Cost Sheet is a statement, prepared at given intervals of time, which provides information regarding elements of cost incurred in production. It discloses the total cost as well as the cost per unit of the product manufactured during the given period. If it is desired to compare the costing results of a particular period with any of the preceding periods, comparative columns can be provided in the Cost Sheet.

The cost sheet is prepared to ascertain cost of product/job/operation or to give quotations or to determine tender price for supply of goods or providing service.

A cost sheet is an exercise in collection of information regarding all the costs incurred in the industry and arranging them in a certain order. The information required to prepare a cost sheet is gathered from several records in the organization.

Contents

- Introduction to Cost Sheet

- Meaning of Cost Sheet

- Definitions of Cost Sheet

- Objectives of Cost Sheet

- Features of Cost Sheet

- Elements of Cost Sheet

- Components of Cost Sheet

- Forms of Cost Sheet

- Purposes of Cost Sheet

- Uses of Cost Sheet

- Estimated Cost Sheet

- Distinction between Cost Sheet and Cost Account

- Cost Statement

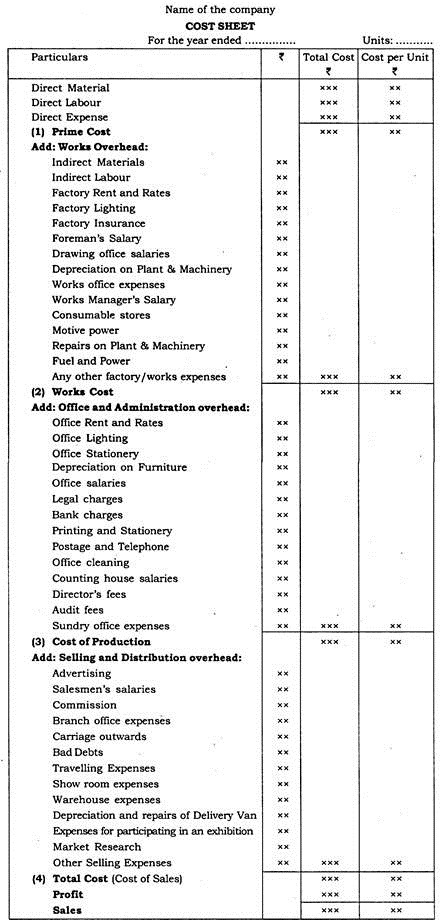

- Specimen and Formulas of Cost Sheet

- Proforma of Cost Sheet

- Points to be Observed While Preparing Cost Sheet

- Information to be Included in Cost Sheet

- Categories of Expenses to be Excluded

- Treatment of Certain Specific Items

- Treatment of Stocks

- Calculation of Profit

- Production Account

- Tender or Quotation Price

- Advantages of Cost Sheet

What is a Cost Sheet: Meaning, Format, Problems, Definitions, Objectives, Elements, Purposes, Estimated Cost Sheet, Cost Statement, Specimen, Proforma, Problems, Advantages, Questions and More…

Cost Sheet – Introduction

A cost sheet is a statement designed to show the output of a particular accounting period along with its break-up of costs. The data incorporated in cost sheet are collected from various statements of accounts which have been written in cost accounts.

ADVERTISEMENTS:

Cost Sheet is a statement, prepared at given intervals of time, which provides information regarding elements of cost incurred in production. It discloses the total cost as well as the cost per unit of the product manufactured during the given period. If it is desired to compare the costing results of a particular period with any of the preceding periods, comparative columns can be provided in the Cost Sheet.

In a cost sheet, the total cost and the unit cost of a product are presented in analytical form showing the details of various elements of cost in total and /or per unit depending on the requirements. Cost sheets are generally prepared under the unit costing method.

The cost sheet is prepared to ascertain cost of product/job/operation or to give quotations or to determine tender price for supply of goods or providing service. A cost sheet helps in the determination of cost per unit and in the fixation of selling price of the product.

ADVERTISEMENTS:

By comparing the cost sheets of the two periods, the management can ascertain the inefficiencies, if any, in production and take corrective action whenever required. If the same product is being produced in two or more factories under the same management or under different managements, cost comparisons are possible by preparing cost sheets for various factories. Thus a cost sheet can be used as a basis for cost control and cost reduction.

Depending on the situation, a cost sheet can be a simple cost sheet or a cost sheet with adjustment for opening and closing stock of work-in-progress and finished goods. It may be observed that there is no hard and fast rule of the sequence of unit cost and total cost column. The total cost column can precede the unit cost column.

Cost Sheet – Meaning

Cost sheet is a statement presenting the items entering into cost of products and services, analysed by their elements, functions and even by their behaviour. It is a statement prepared to show the different elements of cost.

A cost sheet may be defined as “a detailed statement of the elements of cost incurred in production, arranged in a logical order under different heads such as material, labour and overheads, prepared at short intervals of time”. Within the strict meaning of the term it does not include sale proceeds and profit earned. If these are included it is called as “Statement of Cost and Profit”.

ADVERTISEMENTS:

Cost sheet reveals the details of total cost of the job, order or operation. It shows the total cost as well as different elements of the total cost and cost per unit. Thus, Cost Sheet is a statement which presents an assembly of the components of cost.

Cost sheet is a statement prepared to show the cost of production in an industry in terms of total and also in several stages. It also shows the cost at every stage in terms of total production and each unit. This can be prepared for any period of time such as a week, month, quarter year, half year or a year based on the requirement of the industry.

A cost sheet is an exercise in collection of information regarding all the costs incurred in the industry and arranging them in a certain order. The information required to prepare a cost sheet is gathered from several records in the organization.

Since a cost sheet is only a statement, it can be prepared in any format so as to suit the needs of the organization. A cost sheet is also called a statement of cost. A typical cost sheet does not include total sales and profit. If a cost sheet includes sales and profit, it is called a statement of cost and profit.

