Liquidity Preference versus Loanable Funds:

We find that an unnecessary controversy has been raised as to the choice between liquidity preference and loanable funds theories of interest rate.

Those who prefer loanable funds theory contend that it is broader in scope as it permits for more influence on the rate of interest than the liquidity preference theory allows.

For example, an increase in consumption decreases savings, thereby leading to a rise in the rate of interest.

Similarly, changes in the marginal efficiency of capital affect the rate of interest; an increase in MEC will raise the demand for funds for investment and, therefore, the rate of interest. The liquidity preference theory, on the other hand, confines the influences on the rate of interest to the demand for and supply of money for hoarding.

ADVERTISEMENTS:

The advocates of the loanable funds theory admit that hoarding plays an important part in determining the rate of interest: they however, assert that this is not the only influence. Moreover, on the side of supply, liquidity preference theory is confined to the supply of money as determined by the monetary authority; whereas loanable funds include not only the bank money (M) but also voluntary savings (S) and dishoarded wealth (H).

Thus, they feel, loanable funds theory is better than the liquidity preference theory. By linking the rate of interest with liquidity preference, quantity of credit, saving and investment the loanable funds theory looks at the problem in a more practical way as it explains why the market rate of interest can be and is different from the natural rate of interest.

Choice of Reconciliation between Two Theories:

However, the most important aspect that concerns us at present is whether the two theories of loanable funds and liquidity preference are the same, if they are not the same, which theory is better? Where the two theories are not the same, then, according to L.R. Klein, the liquidity preference theory is preferable. There have been at least three attempts to prove that the two theories give identical results, but all the three proofs must be rejected as unsatisfactory.

J. R. Hicks. Prof. J.R. Hicks in his ‘Value and Capital’ attempted to reconcile the two theories by making use of the apparatus of ‘general equilibrium. According to him interest, like all other prices, is determined as a solution of general equilibrium system of n equations. His argument was that one equation follows from all the rest (i.e., equations are mutually consistent because the same variable is there in each equation) and that it can be eliminated.

ADVERTISEMENTS:

As far as Hicks was concerned this is all that he needed to prove his point. The Hicksian general equilibrium approach emphasized the fact that the actual rate of interest in the economy would be the same whether it is determined by the intersections of demand and supply of loanable funds or the demand for and supply of money.

Klein points out that though Hicks was quite correct in stating that the same rate of interest is obtained as a solution to the system of equations no matter what single equation is eliminated, but nothing has been proved by this argument, “It does not tell whether the rate of interest is the mechanism which allocates funds into idle hoards as opposed to earning assets or which brings the supply and demand for loans into equilibrium.

The mere enumeration of equations and variables is misleading”. Cliff Lloyd criticized Hicks’ argument that the rate of interest can be determined either through the flow equation or through the stock equation. Lloyd argues that the loanable funds theory and liquidity preference theory of the rate of interest are not one and the same. It is so, because, Hicks’ argument does not hold true in case of stock-flow commodity. A stock-flow commodity is one that is consumed, produced and held at the same time and a general equilibrium involves not one but two excess demand equations.

ADVERTISEMENTS:

For a stock-flow commodity, the difference between the desired and existing stocks, both considered as a function of price, gives excess stock demand equation and the difference between desired consumption flow and flow of production goods, both considered as a function of price, gives us the excess flow demand equation. If the difference between production and consumption is not zero, there will be changes in stock and the goods market will not be in equilibrium. Hence, the fallacy of Hicks contention that these two theories are the same.

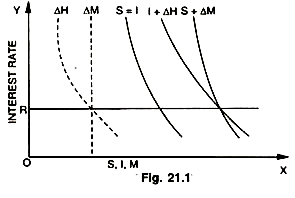

A.P. Lerner. Another reconciliation attempt between the two theories has been made by Lerner. For this, he defined the supply of credit as savings plus the net increase in the amount of money (∆M) during a period and the demand for credit as investment plus net hoarding (∆H) during the period. Evidently these are the definitions of the supply and demand for loanable funds. His attempt is shown in the Fig. 21.1.

Lerner argued that the supply of loanable funds (S + ∆M) and the demand of loanable funds (I + ∆H) during the current period is brought into equilibrium at the rate of interest (or). He then shows that the same rate of interest (or) will also equate the demand and supply of money. This is obtained by adding a constant Mo the amount of money held at the beginning of the period, to both ∆M and ∆H curves.

