shared by good units. Units’ representing abnormal loss are valued like good units produced and the value of units representing abnormal loss is debited to a separate account which is known as abnormal loss account.

Abnormal loss represents an area, which could have been influenced by efforts. Therefore, this loss is kept in a separate account so that reasons for the loss are detected. Abnormal loss is closed by its transfer to profit and loss account at the year end. If the scrap of units representing abnormal loss fetches some value, it should be credited to abnormal loss account and not to the process account.

The balance of abnormal loss account, i.e., difference between values of units representing abnormal loss minus scrap value relating to these units should be transferred to profit and loss account for the year.

Scrap value of normal loss account is credited to process account and scrap value of units representing abnormal loss is credited to abnormal loss account. A doubt may arise, why it is so. Normal loss is inseparably linked with manufacturing operations of the process.

Therefore,the cost of normal loss should be borne by good production during the process. For scrap value relating to normal loss is credited to the process account so that only the actual cost of normal loss is shared by good production in the process.

Abnormal loss represents good units, which could have been produced, if operation had been carried out according to accepted norms relating to manufacturing operations. For this reason, units representing abnormal loss are treated at par with good units for the purpose of valuation.

All cost relating to abnormal loss is debited to abnormal loss account and credited to process cost account so that the cost, which could have been avoided according to norms of operations, is kept separately to facilitate control action to be taken.

The scrap value relating to units representing abnormal loss is credited to abnormal loss account so that only actual cost relating to abnormal loss is debited to profit and loss account at the year end.

Following steps are suggested for valuation of abnormal loss in the process:

(a) Determine the normal production presuming no abnormal loss.

(b) Determine the total accumulated cost relating to the process, i.e., cost transferred + cost introduced in the process (material, labour and proportionate share of overhead) – scrap value of normal loss.

(c) Determine the cost per unit of normal production by dividing the result of step No. 2 by result of step No. 1.

(d) Rate arrived at by step No. 3 should be applied for valuation of both unit representing abnormal loss and output of the process.

4. Process Costing with Abnormal Gain:

Hitherto discussion was confined to a situation where actual production of the process was less than production expected as per norms either due to normal factors or due to abnormal factors. A reverse situation may be experienced, where actual production may happen to be more than the norms of the company permit.

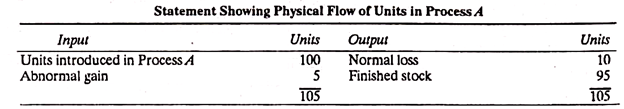

A company may state that 10% of input will be normal loss of process A. Suppose, input in process A is 100 units, normal loss of process A should be 10 units and normal production of process A should be 90 units.

If actual production of process A happen to be 95 units, will 5 units represent abnormal gain in process A? Abnormal gain represents good units, which should not have been produced if the production in the process had been strictly according to accepted norms. This situation arises when output of the process is more than normal production of that process.

Normal production is represented by input minus normal loss relating the performance. For this reason value of units representing abnormal gain is debited to process account and credited to abnormal gain account. When there is abnormal gain, statement showing physical flow of units should indicate it.

Suppose following cost data relating to process is given:

Input in process A is 100 units; Normal loss relating to process 4 is 10%. Actual output is 95 units.

When there is abnormal gain, value of units representing abnormal gain should be debited to process account. For valuation purpose, abnormal gain is treated at par with good units. Normal production in process A should have been 90 units, if there had not been abnormal gain of 5 units. For the purpose of valuation, 5 units should be valued at the rate, at which 90 units would have been valued.

Following steps are suggested for valuation, when there is abnormal gain in the process:

(a) Determine the normal production, presuming if there had not been abnormal gain in the process.

(b) Determine the total accumulated cost relating to the process, i.e., cost transferred + cost introduced in the process (material, labour and proportionate share of overhead) – scrap value of normal loss.

(c) Determine the cost per unit of normal production by dividing the result of step 2 by result of step 1

(d) Rate arrived at by step 3 should be applied for valuation of units representing abnormal gain and output of the process transferred to either next process or finished stock account.

(e) Adjustment for scrap value in case of abnormal gain. When there is abnormal gain, the process and units representing normal loss fetch some scrap value. The balance at the credit of abnormal gain account is transferred to profit and loss account for the year after an adjustment of “scrap value”.

In the above situation, process A will be credited with Rs.20 being the scrap value for 10 units (normal loss). It should be noted from cost data given above that actual loss in the process will not be 10 units. It will be 5 units, i.e., input of 100 units—output of 95 units. Therefore, Rs.20 credited to process account will not be realised in full. Only Rs.10, i.e., scrap value of 5 units will be realised.

For this reason, the amount standing at the credit of abnormal gain account will not be transferred to profit and loss account as it is. Amount of scrap value relating to five units will be debited to abnormal gain account and the balance thus arrived at will be transferred to profit and loss account for the year. This adjustment is always carried out when there is abnormal gain and units lost fetch some scrap value.

Process Costing – Prerequisites

1. The products must pass through two or more specific clearly identifiable production stages. Each stage of production is called a process.

2. The output of each process in semi-finished condition should become the raw materials for the subsequent process.

3. The products produced must be identical and standardized.

4. The production of goods must be continuous and on large scale.

Process Stocks (With Illustrations)

Sometimes there may arise the question of stocks in the various processes of a manufacturing concern.