Cost Sheet – Definitions

All costs incurred or expected to be incurred during a given period are presented in the form of a statement, popularly called cost sheet or statement of cost or production statement.

The chartered Institute of Management Accountants, London defines cost sheet as “a document which provides for the assembly of the detailed cost of a cost centre or cost unit” The cost sheet is prepared with separate columns, one for the cost per unit and the other for the total cost.

Separate columns can also be provided for the current cost and cost of the previous periods. The cost sheet is generally prepared periodically, say weekly, monthly, quarterly and yearly. There is no prescribed format or form of the cost sheet. It’s from, contents and arrangement vary from firm to firm.

According to Harold J. Wheldon, “Cost sheets are prepared for the use of the management and consequently, they must include all the essential details which will assist the management in checking the efficiency of production.”

According to Walter W. Bigg, The expenditure, which has been incurred upon production for a period, is extracted from the financial books and the store records, and out in a memorandum statement. If this statement is confined to the discloser of the cost of the units production during the period, it is termed cost sheet.

Top 4 Objectives of Cost Sheet

(1) It reveals the total cost and cost per unit of goods produced.

ADVERTISEMENTS:

(2) It discovers the break-up of total cost into different elements of cost.

(3) It provides a comparative study of the cost of current period with that of the corresponding previous period.

(4) It acts as a guide to management in fixation of selling prices and quotation of tenders.

Cost Sheet – Basic Features

ADVERTISEMENTS:

The basic features of cost sheet are as follows:

(i) This statement is usually prepared under the output costing method, where the object is to ascertain the per unit cost of production.

(ii) A cost sheet is prepared for a specified period of time, generally for a month, quarter, half year or year.

(iii) The cost sheet generally contains the following information –

ADVERTISEMENTS:

(a) Period,

(b) Total Output,

(c) Cost of raw materials consumed,

(d) Cost of direct labour,

(e) Details of chargeable expenses

(f) Details of overheads namely factory, office and administration and selling and distribution, and

ADVERTISEMENTS:

(g) Aggregate of elements of cost at various stages e.g., Prime Cost, Works Cost, Office Cost and Total Cost.

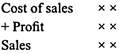

Cost Sheet Elements – Prime Cost, Gross Factory, Cost of Production, Cost of Goods Sold, Cost of Sales and Profit (with Formula)

Various elements of the cost sheet are given below:

Element # 1. Prime Cost:

Prime cost is the addition of all direct costs. It includes direct material cost, direct labour cost and other direct costs. Other direct expenses may include patterns, designs, power expenses etc.

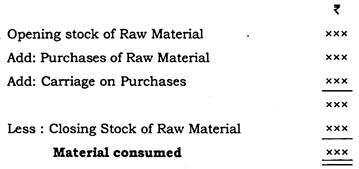

One should remember that direct material cost mean amount of direct material consumed during the period which can be calculated or given below:

Material consumed –

ADVERTISEMENTS:

Opening stock of Raw material

+ Purchases made during the year

+ Carriage in words

– Materials returned

– Scrap of raw materials

– Closing stock of raw material at end.

ADVERTISEMENTS:

Element # 2. Gross Factory Cost:

Factory cost is obtained by adding factory related expenses to the direct costs.

Various factory related expenses are:

i. Indirect materials like oil, lubricants

ii. Indirect labour like foreman, factory manager, clerks

iii. Factory lighting, heating, rent, insurance of factory building

ADVERTISEMENTS:

iv. Repairs and maintenance of plants, machine tools, factory building

v. Factory stationery, welfare expenses of the workers etc.

In addition to that adjustments in respect of cost of opening and closing WIP is also adjusted to calculate net factory/work cost as given below:

Net factory/work cost –

Gross factory cost

+ Opening stock of WIP

– Closing stock of WIP

WIP – WIP is that part of production at which same work has been done but it is still not complete. So WIP is semi-finished stock.

Element # 3. Cost of Production/Officer Costs:

Where office and administration expenses may include:

i. Office salaries

ii. Rent, rate, taxes, depreciation of insurance of office building

iii. Lighting, heating of the office building

iv. Stationary, printing, telephone expenses and other expenses related to office building

v. Director and management salaries.

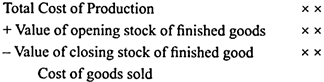

Element # 4. Cost of Goods Sold:

Cost of production is adjusted with the value of opening and closing stock of finished goods to obtain value of cost of goods sold, as given below –

The value of opening stock is generally given in the question. The value of closing stock can be obtained by dividing the total cost of production by number of units produced multiplied by no. of units in closing stock as shown below –

Where closing stock (units) = Production during year + opening stock – Sales during year

Element # 5. Cost of Sales:

Various selling and distribution expenses are added to obtain cost of sales. Selling and distribution expenses may be fixed or variable in the nature.

Some examples of selling and distribution expenses are:

i. Salesman salaries and commission

ii. Advertisement expenses

iii. Commission sales

iv. Warehouses rent, depreciation etc.

v. Depreciation, maintenance of delivery vans

vi. Expenses relating to showrooms.

Element # 6. Profit:

Difference of sales and cost of sales is known or profit as shown below –

Cost Sheet – Components (With Chart)

Cost sheet is a statement which is prepared periodically to provide definite cost of a cost unit.

The various components of a cost sheet are as under:

Cost Sheet Forms – Simple, Cost Sheet of Two or More Types of Products and Preparation of Cost Sheet in Accounts Form

Different forms of cost sheet are given below:

Form # i. Simple Cost Sheet:

Its main objective is to find out the total cost and per unit cost of goods produced. It is not prepared to get the profit or loss. However, if sales are given, then per unit profit can also be calculated.

