The following points highlight the top seven theories of interest. The theories are: 1. Productivity Theory of Interest 2. Abstinence or Waiting Theory 3. Agio or Austrian Theory of Interest 4. Fisher’s Time Preference Theory 5. The Classical Theory of Interest 6. Loanable Funds Theory of Interest 7. Liguidity Preference Theory.

Theory # 1. Productivity Theory of Interest:

This theory was propounded by Physiocrats and developed by German economists. According to this theory, interest is paid for the productivity of capital. According to Wicksell, “interest is the payment by the borrower of capital by virtue of its productivity”.

Capital is productive in the sense that labour, assisted by capital produces more than labour without capital, for example, a fisherman with a net can catch more fish than without it. An agricultural labour with tractor can produce more than without a tractor. Thus capital is as productive as other factors of production.

Criticisms:

ADVERTISEMENTS:

1. Economists criticize this theory for having ignored the scarcity, efficiency and supply of capital that determine the rate of interest.

2. If interest depends merely on productivity, interest rates should vary in proportion to the productiveness of capital. Actually pure rate of interest tends to be the same in the market.

3. Even if loans are taken for consumption purposes, interest has to be paid on them. But loans for consumption purposes are not productive.

4. Productivity theory explains interest from the side of demand only and ignores the supply side altogether.

ADVERTISEMENTS:

5. Mere physical productivity of capital does not explain interest. If people are willing to lend unlimited amounts of loans (money) without interest, business would expand. Interest would not be a cost. But interest is a cost which every entrepreneur must bear with. Hence price in the long-run, must cover all costs including interest.

Theory # 2. Abstinence or Waiting Theory:

Senior, the classical economist is the exponent of the abstinence theory of interest. According to J.S.Mill, interest is the remuneration for mere abstinence. Abstinence theory explains interest from the side of supply whereas the productivity theory explains from the demand side. According to Senior saving involved a sacrifice which he calls it ‘abstinence’. Senior explains that capital is the result of savings, which in turn are the result of abstinence.

People usually may consume their entire income. They save a part of their income only by abstaining from the present consumption. Thus saving was an act of abstaining from consumption. It was necessary to reward people to abstain from consumption since abstinence is regarded as painful. Interest is thus the reward paid for those who saved rather than consumed their incomes.

Criticism:

ADVERTISEMENTS:

1. This theory has failed to explain the demand for capital, hence it is one-sided theory.

2. This theory emphasises that all capital is the result of abstinence, but it is not true.

3. This theory is also criticised on the ground that rich people save without least inconvenience and they do not undergo discomfort on account of saving.

4. Marshall substituted the term waiting for ‘abstinence’. Saving means waiting. When a person saves, he does not abstain from consumption for-ever. He just postpones present consumption to a future date. Generally people do not like to wait; an incentive is necessary to encourage this postponement of consumption. Interest is thus an incentive.

Theory # 3. Agio or Austrian Theory of Interest:

This theory was first advanced by John Rae and later developed by Bohm Bawerk of the Austrian School of Economics. According to this theory interest arises because people prefer present goods to future goods. If people prefer the present goods, there cannot be savings and capital. To induce people to save and accumulate capital an agio or premium or price must be given.

Thus agio is nothing but interest. People generally prefer the present goods to the future goods for three reasons. According to Bohm Bawerk the first reason is an under valuation of the future purchasing power as compared with the present purchasing power, moreover future is uncertain. In the second place present wants are felt more keenly than the future good.

Yet another reason is that a person expects improvement in economic position in future as a result of which the marginal utility of his income will decline. He therefore prefers to use his income at the present when the marginal utility of his income is high. A premium or agio must be given to the lender if he has a part with his income at the present. This premium is the so- called interest.

