Causes of Market Failure of Pareto Optimality and Measures to Correct It!

Market Failure or Non-Attainment of Pareto Optimality:

In the real world, there is non-attainment of Pareto optimality (or optimum welfare) due to a number of constraints in the working of perfect competition. These lead to market failure. Market failure refers to the circumstances under which markets fail to allocate resources efficiently.

They are discussed as under:

1. Monopoly or Imperfect Markets:

Whenever markets are imperfect, as under monopoly, monopolistic competition or oligopoly, the perfect market will fail to achieve the Paretion optimum conditions. The main condition for Pereto optimality under perfect competition is the equality of marginal rate of substitution (MRS) and marginal rate of transformation (MRT) between two products X and Y and their price ratios Px/Py. Thus

ADVERTISEMENTS:

(MRS)XY = Px/Py

and (MRS)XY = Px/P

(MRS) = (MRS)xy

But under monopoly, MRSXY will not equal MRSXY and both will not equal the ratio of their prices (PX/PY).

ADVERTISEMENTS:

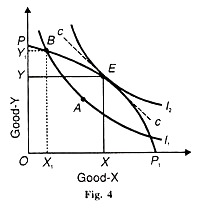

To explain this, consider Figure 4 where the Pareto efficiency conditions for exchange and production are fulfilled at point E. At this point, the MRSxy =MRTxy, because the slope of the transformation curve PP1 equal the slope of the indifference curve I2 , as shown by the tangent CC.

Here MRTxy = MCx/MCy = P/Py = MRSxy, Now suppose that there are perfectly competitive conditions. Since good X is being produced under monopoly conditions, price of good X is higher than its marginal cost, i.e., PX > MCX But good Y is being produced under perfect competitive where PY = MCY Therefore, MCX/MCy = PX/PY Since MCX/MCY = MRTXY if follows that under monopoly production MRTXY = PX/PY. (Fig. 61.4)

But the consumers will equate MRSXY with PX/PY .Thus under monopoly MRTXY, < MRSXY The monopoly production will take place at point В where less of good X and more of good Y will be produced than under competitive conditions.

ADVERTISEMENTS:

Under perfect competition, OX of X and OY of Y is produced at point E, whereas under monopoly OXy of X and OYx of Y is produced at point B. Thus the existence of monopoly leads to the non-fulfilment of Pareto optimality because less of good X by XX1 is produced than under perfect competition.

2. Externalities:

The presence of externalities in consumption and production also lead to market failure. Externalities are market imperfections where the market offers no price for service or disservice. These externalities lead to mal-allocation of resources and cause consumption or production to fall short of Pareto optimality.

Externalities, also known as external economies and diseconomies, lead to the divergence of social costs from private costs and of social benefits from private benefits.

When social costs and private costs and benefits diverge, perfect competition will not achieve Pareto optimality. Because under perfect competition private marginal cost (PMC) is equated to private marginal benefit (i.e. the price of the product). We discuss below how external economies and diseconomies of consumption and production affect adversely the allocation of resources and prevent the attainment of Pareto optimality.

External Economies of production:

These economies accrue to other firms in the industry with the expansion of a firm. They may be the result of reduced input costs which lead to pecuniary external economies or the result of a new technique of production (technological economies by one firm.

Whenever external economies exist, social marginal benefit (SMB) will exceed private marginal benefit (PMB) and private marginal cost (PMC) will exceed social marginal cost (SMC).

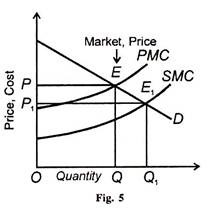

So when under perfect competition, private marginal cost is equated to price which is also private marginal benefit, social marginal benefit will be higher than social marginal cost because of external economies of production. The firms will produce less than the socially optimum level of output. This is illustrated in Fig. 5 where PMC is the private marginal cost curve of firm.

SMC is the social marginal cost curve. D is the demand curve which intersects the PMC curve at point E and determines the competitive price OP and output OQ. But the socially (Paretian) optimum output is OQ1 and price is OP1 as determined by the intersection of the SMC curve and the D curve at point E1. Thus the industry is producing Q1Q less than the socially optimum output OQ1 Since for every unit of output between g, and Q1 social marginal cost (SMC) is less than the competitive market price OP1 its production involves a social gain.