Form # ii. Cost Sheet of Two or More Types of Products:

When producer produces one product having variation in size, shape or quality etc. then he wants to know the item-wise difference of cost regarding the sizes, shapes or quality of the product. It also helps in determining the comparative difference of cost to what extent an item or size is more profitable and which is not profitable.

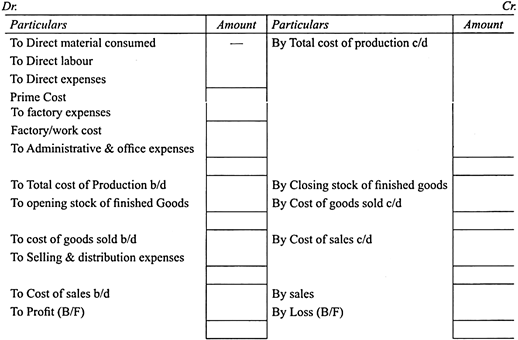

Form # iii. Preparation of Cost Sheet in Accounts Form:

Cost sheet can also be prepared in account form. It is possible when cost of goods consumed and expenses of production are given. It can also be used when different types of production are given and relationship or ratio is to be established between cost to total goods consumed to each and every production.

Cost Sheet – Purposes

A cost sheet is a statement of all costs incurred or expected to be incurred during a given period, in relation to the product/cost unit/cost center/department/operation/process/service, and analysed according to the various elements of cost. It is prepared at convenient intervals such as, weekly, fortnightly, monthly, quarterly, half-yearly or annually or as and when required by the management.

The cost sheet is usually presented both in totals and unit cost. Sometimes, percentage of each item to total cost is also shown. When the particulars of a cost sheet are presented in the form of an account, the same will be called a production account. If a cost sheet shows the total cost and cost per unit, production account shows profit or loss, besides cost.

A cost sheet serves the following purposes:

1. Helps determination of unit cost or product or service.

2. Assists in the fixation of selling price.

3. Facilitates cost comparison between two periods.

4. Brings out weaknesses and inefficiencies, if any.

5. Facilitates cost control and cost reduction.

Some other purposes are given below:

1. It reveals the cost per unit as well as total cost of output.

2. It shows the various elements of cost that go to make up total cost.

3. It helps in fixing up the selling price more accurately.

4. It helps the management to compare the cost of any two periods and ascertain the inefficiencies, if any, in production.

5. It helps in the preparation of estimates for submission of tenders for contracts or jobs.

Cost Sheet – 5 Important Uses Given in Points

1. It helps in presenting the total cost, the different elements of cost and cost per unit.

2. It helps in fixing the selling price/quotation.

3. It helps in cost control by comparison of various elements of cost with the help of standard costing.

4. It also helps in formulating production policy.

5. It communicates about elements of cost to all levels of management.

Estimated Cost Sheet

Estimated cost sheet is a cost sheet which is prepared using estimated figure. The estimated figures are obtained using part-information which are adjusted for future changes in other overheads. Thus material, labour and other overhead are predetermined according to anticipated changes in the future price levels. Overheads to be charged in estimated cost sheet can be calculated using suitable method of absorption like percentage of material, labour hour, machine hours etc.

Most important reason for preparing cost sheet is price quotation. Every company needs to know the quotation prices in order to submit a tender, well in advance.

Thus, cost sheet helps the management to anticipate the prices of the products to be manufactured. The price quoted in the estimated cost sheet should include a portion of desired profit to be earned. The amount of profit will be decided by management.

Difference between Cost Sheet and Cost Account

It is desirable to understand the difference between a cost sheet and a cost account. A cost sheet is a statement, prepared at given intervals of time, which provides information regarding elements of cost incurred in production.

It discloses the total cost as well as the cost per unit of output and provides for the comparison of costing results of a particular period with any of the preceding periods through comparative columns. In short, it is a statement prepared on memorandum basis and does not form part of the double entry system in cost accounts.

A cost account, on the other hand, is an account forming part and parcel of the double entry system of cost accounting which discloses the details of expenditure actually incurred upon a particular job, contract or a process. Unlike a cost sheet, a cost account deals with the result of a one operation or job and does not disclose the result of the whole operation for a given period of time.

The main distinction between the cost sheet and cost account may be summarised as follows:

Cost Sheet:

1. It is a statement showing cost of production per unit or total output.

2. It is an independent and isolated summary of costs relating to a job or a certain volume of output.

3. It is prepared for a short period, say for three or six months while production continuous.

4. It shows the costing data in an analytical manner to suit the purpose for which it is prepared.

5. It presents costing data on unit basis.

6. It is prepared for the purpose of cost determination, cost comparison, pricing, cost control and cost estimation.

Cost Account:

1. Cost account is a ledger account maintained in the Cost Ledger on the principles of double entry.

2. Every cost account is a part of integrated cost accounting system of the entire organisation.

3. Cost accounts are kept for accounting period as a whole and are prepared when the production is completed.

4. Cost accounts make a presentation of total amount of costs without analysis.

5. Cost account does not depict unit cost.

6. Cost accounts make a record of actual costs incurred for the purpose of preparing Costing Profit and Loss Account.

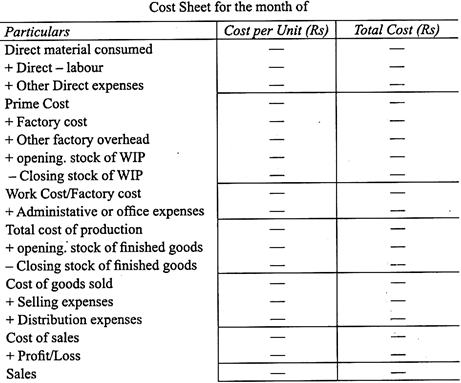

Cost Statement – Preparation and Illustration

Cost statement is similar to cost sheet. The only difference is that in the case of a cost statement, a separate column for cost per unit in respect of various cost elements is not prepared alongside the column of total cost. In case of cost statement, the total cost per unit can be ascertained by dividing the total cost by the number of units produced.