The intersection of S + ∆M and I + ∆H curves (loanable funds) gives us the same rate of interest as is given by ∆H and ∆M curves (liquidity preference). Thus, both the theories stand reconciled in the fact that in both of them savings and investment curves (in the figure S and I curves) have no importance.

However, Lerner’s attempt of reconciliation of the two theories is defective because it is a mistake to make the savings and investment schedules coincident. If we assume this process it will mean savings are automatically the same as investment without there being a mechanism which brings them into equilibrium.

We cannot accept this because it leaves out of account the level of income and treats income as an arbitrary constant. This is wrong. Moreover, according to Klein (he liquidity preference theory, which is stated in terms of stocks cannot be identical with the loanable funds theory which is stated in terms of flows.

Fellner and Somers:

Fellner and Somers tried somewhat successfully to reconcile the two theories. For this the definitions of supply and demand for loanable funds take on some new connotations and they assumed income as given and divided the liquidity preference function into three parts:

(i) The demand for goods other than claims,

ADVERTISEMENTS:

(ii) The demand by people for their own money,

(iii) The demand for claims.

Similarly, the supply aspect of money is also divided into three categories:

(i) The supply of goods other than claims,

ADVERTISEMENTS:

(ii) The supply by people of their own money,

(iii) The supply of claims.

They then took the supply of goods other than claims and the demand for goods other than claims as independent of rate of interest and equal in any general equilibrium situation. They also assumed the demand by people for their own money equals the supply by people of their own money, regardless of the rate of interest.

With these two relations, it follows that the sum of their three supply categories is equal to the sum of their three demand categories at the same rate of interest for which the demand and supply of claims are equal. According to Fellner and Somers, it is the demand and supply of claims that constitutes loanable funds. The equality between the supply and demand for claims they call the loanable funds equation and the equality of the sum of the three supply categories and three demand categories they call the liquidity preference equation. Both these qualities lead to the same interest rate.

ADVERTISEMENTS:

A.L. Wright:

A.L. Wright suggests that in a developing growing and changing economy, in which income is growing and therefore the demand for transactions and speculative balances also grows. The requirements of equality would permit two interest rates which could operate simultaneously and separately in the market. In other words, a firm’s or an individual’s affairs could be in equilibrium, even when the rate of interest differs on borrowing and lending. Wright, thus, assumes the existence of two different rates of interest one of which is the ‘Money or Bank’ rate of interest; and the other as the ‘investment’ rate of interest.

The former is charged on bank overdrafts and the latter prevails in the investment market proper, where the demand for investment is brought into equality with its supply. Prof. Brian Tew, however, objects to such an approach of reconciliation. He doubts whether it is possible to split the loan market into halves so independent of each other that we need not have any equation concerning the prices which rules in them.

Don Patinkin:

Don Patinkin has also criticized the notion that the rate of interest is determined either in the loan or money markets. Functioning of markets, according to Patinkin, depends on price level, interest rate and national income.

The idea of general equilibrium depends on the fact that market is affected by all (types to) prices in the system which in turn, is affected by each price. In general equilibrium analysis, dynamic pressures for affecting a price (like interest rate) cannot originate from one and only one market. It will be a wrong assumption to make. It is more difficult to justify such a logic in case of money market, specially because by its very nature money is spent on all types of goods—and not just on one.

ADVERTISEMENTS:

There is, therefore, no justification in the contention that the money equation denotes a stock and the loan equation a How.

The reason being:

(i) It is difficult to say whether demand for and supply of loanable funds during a given period has the dimension of a flow or not:

(ii) The demand for and supply of loan flows will be equal, only if the demand for and supply of the money stocks are.

The excess demand in money market must have its impact in the loan market, just as the disequilibrium in the latter can cause movements in the rate of interest and bond prices in the money market; (iii) against the analysis of the loan market as well, can be carried in terms of demand for and supply of the total stock of bonds outstanding. Similarly, loanable funds can also be formulated in terms of demand for and supply of bonds and securities. The loanable funds theory stated in this way is perfectly reconcilable with liquidity preference theory. In equilibrium, prices of securities will be such that all individuals will be satisfied with their holdings of bonds and securities.

