Let us make in-depth study of the external sector reforms in India since 1991 and its success.

External Sector Reforms in India Since 1991:

To overcome balance of payments crisis 1991, and restore economic health to the external sector, various measures of stabilisation and structural reforms were undertaken by the new congress government with Dr. Manmohan Singh as the Finance Minister.

They are briefly explained below:

1. Devaluation of Rupee in 1991:

Before 1991, the Indian rupee was overvalued in terms of US $ and other important currencies. This overvaluation of the Indian rupee discouraged our exports and encouraged imports. This foreign exchange policy had therefore anti-export bias. To discourage imports and encourage exports rupee was devalued on July 1, 1991 and again on July 3,

ADVERTISEMENTS:

1991. In the two doses of devaluation, the rupee value in terms of trade-weighted basket of foreign currencies declined on an average by 22.8 per cent. The devaluation of the rupee in July 1991 was followed by the withdrawal of cash compensatory subsidy to exporters which prevailed before.

Thus, devaluation was expected to act as a substitute of export subsidy as the exporters would get more rupees in exchange of foreign currencies. The devaluation was also expected to promote the flow of funds from Non-Resident Indians (NRIs) to India. Besides, exports were expected to go up as the competitiveness of exportable improved. However, devaluation made the imports costlier.

As a result, it would have an adverse impact on import-sensitive export industries and would have given a fillip to cost-push inflation. However, suitable monetary and fiscal policies aimed at stabilisation of price level measures were adopted to check cost-push inflation.

2. Trade Liberalisation and Reduction in Customs Duties:

An important policy in external sector has been to open up the Indian economy to foreign trade. In place of import-substitution, export-led growth strategy has been adopted. Towards that end customs duties on non-agricultural imports have been reduced so that domestic industries should get cheaper imported raw materials and capital goods, to produce goods for exports at lower prices.

ADVERTISEMENTS:

Accordingly, the peak customs tariff rate which was over 300 per cent in 1990 was reduced in a phased manner to 35 per cent in 2002-03 budget and further to 15 per cent in 2005-06 and to 12.5 per cent in 2006-07 budget. Customs duties on imports were lowered not only to increase the competitiveness of Indian exports but to serve other purposes.

First, it checked cost-push inflation which arose due to devaluation of India rupee. Second, it reduced the prices of exportable goods which used a large quantity of imported raw materials and capital goods. This further increased the competitiveness of Indian exportable. Thirdly, lowering of custom duties exposed Indian industries to foreign competition. It was expected that this increased competition would lead to higher productivity in Indian industries.

3. Assistance from IMF and World Bank:

To overcome balance of payments problem, an emergency measure taken was to obtain financial aid from IMF and World Bank. IMF agreed to provide aid only if India fulfilled its preconditions. Its preconditions were that we should devalue our rupee, liberalise imports by lowering customs duties and introduce structural reforms by undertaking various measures of domestic liberalisation and opening up the Indian economy to foreign trade and investment.

India accepted these conditions and got assistance from IMF. Dr. Manmohan Singh argued that these structural reforms were in fact needed by the economy not only to restore confidence of the foreign and domestic investors and thereby to solve balance of payments problem but also to accelerate economic growth. Later events proved him right.

4. Cut in Fiscal Deficit for Macroeconomic Stabilisation:

ADVERTISEMENTS:

Rising fiscal deficit in the eighties was an important cause of worsening of the balance of payments. Therefore, an important measure taken to tackle the problem of balance of payments was to reduce fiscal deficit. The fiscal deficit of the Central Government which was 8.5 per cent of GDP in 1987-88 and 7.3 per cent of GDP both in 1988-89 and 1989-90 was reduced to 4.7 per cent in 1991-92 by reducing Government expenditure and introducing tax reforms.

