Let us make in-depth study of the importance and types of financial sector reforms in India since 1991.

Importance:

Financial sector reforms refer to the reforms in the banking system and capital market.

An efficient banking system and a well-functioning capital market are essential to mobilize savings of the households and channel them to productive uses. The high rate of saving and productive investment are essential for economic growth. Prior to 1991 while the banking system and the capital market had shown impressive growth in the volume of operations, they suffered from many deficiencies with regard to their efficiency and the quality of their operations.

The weaknesses of the banking system was extensively analyzed by the committee (1991) on financial sector reforms, headed by Narasimham. The committee found that banking system was both over-regulated and under-regulated. Prior to 1991 system of multiple regulated interest rates prevailed. Besides, a large proportion of bank funds was preempted by Government through high Statutory Liquidity Ratio (SLR) and a high Cash Reserve Ratio (CRR). As a result, there was a decrease in resources of the banks to provide loans to the private sector for investment.

ADVERTISEMENTS:

This preemption of bank funds by Government weakened the financial health of the banking system and forced banks to charge high interest rates on their advances to the private sector to meet their needs of credit for investment purposes. Further, the lack of transparency in the accounting practice of the banks and non-application of international norms by the banks meant that their balance sheets did not reflect their underlying financial position.

This was prominently revealed by 1992 scarcity scam triggered by Harshad Mehta. In this situation the quality of investment portfolio of the banks deteriorated and culture of’ non-recovery’ developed in the public sector banks which led to a severe problem of non-performing assets (NPA) and low profitability of banks. Financial sector reforms aim at removing all these weaknesses of the financial system.

Under these reforms, attempts have been made to make the Indian financial system more viable, operationally efficient, more responsive and improve their allocative efficiency. Financial reforms have been undertaken in all the three segments of the financial system, namely banking, capital market and Government securities market.

Types of Financial Sector Reforms:

We explain below various reforms in these three segments in financial sector initiated since 1991:

1. Reduction in Statutory Liquidity Ratio (SLR) and Cash Reserve Ratio (CRR):

ADVERTISEMENTS:

An important financial reform has been the reduction in Statutory Liquidity Ratio (SLR) and Cash Reserve Ratio (CRR) so that more bank credit is made available to the industry, trade and agriculture. The statutory liquidity ratio (SLR) which was as high as 39 per cent of deposits with the banks has been reduced in a phased manner to 25 per cent.

It may be noted that under statutory liquidity ratio banks are required to maintain a minimum amount of liquid assets such as government securities and gold reserves of not less than 25 per cent of their total liabilities. In 2008, statutory liquidity ratio was reduced to 24 per cent by RBI.

Similarly, cash reserve ratio (CRR) which was 15 per cent was reduced over phases to 4.5 per cent in June 2003. It may be noted that reduction in CRR has been possible with reduction of monetized budget deficit of the government and doing away with the automatic system of financing government’s budget deficit through the practice of issuing ad hoc treasury bills to the Central Government.

On the other hand, reduction in Statutory Liquidity Ratio (SLR) has been possible because efforts have been made by government to reduce fiscal deficit and therefore its borrowing requirements. Besides, reduction in SLR has become possible because of a shift to payment of market-related rates of interest on government securities.

ADVERTISEMENTS:

Since the government securities are free from any risk and now bear market-related interest rates, the banks may themselves feel inclined to invest their surplus funds in these securities, especially when demand for credit by the industry and trade is not adequate.

The reduction in CRR and SLR has made available more lendable resources for industry, trade and agriculture. Reductions in CRR and SLR also made possible for Reserve Bank of India to use open market operations and changes in bank rate as tools of monetary policy to achieve the objectives of economic growth, price stability and exchange rate stability.

Thus, Dr. C. Rangarajan, the former Governor of Reserve Bank of India, says, “As we move away from automatic monetisation of deficits, monetary policy will come into own. The regulation of money and credit will be determined by the overall perception of the Central monetary authority on what appropriate level of expansion of money and credit should be depending on how the real factors in the economy are evolving”.

