In this article we will discuss about:- 1. Nature of Balance Sheet 2. Title of Balance Sheet 3. Form 4. Basic Division.

Nature of Balance Sheet:

(a) Balance sheet as a statement of assets and liabilities and capital fund:

Balance sheet comprises of list of Assets, Liabilities and Capital Fund at a given date. It sets forth the financial condition of a business concern as contemplated by the accounting records. It reflects the assets owned by the concern and sources of funds used in the acquisition of those assets.

The Balance Sheet is only historic rather than prophetic. In a layman’s language, a Balance Sheet may be called as a statement of equality in which equality is established by representing assets value on one side and the value of liabilities and owners fund on the other side of it. Thus the Balance Sheet shows the nature and amount of all assets owned, the nature and amount of all liabilities and the type of amount of residual investment of the owners in the business.

ADVERTISEMENTS:

(b) Balance Sheet as a statement of sources and uses of funds:

The equality in the total of both sides of the Balance Sheet can also be explained from another point of view. In fact, the equality in the total of both sides of the Balance Sheet is the result of presenting the two different aspects of the same fact.

Assets side represents that aspect which conveys the uses of business fund and liabilities side indicates that aspect which conveys the various sources from which business funds have been achieved.

Thus Balance Sheet is a statement which, on the one hand, reflects those sources from which funds have found its way into the business and, on the other hand, it portrays the various forms of assets or investments in which those funds have been put to use.

Title of Balance Sheet:

ADVERTISEMENTS:

In practice, Balance Sheet is called by different names due to lack of uniformity in accounting system.

The following titles are used in respect of Balance Sheet:

a. Balance Sheet or General Balance Sheet

b. Statement of Financial Position or Condition.

ADVERTISEMENTS:

c. Statement of Assets and Liabilities.

d. Statement of Resources and Liabilities.

e. Statement of Assets, Liabilities and Owners Fund etc.

Of the above, the title ‘Balance Sheet’ is mostly used.

Form of Balance Sheet:

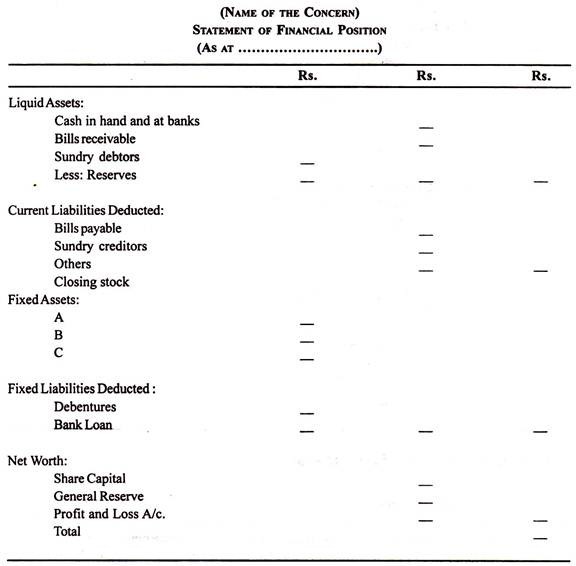

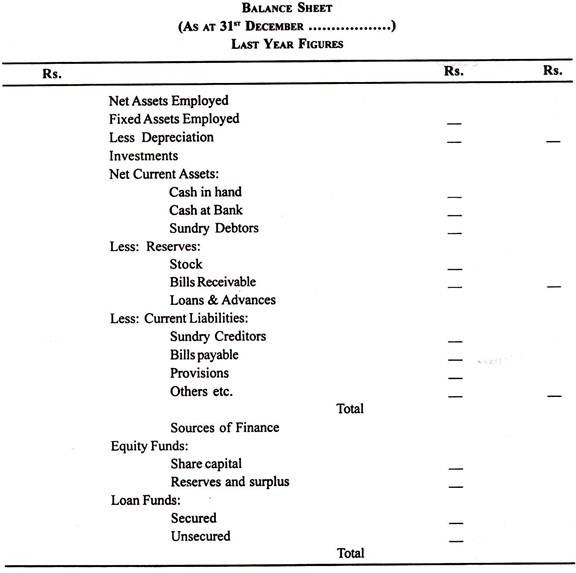

Accounting has developed fairly standard forms in presenting the content of a Balance Sheet. These forms are the account form, report form and financial position form. Each form has its distinguishing arrangement of the contents.

(i) Account Form:

The distinguishing characteristic of this arrangement of the Balance Sheet data is that assets are listed on the left side and liabilities are listed on the right side.

(ii) Report Form:

The distinguishing characteristic of this arrangement of the Balance Sheet is that assets, liabilities and share-holders equity are listed vertically.

ADVERTISEMENTS:

This arrangement is often preferred because it emphasizes the working capital information. The distinguishing characteristic of this arrangement is that the current liabilities are subtracted from the current assets so that the net working capital appears as a separate figure.