Fiscal deficit of Central Government however deteriorated to 6.4 per cent of GDP in 1993-94 but was again brought down to 4.0 per cent in 1995-96 and further to 2.5 per cent in 2007-08. Reduction in fiscal deficit caused growth in aggregate demand to decline which helped in lowering the rate of inflation. Lower inflation rate in the Indian economy increased exports and discouraged imports of goods. Besides, reduction in fiscal deficit ensured smaller government borrowing from abroad.

This worked to lower the interest burden and debt-service charges over a span of time. However, it may be noted that due to fiscal stimulus programme adopted in 2009 and 2010 to prevent economic slowdown fiscal deficit of the Central Government as per cent of GDP rose to 6 per cent in 2008-09 and 6.3% in 2009-10.

5. Switch-over to Market-determined Exchange Rate:

An important measure adopted to tackle the balance of payments problem was that after a two year transition exchange rate was made market determined with effect from 1993. With this exchange rate began to be determined by demand for and supply of foreign currencies and Indian rupee.

The Indian rupee was made convertible on current account transactions. This facilitated the foreign exchange transactions at the exchange rate determined by market forces. This meant that correction in balance of payments which influences demand for and supply of foreign exchange, say US $, could be made to some extent by changes in foreign exchange rate. As a matter of fact, since 1993 there has been substantial depreciation of Indian rupee.

The exchange rate of rupee which was 24.47 rupees per US $ fell to 31.94 in 1994-95 and further to Rs. 35.50 per US $ in 1996-97, to Rs. 47.69 in 2001-02 and further to 48.40 in 2002-03. This improved greatly the incentives to exporters and to NRI remitting funds to India. Imports became more expensive which restrained their growth. However, from 2002-03 to 2008-09 there was appreciation of Indian rupee.

The average value of rupee in terms of number of rupees for a US dollar changed from Rs. 45.95 in 2003-04, to Rs. 44.93 in 2003-04, Rs 45.28 in 2005-06 and further to Rs. 45.99 in 2008-09 to Rs. 47.42 in 2009-10. During 2010-11 it appreciated to Rs. 45.68.

However, from Sept. 2011, due to large capital outflows from India, it started depreciating sharply and was hovering around Rs. 53 to a US dollar in Dec. 2011. Though exchange rate is allowed to be determined by the market forces of demand and supply, Reserve Bank of India intervenes in the foreign exchange market by selling or purchasing dollars to prevent large volatility in the exchange rate. However, RBI has no fixed exchange rate target to achieve.

6. Elimination of Anti-Export Bias:

An important reform in the external sector was change in India’s trade policy which had anti-export bias and pro-import-substitution bias. The new trade policy was to lower customs duties so as to reduce protection to large-scale industries. Protection reduces productivity and efficiency through eliminating foreign competition.

ADVERTISEMENTS:

To remove the pro-import-substitution bias and liberalise imports, in 1992-93 the peak custom duty on imports was reduced from 150 per cent to 110 per cent. The maximum import duty was further reduced to 85 per cent in 1993-94, to 65 per cent in 1994-95 and to 50 per cent in 1995-96 and to 45 per cent in 1997.

The peak customs duty was further reduced to 35 per cent in 2002-03 and to 15 per cent in 2005-06 budget, to 12.5 per cent in 2006-07 budget and to 10 per cent in 2008-09. The lowering of customs duties on imports also removes anti-export bias. The lower custom duties enable the domestic industries to get cheaper imported raw materials and capital goods to produce goods for exports at competitive prices.

7. FEMA Replaces FERA:

Another important reform in the external sector was Foreign Exchange Regulation Act (FERA) was replaced by Foreign Exchange Management Act (FEMA). The stringent provisions of FERA had become obsolete in the context of liberalisation of foreign trade, foreign investment and foreign exchange market in the early nineties. Stringent provisions of FERA were thought to be impeding the speedy globalisation of the Indian economy.