These stocks may be of:

i. Raw Materials,

ii. Finished Goods, or of

iii. Semi-Finished Goods or Work-in-progress

i. Stock of Raw Materials:

Stock of raw materials represents the stock of unused materials in various processes. Stock of raw material in the first process of a product in a manufacturing concern, if any, shall represent the basic raw material of that concern to be returned to the Stores Department.

But the stock of raw material in the subsequent processes (opening as well as closing) shall be treated as the finished product of the preceding process to be valued at the rate at which it was transferred from the preceding process to the concerned process. The opening stock is shown on the debit side of the account prepared for the process concerned while the closing stock is shown on its credit side.

Treatment of stocks of raw material in the process accounts can be explained with the help of the following example –

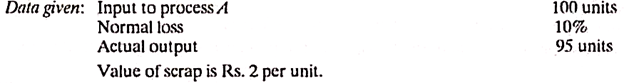

Illustration:

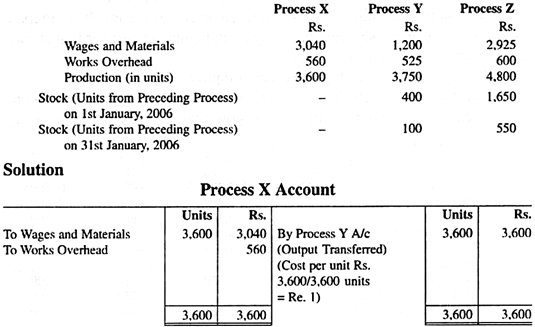

From the following figures, show the cost of the three processes of manufacture. The production of each process is passed on to the next process immediately on completion –

ii. Stock of Finished Goods:

In some cases, the entire output of a process may not be transferred to the subsequent process and a part of it may be held in the processing department in its finished form. Such stock of finished goods (opening as well as closing) is valued on the basis of the cost per unit as shown by the concerned process account (in which stock is held) for the relevant periods.

For the purpose of dealing with the stocks of finished goods, a separate Process Stock Account is prepared with each process. The output of each process is first transferred to its Process Stock Account and from there to the next process account.

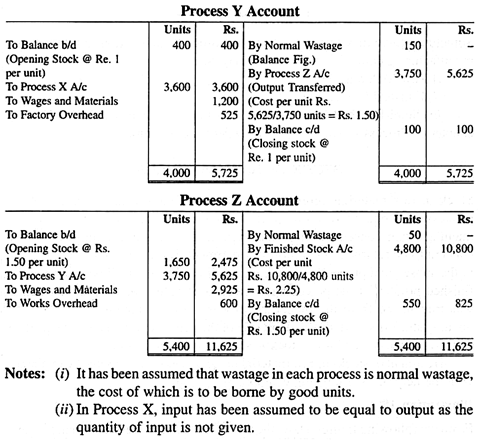

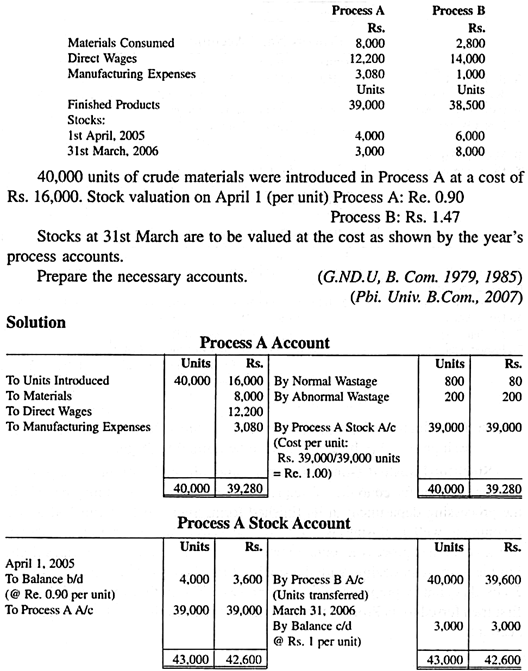

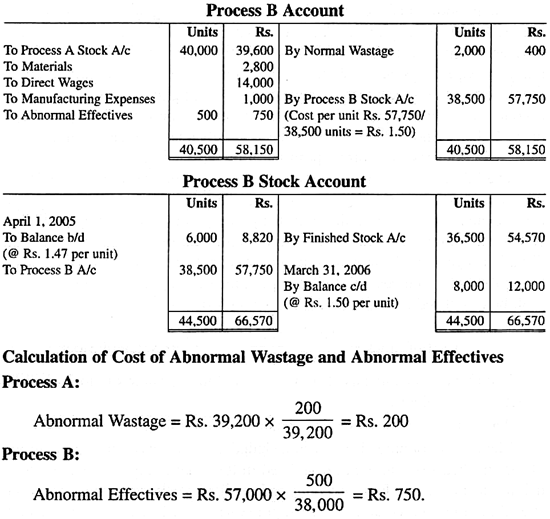

Illustration:

The product of a company passes through two processes, namely A and B respectively. From past experience the percentage of loss, which is computed on the number of units entering the process concerned, is ascertained as under –

Process A – 2%

Process B – 5%

The loss of each process has a scrap value. The wastage of Process A is sold at Rs.10 per 100 units and that of Process B at Rs.20 per 100 units. The following information is available for the year ended 31st March, 2006 –

General Principles or Rules Used in Calculation of Process Costing

The following principles or rules are generally applied to calculate process costing for each process carried out in the organisation:

(i) A separate account for each process is opened and each process is considered as a separate department or cost centre to calculate cost of each process.

