The below mentioned article provides an overview on the Marginal Productivity Theory of Distribution.

The marginal productivity theory states that the demand for a factor depends on its marginal revenue productivity (MRP). MRP is the addition made to total revenue by employing one more unit of a variable factor, other factors remaining unchanged. As a general rule, the marginal revenue productivity of a factor diminishes with the increase in the units of that factor.

When in the initial stages the units of a variable factor are employed, keeping the other factors constant, the total revenue product may increase more than proportionately for some time. But, sooner or later, a time will come when the marginal revenue product will start diminishing, and will tend to equal the price of the factor. This tendency of diminishing MRP follows from the Law of Variable Proportions.

A firm operating under perfect competition has to pay the same price (reward) to a unit of the factor, which is being paid by the industry. In order to have maximum profits, it acts on the principle of substitution. Cheaper factors tend to displace expensive ones.

ADVERTISEMENTS:

For example, if a firm finds it more profitable to substitute machines for costly labour, it will do so. The substitution of cheaper factors for the dearer will continue till the marginal revenue productivity of each factor is equal to its price.

At this stage, the factors of production are employed in their most efficient combination or the least cost combination and the profits of the firm will be maximized. Moreover, substitution also takes place between different units of the same factor.

There being perfect mobility in the factor market, units of a factor tend to move from one use where their marginal revenue productivity is low to another use where it is high, till it is equalized for all the units in different uses.

In equilibrium, therefore, the price of a factor-service must equal its marginal revenue productivity. If the marginal revenue product of a factor unit is more than its price (cost of employing it), it will be profitable for the firm to employ more units of this factor.

ADVERTISEMENTS:

As more units are employed, the marginal revenue product diminishes till it equalises the price. This is the point of maximum profits for the firm. But if more factor units are employed beyond this point, the marginal revenue product will fall below the price and the firm will sustain a loss. This follows from the application of the Law of Non-proportional Returns.

Assumptions of the Theory:

The marginal productivity theory of distribution is based on the following assumptions:

(i) It assumes that all units of a factor are homogeneous.

ADVERTISEMENTS:

(ii) They can be substituted for each other.

(iii) There is perfect mobility of factors as between different places and employments.

(iv) There is perfect competition in the factor market.

(v) There is perfect competition in product market.

(vi) There is full employment of factors and resources.

(vii) The various units of the different factors are divisible.

(viii)One factor is variable and other factors are constant.

(ix) Techniques of production are given and constant.

(x) The entrepreneurs are motivated by profit maximization.

ADVERTISEMENTS:

(xi) The theory is applicable in the long-run.

(xii) It is based on the Law of Variable Proportions.

Explanation of the Theory:

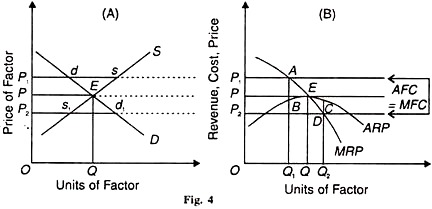

Given these assumptions, first we explain the determination of the price of a factor in an industry in terms of its demand and supply. In Fig. 4(A), the demand curve D of industry intersects its supply curve S at point E which determines OP price and OQ quantity demanded and supplied. Thus all units of the factor (say, labour) in the industry are paid the same price (wage), OP.

ADVERTISEMENTS:

There being perfect competition, a firm will pay the same price (wage) to each unit of the factor (labour) as paid by the industry. Therefore, for the firm, the supply of this factor at that price will be perfectly elastic. It means that the supply curve of this factor at the given price OP is horizontal curve, shown as AFC = MFC in Panel (B) of the figure. AFC and MFC are the average and marginal factor costs of the firm at which it employs the factor units.

The number of factor units, the firm will employ depends upon its demand for that factor. And the demand for the factor depends on its MRP. For equilibrium, it is essential that the price which the firm pays to the factor must equal its MRP. ARP and MFC, that is, Price of the Factor Unit = AFC = MFC = MRP = ARP. This is shown in Panel (B) where E is the equilibrium point for the firm when ARP = MRP = MFC = AFC and it pays OP price for OQ units of the factor. Suppose the factor-price rises to OP1.

At this price, the firms will be incurring AB per unit loss, as the price Q1being paid to factor units is greater them Q1B, their ARP. This will induce some firms to leave the industry. As a result, the supply of factors will increase by ds, as in Panel (A), and the factor price will fall again to OP where equilibrium will be re-established at point E in both (A) and (B) Panels.