The aim of FEMA is to achieve the following objectives:

ADVERTISEMENTS:

1. In seeks to a facilitate foreign trade and payments involving foreign exchange.

2. It seeks to promote orderly maintenance of the foreign exchange market.

The following are the main provisions of FEMA:

1. Under the provisions of this act a person resident in India is permitted to hold, own, transfer or invest in foreign currency, foreign security or any immovable property situated outside India provided such currency, security or property was acquired, held or owned by him when he was resident outside India

ADVERTISEMENTS:

2. Similarly, the act provides that a person resident outside India has been permitted to hold shares, securities and properties acquired by him or her while he or she was resident in India. It also permits a non-resident Indian to hold such properties which have been inherited by him or her from a person resident in India.

3. FEMA provides that any person may sell foreign exchange to any authorized person or dealer or draw foreign exchange from such authorized person if such sale or drawal is a current account transaction (that is, exports and imports of goods and services). However, the government with consultation with RBI can impose reasonable restrictions on such transactions.

4. Further, the FEMA provides that subject to the class of capital account transactions, a person can sell or draw foreign exchange to or from an authorized person. These is limit up to which such capital account transactions are permitted. Besides, RBI has been authorized to regulate the foreign exchange transactions on capital account.

5. Under the provisions of FEMA, every exporter of goods and services will furnish to RBI full particulars including the export-value of goods and services exported and ensure the realisation and repatriation of export proceeds within a period of time and manner prescribed by RBI.

6. Another important liberalisation measure of the use of foreign exchange is that Indian residents going abroad for business purposes or for participating in conferences and seminars need not seek RBI’s permission to avail themselves of foreign exchange up to $ 25000 per trip irrespective of the period of stay.

7. Gifts and Donations. FEMA has substantially increased the prescribed limits in respect of certain payments abroad. In respect of gifts payments limit in foreign exchange has been raised from $ 1000 to $ 5000 and in respect of donations from $ 3000 to $ 5000.

ADVERTISEMENTS:

8. EEFC and RFC Account Holders. The Exchange Earners’ Foreign currency (EEFC) account holders have been permitted to freely use the funds held in EEFC for payment of all permissible current account transactions. Similarly, the Residents’ Foreign Currency (RFC) account holders have also been permitted to freely use the funds held in RFC for payment of all permissible current account transactions.

9. GDR and ADR Permissions. Under FEMA, the Indian firms of good standing have been permitted, with government approval to issue equity and convertible bonds through Global Depository Receipts (GDR) and American Depository Receipts (ADR) in European and US capital markets respectively up to certain specified limits.

10. Violations and Penalties under FEMA. FEMA differs from the earlier exchange regulation Act FERA with regard to penalties and punishment in case of violation of the act. Under FEMA, the receiver of laundered money is to be made culpable, instead of sender/distributor. Thus, only the recipient of hawala money is culpable. Further, the violators of FEMA would no longer be treated as criminals as was the case under FERA but as civil offenders.

The contravention of FEMA provisions would invite a monetary penalty amounting to a maximum of three times of the sum involved in contrast to five times prescribed in the repealed FERA. Besides, under FEMA, although there would be no prosecution in the foreign exchange violation cases, yet in case an offender fails to pay the penalty, the Enforcement Directorate could move court, which could sent him to jail.

In jail also the offender would be treated like a civil prisoner, who has to pay for his stay behind bars. Moreover, under FEMA, search and seizures can be carried out only if Enforcement Directorate has reasons to believe that the suspect will not show up when summoned.

Evaluation:

It is evident from the provisions of FEMA that it has greatly relaxed the conditions for dealings in foreign exchange. This is what was required in the economic environment when the Indian economy has been opened up to expand foreign trade and investment.

ADVERTISEMENTS:

This act has facilitated the growth of India’s exports and made the procurement of imported raw materials and capital goods required for rapid industrial growth. None that when the private sector is playing an important role in promoting economic growth, it is quite appropriate that foreign exchange regulation should be relaxed so that private sector can get the foreign exchange needed for giving a big push to the industrial growth.

Moreover, in India foreign exchange reserves are currently quite large and there is need for its use for productive purposes. It is because of FEMA that foreign institutional investors have brought in capital inflows to invest in equity and debt securities in the Indian capital market. This has resulted in a boom in the Indian capital market.