A simple use of cost accounting is the presentation of cost analysed by the component elements of cost. Usually this presentation is made in the form of a statement known as Cost Sheet. It is a statement showing the items that form a part of cost of products or services. It shows the total cost components by stages and cost per unit of output during a period.

It may be prepared on a weekly, monthly, quarterly or yearly basis according to convenience. It may be prepared on the basis of actual data (historical cost sheet) or on the basis of estimated data (estimated cost sheet depending on the technique of costing employed and the purpose to be achieved). It divides cost information into prime cost, works cost, cost of production and cost of sales or total cost.

Sometimes information relating to costs, sales and profit or loss is included in the cost sheet, which is then termed as ‘production statement’.

Bigg defines a cost sheet as “the expenditure which has been incurred upon production for a period is extracted from the financial books and stores records and set out in a memorandum statement. If the statement is confined to the disclosure of the cost of the units produced during the period, it is termed as cost sheet, but where the statement records cost, sales and profit, it is usually known as production statement”.

However, the modern practice is to extend the cost sheet to show profit and sales also, and call it ‘statement of cost and profit’.

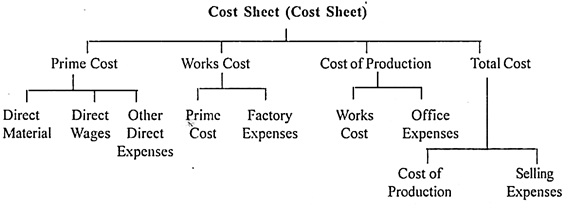

The preparation of a simple cost statement is illustrated in Illustration:

Illustration (Simple Cost Statement):

From the following information relating to a manufacturing firm for the month of January, prepare cost statement showing total cost per unit-

The cost statement can be extended to ascertain the sales value or the profit. In that case, if desired profit rate is given then sales value will be arrived at by adding desired profit to the total cost. But if sales value is given, the profit will be the difference between sales value and the total cost.

Further, the adjustment for opening and closing stocks of work-in-progress and finished goods is made in the same way as is done in the cost sheet.

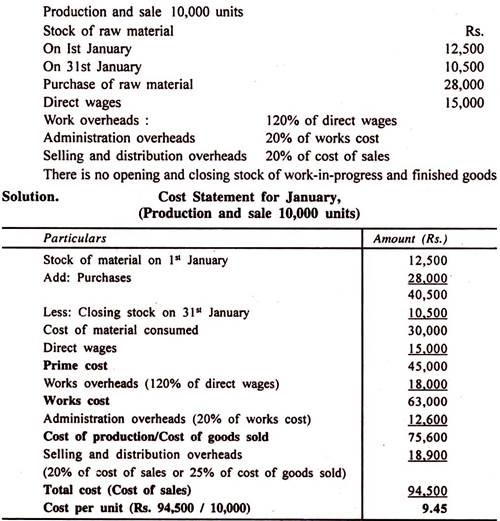

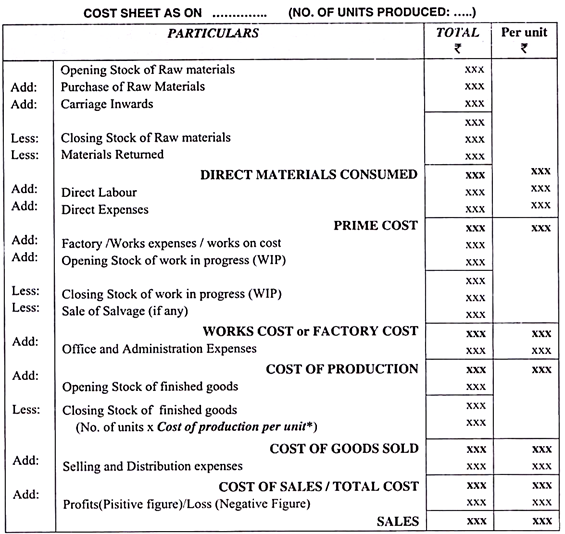

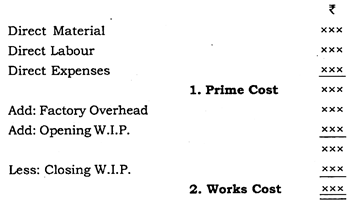

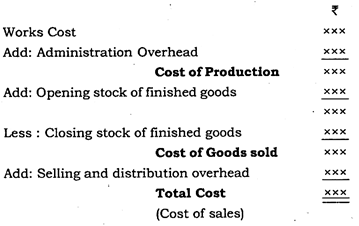

Cost Sheet Format, Proforma, Specimen and Formulas

An analysis of the total cost of production and cost of sales is carried out by preparing a cost sheet. A cost sheet is an important document prepared by the costing department. It is prepared to analyse the components of total cost, thereby determining prime cost, works cost, cost of production, cost of sales and profit.

Cost sheet is a statement showing the total cost under proper classification in a logical order. It reveals the total cost as well as the cost per unit in different stages. It shows the various elements of cost that goes to make up the total cost. It helps in fixing up the selling price more accurately.

A specimen of cost sheet is given below:

Formulas:

(1) Prime Cost is the aggregate of Direct materials, Direct Labour and Direct Expenses.

Prime Cost = Direct Materials + Direct Labour + Direct Expenses

(2) Works Cost is the aggregate of prime cost and works overhead. It consists of the total of all items of cost incurred in the manufacturing of a product.

Works Cost = Prime Cost + Works Overhead.

