Small Open Economy:

Model of Small Open Economy is based on following assumptions:

1. Perfect capital mobility that is, residents of country have full access to world financial market and the Government does not interfere in International borrowing and lending.

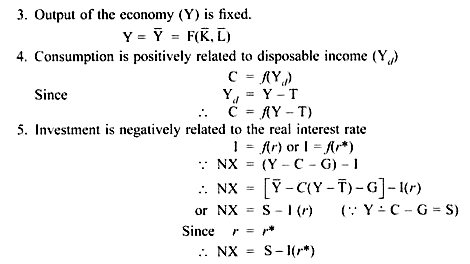

2. Interest rate (r) is always equal to the real interest rate prevailing in the world financial market (r*)

ADVERTISEMENTS:

r = r*

This is because the economy is very small and has negligible affect on the world interest rate

r* is exogenously given

r* is determined where:

ADVERTISEMENTS:

World saving = World investment

If r > r* → Residents of the country will borrow from abroad

r < r* → Residents of the country will lend abroad.

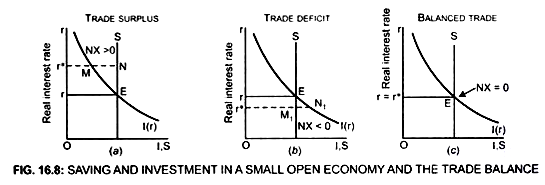

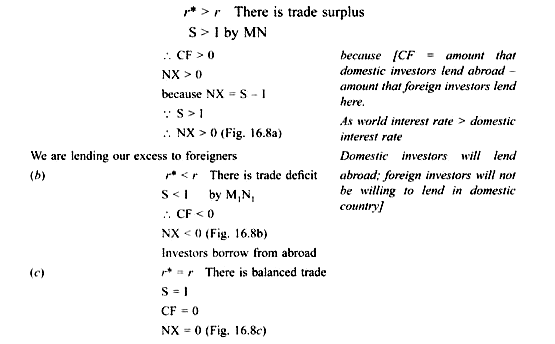

Thus, the trade balance is determined by the difference between S and I at the world interest rate (r*), that is, trade balance depends on variable that determine saving and investment

ADVERTISEMENTS:

Saving curve is vertical because it is independent of (r). Investment curve is negatively sloped because of negative relation between I and r.

In closed economy equilibrium is established at point E where I(r) = S

If the economy is a small economy then trade deficit or surplus will depend on whether world interest rate is greater, equal or less than domestic interest rate

(a) If in a small open economy with perfect capital mobility, world interest rate (r*) is greater than domestic interest rate (r)

Thus, trade balance depends on:

(i) National Saving (Y – C – G) because decrease in the Government spending or increase in taxes, increases the national saving.

ADVERTISEMENTS:

(ii) On the world interest rate, r*: Increase in r* affects investment projects adversely.