Criticism:

1. This theory failed to explain the forces of demand and supply for capital that determine the rate of interest.

ADVERTISEMENTS:

2. The reasons given by Bohm Bawerk do not apply always.

3. The technical superiority of present goods of Bohm Bawerk has been criticised by Irving fisher.

Theory # 4. Fisher’s Time Preference Theory:

This theory is associated with Irving Fisher who emphasises time preference as the central point in the theory. This theory is based on the subjective valuation of income and people’s time preference. According to this theory “interest is the price of time”. In the words of Fisher “interest is an index of community’s preference for a dollar of present over a dollar of future income’.

People in general prefer the present to the future. This is what he calls the time preference. By time preference Fisher means individual’s preference for the present to the future or people’s discounting or under estimating the future.

ADVERTISEMENTS:

There is a tendency on the part of the people to vary the income meant for consumption from time to time by saving and borrowing. Interest is the price paid to the people for present income rather than for future income. According to Fisher the rate of interest varies according to the time preference.

The time preference depends upon the size of income, the distribution of income over the period of time, the composition of income, the certainty of enjoying income in the future, the temperament and the character of the individuals and expectation of the life of the people. If the income size is large, individual will satisfy present wants more and discount the future at a lower rate.

The distribution of income may take place in three different ways. It may be uniform throughout the life or increase with age or decrease with age. If it is uniform individuals will have their time preference according to the size of their income and temperament. But if the income increases with age, individuals will tend to discount the future at a higher rate because their future is well provided. If the income decreases with age, the future will be discounted at a lower rate.

Regarding the degree of enjoying the income in the future, greater the certainty of enjoying income in the future smaller is the degree of time preference. But if the enjoyment of income is not certain the degree of time preference will be greater. The character of individuals also influences time preference.

ADVERTISEMENTS:

A person of forethought discounts the future at a low rate compared to a spend thrift. Similarly a person who expects to live long has less time preference than one who expects to live short. These factors determine individual’s rate of time preference. When the rate of time preference is higher than the market rate of interest, the individuals will borrow; if it is lower he will lend to the market.

Criticism:

1. Fisher’s theory fails to show the influence of the banking system on rate of interest.

2. This theory gives too much importance to willingness or preference; moreover this theory lays much emphasis on consumption expenditure out of income.

3. Fisher did not give importance to the impact of expectations on interest rate. The concept of productivity is free from the element of uncertainty. Both the factors namely expectation and uncertainty are crucial factors to Keynesian concept of marginal efficiency of capital.

4. The theory is based on the assumption of fixed purchasing power of money between the present and the future. In the real world, fluctuations in the value of money are the most common.

ADVERTISEMENTS:

The time preference theory is superior to the other theories since it explains the rate of interest by reference to demand for and supply of capital. The demand for capital depends upon the marginal productivity of capital to investors while the supply of capital depends upon the time preference of individuals. The rate of interest will be determined at the point of equilibrium between demand for and supply of capital. The time preference theory is a complete theory and is the basis of the modern loanable funds theory of interest rate.

Theory # 5. The Classical Theory of Interest:

The classical theory of interest was propounded by the old classical economists. Later it was developed by Marshall, Pigou, Walras, Taussig and Knight. According to this theory rate of interest is determined by the demand for and supply of capital. The rate of interest settles at the point where the demand for capital is equal to supply of capital.

The demand for capital arises from investment and supply of capital from savings. This means that the rate of interest is determined by the volume of savings and volume of investment. This theory explains the rate of interest in terms of saving and investment; this theory is called the saving investment theory of interest.

Classical theory is also known as real or non-monetary theory of interest. This theory refers to saving as real savings and investment as real investment. Real saving refers to those goods which are employed for investment purposes instead of consumption. Real investment refers to the production of capital goods like machinery, buildings, etc., rather than monetary investment, such as stocks and shares.

Thus money does not play an important role in the determination of rate of interest. According to classical economist the rate of interest is determined by the demand for savings to invest in capital

goods and the supply of savings. The two sides of the interest determination, namely, the demand for capital and the supply of capital can be analysed.