(3) Cost of production includes works cost and administration overheads. Production is not deemed to be complete without the managerial and office expenses.

Cost of production = Works Cost + Office and Administration Overheads

(4) Cost of Sales (Total Cost) is the aggregate of all expenses attributable to it. It comprises cost of production plus selling and distribution overheads.

Cost of Sales = Cost of production + Selling and Distribution overheads

When profit is added to the cost of sales, sales can be found out. Usually selling prices are fixed on the basis of cost of sales. It ensures that all the costs are recovered and any desired profit is also obtained.

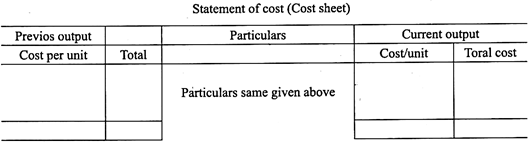

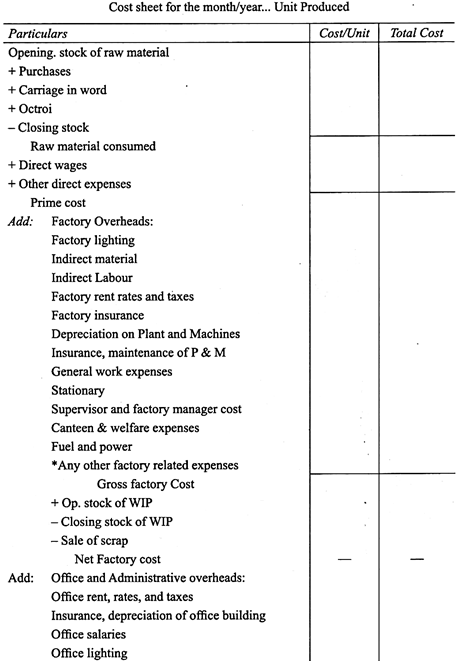

Cost Sheet Proforma – Simple, Comparative, Detailed and Production Account

Simple Cost Sheet:

Proforma of Comparative Cost Sheet:

Proforma of Detailed Cost Sheet:

Proforma of Production Account:

1. Sometimes the amount of sales may not be given while information regarding profit calculation may be given. In such a case, amount of sales will be balancing figure.

2. Opening and closing balances of raw material will be adjusted while calculating amount of raw material consumed. Any sale of scrap/wastages/scrap/material returned will be reduced from the same amount.

3. Opening and closing balance of WIP will be adjusted in work cost in second part of the account. The opening stock will be shown on debit side and closing balance at credit side.

Points to be Observed While Preparing Cost Sheet (With Format)

The cost Sheet exhibits the different stages in arriving at total cost or cost per unit of a product produced or service rendered. The main objective of preparing a cost sheet is to ascertain the cost of manufacture of a product of service.

It is prepared as under:

Points to be observed while preparing the cost sheet:

1. If the output or production in units is not given in the problem, then, per unit column need not be taken in the cost sheet.

2. The opening stock and closing stock of raw-materials should be adjusted before the arrival of cost of materials consumed.

3. The opening stock and closing stock of work-in progress should be adjusted before the arrival of Works Cost.

4. The opening stock and closing stock of finished goods should be adjusted before the arrival of cost of goods sold.

5. The closing stock of finished goods is always valued at the cost of production per unit. If the value for opening stock of finished goods is not given specifically, then opening stock also may be valued at cost of production per unit.

6. The following expenses should be taken under the head factory expenses/works expenses-

i. Fuel and power,

ii. Factory rent,

iii. Foremen’s wages,

iv. Lighting,

v. Heating,

vi. Tools used Consumable stores,

vii. Repairs to buildings,

viii. Indirect materials,

ix. Indirect wages,

x. Leave wages,

xi. Insurance,

xii. Overtime wages,

xiii. Supervision,

xiv. Works stationery,

xv. Canteen and welfare expenses,

xvi. Works salaries,

xvii. Depreciation of plant and machinery,

xviii. Works expenses ,

xix.Gas & water,

xx. Technical director’s fee,

xxi. Laboratory expenses,

xxii. Works telephone expenses ,

xxiii. Internal transport expenses (Haulage) etc.

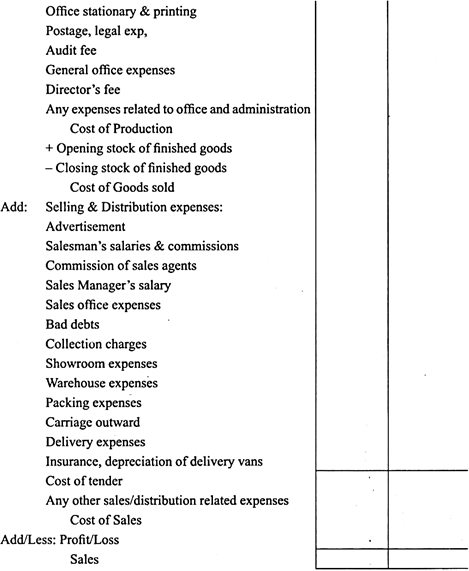

7. The following expenses should be taken under office and administration expenses-

i. Office salaries,

ii. Bank charges,

iii. Legal expenses,

iv. Office rent,

v. Director’s fee,

vi. Printing and stationery,

vii. Office expenses,

viii. Depreciation of office furniture,

ix. Subscription to trade journals,

x. Office lighting,

xi. Establishment charges,

xii. Director’s traveling expenses ,

xiii. Postage,

xiv. Audit fee,

xv. Depreciation & repairs of office equipments.

8. The following expenses should be taken under selling and distribution overheads-

i.Travelers commission,

ii. Advertising Show room expenses,

iii. Bad debts Salesmen salaries & expenses,

iv. Packing expenses,

v. Carriage outwards

vi. Collection charges

vii. Cost of catalog Expenses of sales branch establishment etc.