Stocks and Flows:

Klein points out that if the two theories are stated in terms of stock dimensions rather than flow dimension, they will come to the same thing and there is nothing to choose between them. But the more common treatment of the loanable funds theory is in terms of flows, while the liquidity preference theory is one of stocks. Prof. G.L.S. Shackle has pointed out that the loan or flow market correspond more closely to the market for fresh milk—where, what is demanded from moment to moment or from day to day, is produced from moment to moment or day to day to meet the demand. The stock market corresponds closely—to the market for antique furniture where supply is an existing and non-augmentable quantity existing at all times.

ADVERTISEMENTS:

Generally speaking, there do exist reasons for the superiority of Keynesian liquidity preference theory. T. de Scitovszky has stated, better than anyone else, the economic reasons why an interest theory should be a theory of stocks rather than flows. In his view, price is the allocating mechanism between two flows, when we talk of the common demand and supply analysis.

However, stock approach is proper when dealing with commodities, money for which stocks are independent of the price. It is evident that money and earning assets are commodities which do possess very large stocks. Interest is not the allocating mechanism between the demand for and supply of credit flows, rather it is so between the holdings of stocks of earning and non-earning assets.

Karl Brunner expressed the view that except in a stationary state where new issues are zero and as such, where both stock and flow equilibrium are achieved together, the monetary price—interest—is found to be determined by the stock relation.

It is, therefore, obvious that of the two theories the liquidity preference is favoured more by many. The stock-holder’s behaviour may counteract the flow of supply and thus prevent the result that would have otherwise followed. For example, the decrease in consumers’ demand for a good due to rise in price leads to its fall. As a result of this fall in demand, the price tends to fall subsequently— stock-holders may then desire to increase their stock of the good.

This phenomenon is not so pronounced in the case of commodities for which large stocks are not held or the stocks are independent of the price. But money and earning assets are commodities for which as we know large stocks are held and the stocks are dependent on the price. This means that the stock approach is more realistic.

Those who favour the liquidity preference theory point out that it constitutes an integral part of the analysis of the working of the economic system as a whole. Rate of interest, according to them, as a monetary phenomenon has to be separated from the productivity of capital. The essence of Keynesian contribution lies in filling the important gap in the older theories of interest by stressing the dependence of the demand for money on the rate of interest and by emphasizing that shifts in the liquidity preference curves can permanently effect the rate of interest. “In essence, the Keynesian contribution was to point out that people can make two distinct types of decisions.

ADVERTISEMENTS:

They may decide upon saving or consuming their incomes, and they may decide upon holding idle cash or non-liquid securities. Each decision requires an economic calculation. In the former case, individuals decide on the basis of their incomes, how much they want to save. In the latter case, they may decide on the basis of alternative rates of return i.e., interest rates whether they want to hoard their historically accumulated saving in the form of cash or securities.

The distinction between these two sets of decision clearly calls for a liquidity preference theory of interest. Moreover, liquidity preference theory not only brings forth the important role of money but also integrates money into the theory of output and employment for the economy as a whole.

Sometimes, a question is raised (though unnecessarily) that between the stock and flow theories of the rate of interest—which one is preferred in low income countries? A set and categorical answer is rather difficult to give.

However, an analysis whether the stock or flow theory is applicable in such economies would be interesting and quite in order. We know that interest-elasticity of the demand for money is low in poor economies but more than that it is the price-elasticity of the demand for money which has a considerable impact on interest-elasticity, so much so, that the latter sometimes gives quite opposite relation to that envisaged by Keynesian theory.

This is because the commodity market dominates over the bond market in such economies, besides, there are more violent fluctuations in prices than in interest rates. This difficulty is further complicated by the fact that the short period Keynesian theory of money is in terms of stocks and not in terms of flows. In the case of securities and money, the stocks at any one point of time are more important than any addition or subtraction in them.

In the case of commodities it is the flow of new commodities that are more important than the stocks, from the quantitative view-point. The demand for money in poor economies is, therefore, effected more by the flows of commodities than either by their stocks or by changes in the stocks or flows of securities. This, perhaps, shows that the flow theory is apparently more suitable in such economies.

ADVERTISEMENTS:

But those who prefer the stock theory in such economies argue against the above thesis. They say that it is true that the bill or the bond market in such economies is poor and the speculative demand for money does not arise from the desire to benefit from the changes in the rate of interest due to uncertainties as reflected in their stock exchange markets, which for obvious reasons are poor. The speculative desire liquidity arises mainly for holding commodities on account of uncertainties introduced by the fluctuations in their prices as reflected in the produce exchange markets.