2. End of Administered Interest Rate Regime:

A basic weakness of the Indian financial system was that interest rates were administered by the Reserve Bank/Government. In the case of commercial banks, both deposit rates and lending rates were regulated by Reserve Bank of India. Before 1993, rate of interest on Government Securities could be maintained at low levels through the means of high Statutory Liquidity Ratio (SLR).

Under SLR regulation commercial banks and certain other financial institutions were required by law to invest a large proportion of their liabilities in Government securities. The purpose behind the administered interest-rate structure was to enable certain priority sectors to get funds at concessional rates of interest. Thus the system of administered interest rates involved cross subsidization; concessional rates charged from primary sectors were compensated by higher rates charged from other non-concessional borrowers.

The structure of administered rates has been almost totally done away with in a phased manner. RBI no longer prescribes interest rates on fixed or time deposits paid by their banks to their depositors. Banks have also been freed from any prescribed conditions of premature withdrawal by depositors. Individual banks are free to determine their conditions for premature withdrawal. Currently, there is prescribed rate of 3.5 per cent for Savings Bank Accounts.

Note that Savings Bank Account are actually used by the individuals as current account even with cheque-book facility. Since the banks’ cost of servicing these accounts is high, rate of interest on them is bound to be low. Besides, there is lower interest rate ceilings prescribed for foreign currency denominated deposits from non-resident Indians (NRI). Such a lower prescribed ceiling is required for managing external capital flows, especially short-term capital flows, till we switch over to liberalisation of capital account.

Lending rates of interest for different categories which were earlier regulated have been gradually deregulated. However, RBI insists upon transparency in this regard. Each bank is required to announce prime lending rates (PLRs) and the maximum spread it charges. Maximum spread refers to the difference between the lending rate and bank’s cost of funds.

Interest on smaller loans up to Rs. 2,00,000 are regulated at concessional rates of interest. At present, the interest rate on these smaller loans should not exceed the prime lending rates. Besides, lending interest rates for exports are also prescribed and are linked to the period of availment. Changes in prescribed interest rates for exports have been often used as an instrument to influence repatriation of export proceeds.

ADVERTISEMENTS:

Thus, except prescribed lending rates for exports and small loans up to Rs. 2, 00,000, the lending rates have been freed from control. Banks can now fix their lending rates as per their risk reward perception of borrowers and purposes for which bank loans are sought.

3. Prudential Norms: High Capital Adequacy Ratio:

In order to ensure that financial system operates on sound and competitive basis, prudential norms, especially with regard to capital-adequacy ratio, have been gradually introduced to meet the international standards. Capital adequacy norm refers to the ratio of paid-up capital and reserves to deposits of banks. The capital base of Indian banks has been very much lower by international standards and in fact declined over time.

As a part of financial sector reforms, capital adequacy norm of 8 per cent based on risk-weighted asset ratio system has been introduced in India. Indian banks which have branches abroad were required to achieve this capital-adequacy norm by March 31, 1994. Foreign banks operating in India had to achieve this norm by March 31, 1993.

Other Indian banks had to achieve this capital adequacy norm of 8 per cent latest by March 31, 1996. Banks were advised by RBI to review their existing level of capital funds as compared to the prescribed capital adequacy norm and take steps to increase their capital base in a phased manner to achieve the prescribed norm by the stipulated date.

ADVERTISEMENTS:

It may be noted that Global Trust Bank (GTB), a private sector bank, whose operations had to be stopped by RBI on July 24, 2004 had a capital adequacy ratio much below the prescribed prudent capital adequacy ratio norm. In this regard, link between capital adequacy and provisioning is worth noting. Capital adequacy norm can be met by the banks after ensuring that adequate capital provisions have been made.

To achieve this capital adequacy norm, Government had come in to provide capital funds to some nationalized banks. Some stronger public sector banks raised funds from the capital market by selling their equity. Law was passed to enable the public sector banks to go to the capital markets for raising funds to enhance their capital base. Banks can also use a part of their annual profits to enhance their capital base (that is, ploughing back of retained earnings into investment).