Demand for Capital:

ADVERTISEMENTS:

Demand for capital arises on account of its productivity. Firms desire to make new capital goods which are demanded to produce consumer goods. For any type of capital good it is possible to draw a marginal revenue productivity curve showing the addition made to the total revenue by an additional unit of a capital at various levels of the stock of that capital.

The more the capital assets an entrepreneur has, the less revenue or income he will earn by purchasing one more unit of capital. Under perfect competition, it is profitable for a firm to purchase any capital up to the point at which the price of that capital equals its marginal revenue productivity. The entrepreneur will demand capital goods up to the point at which the expected rate of return on the capital goods equals the rate of interest.

At a higher rate of interest the demand for capital is low and it is high at a lower rate of interest. Thus the demand for capital is inversely related to rate of interest and the demand schedule for capital slopes downward from left to right. However there are certain other factors which govern the demand for capital such as the growth of population, technical progress, the standard of living of the community, etc.

Supply of Capital:

The supply of capital depends upon savings and hence the will to save and the power to save of the community. Some people save irrespective of the rate of interest. They would save even if the rate of interest is zero. Others save because the current rate of interest is just enough to induce them to save. There are potential savers who will save if the rate of interest increases.

In an economy, there may be three types of savers, viz., individual savers, institutional savers like banks, insurance companies, etc., and the government. Saving involves certain inconvenience like sacrifice, or waiting as they have to forgo present consumption which has to be compensated.

ADVERTISEMENTS:

The higher the rate of interest, the larger will be the community savings and the more will be the supply of funds. The supply curve of capital thus slopes upward indicating that more funds will be saved and supplied at a higher rate of interest.

Determination of the Rate of Interest:

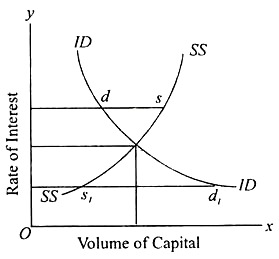

The rate of interest is determined by the intersection of the demand for capital (or investment demand) and supply of savings.

This is shown in the figure given below:

The point of equilibrium is E at which investment demand is equal to saving. V is the natural rate of interest. OQ quantity of capital is demanded and supplied, at ‘Or’ rate of interest. Rate of interest cannot be higher or lower than ‘r’ since charges in saving and investment will force the rate back to ‘r’. For example, if the rate of interest rises above to Or1 the demand for investment funds will fall and the supply of funds will increase.

ADVERTISEMENTS:

Since the supply of capital is more than the demand by ‘ds’ the rate of interest will come down to the equilibrium level ‘Or’. If the rate of interest falls to Or2 the demand for capital will be greater than the supply by S1d1 and the rate of interest will rise to ‘Or’. At the lower rate of interest, people will save less but the demand for investible funds will increase which will raise the rate of interest to the equilibrium level.

Criticism:

The real theory of the classical economists as propounded by Marshall and Pigou has been criticised by Keynes.

1. Keynes has condemned the classical theory as a useless and unrealistic theory. Keynes does not agree with the classical idea that saving is interest elastic. In fact the level of income has more important influence upon the amount saved than the rate of interest. For instance, the rich persons in a community will save automatically, even if the rate of interest is zero. Middle income group also save, because they would like to provide security for their families for the future, so they will save even if the rate of interest is zero. If the rate of interest is high, the low income groups may not be in a position to save.

2. Keynes did not agree with the classical relationship between investment and rate of interest. The classical theory assumes that investment demand will be larger at lower interest rate. Keynes shows that investment does not depend upon rate of interest alone but also upon marginal efficiency of capital.

3. Keynes does not agree with the classical theory that the rate of interest equates saving and investment. According to him, any difference between saving and investment will be removed by changes in the levels of income and expenditure rather than by changes in the rate of interest.

4. The classical theory believes that saving and investment are interest elastic, i.e., both are influenced by interest rates. But it is not true; investment, for instance is influenced by marginal efficiency of capital.

5. Another important defect of the theory is that it has not taken into account monetary factors and credit money that determine the rate of interest.