It is also true that the nature of liquidity as such in poor economies is different from the one in advanced economies. Moreover, these uncertainties combined with social backwardness and lack of investment opportunities in such economies lead to large holdings of idle balances in gold or other consumer durables, thereby giving a fillip to the desire to hold money. Thus, according to them the stock theory is better than the flow theory even in underdeveloped countries.

However, we may conclude that the Keynesian stock theory is superior to classical flow theory of interest because the former is concerned with the equilibrium in the monetary sector, while the latter is concerned with equilibrium in the real sector. Thus, in the money economy of the present world Keynesian theory is more realistic than the classical theory of the rate of interest.

Modern economists have, however, warned against taking up extreme positions favouring one theory and denouncing the other. Economists like J.R. Hicks, A.P. Lerner and Fellner and Somers have made attempts as shown above to reconcile the two theories; the two theories are almost similar and can be used to express the same thing. In classical loanable funds theory, when the demand for loanable funds increases the rate of interest rises. Similarly, an increase in investment in the liquidity preference approach will also raise the rate of interest, because it will mean the use of more cash for transaction purposes. Now, when the total supply of cash remains unchanged, less will be available for hoarding with the result that the rate of interest will rise.

Similarly, an increase in consumption means more cash for transaction purposes; the supply of money remaining unchanged, less would be available for speculative motive and the interest rate will rise. Thus, we have come to the same results through the liquidity preference approach as we did through the loanable funds approach. Prof. D. Hamberg in his ‘Business Cycles’ expressed the view that “In view of the inter-changeability of the two approaches to the explanation of the rate of interest, it is a matter of complete indifference and personal choice, which one of the two approaches is used: Because of the similarities, it is probably best to say that Keynes did not forge nearly as new a theory of the rate of interest as he and others at first thought. Rather, his great emphasis of the influence of hoarding on the rate of interest constituted an invaluable addition to the theory of interest as it has been developed by the loanable funds theories who incorporated much of Keynes’ ideas into their theory to make it more complete.”

As a matter of fact, any general equilibrium analysis of the rate of interest should be able to operate simultaneously as Robertson has said on the three-fold margin of consumption decisions, investment decisions and asset portfolio decisions. In other words, interest is once a reward for waiting, a pure yield on capital and provides for the liquidity that is foregone. Hence any controversy over the choice between the two theories is unnecessary and uncalled for.

We, thus, find that several attempts of synthesis have been made in the field of theory to bring the rate of interest to its own way with the supply and demand for money—the Keynesian determinants, in which either pair of schedules could determine the long-term rate of interest. As the different synthesis approached the problem from different viewpoints, the end results were not the same. Consequently, no conclusion was arrived at.

Further, with the intervention of general asset—preference theory in which all sorts of prices and interest rates become relevant, the implications of all these attempts are, that controversy over the role of rate of interest and its determination need not make people take extreme positions and the rate of interest need not be the centre of continued discussion. Thus, both the theories virtually express the same thing though in different terms. Taken separately, both the theories are indeterminate because both ignore the levels of income.

According to Prof. Hicks a determinate theory of the rate of interest will depend upon a synthesis of the two theories.

According to the determinate theory, the rate of interest along with income is determined by the four important elements:

(i) Marginal efficiency of capital;

(ii) Propensity to consume (save);

(iii) The liquidity preference schedule;

(iv) The total supply of money.

It is popularly called IS and LM approach discussed further. We should realize that with the attempts of reconciliation of the stock and flow theories of the rate of interest made by Hicks, Lerner, Oskar Lange Fellner and Somers, Wright, Patinkin, the controversy about the role and determination of the rate of interest has not come to an end.

These efforts of generalisation specially of Hicks and Lange no doubt led us to what we call a determinate theory of the interest, in which L, M, S and I are all essential elements. But the debate still goes on along different lines and particular mention may be made of the contributions of Tobin, Meltzer, Patinkin, Gurley, Shaw and Chicago monetary experts and their leader Milton Friedman. One thing is certain that the theories of the rate of interest are being integrated with the general theory of capital.