(ii) All the direct and indirect expenses related to a specific process are shown in the debit of the concerned process.

(iii) All the losses which takes place in a process are shown in the credit of that process account.

(iv) If there is any by-product in any process and the by-product has any sale price or market price then it is shown on the credit of the process concerned.

(v) The output of the previous process is transferred to the next process, and the final product is then transferred to Finished Stock account.

(vi) When total cost of the process is divided by the units produced in that process it results into per unit cost of that process.

(vii) In process costing system the units produced in each process are also recorded and hence there is a separate column for units introduced and units produced in every process. The normal loss, abnormal loss or abnormal effective are also recorded in units in the process account as the case may be.

(viii) If the half manufactured goods or work in progress is sold during any process then it is shown in the credit of the concerned process account.

(ix) If the product of one process is transferred to another process by adding profit then the goods transferred in the credit by adding profit in that and the profit is shown in the debit of the process account.

3 Major Processing Methods: Sequential Processing, Parallel Processing and Selective processing (With Examples)

There are three major processing methods:

(i) Sequential processing;

(ii) Parallel processing; and

(iii) Selective processing.

Method # (i) Sequential Processing:

In sequential processing system, products flow in sequence from one processing department to another processing department. The costs are transferred from one process account to another as the product is transferred.

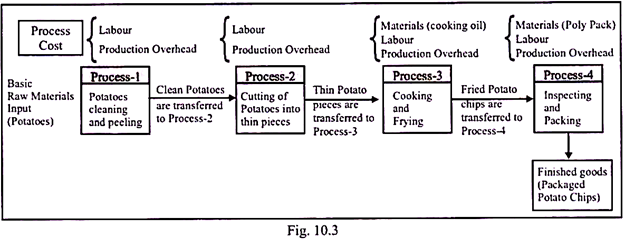

An example of sequential processing is provided below.

Following is a hypothetical potato chips manufacturing company:

Method # (ii) Parallel Processing:

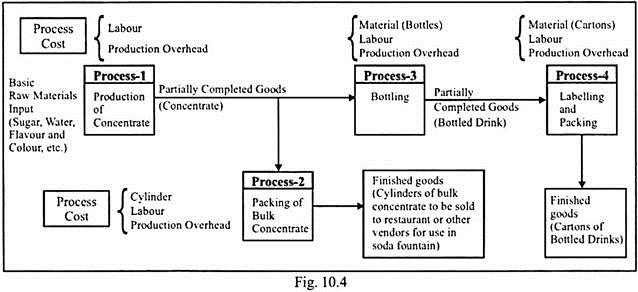

In parallel processing system, after a certain point, two or more products go through two or more separate sets of processes simultaneously. Let us take the example of Reliance Industries Ltd.

In their petroleum refining operations, crude oil is processed initially in one processing department and then the refined output is further processed by different processes simultaneously to get different end products.

An example of parallel processing is provided below.

Following is a hypothetical cold drink manufacturing company:

Method # (iii) Selective Processing:

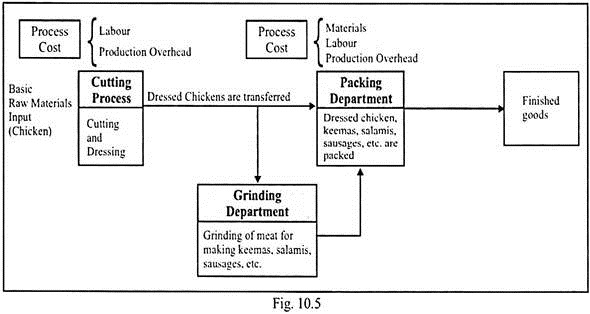

In selective processing system, products go through some but not each processing departments. According to the requirement, some portion of the output is processed further.

For example, in a Chicken processing plant, all products start at the cutting process. Some of the dressed chickens are directly transferred to packaging department and then to finished goods department. Some part of the dressed chickens are transferred to the grinding department and then to the packaging department and finally to the finished goods department.

Double Entry Book Keeping in Process Industries

Double Entry Book Keeping:

For the purpose of cost accounting, a process industry is divided into departments, each department representing a particular process. A foreman/supervisor is responsible for the efficient functioning of his department.

A separate account is prepared for each process on the basis of double entry book keeping with quantity column alongside the amount (total cost) column. Depending on the nature of data and requirement, quantity column may be dispensed with. If desired, the prefix ‘To’ on the debit side and ‘By’ on the credit side may also be avoided.

The account is debited with the cost of materials, labour and overheads relating to the process and the value of byproducts and scrap is credited. The balance of this account, representing the cost of a process, is passed on to the next process and so on until the final product is completed.

In some industries, depending upon the plant arrangement, the output of the process may be transferred to the process stock account from which it may be issued to the next process as and when required.

From the viewpoint of cost accounting, there could be processes which may or may not have process losses. Similarly, in respect of each process, there may or may not be work-in-progress at the beginning or at the end.