ADVERTISEMENTS:

On the other hand, if the factor-price falls to OP2 firms will be earning DC per unit profit because the price Q2D being paid to factor units are less than Q2C, their ARP. Attracted by the profit, some firms will enter the industry. This will raise the factor-demand by s1d1 in the industry and the price will again increase to OP. These price changes are only possible in the short-run. In the long-run, equilibrium will stay on at point E, where OP = ARP = MRP = MFC = AFC.

Its Criticisms:

The marginal productivity theory of distribution has been one of the most criticised theories in economics due to its unrealistic assumptions.

(1) Units of a Factor not Homogeneous:

The assumption that all units of a factor are homogeneous is unrealistic. We know that efficiency of labour differs from worker to worker. Similarly, one piece of land differs from the other in fertility. It is, therefore, not correct to assume that the different factor-units of the same are homogeneous. In fact, heterogeneity and not homogeneity is the rule.

(2) Factors not perfectly Mobile:

ADVERTISEMENTS:

The theory assumes perfect mobility of factors as between different employments and places. But, in reality, factors are mostly immobile, particularly labour.

(3) No Perfect Competition:

The theory is based on another unrealistic assumption of perfect competition which is to be found neither in the factor market nor in the product market. Perfect competition is not a reality but a myth. Rather imperfect competition or monopolistic competition is the rule.

(4) Factors not fully employed:

The theory assumes the existence of full employment in the economy. This assumption of full employment makes the theory static. According to Keynes, under-employment rather than full employment is found in an economy.

(5) All Factors not Divisible:

ADVERTISEMENTS:

The assumption that factor-units are divisible and therefore can be increased by small quantities does not hold true. It is not possible to vary an individual, large or lumpy factor. For example how can the entrepreneur of a firm be increased or decreased by small units? Thus the equality between marginal productivity and price of a factor cannot be brought about by varying its quantities a little less or more.

(6) Production not the Result of One Factor:

According to Taussig and Devonport production of a commodity cannot be attributed to any one factor- land, labour or capital. Rather, it is always the result of factors and their units working together. It is, therefore, not possible to calculate the marginal productivity of each factor unit separately.

(7) Profit not the Main Motive:

The theory assumes that the entrepreneurs are motivated by maximization of profits. But as pointed out by Schumpeter, the entrepreneurial action is guided by the desire to found a commercial kingdom, the will to conquer, the joy of creating and getting things done. It is, therefore, not true to say that the entrepreneur is guided by the profit motive.

(8) Not Applicable in the Short-Run:

ADVERTISEMENTS:

The theory is applicable only in the long-run, when the reward of a factor tends to equal its marginal revenue product. But, in reality, we are concerned with short-run problems. As remarked by Keynes, “In the long-run we are all dead.” This assumption makes the factor pricing unrealistic.

(9) Nested of Technical Progress:

According to Hicks, this theory fails to throw light on the determination of relative shares by neglecting the influence of technical change. Hicks have shown that a labour-saving innovation tends to raise the marginal product of capital relative to that of labour.

The opposite may happen in the case of capital-saving innovation. Sometimes a technical change requires the use of cooperating factors in fixed proportions say two workers for one machine. Thus the marginal productivity theory fails to analyse the problems of technical Change.

(10) Supply of Factors not fixed:

This Theory assumes the supply of factors to be perfectly inelastic. The supply of factors is fixed during the short period and not in the long-run. Therefore, the theory is self-contradictory. For it assumes the supply of factors to be fixed in the long-run to which it applies.

ADVERTISEMENTS:

(11) Only Demand Theory:

According to Samuelson, being a theory solely of the demand for factors, this theory cannot be applied to the factor market as a whole which requires a theory of both the demand for and supply of factors. Thus it is a one-side theory.

(12) No Justification for Inequalities in Income:

The marginal productivity theory is often used to justify the existing inequalities in the distribution of income. The theory states that the price of each factor equals its marginal revenue product which makes the reward inevitably what it is. Apparently, a person gets what he produces.

The basic postulate rests on the proposition that an individual gets what is produced by the resources he possesses and that all persons have equal opportunities. But no two persons possess the same resources and have equal opportunities. Thus the existing distribution of income cannot be justified on the basis of the principle of marginal productivity.

(13) Reward determines Productivity:

According to this theory, the reward of a factor-unit is determined by its MRP. But according to Sydney Webb, when a worker is paid a higher reward (wage), his efficiency and productivity increase. Thus, reward is the cause and not the result of MRP.

Conclusion:

On account of its many weaknesses, Prof. Kaldor regards this theory as intellectual sterility.