We have now started talking in terms of wealth instead of demand for money where money is the more liquid form of wealth. Another evolution has been in broadening the concept of the demand function for money for speculative purposes. The choice lies no more between holding money and bonds (as assumed by Keynes) but between different types of assets of different maturity and earning capacity— this has led to the evolution of the general theory of price formulation of assets and, in turn, also integrates the theory of interest and money with the theory of capital. As such money is not only a link between the present and future or leading species of a large genus but is a state of mind or the beginning of an end.

Keynes criticized the classical and neoclassical versions of the rate of interest through his liquidity approach. But even the liquidity version has been modified, re-interpreted, broadened, classified, and commented upon by Post-Keynesians and in the reformulation of new approach lies their chief contribution. Keynesian system itself was taken to be determined by the Hicksian—Hansen IS and LM curves but it is from these points of departure that Post-Keynesian projections follow.

Structure of Interest Rates:

Another dimension that has been added to the problem of interest rate, after Keynes, is that the analysis is no longer carried on in terms of a single rate of interest, but in terms of structure of rates of interest. Moreover, Keynes’ theory of the rate of interest does not give us the (equilibrium or determinate) rate of interest, if it could give us one, that would have as well been the end of the matter, but it is not so. On the contrary, Keynes’ theory lays down the basis for further debate and development through empirical research.

This problem of understanding the general equilibrium or the functioning of the economy through the structure of the rates of interest rather than through a single rate of interest was solved by making a distinction between long-term and short-term rate of interest and by understanding the process of ‘switching’ of long-term asset balances into short-term securities or even into cash to avoid possible capital losses.

Amongst the important implications are the role of expectations, distinction between the long-term and short- term rates of interest and shortening of the asset portfolio through switching bonds and securities into cash and vice versa. This was so because of the uncertainty and changing future expectations. On account of these factors, the rate of interest differs on debts of varying lengths and maturities and earning capacities. The rate of interest on momentary or daily loans is different from the rate of interest on weekly, monthly, yearly or longer duration loans.

Debts of longer period like four, six or twenty years will still have different interest rates. For the sake of convenience in monetary economics we do speak of the rate of interest without mentioning debt of particular maturity as if there were only one market rate of interest the pure rate of interest that a lender will charge on a riskless default less and easily convertible loan. This, however, does not mean that what really exists in the market is not a complex structure of rates of interest.

In actual practice there is multiplicity of interest rates prevailing in the market. Differences in the structure interest rates for a given stock of money and financial assets at any point of time will depend on risk of default attached to different financial liabilities, lender’s risk aversion, liquidity preference and expectations about future course of interest rates. Interest rates vary directly with default risk. The greater the lender’s perception of default risk, the higher the interest rate charged (default risk premium) to cover potential losses due to default.

Long-term assets are generally associated with higher default risk than short-term assets. It gives rise to credit risk structure theory of interest rates. The two main characteristics of a security are return and risk. Buyers of securities prefer high returns and low risk. These risks are in the form of ‘credit risk’ and ‘market risk’. Interest rates on securities increase as either of these types of risks increase. The ‘credit risk structure’ of interest rates explains variations in the interest rates of various securities of the same maturity by variations in the credit risk of the issues.

Again, interest rates vary directly with taxes paid on earnings from assets. Taxes vary from asset to asset and from wealth-holder to wealth-holder depending upon the income bracket. Almost all long- term assets are subject to lower effective taxes, their pre-tax yields are lower than pre tax yields on short-term assets—giving rise to what is called taxability structure of interest rates, for example discount bonds normally sell at a rate lower than bonds selling at par or at a premium at a price greater than its maturity value because of the tax advantages.

Moreover interest rates also vary inversely with the marketability of an asset. The greater the volume exchanged in the secondary markets and the lower the associated costs, the greater is an assets marketability and lower the interest rate. Short-term assets are generally more marketable than long-term assets.

Liquidity is another important variable which effects the structure of interest rates. It means the ease or convenience with which an asset can be converted into cash to a known value. Interest rate (structure) is inversely related to the liquidity of an asset. One aspect of a security’s liquidity is its potential for capital loss or capital gain. This potential increases as the maturity of the security increases. The longer is the period the greater will be the risk of losing liquidity. The interest rate on a security should increase as its maturity increases to compensate for the increase in market risk.

This explanation of the relationship between the interest rate and the maturity of a security is called ‘liquidity hypothesis’ of the structure of interest rates. The liquidity hypothesis does not purport to provide a complete explanation of the structure of interest rates, but only supplements to other explanations. However, it is ‘the term to maturity’ which has been given considerable attention in the analysis of the structure of interest rates.