ADVERTISEMENTS:

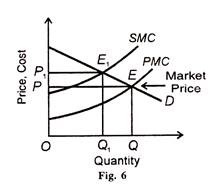

External Diseconomies of Production When there are external diseconomies of production, social marginal cost is higher than social marginal benefit, and firms will produce more than the socially optimal level of output.

A factory situated in a residential area emits smoke which affects adversely health and household articles of the residents. In this case, the factory benefits at the expense of residents who have to incur extra expenses to keep themselves healthy and their households clean. These are social marginal costs because of harmful externalities which are higher than private marginal cost and also social marginal benefit.

ADVERTISEMENTS:

This is illustrated in Figure 6 where the SMC curve is above the PMC curve which intersects the D curve at point E and determines the competitive price OP and output OQ. But the socially optimum output is OO1 and price is OP1, as determined by the intersection of SMC and D curve sat point E1. Thus the firms are producing Q1Q more than the social optimal output OQ1 In this case, for every unit between Q1 and Q, social marginal cost (SMC) is more than the competitive market price OP. Thus its production involves a social loss.

Externalities in Consumption:

They lead to non-attainment of Pareto optimality. In the case of external economies in consumption, the consumption of a good or service leads to increase in utility (or welfare or satisfaction) of other consumers. When an individual installs a TV set, the satisfaction of his neighbours increases because they can watch TV programmes free at his place.

Here social benefit is larger and social cost is lower than private benefit and cost. But the TV owner is likely to use his TV set to a smaller extent than the interests of society require because of the inconvenience and nuisance caused by his neighbours to him.

ADVERTISEMENTS:

External diseconomies of consumption arise when the consumption of a good or service by one consumer leads to reduced utility (or dissatisfaction or loss of welfare) of other consumers. Consumption diseconomies arise in the case of dress, fashions and articles of conspicuous consumption which reduce their utility to some consumers.

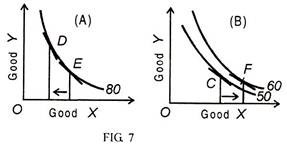

Smokers cause disutility to non-smokers, and noise nuisance from stereo systems to neighbours are other examples. Such diseconomies of consumption prevent the attainment of Pareto optimality. This is explained in terms of Figure 7. Let there be two consumers A and В who buy two goods X and Y.

Consumer A is in equilibrium at point E on the IС curve 80 (utility) in Panel (A). Consumer В is in equilibrium at point С on the IС curve 50 (utility) in Panel (B), when there are no externalities in consumption AMRSXY = BMRSXY. This is because the tangents at points E and С are parallel to each other.

Suppose that (i) A’s utility is not affected by B’s consumption; and (ii) B’s utility is affected by A’s consumption of good X, but not of Y. Given these conditions, assume that redistribution takes place such that there is decrease in the consumption of good X by consumer A. He now moves from point E to D on the same 1C curve 80.

Since B’s utility is dependent on A’s consumption of X, he moves from point С on the IC curve 50 to F on the 1C curve 60. B’s utility of good X has increased. As a result of the shift of IC curve of В from 50 to 60 (utility), the total welfare (utility) increases from 130 (=A’s 80 + B’s 50) to 140 (= A’s 80 + B’s 60), despite the fact that at the new equilibrium the MRS is not the same for both A and B.

ADVERTISEMENTS:

This is because the tangents at points D and F on these IC curves are not parallel to each other. Consumer A is on the same IC curve 80 but consumer В has moved on a higher IC curve with higher utility 60. Thus Pareto optimality is not attained because the utility of one consumer В has been increased without reducing the utility level of the other consumer A.

3. Public Goods:

Another cause of market failure is the existence of public goods. A public good is one whose consumption or use by one individual does not reduce the amount available for others. Examples are city parks, defence, police, ocean or lake fishing, etc.

Public goods have two characteristics: non-excludable and non-rivalrous. A good is non-excludable if it can be consumed by any one. It is non-rivalrous if no one has an exclusive right over its consumption. Its benefit can be provided to an additional consumer at zero marginal cost.

