Classical economists had a view that earning profit is the key business objective of all organizations.

However, modern economists have believed that an organization has to fulfill various alternative objectives, apart from profit, to survive in the long term.

In addition, modern economists have considered profit as one of the important business objectives of organizations. They have given a number of alternative objectives that an organization aims to achieve for long-term growth.

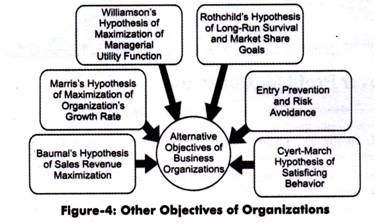

Figure-4 shows alternative objectives of business organizations given by different economists:

The alternative objectives of business organizations (as shown in Figure-4).

1. Baumal’s Hypothesis of Sales Revenue Maximization:

According to Baumal, the maximization of sales revenue is an alternative to profit maximization. He has also stated that sales revenue maximization objective of organizations is characterized as a contradiction between ownership and management in large business organizations.

This dichotomy gives opportunity to set goals other than profit maximization goals. Generally, managers always prefer to maximize theory own utility functions. As per Baumol, the most reasonable factor in manager’s utility function is the maximization of sales revenue. He has given a number of factors that influence managers to follow sales maximization as an objective.

ADVERTISEMENTS:

These factors are given as follows:

a. Close relation between salaries and other earnings of managers

b. Financial institutions, such as banks, lay a great emphasis on sales revenue for granting credit to organizations

c. Sales revenue trend is an indicator of the performance of the organization

ADVERTISEMENTS:

d. Increase in sales revenue increases the organizations’ prestige and reputation in the society

e. Fluctuations in profit with changing conditions make profit maximization a difficult objective

f. Increasing sales strengthen the competitiveness of the organization in market

Baumal’s sales maximization model is criticized on the following grounds:

i. Provides factual evidences that are inconclusive in case of empirical validity of sales revenue maximization objective. Moreover, the model is unable to provide the required data.

ii. States sales revenue maximization as an alternative to profit maximization. However, in the long run, the objectives of sales maximization and profit maximization converge into one.

2. Marris’s Hypothesis of Maximization of Organization’s Growth Rate:

According to Robin Morris, managers strive to maximize the balanced growth rate of an organization subject to managerial and financial constraints.

He defined organization’s balanced growth rate as:

ADVERTISEMENTS:

G = GD = GC

Where

GD = Growth rate of demand for organization’s product

GC = Growth rate of capital supply to the organization

ADVERTISEMENTS:

The equation implies that an organization’s growth rate is balanced when demand for its product and supply of capital to the organization increase at the same rate.

Marris translates the two growth rates in to two utility functions, which are as follows:

Manager’s utility functions = UM = f (salary, power, job security, prestige and status)

Owner’s utility function = UO = f (output, capital, market share, profit and public esteem)

ADVERTISEMENTS:

Owner’s utility function implies the growth of demand for organization’s product and supply of capital to the organization. Thus it can be said that maximization of UO means maximization of demand for organization’s product or growth of the capital supply.

According to Morris, by maximizing these variables, managers maximize there as well as owner’s utility functions. It is because most of the variables in the utility functions of owners and managers are positively related with the size of the organization. The maximization of the size of the organization depends upon the maximization of the growth rate. Thus, managers seek to maximize the growth rate.

However, Marris theory fails to deal with the oligopolistic interdependence. It ignores the price discrimination, which is the main concern of profit maximization.

3. Williamson’s Hypothesis of Maximization of Managerial Utility Function:

In modern organizations, managers and owners are the two separate entities with different objectives. Managers are employees who are paid salary for managerial services, whereas owners are the stockholders of the organization.

The problem of determining the objective of the organization is called as principal-agent problem. Williamson argued that managers pursue objectives other than profit maximization. They maximize their utility functions subject to minimum level of profit.

ADVERTISEMENTS:

Utility function of managers is expressed as:

U= f (S, M, Id)

Where S= Additional expenditure on staff

M= Managerial emoluments

Id= Discretionary investments.

Williamson says that managers maximize their utility function subject to a satisfactory profit. It implies that a minimum profit is required to satisfy shareholders. The utility functions that managers maximize include quantitative and non-quantitative variables where quantitative variables include salary and non- quantitative variables include power, status, and job security.

ADVERTISEMENTS:

This theory fails on aspect of dealing with the oligopolistic interdependence. Williamson’s hypothesis of maximization of managerial utility function is preferred only when competition between organizations is not strong.

4. Rothchild’s Hypothesis of Long-run Survival and Market Share Goals:

Rothchild suggested another alternative of the organization other than profit maximization. He states that the long-term survival is the primary goal of an organization. Attaining and retaining market share is an additional objective of the organizations.

The managers secure their market share and long term survival of an organization. The organization seeks to maximize the probability of its survival into the future. With the help of this objective, the owners are able to provide security and business to their future generations. However, this objective of long-run survival is hard to measure and difficult to practice.

5. Entry Prevention and Risk Avoidance:

Some economists have suggested that an objective of organizations is to prevent the entry of new organizations in the industry.

ADVERTISEMENTS:

The goals behind entry prevention are as follows:

a. Attaining profit maximization in the long run

b. Securing a stable market share

c. Avoiding risks caused by unpredictable behavior of new organizations

Some economists say that the possibility of profit maximization is reduced if management is divorced from ownership. On the other hand, some economists suggest that profit maximization can survive in the long run. Other goals can be achieved easily if profits are maximized.

6. Cyert-March Hypothesis of Satisficing Behavior:

ADVERTISEMENTS:

Cyert March hypotheses is an extension of the theory called Simon’s hypothesis of organizations’ satisfying behavior. According to Simon, real business world is full of uncertainty where accurate and adequate data is not easily available. If data is available, it is difficult for managers to process it because of time and other constraints.

In these conditions, it is not possible for organizations to maximize profit, nor can it seek to maximize sales and growth. Adding to this, Cyert-March added that apart from dealing with the uncertain business environment, managers have to satisfy a variety of groups of people, such as managerial staff, shareholders, customers, lawyers, and accountants, having interest in the organization.

Thus, satisficing behavior, according to Cyert March hypothesis is satisfying various interest groups by sacrificing organization’s interest or objective. The assumption under this theory is that an organization is a coalition of different groups connected with various activities of the organization. All the groups have some expectations from the organization that are fulfilled by sacrificing some of the interests of organizations.

For reconciling between conflicting interests and goals of an organization, the aspiration level of the organization is combined with the following goals:

a. Production goal

b. Sales and market share goals

c. Inventory goal

d. Profit goal

Goals and aspiration levels are set after evaluating the manager’s past experience and assessment of the future conditions of the market. These aspiration levels are modified and revised according to changing business environment.

This theory has been criticized on the following aspects:

a. Fails to explain the organization’s behavior under dynamic conditions in the long run

b. Fails to predict the future course of action of organization’s activities

c. Fails to deal with the equilibrium of organization of industry

d. Fails to take into account the interdependence of organizations.