Process Costing – Procedure

For each process a separate account is opened. All direct expenses and indirect expenses relating to the product are debited to the process account concerned. If one process completes the manufacture, the units produced are transferred to finished stock. If finished product of one process is required by the next process as raw material, the units produced are transferred to the next process account.

The total cost of each process, after adjusting the value of work-in-progress (opening and closing) for each cost period, being divided by the number of units produced by that process during the same period, gives the unit cost. The process account may be ruled with an additional column to show the unit cost.

Process Costing Procedure (With Illustration)

Under process costing, the manufacture of a product is divided into well-defined processes. A separate account is opened for each process to which all costs incurred thereon are charged. The total number of units produced during a given period is calculated and by dividing the total cost of a process by the total number of units produced, the cost per unit shall be obtained.

The finished material of one process constitutes the raw material of the next or subsequent process and therefore, the finished material as also the cost of each process is transferred to the next process till it is transferred to the Finished Stock Account.

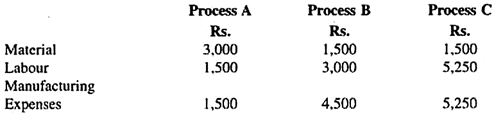

The process costing procedure can be explained by means of the following illustration –

Illustration:

A product passes through three processes, Process A, Process B and Process C, to completion. The production of the commodity was 1,000 tonnes.

The costs were as follows –

Assume that there was no work-in-progress either at the beginning or at the end. Show the process costs for each process and the total cost of the finished product.

Process Costing – Equivalent Production: Calculation and Procedure

In a manufacturing unit generally it is not possible to complete the work on all the units on which work has been started. Along with the completed units in all respect at the end of the specific period (may be the month or six months (or a year) there may remain some unit on which work has been started and may be finished upto an advance stage in respect of material labour or overheads but which are not fully complete.

For the purpose of simplicity say (work in progress) on which work started but not completed. To convert the work in progress or partly completed (manufactured) units into fully complete units (assumption only) is known as Equivalent Production.

For simplicity let us suppose on January 1, 2019 the work was started on 3000 units. But on 31st January, 2019 if none of the units is fully complete (means not in a saleable condition) but on these 3000 units 80% work has already been done or finished upto the end of January 2019 then we can say the Equivalent Production for the month is 2,400 units (i.e., 3,000 x 80/100).

lf we take the efficiency of the organisation in terms of completed units only then the efficiency for January 2019 will be zero because there is no complete unit produced. But if we take the concept of equivalent unit into consideration for measuring efficiency then we can say the output for Jan. 2019 is equal to 2,400 units and the efficiency level for the period is 80%.

So equivalent unit may represent the production of a process in terms of completed unit. It also means converting the uncompleted units into equivalent of completed units. The degree of completion of work in progress is a technical estimate and thus it needs the expertise opinion otherwise stock value will be recorded wrongly and thus the final accounts will not show true and fair picture of the business.

Equivalent unit = Actual number of units in progress of manufacturing x Percentage of work

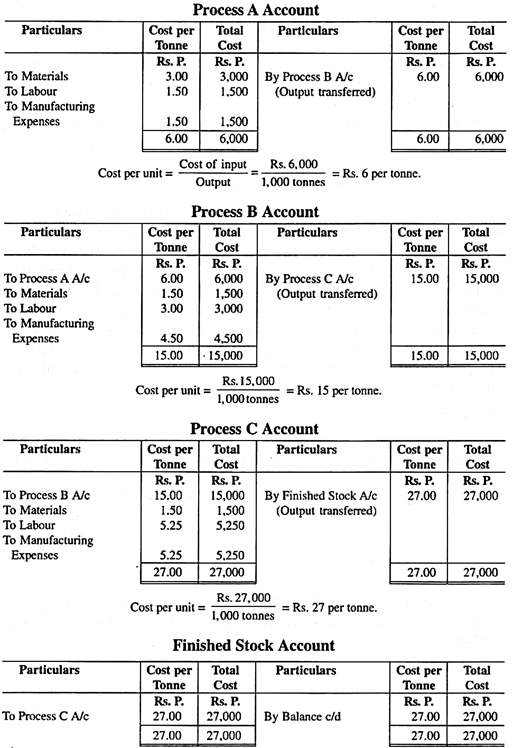

Calculation of Equivalent Production:

Method I:

The steps are:

(1) Opening work in progress x Work not done

Add – Units completed during the period

(i.e., units started less closing stock)

Add – Closing stock x Work done

As for example –

Opening work in progress 6,000 units. 40% work completed. Units Introduced in the process during the period 30,000. Closing Stock 8,000 units, 30% complete.

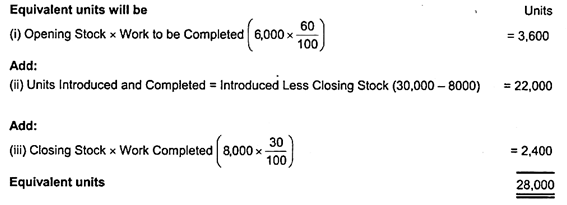

Method II:

Units completed during the period (Units started + Opening stock of units – Closing stock of units)

Add – Units of closing stock completed during the period.

Less – Opening stock units completed during the previous period.