Success of External Sector Reforms:

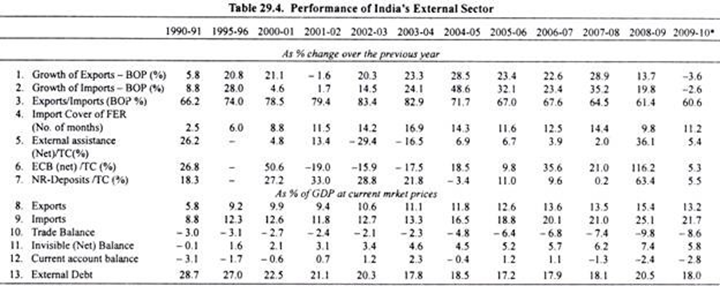

The balance of payments crisis of 1991 resulting in the depletion of foreign exchange services provided an opportunity to the government to undertake reforms in the external sector. In Table 29.4 we present the key indicators of the external sector. It will be seen from table 29.4 that the reform measures improved the performance of India’s external sector and brought good dividends. Export growth zoomed to 20.8 percent in 1995-96.

After registering slow growth in the next four years due to global slowdown, growth rate of 21 per cent and 20.3 per cent in 2000-01 and 2002-03 respectively was attained. In the next three years (2003-06) this high growth rate in exports had been maintained. Fears that imports will rapidly increase due to import liberalisation, would swallow domestic industries and result in large increase in deficit in current account balance have not come true.

This is due to more efficient management of changes in foreign exchange rate as an essential part of economic reforms. Further, as a result of liberalisation of capital flows, NRI deposits increased two times from 1.5 billion US dollars in 1990-91 to 2.8 billion US dollars in 2001-02 and to 3.6 US billion dollars in 2003-04 and rose further to 4.3 US dollars in 2006-07 (see Table 29.4). However, in 2007-08 increase in NRI deposits was quite small but they again rose to 4.3 billion dollars in 2008-09. In 2009-10 and 2010-11 NR deposits were $ 2.9 billion and $ 3.18 billion respectively.

ADVERTISEMENTS:

An important benefit of external sector reforms has been improvement in current account balance of payments. The deficit in current account balance which was 3.1 per cent of GDPmp in 1990-91, fell to 1.7 per cent in 1995-96, 1 to 1.4 per cent in 1997-98 and further fell to 0.6 per cent in 2000-01.

The significant point to note is that throughout the nineties after 1991, current account deficit in balance of payments never exceeded two per cent of GDPmp. This is no means achievement of economic reforms in the external sector. It is important to note that in the three years (2001- 02, 2002-03 and 2003-04), the surplus in current account was achieved (see Table 29.4 above).

After 2003-04 there was current account deficit but it remained at low level except in 2008-09 and 2009-10 when current deficit went up to 2.4 and 2.8 per cent of GDP due to global economic slowdown following the global financial crisis. In 2010-11, the current account deficit was 2.6 per cent of GDP.

It may however be noted that deficit in current account balance is not bad provided it is within reasonable limits and there are either enough foreign exchange reserves in the country or enough net current capital inflows into India. In fact, current account deficit represents absorption of foreign capital by the Indian economy.

Another big achievement of the external sector reforms is the flows of foreign investment in India which has contributed a good deal to the growth of industrial production and as result Indian exports rose sharply. Foreign investment (net) increased from only 103 million US $ in 1990-91 to around 5.35 billion US $ in 1997-1998 and further increased to around 15.5 billion US $ in 2005-06 and to 43.4 billion US $ in 2007-08 (see Table 29.4).

Of course, foreign capital flows into India are lower than those into China. However, due to economic slowdown, foreign investment declined to 3.5 billion US$ in 2008-09 because of net outflows of portfolio capital. But again went up to 51.2 billion. In 2010-11 net foreign investment in India was $ 44.3 billion.