Non-current assets are added to the net working capital. Non-current liabilities are deducted from the total net working capital and non-current assets so that the total net assets figure appears. The residual nature of the stock holders equity is strongly emphasised by this procedure. A model proforma can be given to illustrate the form of Balance Sheet.

Some concerns in India use another form of Balance Sheet proforma as shown below:

ADVERTISEMENTS:

Basic Division of Balance Sheet:

A full and fair presentation of a business’s profit or loss on the income statement still does not reveal the whole financial story. The Balance Sheet is the formal report that provides this information and it complements the income statement by supplying vital details concerning the overall financial picture. The various items of the Balance Sheet may be grouped into the following categories for the purpose of interpretation.

(a) Current Assets:

All assets that will normally be converted into cash or that will be consumed during the operating cycle of the business or within one year, whichever is longer, are known as current assets.

ADVERTISEMENTS:

The operating cycle refers to the period of circulation of working capital through the business and it typically involves the purchase of raw materials, the conversion of raw materials into finished goods on account the collection of accounts receivable, and finally, the purchase of additional materials to start a new cycle.

Since the operating cycle is less than one year in most business, a commonly accepted time limit for determining which assets are current in the one-year period. However, the operating cycle should be used if it is longer than one year.

The following types are customarily found in the current asset category:

(i) Cash and cash items, such as cash on hand, bank checking and saving accounts and other cash items available for unrestricted use.

(ii) Marketable securities such as temporary or short term investments.

(iii) Short term receivables such as accounts and notes.

ADVERTISEMENTS:

(iv) Inventories, such as raw materials, supplies work in process and finished goods held for sale or use in ordinary business operations.

(v) Prepaid expenses, such as insurance, interest and taxes.

(b) Fixed Assets:

Fixed assets are those assets which are acquired for the purpose of using them in the conduct of business operations and for reselling to earn profit. It is only by making use of these assets that the functions like production and distribution are being performed for earning income.

Some examples of assets coming into category of fixed assets are:

(i) Land,

ADVERTISEMENTS:

(ii) Buildings,

(iii) Plant, Machineries, Tools and Equipment,

(iv) Furniture and Fixtures,

(v) Leasehold Improvements, and

(vi) Trucks and Automobiles.

(c) Intangible Assets:

ADVERTISEMENTS:

These are the assets which cannot be seen or touched. Intangible assets are normally carried on the Balance Sheet at their original cost less that part of the cost amortised in prior periods.

Normally, the following are included in the category of intangible assets:

(i) Patents and copyrights,

(ii) Leaseholds,

(iii) Franchise, and

(iv) Goodwill.

ADVERTISEMENTS:

(d) Other Assets:

This is the residual division of assets in the sense that assets not coming in the above categories may be included in this division. These assets possess a tangible form but these are not directly used in the operations of business.

Such assets may be:

(i) Investments excluding government securities and other marketable securities.

(ii) Non-trade debtors.

(iii) Fund earmarked for assets – extension or replacement for debentures – redemption or for redemption of contingent liability.

(e) Deferred Expenditures:

There are certain expenditures which are not incurred repeatedly or which are not of recurring nature and which do not arise from the present operations. These expenditures contribute income or benefit in the future years also. Therefore, such expenditures are treated in the accounting as charge on future profits.

In other words, these expenditures are written off gradually over several years of operations, treating each year’s share in such expenditures as a charge on operational profits for that year. The amount of such expenditures is not written off at a point of time is shown as an asset in the Balance Sheet prepared at that point of time.

(f) Current Liabilities:

Debts falling due within the next year or the next operating cycle are current liabilities. In other words, all short term obligations generally due and payable within one year are described as current liabilities. The most common current liabilities are Accounts Payable, Notes Payable and Accrued Expenses Payable.

The current liabilities include:

(i) Trade Creditors also known as Accounts Payable

(ii) Bills Payable also known as Notes Payable

(iii) Short-term public deposits

(iv) Outstanding or accruals

(v) Creditors on open accounts or short term loans

(vi) Bank overdraft but not bank loan

(vii) Amount payable to subsidiaries

(viii) Provision for taxes or taxes payable

(ix) Unpaid or unclaimed dividends but not proposed dividends

(x) Current maturity of funded debt or long term debt due and payable within the period of current year.

(g) Non-Current Liabilities:

These are also called long-term liabilities or debts. All such liabilities payable over a long period of time are known as Non-Current Liabilities.

Some examples of such liabilities are:

(i) Loan or mortgage,

(ii) Debentures or bonds,

(iii) Bank Loan, and

(iv) Loans from financial Institutions.

(h) Net Worth:

It is in practice being called by several names such as Net Assets, Share Holders Fund, Owners’ Equity and Net Capital Employed. Generally speaking, what remains after deducting all liabilities from total assets is called Net Worth or Share Holders Fund.

While analyzing this item, we must consider the following items:

(i) Preference Share Capital,

(ii) Equity Share Capital,

(iii) General Reserves,

(iv) Capital Reserves, and

(v) Other Reserves or Undistributed Profits.