6. Keynes criticizes the basic assumption of the classical theory, namely that the resources in a society are fully employed. He believed, in less than full employment situation, where resources are unemployed interest is not essentially an inducement of saving.

7. The classical theory includes savings out of current income for supply of savings which makes it inadequate. Bank credit and past savings are other sources of supply of capital. The classical theory remains incomplete by neglecting these factors in the supply schedule of capital.

8. Classical theory is criticised as indeterminate. Since savings depend upon the level of income it is not possible to know the rate of interest unless the income level is known before-hand. The income level itself cannot be known without knowing the rate of interest. For each income level a separate saving curve will have to be drawn. These are circular reasons which offer no solution to the problem of interest.

9. This theory also neglects the influence of the demand for idle money balances on the determination of the rate of interest on the demand side.

10. This theory ignores consumption loans and takes into account only capital used for productive purposes.

Theory # 6. Loanable Funds Theory of Interest:

The loanable funds theory known as the neo-classical theory explains the determination of interest in terms of demand and supply of loanable funds. This theory was developed by Swedish economists and first formulated by Knut Wicksell but contributions were made by other Swedish economists such as Bertil Ohlin, Gunnar Myrdal, Eric Lindahl and English economists like Pigou and Robertson.

The term loanable funds means the total amount of money which is supplied and demanded in the market. According to loanable funds theory interest is the price paid for the use of loanable funds. There are several sources of both supply and demand of loanable funds.

Supply of Loanable Funds:

The supply of loanable funds comes from four basic sources namely, savings dis boarding, bank credit and disinvestment.

(a) Savings:

Private savings, individual and corporate savings are the main source of saving. In the loanable hinds theory savings are classified as planned (exante) and unplanned (expost) savings of individuals and households. Exante savings are planned by individuals at the beginning of a period in the hope of expected incomes and anticipated expenditure on consumption. In the Robertsonian expost sense savings is the difference between the income of the preceding period and the consumption of the present period.

In both the cases the amount saved varies at different rates of interest. More savings will be coming at higher rates of interest. Just like individual, business sector will also save. A part of the earnings of the business is declared a dividend and the undistributed part constitutes business or corporate savings. Corporate savings also depends upon current rate of interest. A higher rate of interest encourages business savings.

(b) Dishoarding:

Dishoarding also brings forth the supply of loanable funds. When people dishoard the previous hoardings, the supply of loanable funds increases. Cash balances remaining idle in the previous period, becomes active balances in the present period, are available as loanable funds. At higher rate of interest more will be dishoarded.

(c) Bank Credit:

Money created by banks adds to the supply of loanable funds. By creating credit money banks advance loans to the businessmen. The supply of loanable funds varies with rate of interest. Generally the banks will lend more money at higher rates of interest.

(d) Disinvestment:

Sometimes, due to disinvestment funds, flow into capital market adding to the supply of loanable funds. Due to structural changes, the existing stock of machines and other equipment’s are not replaced.

They are allowed to wear out. Hence a part of the revenue from the sale of the commodities will not be needed to keep the machines in proper condition or to replace them. Instead this will increase the supply of loanable funds. Disinvestment increases when the rate of interest is high. These components of loanable funds are denoted by savings(s), dishoarding (DH), disinvestment (DI) and bank credit (BM).

Demand for Loanable Fund:

The demand for loanable funds mainly comes from three sectors namely government, businessmen and consumers who need them for purposes of investment, hoarding and consumption. The government borrows funds for the provision of public goods, for development purposes or for war preparations. Major part of demand for loanable funds comes from business firms which borrow money for purchasing or producing new capital goods and for starting investment projects.

This is the most important constituent of demand for loanable funds. Rate of interest is the price of the loanable funds required to purchase the capital goods. Businessmen will find it profitable to purchase large amount of capital goods, when the rate of interest is low. Thus the demand curve for loanable funds for investment purposes is interest elastic and slopes downwards to the right.