4. Competitive Financial System:

After nationalization of 14 large banks in 1969, no bank had been allowed to be set up in the private sector. While the importance and role of public sector banks in Indian financial system continued to be emphasised, it was however recognized that there was urgent need for introducing greater competition in the Indian money market which could lead to higher efficiency of the financial system.

Accordingly, private sector banks such as HDFC, Corporation Bank, ICICI Bank, UTI Bank, IDBI Bank and some others have been set up. Establishment of these banks has made substantial contribution to housing finance, car loans and retail credit through credit card system. They have made possible the wider use of what is often called plastic money, namely, ITM cards, Debit Cards, and Credit Cards.

ADVERTISEMENTS:

In addition to the setting up of private sector Indian banks, competition has also sought to be promoted by permitting liberal entry of branches of foreign banks, therefore, CITI Bank, Standard Chartered Bank, Bank of America, American Express, HSBC Bank have opened more branches in India, especially in the metropolitan cities

An important recent step is the liberalisation of foreign direct investment in banks. In the budget for 2003-04, the limit of foreign direct investment in banking companies was raised from 49 per cent to the maximum 74 per cent of the paid up capital of the banks. However, this did not apply to the wholly owned subsidiaries of foreign banks.

A foreign bank may operate in India through any one of three channels, namely:

(1) As branches of foreign banks,

(2) A wholly owned subsidiary of a foreign bank,

(3) A subsidiary with aggregate foreign investment up to the maximum of 74 per cent of the paid-up capital.

ADVERTISEMENTS:

The above measures are expected to facilitate setting up of subsidiaries by foreign banks. Besides fostering competition among banks they have also increased transparency and disclosure standards to reach the international standards. Banks have to submit to RBI and SEBI, the maturity pattern of their assets and liabilities, movements in the provision account and about non-performing assets (NPA).

RBI’s annual publication ‘Trends and Progress of Banking in India’ provides detailed information on individual bank’s financial position, that is, their losses, assets, liabilities, NPA etc. which enable public assessment of the working of the banks.

5. Non-Performing Assets (NPA) and Income Recognition Norm:

Non-performing assets of banks have been a big problem of commercial banks. Non-performing assets mean bad loans, that is, loans which are difficult to recover. A large quantity of non-performing assets also lowers the profitability of bank. In this regard, a norm of income recognition introduced by RBI is worth mentioning. According to this, income on assets of a bank is not recognized if it is not received within two quarters after the last date.

In order to improve the performance of commercial banks recovery management has been greatly strengthened in recent years. Measures taken to reduce non-performing assets include restructuring at the bank level, recovery of bad debt through Lok Adalats, Civil Courts, setting up of Recovery Tribunals and compromise settlements. The recovery of bad debt got a great boost with the enactment of ‘Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest’ (SARFAESI). Under this Act, Debt Recovery Tribunals have been set up which will facilitate the recovery of bad debts by the banks.

As a result of the above measures gross NPA declined from Rs. 70,861 crores in 2001-02 to Rs. 68, 715 crores in 2002-03. But there are substantial amounts of non-performing assets whose recovery is still to be made. Besides, as a result of introduction of risk-based supervision by RBI, the ratio of gross NPA to gross advances of scheduled commercial banks declined from 12.7 per cent in 1999-2000 to 8.8 per cent in 2002-03.

6. Elimination of Direct Credit Controls:

Another significant financial sector reform is the elimination of direct or selective credit controls. Selective credit controls have been done way with. Under selective credit controls RBI used to control through the system of changes in margin for provision of bank credit to traders against stocks of sensitive commodities and to stock brokers against shares. As a result, there is now greater freedom to both the banks and borrowers in respect of credit.

ADVERTISEMENTS:

But it is worth mentioning that banks are required to observe the guidelines issued by RBI regarding lending to priority sectors such as small scale industries and agriculture. The advances eligible for priority sectors lending have been increased at deregulated interest rates.