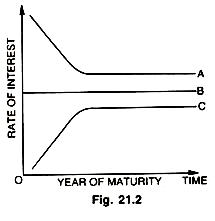

‘Term of maturity’ refers to the length of time between the issuance of an asset and its maturity. It is also w called the term structure of interest rates yield curves measure w the term structure and show the relationship between market? interest rates and term to maturity. A curve showing the o relationship between interest rate and the maturity on securities is called a yield curve as shown in the Fig. 21.2.

Figure 21.2 the yield curves that reflect the three basic term structures of interest rates at any point of time. Yield curve ‘A’ indicates that long term rates are less than short-term rates. Yield curve ‘B” indicates that there is no difference between Fig. 21.2 short and long-term rates. Yield curve ‘C’ indicates that long term rates are greater than short-term rates. A security’s market risk increases as its maturity increases.

There are three ways in which the relationship between the maturity of a security and its interest rates are manifested, giving rise to liquidity hypothesis, segmented markets hypothesis and expectations hypothesis.

Segmented Theory (Hypothesis):

The segmentation hypothesis is based on the assumption that most borrowers and lenders do not readily switch amongst securities of differing maturities. In other words, advocates of segmentation theory believe that long and short maturities are not considered to be good substitutes by market participants. It is argued that sufficient institutional preferences and legal constraints exist that prevent most lenders and borrowers from switching between long-term market and short-term market in response to changes in the interest rate differential between these two markets.

As a result of this most borrowers and lenders are able to participate in only one maturity of the financial markets and the markets for securities of various maturities get segmented. A change in the demand and supply of securities or money stock in a particular market will cause a change in the interest rate in that market but will not effect the interest rates in markets for securities of other maturities.

The central idea of the segmented markets theory of the structure of interest rates is that major groups of borrowers and lenders prefer to match the maturity structure of their liabilities and assets. The long-term liabilities are matched with long-term assets and short-term liabilities are matched with short-term assets. Since there are different interest rates at which securities of varying lengths are held, the loans with different lengths are imperfect substitutes for different lender-borrower groups.

The markets for different types of financial assets are segregated in the sense that funds from one market do not flow freely into markets for substitutable assets giving rise to anomalies. Due to these complex diversities of the structure of interest rates and debts of varying lengths—the entire loan market is segmented or divided into different sub-markets and in each segment or part of the market, there is a different rate of interest.

The prevalence of segmented markets is supported by empirical evidence and the behaviour of many institutional borrowers and lenders is in conformity with this theory. For example, portfolios of commercial banks are of short-term nature and so also their liabilities. On the other hand, portfolio assets of insurance companies, corporations, lending institutions are of long-term nature and so also their liabilities. Not the behaviour of lenders but also the behaviour of borrowers lends support to this theory of the structure of interest rate.

It has been generally observed that consumers finance less durable consumer purchases by borrowing short-term debts but more durable assets like houses, property etc., are financed with long-term liabilities. Again, business units finance their raw-materials, inventories with short-term loans, while plant, machinery and equipment’s are financed through long-term debts.

Despite, evidence in support of the segmented markets theory of the structure of interest rates and interest rate differentials, the recent research has cast doubts on this and more and more academic thought is veering round on alternative explanation of the interest rate structure—called the expectations theory.

The theory was developed by J.R. Hicks in his famous book “Value and Capital’. The central idea of this theory is that the structure of interest rate at any particular time is determined by the expectations of borrowers and lenders concerning the future rates of interest—because investors must maximize profits and therefore they switch funds from one maturity to another or reshuffle their assets to balance the objectives of liquidity and profitability.

Moreover, investors always have certain expectations about future which they hold with confidence. The pure expectations hypothesis concludes that if interest rates are expected to remain the same, the term structure curve (yield curve) will be horizontal—if the rates are expected to increase, the curve will be upward sloping—and if the rates are expected to decrease the curve will be downward sloping. In actual practice, however, the expectations hypothesis is always supplemented by the liquidity hypothesis.

The term structure of interest rates—rates on loan of successively longer maturity, usually riskless securities (and typically government debt)—is a subject that has received much attention in monetary economics in recent years.