Thus public goods being both no excludable and non-rivalrous are not sold in a free market like private goods. They lead to market failure in the following ways.

The consumption of a public good is always ‘joint and equal. The Paretian condition for a public good is that its marginal social benefit should equal its marginal social cost (MSB = MSC). But the characteristics of a public good are such that the economy will not reach a point of Pareto optimum in a perfectly competitive market. Public goods create positive externalities.

The externality starts when the marginal cost of consuming or producing an additional unit of the public good is zero but a price above zero is being charged. This violates the Paretian welfare maximisation criterion of equating marginal social cost and marginal social benefit. This is because the benefits of a public good must be provided at a zero marginal social cost.

ADVERTISEMENTS:

Again, public goods are not subject to the “exclusion principle” which means that their benefits are available to everybody whether a person pays for them or not. But in the case of some public goods, exclusion is practiced. Take the example of a bridge as the public good whose use is restricted to those who pay a toll tax.

This does not lead to Pareto optimality because the toll tax restricts the services of the bridge to only those who pay the toll tax. For Pareto optimality, its services should be available to every consumer at a zero price.

In the case of some public goods where exclusion cannot be practiced, all payments for their services are purely voluntary. In such a situation, many users have the tendency to avoid paying for their services when they know their benefits can be obtained free.

All such users are known as “free riders”. Therefore, when such a public goods is produced much less than the optimum quantity would be available to its users. The use of Star TV signals by TV owners with their own “dish” antennas is an example of free riders because they do not pay anything for signals whereas cable operators pay.

The market failure in the case of public goods can be summed up in terms of the efficiency conditions of Pareto optimality. Suppose there are two individuals A and В and two goods X and Y with X being a public good in the economy.

ADVERTISEMENTS:

The Paretian efficiency condition is fulfilled when MCX/MCy = MRTxy =AMRSXY = BMRSXY .Since both individuals A and В can use the public good X at the same time, the equilibrium condition for maximum welfare becomes MCX/MCY = MRTxy = AMRSXY + BMRSxy. This equation shows that there will be underproduction as well as under consumption in the case of public good X because both A and В use it at the same time.

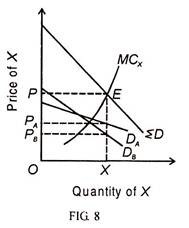

Thus Pareto optimality is not attained. This is illustrated in Fig. 8 where X is a public good and DA and Du are the demand curves of two individuals A and В respectively. MCX is the marginal cost curve of the public good and MCX =AMRSXY + BMRSxy. The curve ΣD is the vertical summation of DA and DB curves.

The curves MCX and ΣD intersect at point ΣD which determines OP price and OQ quantity of public good. The two consumers are charged the price OP = OPA + OPB. But each consumer is being charged a different price. This is a case of price discrimination because OPA >OPH. Hence there is market failure.

4. Increasing Returns to Scale:

There are increasing returns to scale or decreasing costs due to technical externalities that lead to market failure under perfect competition. When there are increasing returns to scale in a perfectly competitive market, they either lead to monopoly or to losses.

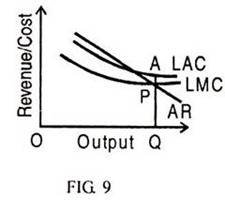

As output increases under increasing returns to scale, the long run average cost (LAC) curve falls over the relevant range. When the LAC curve falls, the LMC curve lies below it (LMC< LAC) and firms under perfect competition incur losses.

ADVERTISEMENTS:

But they cannot remain under losses in the long run and leave the industry. If this situation persists for some time, there will emerge either oligopoly firms or a monopoly firm. Figure 9 illustrates the situation of market failure when there are increasing returns to scale. The LMC curve lies below the LAC curve over the relevant range.

The LMC curve (which is the supply curve under perfect competition) intersects the AR curve (which is the demand curve under perfect competition) at point P so that OQ quantity of the product is produced at QP price. Since the LAC curve is above the price QP, there is PA per unit loss which will compel the firms to leave the industry.

