In this article we will discuss about the effects of ad valorem taxes in a competitive industry.

An ad valorem tax is a value-based tax. It is imposed as a fixed percentage of the price of a commodity. It is sometimes called a sales tax. We shall assume here that the tax is collected from the buyers rather than from the sellers. For, this will make our task of explaining the effects of the tax easier.

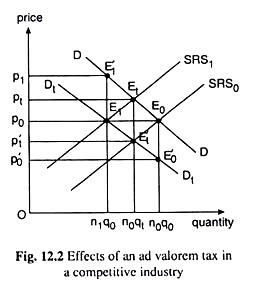

Let us suppose that the demand curve for a good is DD in Fig. 12.2 and the supply curve before the imposition of the tax is SRS0. Therefore, the market equilibrium occurs at the point E0. At this point the price has been determined to be p0 and the quantity bought and sold in the industry has been obtained to be n0q0 where n0 is the number of firms in the industry and q0 is the output of each firm.

ADVERTISEMENTS:

It is assumed that the firms and the industry are in long-run and short-run equilibrium initially, i.e., at p = p0, the typical firm is in equilibrium at the minimum point of its short-run and long-run average cost curves. The firm’s picture is not shown in Fig. 12.2.

Now, if an ad valorem tax is imposed on the good and the buyers are to pay the tax, then the price that the buyers would pay, would include the tax and the sellers will receive the price net of tax. The demand curve DD shows the price that the buyers would pay at each quantity purchased, and the curve DtDt shows the price net of tax that the sellers would receive at each quantity sold (or supplied).

The vertical gap between DD and DtDt curves gives us the absolute amount of the tax at any particular q. Let us suppose that the ad valorem tax has been imposed at the rate of fraction s (0 < s < 1), of the price (the buyers pay) of the good.

As the quantity bought and sold increases and the price decreases, the absolute amount of the tax also decreases. That is why, in Fig. 12.2, the vertical gap between the DD and DtDt curves diminishes as the quantity increases.

ADVERTISEMENTS:

The pre-tax or the initial equilibrium point is the point E0 and the price-output combination at that point has been (p0, q0) for the firm and (p0, n0q0) for the industry. Let us now suppose that an ad valorem tax at the rate of fraction s (0 < s < 1), is imposed on the good.

After the imposition of the tax, the point E0 would no longer be the demand-supply equilibrium point. For, at this point, to supply the quantity of n0q0, the sellers want a price of p0, but they are getting the price net of tax which is equal to P’0 < p0.

In the post- tax situation the market would be in equilibrium at the point of intersection E’t between the DtDt and SRS0 curves, for, here, at q = n0qt, the buyers are willing to pay the price pt, and the sellers are getting the price net of tax which is p,’ and which they are actually demanding.

Therefore, the post-tax price-quantity combination would be (pt, n0qt) at the point Et, pt > p0 and n0qt < n0q0, i.e., in the post-tax situation, price would be higher and the output of the industry smaller. Since the number of firms remains unchanged at n0 and the industry output decreases from n0q0 to n0qt, the output of each firm, qt, is now smaller than q0.

ADVERTISEMENTS:

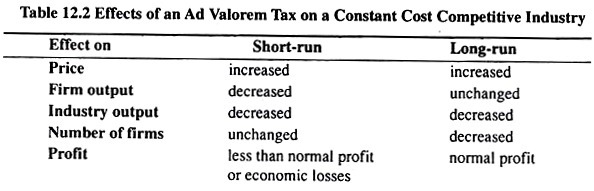

Therefore, in the short run, the effects of imposition of an ad valorem tax will be: the price will increase, the firm’s output and industry output will decrease, the firms would earn economic losses and the number of firms would remain unchanged.

At p = p0, the firm earns only the normal profit, p0 being equal to the minimum average cost. Therefore, at the net-of-tax price which is equal to p’t <p0, the firms are not able to earn even the normal profit, i.e., they are having losses. So, in the long-run adjustment process, some of the firms would be leaving the industry.

Since the SRS curve of the industry is a horizontal summation of the SMC curves of the firms, this curve will now be shifting to the left from its present position of SRS0.

This process would continue, i.e., the number of firms would be decreasing and the SRS curve of the industry would be shifting to the left and the price would be rising till the price (including the tax) rises to pi in the long run, and the net-of-tax price rises to p0 so that the firms that are still remaining in the industry, will be able to earn normal profit again.

This post-tax long-run equilibrium will be obtained when the SRS curve takes the position of SRS1 and cuts the DtDt curve at the point E1.

Also, at E1, the industry output is n1q0 where n1 is the number of firms still remaining in the industry (n1 < n0) and q0 is the output of each firm. It may be noted here that in a constant cost competitive industry, the position of the cost curves would not be affected by the long-run adjustment process.

That is why, at p = p0, the firm’s output would remain the same at q = q0, and, as we have assumed, at this price the firms would earn only normal profit and the firms and the industry will be in long-run equilibrium.

Therefore, the long-run effects of imposition of an ad valorem tax on a constant cost competitive industry would be: price would increase, firm’s output would remain unchanged, number of firms would fall, the industry output would fall, and the firms would earn normal profit.

We have summarised the effects of an ad valorem tax in the following table.