9. While calculating the cost per unit, the costs should be divided by the actual units produced till the stage of cost of goods sold. There after it should be divided by the actual units sold.

10. The following expenses should not be taken anywhere in the cost sheet-

i. Income tax paid,

ii. Preliminary expenses and goodwill written off,

iii. Interest paid on borrowed capital,

iv. Dividend paid,

v. Hire purchase installment paid and other such financial expenses.

Information to be Included in Cost Sheet

Following information is required to be included in cost sheet:

(i) Cost and volume of materials consumed, direct wages and other direct expenses in a particular period.

(ii) Estimated amount of indirect expenses in a particular period and its distribution under different heads.

(iii) Calculation of relationship of each element of expenditure to total cost. This type of calculation is generally made in terms of percentage.

(iv) It shows the comparative figures of the previous period to assess the progress of the business.

(v) It also makes possible to calculate the per unit cost and the total cost on standardized basis for comparative study.

(vi) It helps in the preparation of statement of profit and loss with the cost sheet for a particular period.

(vii) It presents the volume and units produced during a particular period.

Broad Categories of Expenses to be Excluded in Cost Sheet

While preparing cost sheet, some broad categories of expenses are not to be included as they are purely financial items, not forming part of cost of production.

These are the following:

(i) Purely Financial Charges:

1. Loss on sale of investment, fixed assets, etc.

2. Fines and penalties

3. Interest on debentures, bank loans, fixed deposits, mortgages, etc.

4. Obsolescence loss, i.e. loss due to scrapping of a machinery before the expiry of its life

5. Damages payable through a court of law.

(ii) Purely Financial Incomes:

1. Interest received on bank deposits

2. Transfer fee received

3. Discount, commission received

4. Rent/Interest/Dividend receivable

5. Profit on sale of investments, fixed assets etc.

6. Damages received through a court of law.

(iii) Appropriation of Profits:

1. Writing-off goodwill, preliminary expenses, capital raising expenses, discount on the issue of shares and debentures

2. Income tax

3. Dividend on shares

4. Charitable donations

5. Appropriation to sinking fund

6. Transfer to reserves

7. Excess provision for depreciation due to change in method of charging depreciation etc.

(iv) Abnormal Gains and Losses:

1. Abnormal losses of materials

2. Abnormal idle time of labour.

Treatment of Certain Specific Items (With Format)

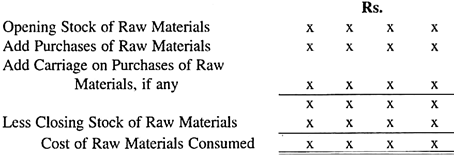

1. Direct Material:

If opening stock of raw materials, purchases of raw materials, carriage on purchases and closing stock of raw materials are given, then with the help of the following, Materials consumed (Direct Material) can be calculated –

2. Work-in-Progress:

Work-in-Progress means semi-finished goods or partly – finished goods. In other words, work-in-progress means units on which some work has been done but which are not yet complete. Usually it is valued at works cost basis.

If it is valued at works cost, then opening and closing work-in-progress will be adjusted as follows –

3. Stock of Finished Goods:

If opening and closing stocks of finished goods are given, then these must be adjusted before calculating cost of goods sold, as under –

4. Factory Overheads:

They refer to all indirect expenses incurred on production processes. It is also known as works overhead or works on cost.

They include:

i. Factory Rent, Rates and Taxes

ii. Motive Power

iii. Indirect Material

iv. Factory Lighting

v. Depreciation and repairs of plant and machinery

vi. Oil and Water

vii. Drawing office salaries

viii. Research and Development Expenditure

ix. Experimental Expense

x. Consumable stores

xi. Wages of foreman

xii. Estimating Expense

xiii. Factory Manager’s Salary

xiv. Other factory expenses

5. Administration Overheads:

The expenses of formulating the policies, directing and controlling the operations of an organisation are known as Administration Overheads.

They include:

i. Office rent, rates and taxes

ii. Printing and stationery

iii. Postage

iv. Office lighting and insurance

v. Counting house salary

vi. Director’s fee

vii. Audit fee

viii. Legal expense

ix. Depreciation and Repairs on furniture and office building

x. Office Manager’s salary

xi. General expense

xii. Staff salary

xiii. Bank charges

xiv. Gas and water – office

xv. Sundry office expense

6. Selling and Distribution Overheads:

All expenses incurred in securing and retaining customers for the products are selling expenses. Distribution expenses are the expenses concerned with despatching and delivering finished goods to customers.

They include:

i. Advertisement

ii. Commission allowed

iii. Discount

iv. Sales department expenses

v. Sales promotion expenses

vi. Carriage outwards

vii. Bad debt

viii. Expenses for participating in an exhibition

ix. Show room expense

x. Branch office expense

xi. Market research expense

xii. Delivery van expense

xiii. Warehouse expense

xiv. Salary to sales personnel

xv. Other selling and distribution expenses

7. Non Cost Items:

Non-cost items are those expenses which are excluded from the computation of cost. E.g. – Donation, income tax, debenture interest, transfer to reserve, provisions, preliminary expense, discount on issue of shares, dividend, charity, cash discount, loss on sale of asset, goodwill written off, etc.