As for example –

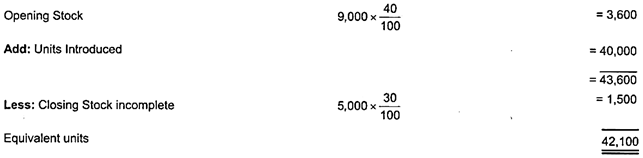

Opening Stock 9,000 units, 60% work completed. Units introduced during the period 40,000 units. The closing stock is 5,000 units on which 70% work is complete.

Method III:

Opening Stock work not done in previous period (i.e., work incomplete)

Add – Input of unit – incomplete

Less – Closing stock – work not done (work incomplete)

The same example in method II can be done as below –

Procedure for Evaluation:

The steps in evaluation can be:

(i) Calculate Equivalent Production for the period.

(ii) Calculate the process cost according to the elements of cost.

(iii) Calculate the cost per unit of Equivalent output according to each element of cost.

(iv) Calculate the total cost of the production.

For this purpose the following three statements are to be prepared:

(i) Statement of Equivalent Production.

(ii) Statement of Cost.

(iii) Statement of Evaluation.

Process Costing – Valuation of Work-in-Progress

In process industries there must be some partially finished units i.e., work-in-progress (opening and closing) in each process at the end of an accounting period. The cost of such unfinished units is lower than a finished unit.

Hence, when there are inventories of WIP, unit cost cannot be obtained by simply dividing the total cost by the number of units processed. Units in WIP must be converted to a base which can be equated with completed production. This is called ‘Equivalent Production Analysis’.

CIMA has defined equivalent units as – “a notional quantity of completed units substituted for an actual quantity of incomplete physical units in progress, when the aggregate work content of the incomplete units is deemed to be equivalent to that of the substituted quantity of completed units”.

For example, 200 units 50% complete will be equal to 100 equivalent units. Equivalent production is obtained by multiplying the actual number of units in process by their stage of completion in terms of cost. Suppose, 6,000 units are completed and transferred to the subsequent process, and 3,000 units remain incomplete (at the stage of 40% completion) at the end of the period.

The equivalent units for the period will be 7,200 units, i.e., 6,000 + 40% of 3,000. If the costs incurred during the period is Rs. 14,400, the cost per equivalent unit will be Rs. 2, i.e., Rs. (14,400/7,200).

The finished output and WIP are valued as follows:

The stage of completion may be different for different cost elements, e.g., materials may be 100% complete but labour and overheads may be 40% complete. Thus, equivalent units are to be calculated separately for each cost element. Equivalent units are not physical units but they are abstract units used to facilitate calculation of product costs and performance.

Process Costing – Opening Work-in-Progress: FIFO Method, Average Method and Weighted Average Method

When opening WIP is involved, the value of completed units transferred to the subsequent process is computed either by:

(a) FIFO (First-in-first-out) Method, or

(b) Average Method & Weighted Average Method.

(a) FIFO Method:

Here WIP moves on a first-in-first-out basis, i.e., unfinished work on opening WIP units is first completed before taking up work on any new units. Hence none of the opening WIP will find a place in the closing WIP. This is shown separately in the statement of equivalent production units.

The inventory costs brought forward from previous year is not added to the current costs. The objective of this method is to value the closing WIP at current costs.

(b) Average Method & Weighted Average Method:

Average Method:

This method is used when degree of completion of opening WIP is not given. The opening WIP units are not shown separately in the equivalent production statement, but are included in the total units completed and transferred to the subsequent process/finished stock.

The value of opening WIP is added to the costs incurred during the current accounting period, and the total cost is divided by the total equivalent units to get the average cost of equivalent units. Thus, element wise breakdown of cost into material, labour and overheads is absolutely necessary.

Weighted Average Method:

Where several dissimilar products are produced in the same process, a close study of production and costs of each variety of products is essential. The relative importance of one as compared to others should also be indicated in terms of points. These points are used as a common denominator.

To find cost of production in this method, statements of weighted average production in terms of points and cost for each variety of products should be prepared. When weights or points are considered, the calculation of weighted average process cost becomes easy.

FIFO vs Average Cost Method:

Both the methods have certain advantages. The main difference between the two methods is that they treat the opening stock of WIP in a different way.

In FIFO method, it is shown separately. Costs incurred to finish this opening WIP are added to the opening WIP cost to arrive at the total cost of completed units of opening WIP at which it is transferred to the subsequent process.

Units which have been introduced in the process and completed during the same period have their own unit cost. This cost may not be the same as the completed unit cost of units of opening WIP.

In average cost method, the cost of opening WIP is added to material, labour and overhead costs incurred during the period. The cost per unit is obtained by dividing these costs by equivalent production. When prices are rising, (i.e., during inflation), FIFO indicates a lower cost of units finished and a higher inventory value as current costs are applied to closing inventory.

When prices are declining, the FIFO indicates lower profits as older or higher prices are applied to units completed and sold. The average method tends to narrow the wide fluctuations in prices. Hence average method is widely used.

FIFO is used when the value of opening WIP is a lump sum figure and the degree of completion is not given. Average method is used when opening WIP is given in terms of materials, labour and overhead but the degree of completion is not mentioned. If the stage of completion and the value in terms of materials, labour and overhead of the opening WIP are mentioned, then either FIFO or Average method, may be used. If the question specifies a method, then that method is applied.