The demand for loanable funds on the part of the consumers is for the purchase of durable consumer goods like scooter, houses, refrigerators, television sets, etc., Lower rates of interest will induce them to borrow more. Hence demand curve for loanable funds for consumption purposes is also downward sloping. Funds are also demanded for the purpose of hoarding them in liquid form as idle cash balances.

This is to satisfy their desire for liquidity preference. It is important to note that a person who supplies the loanable funds is the same person who demands loanable funds for hoarding purposes. A saver for instance who hoards his savings supplies loanable funds and also demands them to satisfy his liquidity preference. Hoarding is also interest elastic. The rate of interest is determined by the equilibrium between the total demand for loanable funds and the total supply of loanable funds.

The loanable funds theory is more realistic than the classical theory in several respects. The classical theory neglects monetary influences on interest. The loanable funds theory takes into account bank credit on the supply side. The theory recognises the role of hoarding as a factor influencing the demand for funds.

Criticism:

1. This theory is unrealistic for combining monetary factors with real factors. It is not proper to combine non-monetary factors like saving and investment with monetary factors like bank credit and dishoarding without bringing changes in the level of income.

2. The theory exaggerates the effect of rate of interest on savings. In fact, the rate of interest does not influence the volume of savings as suggested by the theory. Generally speaking people save not to earn interest. People save more even without any increase in the rate of interest; they save even if the rate of interest falls to zero. Thus for some people savings are interest inelastic.

3. Loanable funds theory like the classical theory is criticised on the ground that it is indeterminate. The supply of loanable funds consists of savings, bank credit and dishoarding.

4. Since savings varies with the level of income, the total supply of loanable funds will also vary with income. Thus loanable funds theory is indeterminate unless the income level is already known.

5. Another criticism against the loanable funds theory is that it is based upon the assumptions of full employment of resources, which does not exist in the real world. Loanable fund theory implies that it is not applicable to the situation of less than full employment. However the theory takes into account the increase in the level of income due to investment and its influence on savings. If full employment is assumed, income would not increase at all.

The theory states that the supply of loanable funds can be increased by releasing cash balances from savings and decreased by absorbing cash balances into savings. This means that the cash balances are elastic. This is not true because the total cash balances available are in fixed proportion to the supply of money at any time. Even if there are variations in the cash balances they are in fact, in the velocity of circulation of money rather than in the amount of cash balances in the community.

Theory # 7. Liguidity Preference Theory:

Keynes introduced a monetary theory of interest in his famous book, “The General Theory of Employment, Interest and Money”. According to him interest is a reward for parting with liquidity. His theory is known as liquidity preference theory of interest. Liquidity preference means the demand for money to hold or the desire of the public to hold cash. According to Meyer, “liquidity preference is the preference to have an equal amount of cash rather than a claim against others”.

To Keynes interest is purely a monetary phenomenon because the rate of interest is determined in terms of money. Money is the most liquid asset and people would like to keep their assets in cash. To make them surrender the liquidity, they must be paid a reward. This reward is paid in the form of liquidity. The more the desire for liquidity, higher shall be the rate of interest demanded to part with liquidity. This theory is characterised as the monetary theory of interest, as different from the real theory of classical economists.

Factors Determining Liquidity Preference:

Liquidity preference depends upon many factors. According to Keynes the desire for liquidity or the desire of the people to hold liquid cash arises because of three motives, namely:

(i) The transaction motives,

(ii) The precautionary motive and

(iii) Speculation motive.

Transaction Motive:

The transaction motive refers to the demand for money or the ‘need for cash for the current transactions of personal and business exchanges’. It is divided into income and business motives. The income motive is meant to bridge the interval between the receipt of income and its disbursement. The business motive refers to the interval between the time of incurring business costs and that of the receipt of the sale proceeds.

If the time between expenditure to be incurred and the receipt of income is small, less cash will be held by the people for current transactions and vice versa. Most of the people receive their income weekly or monthly, while the expenditure is to be incurred every-day. Therefore it becomes necessary to keep certain amount of ready money in hand to make current payments.