This is in accordance with the recognition that the main problem is more of availability of credit than the cost of credit. In June 2004 UPA Government announced that credit to farmers for agriculture will be available at 2 per cent below PLR of banks. Further, credit for agriculture will be doubled in three years time.

7. Promoting Micro-Finance to Increase Financial Inclusion:

To promote financial inclusion the government has started the scheme of micro finance. RBI provides guidelines to banks for mainstreaming micro-credit providers and enhancing the outreach of micro-credit providers inter alia stipulated that micro-credit extended by banks to individual borrowers directly or through any intermediary would henceforth be reckoned as part of their priority-sector lending. However, no particular model was prescribed for micro-finance and banks have been extended freedom to formulate their own model(s) or choose any conduit/intermediary for extending micro-credit.

Though there are different models for pursuing micro-finance, the Self-Help Group (SHG)-Bank Linkage Programme has emerged as the major micro-finance programme in the country. It is being implemented by commercial banks, regional rural banks (RRBs), and cooperative banks.

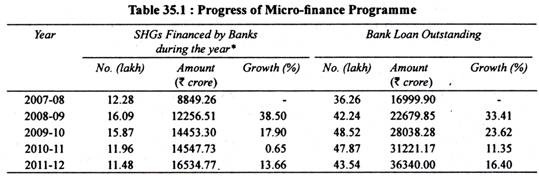

Under the SHG-Bank Linkage Programme, as on 31 March 2012, 79.60 lakh SHG-held savings bank accounts with total savings of? 6,551 crore were in operation. By November 2012 another 2.14 lakh SHGs had come under the ambit of the programme, taking the cumulative number of savings-linked groups to 81.74. As on 31 March 2012, 43.54 lakh SGHs had outstanding bank loans of Rs. 36,340 crore (Table 35.1). During 2012-13 (up to November 2012), 3.67 lakh SHGs were financed with an amount Rs. 6, 664.15 crore.

Extension of Swabhimaan Scheme:

ADVERTISEMENTS:

Under the Swabhimaan financial inclusion campaign, over 74,000 habitations with population in excess of 2,000 had been provided banking facilities by March 2012, using various models and technologies including branchless banking through business correspondents (BCs).

The Finance Minister in his Budget Speech of 2012-13 had announced that Swabhimaan would be extended to habitations with population more than 1,000 in the north-eastern and hilly states and population more than 1,600 in the plains areas as per Census 2001.

Accordingly, about 45,000 such habitations had been identified for coverage under the extended Swabhimaan campaign. As per the progress received through the conveners of State Level Bankers’ Committee (SLBC), out of the identified habitations, 10,450 have been provided banking facilities by end of December, 2012. This will extend the reach of banks to all habitations above a threshold population.

8. Setting up of Rural Infrastructure Development Fund (RIDF):

The Government of India set up the RIDF in 1995 through contribution from commercial banks to the extent of their shortfall in priority sector lending by banks with the objective of giving low cost fund support to states and state-owned corporations for quick completion of ongoing projects relating to medium and minor irrigation, soil conservation, watershed management, and other forms of rural infrastructure.

The Fund has continued, with its corpus being announced every year in the Budget. Over the years, coverage under the RIDF has been made more broad-based in each tranche and, at present, a wide range of 31 activities under various sectors is being financed.

ADVERTISEMENTS:

The annual allocation of funds for the RIDF announced in the Union Budget has gradually increased from Rs. 2000 crore in 1995- 96 (RIDF 1) to Rs. 20,000 crore in 2012-13. Further, a separate window was introduced in 2006-07 for funding the rural roads component of the Bharat Nirman Programme with a cumulative allocation of Rs. 18,500 crore till 2009-10.

From inception of the RIDF in 1995-6 to March 2012, 462,229 projects have been sanctioned with a sanctioned amount of Rs. 1, 43,230 crore. Of the cumulative RIDF loans sanctioned to state governments, 42 per cent have gone to the agriculture and allied sector, including irrigation and power; 15 per cent to health, education, and rural drinking water supply; while the share of rural roads and bridges has been 31 per cent and 12 per cent, respectively. The annual allocation of funds under the RIDF has gradually increased from Rs. 2,000 crore in 1995-6 (RIDF I) to Rs. 20,000 crore in 2012-13 (RIDF XVIII).