Steps in Valuation of Equivalent Units:

1. Reconcile units input to the production process with the units output or in process at the end of the period.

2. Convert the physical units as obtained in (1) into equivalent units of production for each cost element, i.e., material, labour and overheads.

3. Compute the total costs for each cost element during the period.

4. Divide the total costs by equivalent units to get the cost per equivalent unit.

5. Multiply equivalent units by cost per equivalent unit to determine the cost of completed production and work-in-progress.

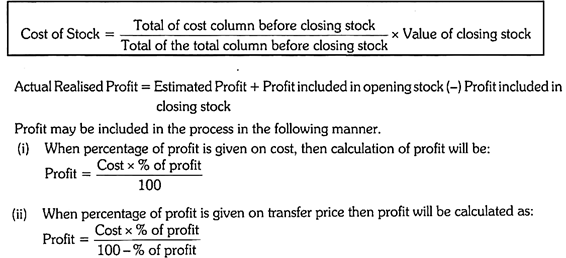

Process Costing – Reasons for Introducing the Concept of Profit from one Process to Another (With Formula)

In so many organisations the management may decide to transfer the product of one process to the next process not at the cost of production but at the market price or by adding profit in the cost. The profit may be agreed percentage either on cost price or on transfer price.

The reasons for introducing the concept of profit from one process to another process may be the following:

(i) To compare the cost of production with the market price.

(ii) To analyse the efficiency or the inefficiency of each department or process involved the production.

(iii) To decide whether to produce or to purchase the product of process from the market is profitable or not.

(iv) To keep the secrecy of the cost of production.

(v) To find out the economies of production in the factory.

But the concept of inter-process profit results into complication of accounts as the stock of the 2nd, 3rd and all the next process will include the element of the profit and the final account will not show the true and fair picture of the business. The reason being business is earning profits from itself. So provision is to be created to value the stock at cost price when the concept of inter-process profit is introduced.

In order to compute the profit element in closing stock and to obtain the net realised profit for a period, three columns have been introduced on each side of the process accounts and closing stock have been deducted from the debit side of the process account in place of showing the closing stock on credit side of the process account.

The cost of the stock is calculated with the following formula:

Reserve for Unrealised Profit:

As the goods are transferred at profit so for the amount of profit included in stock needs the creation of reserve for unrealised profit. The purpose is to show the value of closing stock at cost price in place of inflated price.

Process Costing – By-Products and Joint Products (With Accounting Methods)

By-Products:

By products are defined as ‘any saleable or usable value incidentally produced in addition to the main product.’ Thus, by-products mean secondary products (in terms of sales value usually) arising in the course of manufacturing the main product(s). By products possess a lesser value when compared to main products.

In Dairy industries, butter or cheese is the main product, but butter milk is the by-product. In an Oil refinery, petrol is the main product, while sulphur, chemical fertilisers, bitumen are the by-products.

By-products may require further processing after being separated from the main products. The point at which they are separated from the main product is called the ‘split off point.’ Till the split-off point all expenses incurred are considered to be joint expenses.

Accounting for By-Products:

The accounting methods of by-products may be classified into:

1. Non cost methods

2. Cost methods.

1. Non Cost Methods:

(i) Other Income Method – In this method the sales value of by products is credited to profit and loss account, treating it as miscellaneous income.

(ii) By products sales deduced from total cost – Under this method the sale proceeds of the by-products are treated as deductions from total costs. The sales value is deducted either from the production costs or cost of sales.

(iii) By-product sales added to the main product sales – In this case all costs incurred on main and by-products are deducted from the combined sales of the main product and by-products.

(iv) Crediting sales value less administration, selling and distribution expenses – In this method, a portion of the administration, selling and distribution overhead incurred for disposing of the by-product is deducted from the sale value for credit to process account.

(v) Crediting sales value less the costs incurred on by-products after split off point – In certain cases it becomes necessary to perform some further operations on by-products after the split off point, in order to make it saleable. Credit is given to the process account for sale value less the cost after split off point.

(vi) Reverse cost method – Under this method, an estimated profit from the sales of by-products, selling and distribution expenses and further processing costs after the split off points are deducted from the sale value of by-products and the net amount is credited to the main product.

2. Cost Methods:

(i) Opportunity or replacement cost method – This method is followed where by-products are utilised by the factory itself as input material for some other process. The opportunity cost or replacement cost which otherwise would have been incurred if the by-products were to be purchased from outside suppliers is taken as the basis for costing by-products. The process account is credited with the value of by-products so ascertained.

(ii) Standard cost method – A standard cost is fixed on the basis of technical assessment for each by-product and credit is given to the process account on this basis. Because of the stability of this method, effective control would be exercised on the cost of the main product.

(iii) Apportionment on a suitable basis – Where by-products are of major importance, cost should be apportioned on the most suitable basis, i.e. Physical measurement, market value etc.

Joint Products:

In some industries, two or more products of equal importance and value are produced, simultaneously in a process. Such products are called Joint Products. Motor spirit, kerosene oil, fuel oil, lubricating oil, wax, tar and asphalt are the examples of joint products produced from crude petroleum.

