Adam Smith’s theory of absolute cost advantage in international trade was evolved as a strong reaction of the restrictive and protectionist mercantilist views on international trade. He upheld in this theory the necessity of free trade as the only sound guarantee for progressive expansion of trade and increased prosperity of nations. The free trade, according to Smith, promotes international division of labour.

Every country tends to specialize in the production of that commodity which it can produce most cheaply. Undoubtedly, the slogans of self- reliance and protectionism have been raised from time to time, but the self-reliance has eluded all the countries even up to the recent times. The free and unfettered international trade can make the countries specialise in the production and exchange of such commodities in case of which they command some absolute advantage, when compared with the other countries.

In this context, Adam Smith writes; “Whether the advantage which one country has over another, be natural or acquired is in this respect of no consequence. As long as one country has those advantages, and the other wants them, it will always be more advantageous for the latter, rather to buy of the former than to make.”

When countries specialise on the basis of absolute advantage in costs, they stand to gain through international trade, just as a tailor does not make his own shoes and shoemaker does not stitch his own suit and both gain by exchanging shoes and suits.

ADVERTISEMENTS:

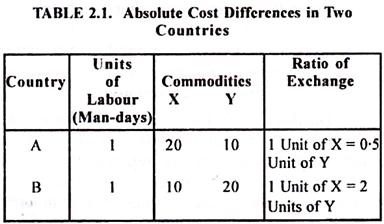

Suppose there are two countries A and B and they produce two commodities X and Y. The cost of producing these commodities is measured in terms of labour involved in their production. If each country has at its disposal 2 man-days and 1 man-day is devoted to the production of each of the two commodities, the respective production in two countries can be shown through the hypothetical Table 2.1.

In country A, I man-day of labour can produce 20 units of X but 10 units of Y. In country B, on the other hand. I man-day of labour can produce 10 units of X but 20 units of Y. It signifies that country A has an absolute advantage in producing X while country B enjoys absolute advantage in producing commodity Y. Country A may be willing to give up 1 unit of X for having 0.5 unit of Y. At the same time, the country B may be willing to give up 2 units of Y to have I unit of X. If country A specialises in the production and export of commodity X and country B specialises in the production and export of commodity Y. both the countries stand to gain.

The absolute cost advantage of country A in the production of X and that of B in the production of Y can also be expressed as below:

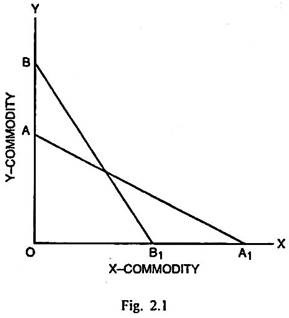

It is possible to explain the cost difference in two countries A and B concerning the commodities X and Y geometrically through Fig. 2.1.

In Fig. 2.1, AA1 is the production possibility curve of country A. Given the techniques and factor endowments, if all the resources are employed in the production of X commodity, it can produce OA1 quantity of X. On the contrary, if all resources are used in the production of Y, country A can produce OA quantity of Y. BB1 is the production possibility curve of country B.

In case of this country, if all resources are employed in the production of X commodity, OB1 quantity can be produced. Alternatively, if all the resources are used in the production of Y, it is possible to produce OB quantity of Y. The slope of production possibility curve is measured by the ratio of labour productivity in X to labour productivity in Y in each country.

ADVERTISEMENTS:

Slope of AA1 = LXA/LYA

Slope of BB1 = LXB/LYB

Since slope of AA1 is less than the slope of BB1, it signifies that country A has absolute cost advantage in the production of X commodity, while country B has the absolute cost advantage in the production of Y commodity.

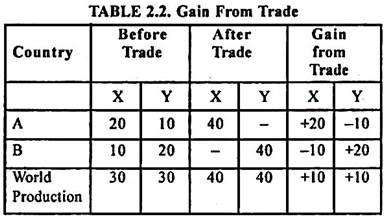

Adam Smith also emphasised that specialisation on the basis of absolute cost advantage would lead to maximisation of world production. The gains from trade for the two trading countries can be shown through Table 2.2.

Before trade, Country A produces 20 units of X and 10 units of Y. After trade, as it specialises in the production of X commodity, the total output of 40 units of X is turned out by A and it produces no unit of Y. Country B produces 10 units of X and 20 units of Y before trade. After trade it specialises in Y and produces 40 units of Y and no unit of X. The gain is production of X and Y commodity each is of 10 units. The gain from trade for country A is +20 units of X and -10 units of Y so that net gain to it from trade is +10 units of X. Similarly net gain to country B is +10 units of Y.

An interesting aspect of Smith’s analysis of trade has been his ‘Vent for Surplus’ doctrine. According to him, the surplus of production in a country over what can be absorbed in the domestic market can be disposed of in the foreign markets. It was basically this desire that led Mercantilists and subsequent theorists to place much emphasis on the international trade.

The ‘Vent for Surplus’ doctrine implies that the international specialisation is not reversible and that it is an integral part of the development process in any country. In addition, this doctrine implies that the foreign trade results in the fullest utilisation of the idle productive capacity that is likely to exist in the absence of trade. This implication makes a clear departure from the assumption held in the comparative cost approach that the resources are fully employed even before trade. What trade does is to bring about a more efficient allocation of them.

Criticisms:

ADVERTISEMENTS:

Adam Smith, no doubt, provided a quite lucid explanation of the principle of absolute cost advantage as the basis of international transactions, yet his theory has certain weaknesses.

Firstly, this theory assumes that each exporting country has an absolute cast advantage in the production of a specific commodity. This assumption may not hold true, when a country has no specific line of production in which it has an absolute superiority. In this context Ellsworth says “Smith’s argument is not very convincing as it assumed without argument that international trade required a producer of exports to have an absolute advantage, that is, an exporting country must be able to produce with a given amount of capital and labour a larger output than any rival. But what if a country has no line of production in which it was clearly superior.”

Most of the backward countries with inefficient labour and machinery may not be enjoying absolute advantage in any line of activity. So the principle of absolute cost advantage cannot provide complete and satisfactory explanation of the basis on which trade proceeds among the different countries.

Secondly, Adam Smith simply indicated the fundamental basis on which international trade rests. The absolute cost advantage had failed to explore in any comprehensive manner the factors influencing trade between two or more countries.

ADVERTISEMENTS:

Thirdly, the ‘Vent for Surplus’ doctrine of Adam Smith is not completely satisfactory. This doctrine can have serious adverse repercussions on the growth process of the backward countries. These countries do not sell their surplus produce in foreign markets but are constrained to export despite domestic shortages for the reasons of neutralising their balance of payments deficit.

A more detailed and satisfactory explanation concerning the basis of international trade has been provided by David Ricardo and J.S. Mill.