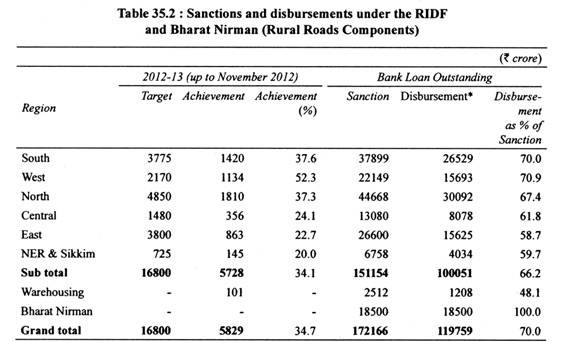

As against the total allocation of Rs. 1, 72,500 crore, encompassing RIDFI to XVIII, sanctions aggregating Rs. 1, 51,154 crore have been accorded to various state governments and an amount of Rs. 1, 00,051 crore disbursed up to the end of November 2012. Nearly 55 per cent of allocation has been made to southern and northern regions. The National Rural Roads Development Agency (NRRDA) has disbursed the entire amount of Rs. 18,500 crore sanctioned for it (under RIDF XII-XV) by March 2010. During 2012-13 (up to end November 2012), Rs. 5,829 crore was disbursed to the states under the RIDF (Table 35.2).

The Government of India has decided to introduce a Direct Benefit Transfer (DBT) scheme with effect from 1 January 2013. To begin with, benefits under 26 schemes will directly be transferred into the bank accounts of beneficiaries in 43 identified districts across respective states and union territories (UT).

Banks will ensure that all beneficiaries in these districts have a bank account. All PSBs and RRBs have made provision so that the data collected by the Departments/Ministries/Implementing agency concerned can be used for seeding the bank account details in the core banking system (CBS) of banks with Aadhaar. All PSBs have also joined the Adhaar Payment Bridge of the National Payment Corporation of India for smooth transfer of benefits.

Termination of Automatic Monetisation of Budget Deficits:

This is significant reforms measure to put a check on the growing fiscal deficit of the Central Government. Before 1997 whenever there was a deficit in Central Government budget this was financed by borrowing from RBI through issuing of ad hoc treasury bills. RBI issued new notes against these treasury bills and delivered them to the Central Government.

Since Government incurred deficits year after year, the question of retiring these ad hoc treasury bills did not arise. In this way there was automatic monetisation of Central Government’s budget deficit resulting in the increase in reserve money in the economy. With the operation of money multiplier, the increase in reserve money led to a manifold increase in money supply in the economy which contributed to inflationary tendencies in the Indian economy. Dr. C. Rangarajan in an important contribution to financial management highlighted the adverse effects of automatic monetisation of Government’s budget deficits through ad hoc treasury bills.

Since in the eighties and nineties Government borrowed heavily due to large fiscal deficits, expansionary impact of these deficits had to be countered by RBI by raising CRR and SLR from time to time. Besides, in the context of heavy borrowing by the Central Government the need to counter the impact on the money supply by raising CRR to mop up excess liquidity increased so as to control inflation.

In this environment RBI could not use the instrument of open market operations to regulate the money supply and rate of interest. At a time when Government borrowed heavily in the market to meet its large deficit, the use of open market operations (i.e. selling Government securities in the open market from its own reserves by RBI) would have resulted in sharp rise in interest rate.

Dr. Rangarajan succeeded in getting abolished the system of automatic monetisation of ever-rising budget deficits through the issue of ad hoc treasury bills by the Government. In its place the system of Ways and Means Advances (WMA) were introduced from April 1,1997. Under this new system of Ways and Means Advance (WMA) financial limits are fixed to accommodate temporary mismatches in Government receipts and payments and further that market related interest rate is charged on these advances.

