Aside from the various effects already mentioned, protection, consumption, revenue, income redistribution and terms of trade, tariffs may also have an important bearing on the level of national economic activities.

In times of economic recession, a high unemployment, argument goes that imports produced with “underpaid” foreign labour are taking jobs away from domestic workers.

Precisely what is the connection between tariffs and national income?

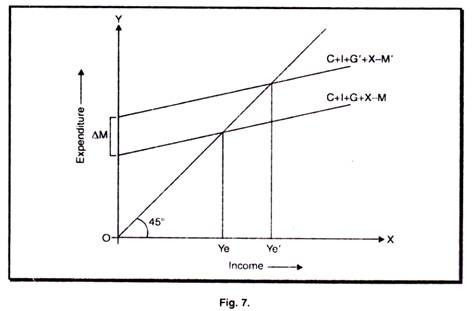

Since imports constitute a leakage out of the domestic income stream, a reduction of the volume of imports caused by the imposition of the tariff should stimulate the national economy. Consumers shift their purchases out of imports and into domestically produced goods. As a result of the tariff induced reduction in imports (exports assumed to be unaffected) the multiplier effect comes into play and drives the economy upward to a new higher equilibrium level of real income. This is illustrated in the following figure.

ADVERTISEMENTS:

In an open economy we know that:

Y=C+I+G+X-M

Before the tariff, the relevant aggregate demand function Y = C + I + G + X – M intersects the 45° line at equilibrium income Ye. Now the tariff is imposed, which reduces imports (M) and thereby increases the term (X – M) or net foreign investment. This reduced leakage from the income stream acts in the same way as an autonomous injection and raises the aggregate demand function to Y = C + I + G + X – M1 via the national income multiplier, income is driven upward to a new, higher equilibrium at (Yie).

Thus, a tariff tends to stimulate national economic activity and presumably relieves unemployment. Of course, the domestic gain in economic activity and employment is obtained by imposing a tariff and shutting out imports, and it is therefore detrimental to economic activity in other countries. Their exports are reduced, and the multiplier effect ensures that their equilibrium incomes and employment fall.

ADVERTISEMENTS:

Hence, in retaliation they are likely to impose tariffs of their own to reduce imports, and the effect on domestic economic activity of the home country’s initial tariff increase will fall far short of its goal as its own exports fall. There is no question that everything else being equal, tariffs do tend to stimulate domestic income and employment. Yet this “beggar- my-neighbour” type of policy, will fail if, as is likely, there is retaliation on the part of a country’s trading partners in the form of increased tariff on imports from the home country.