Cost Sheet – Treatment of Stocks (With Illustrations)

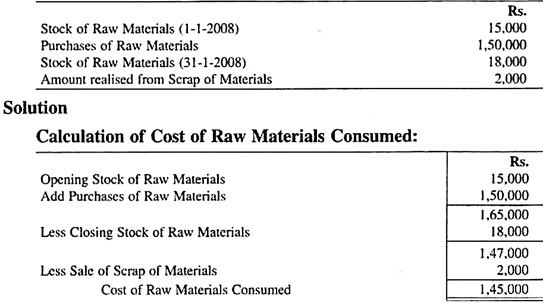

(i) Stock of Raw Materials:

While preparing a cost sheet, it is necessary to ascertain the cost of raw materials consumed. In order to arrive at the cost of raw materials consumed, the value of the opening stock of raw materials is added to the cost of raw materials purchased and the value of the closing stock of raw materials is deducted from the same.

Calculation of cost of raw materials can be shown as follows:

Material Scrap or Wastage:

These are materials which are useless for their original purpose. If the scrap materials are in a raw condition, the cost of materials used should be reduced by the amount realised from the sale of scrap.

If the scrap materials are derived or obtained in the course of manufacturing process, the amount realised from the sale of such scrap, if any, should be deducted from works overhead or from the works cost.

Illustration:

From the following information calculate the cost of raw materials consumed during January, 2008 –

(ii) Stock of Work-in-Progress:

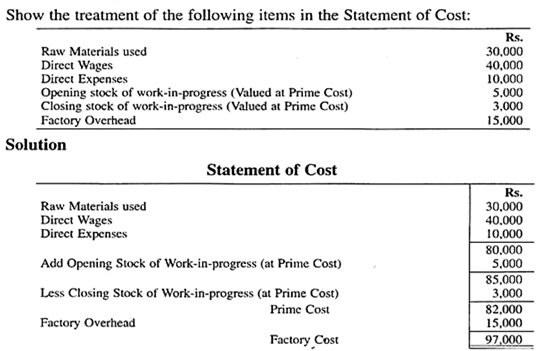

Work-in-progress refers to partly finished goods or the goods which are yet in the manufacturing process. The stock of work-in-progress may be valued at Prime Cost or at Works Cost. In case work-in-progress is valued at prime cost, the cost of work-in-progress shall consist of cost of direct materials consumed, direct wages paid and other direct expenses incurred for the work-in-progress.

The adjustment for work-in-progress valued at prime cost should be made at the stage of ascertaining the Prime Cost.

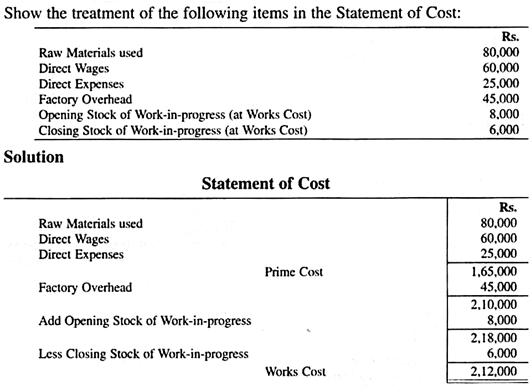

But where the work-in-progress is valued at works cost, the cost of work- in-progress shall consist of cost of direct materials consumed, direct wages paid and direct expenses incurred for the work-in-progress and a proportionate part of the total works overhead. Generally, the valuation of the stock of work- in-progress is made on the basis of works cost.

In case, the basis for the valuation of work-in-progress has not been given, it should be assumed that the same has been made on the basis of works cost. The adjustment for the stock of work-in- progress valued at works cost should be made at the time of calculating the Works Cost.

Illustration:

(iii) Stock of Finished Goods:

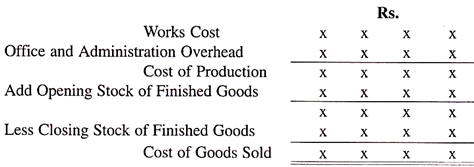

The stock of finished goods or completed units is valued on the basis of Office Cost (or Cost of Production) and hence the adjustment for the stock of finished goods is made after ascertaining the Office Cost or Cost of Production.

The cost of opening stock of finished goods is added to the cost of production, while the cost of closing stock of finished goods is deducted from the cost of production and the adjusted figure so arrived at shall be the ‘Cost of Goods Sold’.

The treatment of stock of finished goods in cost sheet can be given as follows:

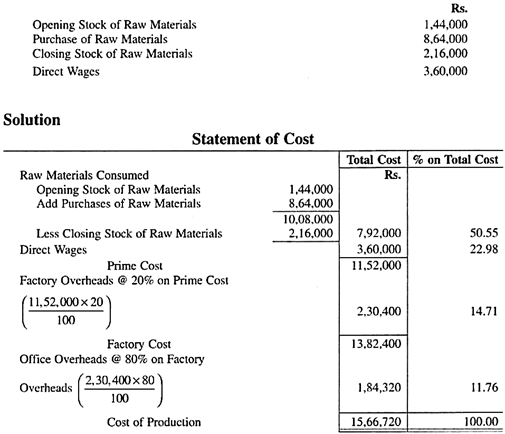

Illustration:

From the following particulars, prepare a statement of cost of production for the year ended 31st March, 2008 and show what percentage each individual item of cost bears to the total cost.

Calculate factory overheads @ 20% on prime cost and office overheads @ 80% on factory overheads.

(iv) Purchase Expenses:

These are the expenses incurred to get the raw- materials from the places of their sources to the purchasing industry. These expenses are also considered a part of the purchase cost of raw-materials as the raw-materials cannot be physically brought to the purchasing industry without incurring these expenses. These expenses are added to the cost of raw-materials, in the prime cost.

Examples of purchase expenses – Transportation expenses inwards, freight charges inwards, import duty, insurance, taxes etc. payable on materials purchased.

(v) Sale of Scrap:

Scrap in this context may be considered as the residue of raw-materials, which emerges naturally in some production processes. Scrap cannot be considered finished goods however it also has a saleable value. This value is adjusted in the cost sheet by being deducted from the factory cost.