Since under perfect competition P = LMC = LAC, the present condition of P = LAC > LMC leads to non-fulfilment of Pareto optimality.

5. Indivisibilities:

The Paretian optimality is based on the assumption of complete divisibility of products and factors used in consumption and production. In reality, goods and factors are not infinitely divisible. Rather, they are indivisible. The problem of indivisibility arises in the production of those goods and services that are used jointly by more than one person. An important example is the use of a particular road by a number of persons in a locality.

Every person residing there uses the road. But the problem is how to share the costs of repairs and maintenance of the road. In fact, none will be interested in its repairs and maintenance. Thus marginal social costs and marginal social benefits will diverge from each other and Pareto optimality will not be achieved.

6. Common Property Right:

Another cause of market failure is a common property resource. It most common example is fish in a lake. Anyone can catch and eat it bout no one has an exclusive property right over it. It means that a common property resource is non-excludable (any one can use it) and non-rivalrous (no one has an exclusive right over it).

The lake is a common property for all fishermen. When a fisherman catches more fish, he reduces the catch of other fishermen. But he does not count this is a cost, yet it is a cost to society.

Because the lake is a common property resource where there is no mechanism to restrict entry and to catch fish. The fishermen who catch more fish impose a negative externality on other fishermen so that the lake is over exploited.

This is called the tragedy of the commons which leads to the elimination of social gains due to the overuse of common property. Thus when property rights are common, indefinite or non-existent, social costs will be more than private costs and there will not be Pareto optimality.

7. Asymmetric or Incomplete Information:

Consumers, producers and resource owners have perfect knowledge about market conditions under perfect competition. But in the real world, there is asymmetric or incomplete information due to ignorance and uncertainty on the part of buyers and sellers of goods and services.

Thus they are unable to equate social and private benefits and costs this is because consumers are ignorant about the quality of goods that they buy benefits of goods.

Similarly, firms are ignorant and uncertain about future prices costs sales, actions of rivals, etc. In some cases, information about market behaviour in the future may be available but that may be insufficient or incomplete. Thus market failure is inevitable.

8. Incomplete Markets:

Markets for certain things are incomplete or missing under perfect competition. The absence of markets tor such things as public goods and common property resources is a cause of market failure. There is no way are benefits and costs either in the Present or in the future because their markets.

Measures of Correct Market Failure:

To correct market failure in each case discussed above, economists suggest the following measures:

1. Control of Monopoly Power:

Monopoly power can be controlled by the government by anti-monopoly laws and restrictive trade practices legislation. These aim at removing unfair competition, preventing unfair price discrimination and fixing prices equal to competitive prices.

The governments can also being down monopoly price to the competitive level by price regulation and taxation. It may impose price ceiling so that monopoly price should be near or equal to competitive price regulating authority of commission which fixes a pie tor the monopoly product below the monopoly price.

Taxation is another way of controlling monopoly power. The tax may believe Lump sum without any regards to the output of the monopolist. Or it may be proportional to the output, the amount of tax rising with the increase in output. In either case, the aim is to bring monopoly price to the competitive level. Lastly Prof Pisou favoured nationalisation of monopoly to put an end to monopoly power.

2. Externalities:

To achieve optimal allocation of resources in the face of externalities, Pigou suggested social control measures and the use of taxes and subsidies. The state can interfere in all cases of external diseconomies of production to remove the divergence between private and social costs and benefits.

For instance it can ask the factory owner to move out of the residential area by providing appropriate facilities to the smoke emitting factory. In the case of external diseconomies of consumption, the state can put an end to noise nuisance by banning the use of loud speakers except for special occasions during specific hours with prior permission.

Pigou further suggested that the state should encourage production of goods with positive externalities by the subsidy on per unit of commodity to the producer. It can be help consumers in maximizing their satisfactions by tax concessions so that they consume more commodities. It can help consumers in maximising their satisfactions by tax concessions so that they consume more commodities.

In the case of negative externalities it should discourage their consumption and production by leaving taxes. For instance, the state can levy a tax on every family in the area and pay the sum so collected to the smoke matting factory to move away Thus taxes and subsidies help to bridge the gap between private and social costs and benefits.