The limit for WMA and rate of interest charged on them are mutually agreed between RBI and Government from time to time. Further, after 1999 no overdrafts by the Government are permitted for a period beyond 10 consecutive days. Thus, ways and means advances are in fact loans to the Government given by RBI for a short period of time.

It is important to note that with the abolition of ad hoc treasury bills, the system of 91 days tap treasury Bills has also been discontinued with effect from April 1, 1997. Accordingly, with the introduction of the system of Ways and Means Advances (WMA), the conventional concept of budget deficit and deficit financing have also lost their relevance.

Therefore, the earlier practice of showing budgetary deficit in Government’s budget and the extent of deficit financing has been abandoned. Instead, at present the magnitudes of fiscal deficit, revenue deficit and primary deficits are provided in the budget and become key indicators of Government’s fiscal position.

It is clear from above that the new system of Ways and Means Advances (WMA) has given more autonomy to RBI for conducting its monetary policy. Another related important financial reform is the enactment of’ Fiscal Responsibility and Budget Management (FRBM)’ Act, which provides a relationship between Government’s fiscal stance and RBI’s monetary management.

According to FRBM, Central Government will take appropriate measures to reduce fiscal deficit to 2 per cent and to eliminate entirely revenue deficit in a time-bound manner by March 31, 2008. It has been provided in the law that revenue deficit and fiscal deficit may exceed targets specified in the rules only on grounds of national security or natural calamity or such other exceptional circumstances as specified by Central Government.

An important provision of the Act is that the Central Government shall not borrow from RBI except by Ways and Means Advances. Further, an important feature of FRBM Act is that RBI will not subscribe to the primary issues of Central Government securities from the year 2006-07.

Pension Reforms:

Since October 2003, a New Pension Scheme (NPS) was introduced by the Central Government for its employees. Later many States have also joined the scheme for their employees. The New Pension Scheme is a contributory retirement scheme.

All employees joining Central Government after January 1, 2004 have to join the scheme and contribute to it to obtain pension after their retirement. Later many states have also joined the scheme for their employees. It is now also open to private individuals and eight fund managers manage the scheme.

The pension authority was named as Pension Fund Regulatory and Development (PFRDA). Till September 2013, this pension authority has been functioning under executive authority since October 2003. Now in September 2013, the Indian Parliament passed the Pension Fund Regulatory Development Authority Bill, eight years after it was introduced in March 2005. This bill seeks to empower PFRDA to regulate the pension scheme (NPS).

The corpus of PFRDA has Rs. 34,965 crore. NPS has been there with us for nine years and to manage such a large amount of Rs. 35,000 crore was not good to be managed by a non-statutory authority. It should be managed by a statutory authority. All that this new legislation does is to make the non-statutory authority a statutory authority.

The legislation regarding Pension Fund Regulatory and Development Authority passed by the Parliament is an important financial reform that will pave the way for foreign investment in the sector. At present the new pension scheme has about 5.3 million subscribers and the scheme has a corpus of around Rs. 35,000 crore.

The Finance Minister has clarified that foreign investment in the pension sector will be 26% and linked to that in the insurance sector. The government has already approved 49% foreign investment in the insurance sector.

“I am confident that the Pension Bill will be passed in Rajya Sabha,” Chidambaram said adding that the government had accepted all but one suggestion of the Standing Committee on Finance that gave its recommendations on the Bill in August 2011. The PFRDA will notify New Pension System schemes that provide minimum assured returns, incorporated after the standing committee suggested some sort of guaranteed returns.

The NPS will also provide for withdrawal for some limited purposes, which was not the case earlier. The reform will go a long way in increasing the coverage of formal pension and social security plans in India, where only about 12% of the active workforce has any formal pension or social security plan.

The opening of the pension sector, even at 26%, will encourage foreign investors to put their money, as India has a huge population that needs social security cover. We do not have much pension products now but once there are more players, there will be more products which will help to channelize this pension money into the economy. The Bill will further empower the PFRDA to regulate the NPS and other pension schemes that are not covered under any Act.