This article provides notes on general equilibrium of wage flexibility.

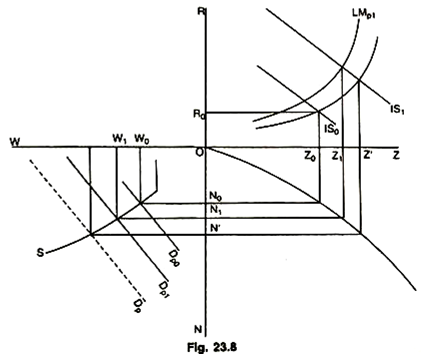

In Fig. 23.8, the general equilibrium has been shown by the three markets (goods, labour, money) having been combined.

Part A contains the LM—IS curves and shows the equilibrium of good and money markets. Part C shows the labour market. Part B relates the level of employment (AO to the output produced in the economy.

The diagram shows that there is equilibrium in all the markets simultaneously in the economy. Now, suppose the government want to reflate the economy by following an expansionary fiscal policy. This has been shown by a shift in the IS0 curve leading to a new equilibrium with a higher Z (output) and a higher R (rate of interest). The addition of the labour market, no doubt, makes things more complicated but also introduces greater realism.

ADVERTISEMENTS:

Ignoring (for the time being), the effects of the labour market on the rest of the system, the expansionary fiscal policy is shown by an upward shift in the IS curve from IS0 to IS1. This gives us an equilibrium level of output at Z1. But the firms were initially and originally in equilibrium while employing N0 labour and producing Z0 output.

The increase in demand will not of itself induce firms to increase output as losses might result with such an increase in output. If the initial equilibrium position in the labour market was such that the last man employed produced an amount whose value was exactly equal to the going wage rate (AR = W = P) then the extra men required to produce the extra output would produce an amount whose value was less than the going wage rate (AR < W and therefore the possibility of losses).

However, the initial rush and rundown in stocks which reflects the excess demand will indicate to firms (the possibility) that they can raise the prices. A price increase raises the value of each man’s output and, therefore, makes it profitable to employ more labour in order to produce this extra output. If the equilibrium output was Z ‘then prices would have to rise until the demand for labour curve shifted from Dp0 to Dp1.

ADVERTISEMENTS:

However, the equilibrium output is likely to be somewhat lower than Z’ because of the effects of the price rise on the goods and money markets. The price rise will increase the size of the income-related demand for money associated with any given real output. If the money supply remains fixed, this will shift the LM curve from LMp0 to LMp1. The price rise may also have some relatively small effect (not shown in the figure) on the demand for goods.

The distribution of wealth will change, because creditors will be worse off in real terms, while debtors will be better off. There is some possibility that consumption will increase with wealth so that creditors will consume less and debtors will consume more. These effects are expected to cancel each other out—except for the fact that some individuals may consume less as a result of the price rise, government’s consumption and investment expenditure is unlikely to alter so that the net effect would be a fall in demand.

There may also be a redistribution of income from fixed income receipts to profit earners, who may consume a smaller proportion of their income. In addition, there may b- some reduction in demand for exports and increase in the demand for imports. All these effects are likely to shift the IS curve inwards a little from IS, i.e., the same interest rate will produce a lower equilibrium level of output. Hence, a new equilibrium position may exist at which output, employment, price level, the money wage rate and the rate of interest are all greater as shown in the figure at Z1, N1 and W1.

However, this new position will not be one of equilibrium if the price rises always lead to compensatory claims of wage rises. If any price rise is fully compensated by a wage rise, then, the supply curve of labour will also shift together with the demand curve and the employment will not increase and may eventually fall to the original level of No and the output will fall to the original level of Z0. Hence, the final equilibrium output and employment remain unchanged while the price level, money wage rate and the rate of interest are greater.

ADVERTISEMENTS:

Now, let us suppose that the government aims to reflate the economy by means of expansionary monetary policy rather than fiscal policy. The same sort of reasoning for analysis could be followed. The expansionary monetary policy shifts the LM curve to the right. The LM and IS curves intersect at a higher level of output and lower level of interest rates. But employers will not take or employ more labour and produce more output unless prices rise.

The rise in prices shifts the demand curve for labour and the equilibrium level of employment rises. The rise in prices also shifts the LM curve to the left and may also shift the IS curve to the left. Hence, a new equilibrium may exist at which output, employment, the price level and the money wage rate are higher while the rate of interest is lower. But, if the price rise is once again fully compensated by the rise in wages then the end result of monetary policy will be to change the price level, the money wage rate, the rate of interest while leaving the level of output and unemployment unchanged.

This general equilibrium model whether it pertains to two markets or three markets is static as it compares the equilibrium positions but does not tell us anything about how the economy moves from one position to another. However, two conclusions definitely emerge as a result of discussion and analysis of general equilibrium. One is that, if changes in prices are always fully compensated by changes in money wage rates, then there is only one possible level of employment and one possible level of output in the economy.

Changes in the fiscal or monetary policy produce changes in the equilibrium price level but have no effect on the equilibrium levels of output and employment. The second result is that firms cannot be persuaded to alter their output and hence the level of employment unless the price level changes.