ADVERTISEMENTS:

Of greater significance is the inflows of foreign exchange. Foreign exchange reserves in India which were a meagre amount of 5.8 billion US $ in 1990-91 climbed to 26 billion US $ in 1997-98, 5 times increase in seven years. There has been greater inflows of foreign exchange in the last few years with the result that foreign exchange reserves in India reached a level of 150 billion US dollars in March 2006 and further to US $ 309 billion at end-March 2008.

But as a result of capital outflows in 2008-09 due to global financial crisis foreign exchange reserves fell to $252 billion at end-March 2009 but again picked up and stood at $ 304 billion at end-March 2011. As a matter of fact, such a large stock of foreign exchange reserves has created problem for us as this has economy. However, they served as cushion in case of capital outflows from India as it is happening in the later half of 2011-12.

It will be seen from Table 29.4 (Row 4) that foreign exchange reserves which in 1990-91 covered imports required for only 2.5 months rose to such an extent that the foreign exchange reserves covered Indian imports for 8.2 months in 1992-2000 and for as high as 16.9 months in 2003-04 and 14.4 months in 2007-08. At present (2013-14) foreign exchange reserves are US $ 275 billion (Sep. 2013) and cover about 70 months of imports.

External Debt Situation:

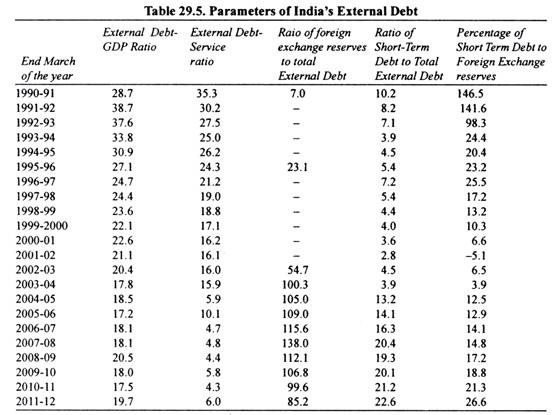

It will be observed from Table 29.5 that external debt which as per cent of India’s GDP was 2 8.7 per cent in 1990-91 fell to 22.1 per cent in 1999-2000 and further to 18.0 per cent at end March 2008 and was also at 18% at end-March 2010 but again rose to 19.7 per cent at end-March 2012. High external debt service ratio (that is, ratio of external debt service to current receipts) of 35 per cent in 1990-91 which contributed to our balance of payments crisis in 1991, was brought down to about half of that (i.e. 17 per cent) in 1999-2000 (See Table 29.5) and further to 4.3 at end-March 2009 and stood at 4.3% at end-March 2011 but rose to 6% at end-March 2012. This significantly reduced our burden of external debt relative to our GDP.

The ratio of short-term foreign debt to foreign exchange reserves is very critical from the viewpoint of foreign exchange management when there is flight of capital from a country. If it is very high as was the case in East Asian crisis of 1997-98, it can land a country into a great trouble.

It goes to the credit of India’s external sector reforms that ratio of short-term debt to foreign exchange reserves was brought down from an extremely high level 146.5 per cent in 1990-91 to just 10.3 per cent in 1999-2000. With greater inflows of foreign exchange reserves during three years (2000-2003) and payback of a part of short-term debt, the ratio of short-term debt to foreign exchange reserves fell to just 3.9 per cent at the end of March 2004 but rose again to 14.8 per cent at the end of March 2008 (Table 29.5).

It is now widely recognized that while East Asian countries experienced a severe crisis in 1997-98, India successfully weathered the storm. Thus a prudent external debt policy has placed India’s external debt in a comfortable position.

Recently, policy focus has been on concessional and relatively less expensive source of external funds. In this policy focus preference for long maturity loans, monitoring of short-term debts and emphasis on non-debt creating capital flows is being given. Recent initiatives towards reducing burden of external debt include prepayment of costly Government and non-Government external loans, rationalizing interest rates and structure of NRI deposits, and making end -use specifications for external commercial borrowing (ECB).