Three aspects of the theory of the term structure of interest rate are debated and highlighted:

(i) Expectations concerning the spot—rates that will prevail in future

(ii) Liquidity preference—implying that investors have an aversion to risk of capital loss so that they may be compensated by a liquidity preliminary for holding long-term securities

(iii) Market segmentation assuming that short and long-term rates respond virtually independent of each other to changes in the stock of loans of different maturities outstanding, with no switching between maturities in response to changes in relative prospective yields because investors are send to match maturities of their assets to those of their liabilities.

Although the expectations hypothesis and the segmentation hypothesis are based on opposing assumptions and offer different explanations about how the interest rates of various maturities are related yet the liquidity hypothesis supplements either of the two. It is very difficult to say which one of these is correct at a particular time. The real world probably contains elements of both hypotheses. The truth is somewhere between the pure expectations and pure segmentation hypothesis.

But the expectations hypothesis supplemented by liquidity hypothesis seems to have greater empirical support. It is, therefore, clear that whatever be the theory that may explain the structure of the rate of interest— it has become more important tool of analysis in money markets than pure or the rate of interest as advocated by Keynes.

To sum up, it may be said that Keynes’ theory of liquidity preference stands modified and reinterpreted in various ways. For example, Keynes gave limited interpretation to the demand for money, the three motives or holding money stand integrated, relation between the demand for money and the rate of interest has been further analysed to see whether a stable relationship exists at all, attempts have been made to empirically estimate the demand function for money.

Keynes’ two-asset model has given place to portfolio balance theory : money is treated as a problem in the capital theory and there is general integration of the theory of money with the theory of capital and wealth—in other words, there is integration of monetary theory with the theory of value, attempts have been made to see whether a liquidity trap exists at all ; analysis has been carried on-by Patinkin by giving up the assumption of a given price level, analysis is now carried on in terms of the structure of the rates of interest instead of a single rate of interest. In brief, it may be said that we have a liquidity preference theory—a bond preference theory and a real asset preference theory.

Rate of Interest in Developing Economies:

Rate of interest and its structure in an underdeveloped economy are not very helpful in stimulating investments. No doubt, there is high liquidity preference (demand for money), but it mainly arises from uncertainties and speculation in commodities. There is no desire to earn from the rise and fall in prices of bonds because bonds and securities market is not well developed.

Moreover, savings are almost inelastic to the changes in the rates of interest. In the Keynesian case, an increase in the supply of money, other things being given, would lead to a fall in the rate of interest and increase in investment. But, in an underdeveloped economy, in which the wage-goods gap is not covered, an increase in the supply of money would lead to a rise in prices and not to a fall in the rate of interest.

Besides, there exist in an underdeveloped economy vast disparities between long and short-term rates of interest. There is no ‘the” rate of interest in the sense of giving an integrated interest rate structure; the whole structure stands at a very high level, compared to its counterpart in developed economies; most rates are institutionally determined and are less flexible; the range of different rates is too wide; for example, it varies from 2% call money rate on treasury bill rate to 20%—60% on agricultural loans.’ The interest rate structure is amenable to monetary policy in the upward direction, but very little in the downward direction.

This is because of the poor banking facilities, through which monetary authorities usually control interest rates. The indigenous bankers and non-financial intermediaries, who form an important link remain outside the purview of the central bank.

There are other conditions for an effective flexible interest rate policy which are not to be found in low income countries, e.g., a developed bill market, organized capital market, general discount market, rational and sensitive assets structure of banks, integration of the money market in which there is effective cooperation and control between banks and central bank—all these are lacking in underdeveloped countries, hence, the limitation of the rate of interest to act as an instrument of development.

However, the analysis makes it imperative that economies aspiring for economic development must have a rate of interest, which is neither very high nor very low and which is conducive to economic development and better investment. The rate of interest in such economies is not determined, in fact, cannot be subject to any economic principles or to any rigid economic considerations.

It is the result of so many factors, sometimes it is customary or institutional as in rural areas, sometimes it is determined by demand and supply and at another time by liquidity (specially the speculative demand for commodities). It differs widely from season to season, industry to industry and from one area to another in the same country.

The demand for money goes up in busy seasons and with favourable monsoons and crops and dries up completely in slack seasons or with failure of rains. So the rate of interest fluctuates violently. That is why it is said that search for an equilibrium or natural rate of interest or a theory of interest rate determination in such low income countries is useless for it amounts to chasing a black cat in a black room with closed eyes.