Thus, joint products have the following features:

1. The products are the simultaneous outcome of the joint process and from the same raw materials.

2. The products have equal commercial value.

3. The products require further processing to finish them into more useful and valuable products.

The joint products cannot be identified as separate products up to a certain stage in manufacturing. This stage is known as the split off point. Costs incurred prior to this stage are joint costs, and costs thereafter are called subsequent costs. The cost before the separation stage has to be distributed to each product.

There are various accounting methods adopted for this purpose:

(i) Average Unit Cost Method:

In this method, the total process costs (up to the point of split off) are divided by the total weight or units produced to get average cost per unit of production. The process losses are borne by the joint products in the ratio of their output weight units.

This method can be applied where the joint products can be measured in terms of common unit such as litre, gallon, lb, kg, etc. Where the end products cannot be expressed in common unit, this method is not helpful.

(ii) Physical Unit Method:

A physical base, e.g., raw materials, is the proportion used to apportion pre-separation point costs to joint products. In other word the physical volume of materials found in joints products at the point of separation is found out and on that very basis the cost is apportioned. Process loss is borne by joint products in the ratio of their output-weight.

This method can be applied when physical units of production are similar or can be correlated by a factor or coefficients. This method may not be helpful where costs have no relationship to the output weight of individual products.

(iii) Survey Method:

In this method, all important factors such as volume, selling price, technical side, marketing process etc. affecting costs are ascertained by means of an extensive survey. Points values or percentages are given to individual products according to their relative importance and costs are apportioned on the basis of total points. These ratios should be revised from time to time depending upon the factors affecting production and sales.

(iv) Market Value Method:

This is the most popular method because it makes use of a realistic basis for apportioning joint costs. In this method joint costs are apportioned after ascertaining “what the traffic can bear.”

In other words, the products are made to bear a proportion of the joint cost on the basis of their ability to absorb the same. Market value means weighted market value i.e., units produced X price of a unit of joint product.

(a) Market Value at the Point of Separation or Relative Market Value Method:

This method involves the following steps:

1. The physical output of each product i.e. multiplied with the market price at the split off point.

2. The resultant market value of all products are then added.

3. The percentage of the market value of each product to the total of the market values is found out.

4. These percentages are used to allocate the total input cost among the joint products.

(b) Market Value after Further Processing:

Here the basis of apportionment of joint costs is the total sales value of finished products and involves the same principle.

(c) Net Realisable Value Method:

From the sales value of the joint products (at finished stage) the following are deducted:

1. Estimated profit margins.

2. Selling and distribution expenses, if any and

3. Past-split off costs.

The resultant figure so obtained is known as net realisable value of joint products. Joint costs are apportioned in the ratio of net realisable values. This method is widely used in many industries.

Process Costing With Process Loss

Process cost account keeping is very simple when there is no process loss. All materials, wages and overheads are debited to the process and the accumulated costs are transferred to the subsequent process.

Process Costing with Process Losses (Normal Loss, Abnormal Loss and Abnormal Gain):

In process industries, loss of materials is inherent. Such loss is called normal loss. Normal loss depends on the type and property of materials, nature of operation involved and other technical factors. It can be estimated in advance on the basis of past experience and its cost is added to good units of production.

It is an anticipated loss. If the loss is caused due to unexpected or abnormal conditions e.g., substandard materials, accidents, carelessness, bad workmanship, bad design, etc., it is called abnormal loss. Such loss can be minimised by appropriate corrective action. In fact, any loss exceeding normal allowance is considered as abnormal loss in process costing. It cannot be estimated in advance.

If the actual process loss is less than the estimated normal loss for using a different material or improved method, the difference is considered as abnormal gain. It may also be defined as unexpected gain in production under normal conditions. Suppose, a company specifies that 15% of its input will be normal loss of process I. If input is 100 units, then its normal output will be 85 units. If actual output is 90 units, then 5 units is considered as abnormal gain.

When normal loss fetches no value, the cost of normal loss is absorbed by good production units of the process. Thus the cost per unit of good production is increased. If the normal loss-units have some realisable value as scrap, then the value is credited to the process account to arrive at normal cost of normal output.

The units representing abnormal loss are valued like good units produced up to the stage of manufacture when the units are scrapped and debited to a separate account called abnormal loss account. Hence, the degree of completion of abnormal loss units is first identified and then they are converted into equivalent production units to arrive at the element wise cost. If the abnormal loss units have realisable value, then that value is credited to abnormal loss account. The balance of abnormal loss account, i.e., the value of units representing abnormal loss minus realisation value is written off to costing profit and loss account.

Units representing abnormal gain are valued like normal output of the process. The value of abnormal gain is shown on the debit side of process account and credit side of the abnormal gain account. Since abnormal gain occurs as a result of actual loss being less than normal, the scrap realisation shown against normal loss gets reduced by the scrap value of abnormal gain.

Hence, there is an apparent loss by way of reduction in the scrap realisation value attributable to abnormal effectives. This loss is set of against abnormal effectives by debiting the account. The balance of this account, i.e., abnormal gain is transferred to costing profit and loss account.

Process Costing – Loss in Weight and Sale of Scrap

In so many industries when the goods are in manufacturing process there can be loss in weight of the input of material due to evaporation, moisture like chemicals, spirit, alcohol, essence etc. There can be weight loss also in the material because of working as furniture making from wood, or boring and drilling on iron bars etc. This is known as scrap. The scrap sometime is sold at a nominal value in the market or may not having any value.

