Here we detail about the effects of problems of wage flexibility on effective demand.

(i) Wages and Investment:

If a general wage cut is likely to be repeated in future the expectation or possibility of further wage reduction in future will have adverse effects on investment. The entrepreneurs would continue to postpone investment in the expectation of a further fall in wage rate in future, unless the wages have touched the rock-bottom.

This will not diminish efficiency of capital but will also lead to the postponement both of investment and consumption. If, however, the nature of wage cut is such that it is not expected to be followed by further cuts, it will have favourable effect on investment, as a cut in money wages reduces the cost of production and expands the profit margin.

The practice, however, of modern democratic economies seems to be that of a slowly falling wage level, rather than a once for all cut in wage level, which has quite adverse effect on MEC and investment. “A rigid money wage policy would probably have a more favourably effect on MEC than a policy in which wages sag slowly to lower and lower levels.” Thus, it all depends upon the nature of the wage cut.

ADVERTISEMENTS:

(ii) It is further argued, that a general reduction in money wages may lead to favourable expectations in the minds of entrepreneurs and may increase the MEC and investment, but labour reaction under such circumstances assumes special importance. If the workers decide to resist strongly and reduction in money wages and ask for higher wages in future, then these labour troubles may offset otherwise favourable expectations on investment.

A cut in money wage rates will agitate labour more than “a gradual and automatic lowering of real wages as a result of rising price.” Even though workers know that wage cuts would mean more jobs for them in general, in the absence of overall collective bargaining, self-interest would compel any group of labour to resist reductions in wages.

(iii) Wages, Saving and Investment:

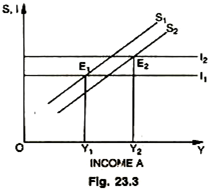

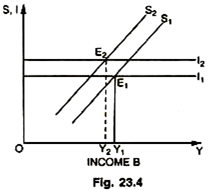

Our understanding of the effect of wage reductions on the propensity to invest becomes more clear if we analyse the effects of wage changes on the propensity to save (saving). To follow the point clearly, let us construct two simple models—in both these models wage reductions lead to an increase in investment but lead to a fall in savings schedule in the first model, and rise in saving schedule in the second model as shown in Fig. 23.3 and 23.4.

In Figure ‘A’, wage reduction shifted the investment schedule upward from I1 to I2 and saving schedule downward from S1 to S2. Before wage cut two schedules intersected at E1 to give equilibrium income Y1 but after wage cut the S and I schedules cut at E2 to give equilibrium income at Y2. If wage cuts really had their effects on investment and saving, high levels of income and employment could be achieved simply by wage cuts, but this is open to grave doubts as model of Fig. 23.4, is more realistic than the model of Fig. ‘A’, ahead.

In Fig. 23.4 when investment shifts from I1 to I2 saving schedule also increases from to S1 to S2 with the result that there is lower equilibrium income at Y2 and, therefore, a lower level of employment. The presumption of the saving schedule shifting upward is a reasonable presumption as a general wages cut would result in a fall of consumption function.

The fall in consumption function would occur on account of the radical change in the distribution of income, because wage cuts would mean that the income will go to low consuming and high saving group of businessmen, rentiers, etc. from high consuming and low saving group of wage-earners. Hence, as a result of redistribution of income consumption would fall and savings would increase leading to an upward shift of saving schedule.

There is thus no simple correlation between wage reductions and investment as wages are at once cost and demand. “Money wage rate changes are double edged, they change money costs but they change at the same time money incomes and hence money expenditures.” In particular case, it is perfectly correct to concentrate on the analysis of the “effect of wage reductions” on costs, ignoring at the same time the effects of these cuts on demand.

ADVERTISEMENTS:

But while examining’ the effects of general wage reduction one cannot ignore the effects of wage reductions on demand as well as costs. One thing, however, is clear that an upward shift of investment function accompanied by an upward shift of saving function inevitably leads to “under employment equilibrium.” Since investment depends upon many factors, besides cost and demand the net result of wage changes on propensity to invest (investment) is at least indeterminate.

(iv) Wage, Debt and Investment:

Further with reduction in money wages and consequent fall in prices, the burden of the debt is increased and entrepreneurs find it very hard to meet the obligations and to pay to the debenture holders the stipulated sums. This also increases the real burden of the national debt, which means higher taxation, required to service and to repay the debt. Thus, any favourable effects on business expectations, marginal efficiency of capital and investment are offset by depressing effects on investment of a greater burden of debt both of public and private nature.