Cost Sheet – Problem and Calculation of Profit (With Examples)

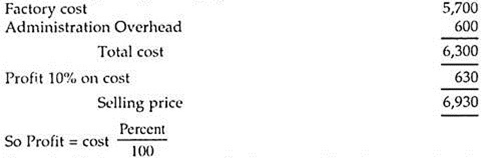

Profit may be calculated either as a percentage of cost or selling price.

Example:

Profit as a percentage of cost.

Example:

Profit as a percentage of selling price. Here the percentage is on selling price. Selling price includes cost + profit.

Cost Sheet – Production Account (With 6 Points of Difference)

When information relating to the total cost of production, sales and the profit or loss made during the period are presented in the form of an account with debit and credit sides on the double entry principles, the account is called Production Account.

The production account is usually divided into two parts. The first part reveals the total cost of production and second part reveals cost of goods sold, selling and distribution expense, sales and profit or loss made during the period.

Difference between Production Account and Cost Sheet:

The following are the main points of difference between a production account and a cost sheet:

Production Account:

1. A production account is an account

2. It is based on double entry principles

3. It is based on actuals

4. It is prepared for each production department

5. Expenses are not classified in this account

6. The main objective is to reveal not only the total cost and cost per unit, but also the profit earned or loss suffered on the sales.

Cost Sheet:

1. A Cost Sheet is only a statement

2. It is just a memorandum statement and does not form part of double entry system.

3. It is based on actuals and estimates.

4. It is prepared for each job.

5. Expenses are classified to ascertain different divisions of cost.

6. The main objective is to reveal the total cost of production as well as cost per unit of output.

Tender or Quotation Price – Factors, Items to be Analysed and Procedures

Generally, production cost is ascertained after the completion of production work. But sometimes it becomes necessary to ascertain the production cost before commencing the production work. For example, a contractor will have to estimate his contract cost before commencing the contract work.

Often, the manufacturer is required to quote the estimated price by adding some profit for getting the orders from customers. Such estimated price is known as ‘Tender price or Quotation price’. Tender or quotation price is a price at which the manufacturer is ready to supply his goods to the customers.

Generally, this price is fixed after considering various factors such as:

(i) Past cost figures

(ii) Variations in cost in the current period

(iii) Expected margin of profit and

(iv) Number of competitors in the field.

Since the lowest tender price is accepted by the intending buyer, the manufacturer has to carefully consider all the above factors. A slight difference in calculation of the tender price may result in losing the tender.

Hence, the following items are to be analysed while preparing the tender:

1. Direct materials

2. Direct wages

3. Factory overheads

4. Administrative overheads

5. Selling and distribution overheads, and

6. Expected profit

An estimated cost is taken as the basis for fixing the tender price; it has to be developed on the basis of present costs with due regard to likely changes in the ensuing period to which they are to be applied.

The general procedure of estimation may be summarised as follows:

1. Direct Materials:

The cost of direct materials can be estimated by multiplying the quantity required for a unit of output by the probable purchase cost of materials. Purchase cost of materials will be estimated in the light of future changes in market conditions.

2. Direct Wages:

It can be estimated on the basis of job requirements and anticipated changes in wage rate.

3. Overheads:

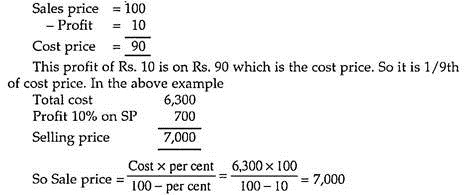

The amount of overheads is to be estimated on the basis of past experience as a percentage as given below:

4. Estimation of Profit for a Tender or Quotation:

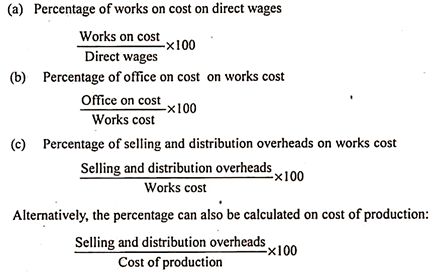

The tender price is determined after adding the amount of profit to total cost. Generally, instead of giving the amount of profit, the percentage of profit is given in the questions. On the basis of such percentage, the amount of profit is determined.

The following two conditions may be possible:

Cost Sheet – Main Advantages Available to a Manufacturing Concern

The main advantages of cost sheet available to a manufacturing concern are as follows:

1. Disclosure of Cost –

Cost Sheet enables the manufacturer to ascertain exact cost per unit in a scientific manner. Further, it also discloses the extent to which each element of the expenditure contributes to the total cost.

2. Determination of Selling Price –

By disclosing the actual cost of production, the cost sheet provides the manufacturer with a reliable basis for fixing competitive selling price of his product. Thus, it saves the manufacturer from losses which arise due to injudicious fixation of prices without looking to the cost of production.

3. Cost Control –

A cost sheet, by providing a comparative study of various elements of current costs with the cost of the previous period enables the manufacturer to find out the causes of variations in cost and to eliminate the adverse factors and conditions which go to increase the total cost.

4. Determination of Tender Price –

Cost sheet provides a reliable basis for preparing tenders or quotations at which the manufacturer offers to supply goods to a prospective customer at some future date.

Some more advantages given in point wise format:

1. It reveals the total cost and cost per unit of the units produced during the given period.

2. It discloses the different elements of cost and total cost.

3. It helps in fixing up the selling price more accurately.

4. It helps in the preparation of estimates for submission of Tenders for contracts and jobs.

5. It helps to locate inefficiency by the comparison of past figures with current figures.

6. It helps the manufacturer in formulating a definite useful production policy.

7. It enables the manufacturer to keep control over the cost of production.

Thus, Cost sheet presents the cost information pertaining to a cost centre or cost unit, bringing out the nature of various components of costs.