But it results into weight loss of the quantity in output. This loss is shown in the credit of process account. This loss increases the cost of production of the product produced in the process. If the scrap is sold then the sale value of scrap is also shown on the credit of process account which results into decreasing the cost of production.

Similarities between Job Order Costing and Process Costing

Similarities between Job Order Costing and Process Costing:

1. The main aim of both the systems are to assign material, labour and overhead cost to products and to provide a mechanism for computing cost per unit and control of cost.

2. Both systems maintain and use same basic accounts such as – raw materials control account, wages control account, production overhead account and finished stock account.

3. In both the systems, flow of cost is basically the same.

Raw materials → Work-in-progress → finished goods.

Different Forms of Process Accounts

The process accounts can be prepared in different forms due to various reasons like production of joint products and by-products, normal loss and abnormal loss, or may be due to transfer of the product of one process to another at profit and so on.

So, the process accounts can be prepared in the various forms like:

(i) Simple process accounts having debit and credit columns.

(ii) Loss in weight due to evaporation or scrap, etc.

(iii) When there is sale of half manufacturing product during the production process.

(iv) When there is a problem given regarding valuation of opening stock and closing stock.

(v) Problems may relate the abnormal loss or abnormal effectives.

(vi) Problems related to joint products and by-products.

(vii) Problem related to oil refining process.

(viii) Transfer of product by adding profit to the next process.

Difference between Job Costing and Process Costing

Difference # Job Costing:

(1) Cost Calculation – Cost is determined for every job or batch or product.

(2) Cost unit – Each Job or batch of product is the cost unit for which cost is ascertained.

(3) Nature – Each job is separate and distinct. Job may be dependent and Independent

(4) Controlling aspect – Since each job is separate and distinct, greater supervision and control is required by management.

(5) Completion of task – Completion of job is necessary for calculating of cost of a job, order.

(6) WIP (work in progress) – Work in progress is not a common feature. There may or may not be WIP in the beginning or at the end of the period.

(7) Production for – Job is undertaken only when there is an order from the customer.

Difference # Process Costing:

(1) Cost Calculation – Cost is determined for every process.

(2) Cost unit – Each distinct process of the production is cost unit.

(3) Nature – All process are related to each other. Output of one process, becomes input for the next process till it reaches to finished product.

(4) Controlling aspect – Since production is continuous and products are standardized so comparatively lesser control is required.

(5) Completion of task – There is no such requirement. Cost of process can be obtained even if product is incomplete.

(6) WIP (work in progress) – Since production is a continuous process therefore, normally there are opening and closing balances in process accounts.

(7) Production for – In process costing, products are standardised and production is carried on for stocks.

Difference between Contract Costing and Process Costing

Difference # Contract Costing:

1. Performance – In contract costing work is performed generally outside the factory or at the work site.

2. Production Order – Generally work is started after receiving the special order from the customer.

3. Transfer – In the contract costing every contract is separate and independent from each job or contract.

4. Cost Control – Being every job is separate and each job has special characteristics and the job is not standardised so cost control is difficult.

5. Cost Calculation – In contract costing actual cost can be known only after the contract is complete.

6. Per unit cost – In contract cost the total cost of each contract is calculated.

7. Separate Entity – In contract costing every contract is a separate entity.

Difference # Process Costing:

1. Performance – Work in process costing is performed within the factory premises.

2. Production Order – In process costing work is performed for stock purpose on the continuous basis.

3. Transfer – In process costing work of the next process depends on the work of the previous process. So, the processes are interrelated to each other.

4. Cost Control – Being each process is standardised and stable and can be predetermined so control is easier.

5. Cost Calculation – In process costing costs are calculated on the basis of period after the completion of the process.

6. Per unit cost – In process costing per unit cost is calculated after the process is complete.

7. Separate Entity – In process costing as the process is a continuous process so the products lose their separate identity.

5 Major Difficulties Confronted in the Course of Working a System of Process Costing

The major difficulties to be confronted in the course of working a system of process costing are:

(a) Proper treatment of wastage and scrap;

(b) Accounting for losses and gains in the course of processing;

(c) Computing the correct value of incomplete units at the end of the accounting period;

(d) Accounting for joint products and by-products that may emerge from a process; and

(e) Accounting for inter-process profits.

Process Costing – 6 Main Advantages

The advantages of process costing can be summarised as follows:

1. The cost of different processes as well as finished product can be computed conveniently at short intervals, say, daily or weekly.

2. Control over cost and production can be advantageously effected as pre-determined and actual data are available for each department or process.

3. It involves less clerical work because of the simplicity of cost records.

4. The average costs of homogeneous products can easily be computed.

5. Expenses can be allocated to different processes on rational basis and accurate cost, thus, can be ascertained.

6. It enables the correct valuation of closing inventories.

Process Costing – Major Disadvantages

1. The cost, ascertained at the end of the process is called historical cost which is of very small use for managerial control. Since it is based on historical costs, it has all the weaknesses of historical costing.

2. The system of costing conceals weaknesses and inefficiencies in processing.

3. It does not evaluate the efforts of individual workers or supervisors.

4. The valuation of work-in-progress on the basis of degree of completion is merely a guess work.

5. If production is not homogeneous, as in the case of foundries making castings of different sizes and shapes, the average cost may give an incorrect picture of cost.