(v) Wages, Foreign Trade and Investment:

In an unclosed (open) economy there may be, besides these effects, the additional effects of the “balance of trade” and the “terms of trade” and through them on income and employment. In an open system, the reduction in money wages (if it is a reduction relatively to money wages abroad) will tend to increase the balance of trade and hence investment since the export position of the wage cutting countries will become more favourable as against other countries (assuming that they do not also cut wages).

Such an increase in exports relative to imports is equivalent to an increase in foreign investment and through multiplier effects should have favourable effects on income and employment. This, however, assumes that this advantage is not offset by restrictions on foreign trade such as quotas and tariffs. At the same lime, though a reduction in money wages causes the balance of trade to increase, it is likely to worsen the “terms of trade” (through lower export prices). This may result in a reduction in real income and at a lower real income the ratio of consumption to income, no doubt, may rise, but this does not establish, as Keynes understands it, that the propensity to consume would rise.

(vi) Wages and Consumption:

The most important constituents of effective demand is consumption. Classicals held the view that wages cuts effect consumption in a favourable manner. Their argument was that a fall in wage cuts will reduce the costs of production, which in turn will lower prices. Lower prices will increase consumption on account of increase in demand. But this was a vain attempt to apply certain principles concerning the price and demand of a particular product to the problem of total consumption.

Classicals emphasized wages as a cost of production and conveniently forgot the fact that while wages were costs to producers, they were income to wage earners. According to Keynes, wages-cuts do not affect consumption favourably. Wage-cuts will result in the redistribution of income favouring the rich, for example, when wages are lowered, the incomes of the interest and rent receivers remain the same or even may increase as compared to the incomes of wage earners, thus, redistributing the income in an unequal manner as the same is shifted from groups having high consuming propensities (workers and the poor) to the groups having high saving propensities (the capitalists and the rich).

The consumption of wage-earners will fall, thereby leading to a decline in the total demand and hence in production and employment. Professor A.C. Pigou, however, argued that when prices fall in the economy due to wage cuts, the real value of money assets (bonds and securities) goes up. This appreciation in real value of the money wealth of people is likely to induce them to consume more. This likely increase in consumption resulting from wage-cut is called the ‘Pigou Effect’ or the ‘Real Value of Money Asset Effect’. But there are writers who have expressed grave doubts about the practical significance of ‘Pigou Effect’ in a depression ridden economy.

(vii) Wages and Rate of Interest:

It has been argued by classicals that a wage-cut by lowering the rate of interest may stimulate investment and hence employment. It is contended that when wages are lowered people will have less demand for day-to-day transactions. A fall in wages will normally be accompanied by a fall in prices (because the purchasing power will be reduced).

The lower wages accompanied by lower prices will lower the demand for the amount of money needed to carry on transactions (M1). They shall, therefore, be left with some surplus cash which they are likely to use for speculative purposes (M2), i e- for the satisfaction of the desire to gain from the fluctuations of the rate of interest. When the supply of money for speculative purposes will increase, it will also bring down the rate of interest.

ADVERTISEMENTS:

Assuming that the total supply of money (M) remains constant, a fall in the transactions demand for money supply required to satisfy the speculative demand for money (M2), which in turn, will lower the rate of interest. The reduction of the rate of interest, in this way, is called the Keynes Effect’.

The extent to which the rate of interest will fall will depend on the quantity of money released from active balances (M1) to inactive balances (M2) and the interest elasticity of liquidity preference for speculative balances. But the proposition that wage-cuts lead to a fall in the rate of interest in the manner described above is ridiculous and a painful way of reducing the rate of interest, because the rate of interest is a monetary phenomenon being dependent on the demand for and supply of money. The proper way to lower interest rate is to follow a suitable monetary policy of increasing the supply of money and not to follow a policy of wage-cuts.

Hence, there is no scope of increasing employment in this manner except through a rise in real effective demand. Thus, the effect of money wage-cuts on the level of employment will depend on the importance of Pigou Effect, on the significance of foreign trade on the effect of ‘money illusion on consumption’, on money illusion in the tax structures on the effect of a redistribution of income on consumption, and finally on the nature of expectations induced by the wage-cut.