Similarly the businessmen and the entrepreneurs also require ready cash to meet their current expenses, especially, for payment for raw materials and transport, to pay wages and salaries and to meet other expenses. Money held for this business motive depends to a large extent on the volume of trade of the firm. Changes in the transaction demand for money depends upon the level of income.

The Precautionary Motive:

Precautionary motive for holding money refers to the desire of the people to hold cash balances for unforeseen contingencies. Both individuals and businessmen keep cash in reserve to meet expected needs like sickness, accidents, travel, unemployment and other contingencies.

Money held under the precautionary motive is rather like water kept in reserve in a water tank. The precautionary demand for money depends upon the level of income, business activity, the nature of the individual, availability of cash, the cost of holding liquid assets, financial soundness and accessibility to the credit market.

Speculative Demand for Money:

Money held under speculative motive is for “securing profit from knowing better than the market what the future will bring forth”. In other words it reflects the desire to hold one’s resources in liquid form in order to take advantage of market movements regarding the future changes in the rate of interest. Individuals and businessmen who have funds after keeping enough for transactions and precautionary purposes like to gain by investing in bonds.

Supply of Money:

Among the two determinants of the rate of interest the supply of money refers to the total quantity of money in circulation for all transactions at any time. It is exogenously determined by monetary authorities. Thus the quantity of money is fixed by the monetary authorities and hence the supply curve of money is assumed to be perfectly inelastic. Supply of money consists of coins, notes and bank deposits.

Determination of the Rate of Interest:

According to Keynes the demand for money namely the liquidity preference and supply of money determine the rate of interest. The rate of interest like the price of a commodity is determined at a level where the demand for money equals the supply of money.

Criticism:

The Keynesian theory of interest has been severely criticised by Hansen, Robertson, Knight and others.

1. This theory explains the working of everything through the bond market and regards bonds as the only alternative to money. Thus the theory lacks realism.

2. This theory points out the rate of interest as purely a monetary phenomenon; real forces like productivity of capital and thriftiness or saving by the people also play an important role in the determination of the rate of interest.

3. Keynes’ concept of demand for money is not comprehensive. To him the demand for money means liquidity preference. But money is demanded also for consumption and investment purposes.

4. Keynes states that liquidity is essential for interest rate. But as Hazlitt says, even “if a man is holding his funds in the form of time deposits or short-term treasury bills, he is being paid interest on them.

5. Robertson dubbed this theory as ‘at best an inadequate and at worst a misleading account’.

This theory is an incomplete theory because it has not taken into account the factors like credit money and loanable funds for the determination of rate of interest.

6. This theory assumes the supply of money to be constant. Hence the rate of interest is influenced by the demand for money. This theory is thus one-sided.

7. Keynes’ theory explains interest as a short-term phenomenon. So it cannot be applied to long period.

8. The greatest fallacy in Keynes’ analysis is that it ignores the influence of real factors in determining the rate of interest. Knut Wicksell was the first economist to present a real-cum- monetary theory of interest which was further refined by Irving Fisher.

9. The concept of ‘liquidity trap’ is also wrong. In reality the liquidity preference schedule may not be perfectly elastic at low rate of interest. Especially during depression, general pessimism prevails in the economy. It is therefore not correct to argue that the rate of interest will go up in future.

10. The Keynesian theory is also indeterminate like the classical theory. The supply and demand for money schedules cannot give the rate of interest if the income level is not known. In the classical theory also the demand and supply schedules for savings offer no solution unless the income is known. Thus according to Prof. Hansen “Keynes’ criticism of the classical theory applies equally to his own theory”.

11. Hicks, Lemer, Hansen and others opine that the rate of interest, along with the level of income is determined by factors like investment demand function, the supply of savings function, the liquidity preference function and the quantity of money function. Keynes does not bring all these factors into his theory. Thus Keynes fails to provide an integrated and determinate theory of interest.