Another measure commonly suggested is internalisation or unitization of externalities in production For example firms that are engaged in oil operations in the same filed lead to inefficient over-drilling and over pumping. With unitization or merger of firms, oil is produced most efficiently without diseconomies of production.

3. Public Goods:

Because public goods are non-excludable and non-rivalrous, they are not sold in a free market like private goods. Therefore, they cannot be provided by private firms. In this situation, they can be provided by some public authority.

As the benefits of public goods are indivisible, the state should make people share the costs of public goods so that everyone is made better off. “One way to pay for a public good is to charge each person the same proportion of the maximum amount he or she would be prepared to pay rather than go without the good, while fixing that proportion so as to cover the total costs of production”.

In the case of some public goods such as materials for defence, the government can either itself produce them or it can pay private firms to produce them. So far as the free rider problem is concerned whereby such services as defence, police, etc. are provided free to every user, they can be provided by the government out of tax revenue.

4. Increasing Returns to Scale:

For the problem of increasing returns to scale (or decreasing costs), opinions differ concerning government’s role in providing solution to market failure. Some economists opine that government should nationalise such industries which operate under decreasing cost and lead to over production.

Others do not approve of it because they feel that government control would make conditions worse. Still others suggest that private firms should produce goods and government should enforce price regulation and tax them so that social and private costs and benefits are equalised.

5. Indivisibilities:

The solution to the problem of indivisibility in the case of goods and services used jointly by more than one person such as street lighting or road, the local body such as Municipal Corporation should either spend on its repairs and maintenance or tax the residents or users of the road or street lighting.

6. Property Rights and the Coase Theorem:

Common property rights lead to externalities. Property rights relate to “who owns property, to what uses it can be put, the rights people have over it and how it may be transferred.” One solution is to extend property rights so completely that everyone has the right to prevent people from imposing any costs on them.

This can be done in the case of public property like parks, libraries, etc. The second solution is to distribute the property of the rich to the poor. But it is more a question of altering property rights rather than extending the ownership rights. But such a solution will be impractical.

The third solution is for the government to charge the damages and compensate for the damages. But it involves the problem of compensating those who acquired property at a lower cost because of the damage. The fourth solution is to file a legal suit for monetary damages by the party that has been harmed by the externality (say smoke).

Another solution has been suggested by Prof. Ronald Coase (who received the Nobel Prizein Economics in 1991). According to him, market failure due to property rights can be eliminated through private bargaining among the affected parties.

He points out that if property rights are clearly defined and marketable and transaction costs are zero, a perfectly competitive economy will allocate resources optimally, even under externalities.

This is called the Coase Theorem. By transactions costs he means costs of negotiating or enforcing a contract. According to Coase, if it is possible to carry out such negotiations at little or no cost, the parties responsible for an external benefit or cost can negotiate with the parties affected by an externality.

The sufferer from an externality should levy a charge or offer a bribeto the party which is getting the maximum benefit from the common property. Thus in the absence of transaction costs, the externality will be internalised and the socially optimal level of output will be achieved.

7. Aymmetric or Incomplete Information:

Market failure can be eliminated when rules are framed by regulating authorities by requiring producers to describe correctly about their products and prices. This will provide people with correct and relevant information about products.

Market failure can also be corrected if produces produce high quality standard products and offer guarantees and warranties to buyers. This requires widespread publicity on the part of sellers so as to provide correct information to consumers.

In case where ignorance is the reason for incomplete information, the direct provision of information by the government may help to correct market failure. For example, employment exchanges provide information on jobs to those looking for work and ask firms to get in touch with them for the supply of suitable labour.

This will help the labour market to work efficiently. Similarly, government providing statistics on prices, costs, employment, sales trends, exports, imports, etc. help firms to plan their production with greater certainty. Some private organisations can also help in providing useful data on them.

8. Missing Markets:

To correct market failure in the case of missing or incomplete markets where two goods are jointly produced two Nobel laureates K. Arrow and G. Debreu suggest a separate market for each in which each good and service can be traded to the point where the social and private marginal benefit equals the social and private marginal cost. This condition will lead to optimal allocation of resources.